I Asked Rick Rule a Question the Mining Industry Keeps Avoiding | PDAC 2026 Part 1/3

Glenn Jessome of Silver Tiger Metals Inc. talks to Don Durrett | Metals Investor Forum | Feb 2026

JJ Jennex of Guanajuato Silver Company talks to Peter Krauth at the Metals Investor Forum in Toronto

Silver Demand Explosion: Solar, EVs & AI Are Draining Global Supply Faster Than You Think

Advance Metals (ASX:AVM) – Broad Silver Intervals Confirm Yoquivo Resource Potential

Rick Rule: Gold Price in War, Silver Strategy, Oil Stock Game Plan

Vortex Metals Announces Non-Brokered Private Placement

Kootenay Silver Provides an Update on Activities

Vizsla Silver Provides Update on Situation in Concordia

Advance Metals Reports Broad Silver-Gold Intersections Confirm Resource Upside Potential at Yoquivo

Advance Metals reported broad silver-gold drill intersections at its Yoquivo Project in Chihuahua, Mexico, confirming strong mineralization continuity and indicating potential for a significant resource upgrade. The results support expanding the geological model and evaluating larger-scale development scenarios as the company works toward an updated JORC mineral resource estimate expected in 2026.

Luca Intersects 7.6 Metres of 16.1 g/t Gold at Tahuehueto Mine – Expanding High-Grade Mineralization Near Existing Workings

Luca Mining reported new drilling results from its Tahuehueto Mine in Durango, Mexico, intersecting 7.6 m grading 16.1 g/t gold equivalent, confirming high-grade breccia mineralization below current workings. The results demonstrate continuity in the Creston vein system and potential to expand near-mine resources, prompting a 40% increase in the 2026 drill budget to $3.5 million.

Pan American Silver Discovers New High-Grade Veins at the La Colorada Mine

Pan American Silver reported the discovery of at least four new high-grade silver veins at the La Colorada mine in Zacatecas, Mexico. Drilling between the Cristina and San Gerónimo systems returned strong intercepts, with 40% of holes exceeding 1,000 g/t silver. The Filomena, Nicolasa, Bernardina, and Josefina veins may expand mineral resources and support future high-grade development.

Columba drilling returns 10 meters of 503 gpt silver, 0.1% lead, 0.6% zinc and 9.88 meters of 319 gpt silver, 0.1% lead and 0.6% zinc from the Columba Drill Program

Kootenay Silver reported additional drill results from its Columba High-Grade Silver Project in Chihuahua, Mexico, including 10 m grading 503 g/t silver and 9.88 m grading 319 g/t silver from the Lupe Vein system. The ongoing drill program—expanded to 60,000 meters—is focused on step-out drilling to expand resources, currently estimated at 54.1 million inferred ounces of silver at 284 g/t.

Columba Drilling Returns 10 Meters of 503 gpt Silver, 0.1% Lead, 0.6% Zinc and 9.88 Meters of 319 gpt Silver, 0.1% Lead and 0.6% Zinc From the Columba Drill Program

Kootenay Silver reported additional drill results from its Columba High-Grade Silver Project in Chihuahua, Mexico, including 10 m grading 503 g/t silver and 9.88 m grading 319 g/t silver from the Lupe Vein system. The ongoing drill program—expanded to 60,000 meters—is focused on step-out drilling to expand resources, currently estimated at 54.1 million inferred ounces of silver at 284 g/t.

