Canuc Acquires MacDonald Mines

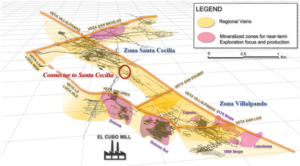

Canuc Resources Corporation completed its acquisition of Macdonald Mines Exploration Ltd., acquiring all Macdonald Mines shares by issuing 73,768,343 Canuc shares at an exchange ratio of 1.497 Canuc shares per Macdonald Mines share. The deal, pending final TSXV approval, makes Macdonald Mines a wholly owned Canuc subsidiary, integrating the 19,710-hectare SPJ Project in Sudbury, Ontario, with Canuc’s San Javier Silver-Gold Project in Mexico. The acquisition aims to leverage synergies for new discoveries and cash flow from mine tailings.