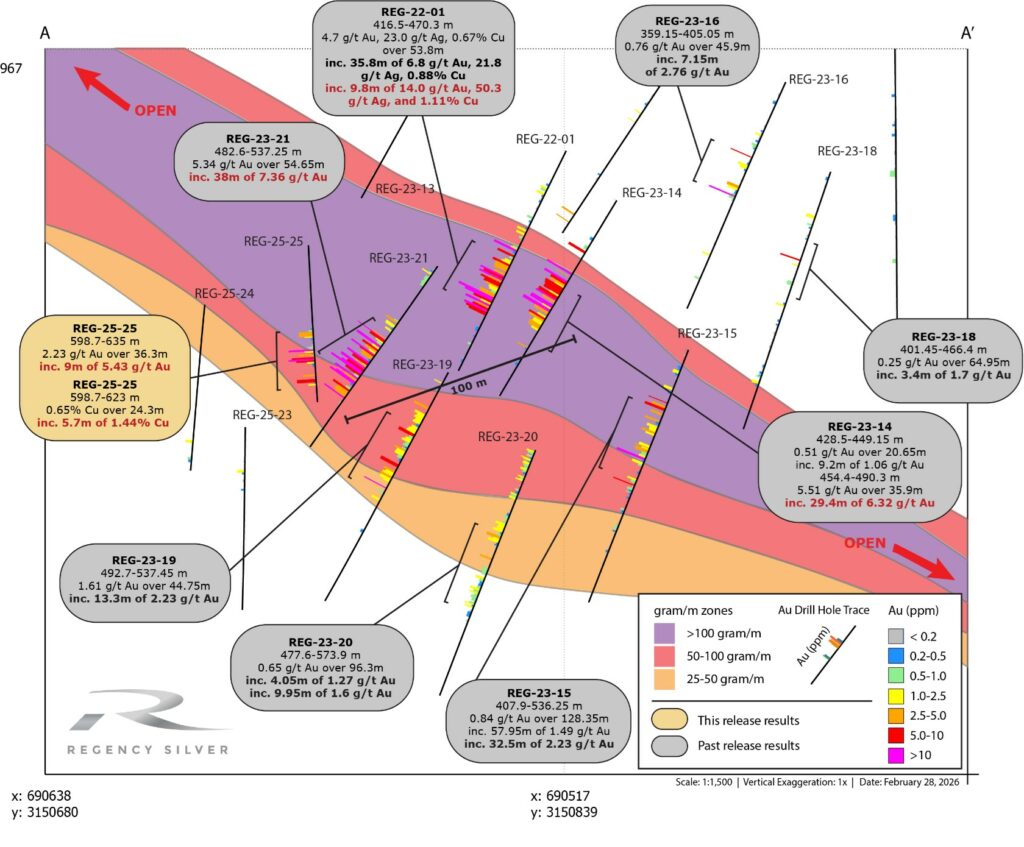

Regency Silver Confirms New Silver-Rich Zones Beneath Historic Mine; System Expands 125m Down Dip

Regency Silver reports that 2025 drilling at its Dios Padre project in Sonora, Mexico has identified new silver-rich zones beneath the historic mine, extending the system 125 m down dip. Highlight assays include 158 g/t silver with copper over 9 m and 5.4 g/t gold over 9 m, supporting continuity of mineralization and potential for substantial new silver-rich zones.

Minaurum Accelerates Exploration at Alamos Silver Project; Expands to Six Drill Rigs and Reports Additional Results

Minaurum Silver has expanded drilling at its Alamos Silver Project in Sonora, Mexico, to six rigs as part of a 50,000-metre Phase II program. Step-out drilling continues on key veins like Europa and Travesía-Quintera, with standout high-grade silver-equivalent intercepts reported, supporting plans for an updated resource estimate later in 2026.

Riverside Resources Expands Porphyry Copper Targets at Ariel Project, Sonora, Mexico

Riverside Resources reported expanded porphyry copper-gold targets at its 100 %-owned Ariel Project in Sonora, Mexico, including high-grade rock samples (e.g., up to ~320 g/t Ag and 5.4 % Pb) and alteration signatures typical of major copper systems. Work has refined multiple priority zones and integrated mapping, geochemistry and geophysics, positioning Ariel as a drill-ready, district-scale target near the La Caridad copper belt.

Masivo Silver Corp. Launches Phase I Drill Program at Cerro Colorado Project, Sonora, Mexico

Masivo Silver Corp. has started its Phase I diamond drilling at the Cerro Colorado Project in Sonora, Mexico, with about 8 holes totaling ~1,500–2,000 m to test high-priority silver-copper targets defined by geological work and historical data. This first drill phase aims to validate geological models and explore mineral continuity at depth.

Silverco Mining Releases Remainder of 2025 Assays, Drilling 13.6m Grading 370 g/t AgEq, 12.0m Grading 236 g/t AgEq, 3.7m Grading 803 g/t AgEq, and 6.8m Grading 255 g/t AgEq

Silverco Mining reported the final 2025 drill results from its 15,000 m program at the Cusi Property in Chihuahua, Mexico, showing high-grade silver-equivalent intercepts (e.g., 370 g/t over 13.6 m, 803 g/t over 3.7 m, 255 g/t over 6.8 m). Results extend mineralization at San Miguel and San Juan and highlight further district potential. No production decision has been made yet.

Silver Storm Reports 50% Completion of Processing Plant Rehabilitation Activities at La Parrilla

Silver Storm Mining Ltd. says its rehabilitation of the La Parrilla Silver Mine Complex processing plant in Durango, Mexico is ~50 % complete, advancing crushing, flotation, oxide and milling circuits. The progress is a key step toward a potential restart of operations in Q2 2026, including expanded sulphide processing capacity.

Capitan Silver Intersects 2,451 g/t Silver Equivalent over 1.5 Metres, within a Wider Zone of 684 g/t Silver Equivalent over 9.1 Metres at the Cruz De Plata Project

Capitan Silver reported very high-grade drill results at its Cruz de Plata project in Durango, Mexico, including an intersection of 2,451 g/t silver-equivalent over 1.5 m within a broader zone of 684 g/t AgEq over 9.1 m, highlighting expanding high-grade silver mineralization and ongoing diamond drilling to test and extend targets along the Jesús María trend.

Mammoth Identifies Draw Point Locations for Future Small-Scale Gold-Silver Mineral Extraction and Pilot Leach Testing at its Tenoriba Gold-Silver Property, Mexico

Mammoth Resources has pinpointed several high-grade “draw point” locations at its 100%-owned Tenoriba gold-silver project in Chihuahua, Mexico for small-scale extraction and pilot heap leach testing. Using surface and drill data, geologists identified targets with attractive near-surface grades. Next steps include field checking and metallurgical tests to assess recoveries and potential tonnage.

Vortex Metals Announces Non-Brokered Private Placement

Vortex Metals announced a non-brokered private placement to raise up to $850,000, issuing 17 million units at $0.05 per unit, each consisting of one common share and a warrant exercisable at $0.06 for three years. Proceeds will fund exploration at the Illapel Copper-Silver Project in Chile and provide working capital for the company.

Kootenay Silver Provides an Update on Activities

Kootenay Silver provided an update on its activities in Mexico, highlighting ongoing step-out drilling at the Columba High-Grade Silver Project in Chihuahua, which hosts 54.1 million inferred ounces of silver at 284 g/t. The company is also advancing a Preliminary Economic Assessment for the La Cigarra Project, with mine design, tailings, and cost studies underway and completion expected in mid-to-late Q2 2026.

Orex Minerals Inc. Announces Closing of Private Placement

Orex Minerals announced the closing of a non-brokered private placement to raise up to $5 million, issuing units priced at $0.165, each consisting of one common share and one warrant exercisable at $0.22 for 24 months. Proceeds will be used primarily for general working capital as the company advances its exploration partnerships and projects in Mexico and Canada.

Luca Strengthens Technical Leadership with Appointment of COO and Builds Team to Execute on Mine Optimizations

Luca Mining appointed Nick Shakesby as Chief Operating Officer, strengthening its technical leadership as it advances operational optimization and growth at its Campo Morado and Tahuehueto mines in Mexico. The company also named Dr. Jose Hernandez as VP Metallurgy and moved Ramón Mendoza to Chief Technical Officer, focusing on the Campo Morado Expansion study and mine plan update.

Highlander Silver to Commence Trading on NYSE American Under Symbol “HSLV”

Highlander Silver Corp. announced that its common shares have been approved for listing on the NYSE American and are expected to begin trading on March 11, 2026, under the symbol HSLV. The company will maintain its Toronto Stock Exchange listing, with the dual listing intended to increase liquidity and broaden access to U.S. investors.

Vizsla Silver Provides Update on Situation in Concordia

Vizsla Silver reported that following the security incident near its Pánuco Project in Concordia, Mexico, two additional workers have been confirmed deceased and three remain missing. The company has suspended site operations, is cooperating with Mexican authorities, supporting affected families, and reviewing security protocols while assessing when activities can safely resume.

Pan American Silver Announces Renewal of Normal Course Issuer Bid

Pan American Silver announced the renewal of its Normal Course Issuer Bid, allowing the company to repurchase up to 21.1 million shares (about 5% of outstanding shares) on the TSX and NYSE between March 6, 2026 and March 5, 2027. Shares bought will be cancelled and funded from working capital, reflecting management’s view that the stock may trade below its underlying value.

Aura Announces Credit Rating Upgrade on Global Scale to ‘BB-’ From ‘B+’ and on Brazilian National Scale to ‘brAA+’ From ‘brAA’, Both With Outlook Revised to Stable

Aura Minerals announced that S&P Global Ratings upgraded its issuer credit rating to BB- from B+ and its Brazilian national scale rating to brAA+ from brAA, both with a stable outlook. The upgrade reflects stronger production growth, favorable gold prices, solid cash flow, and expectations of low debt-to-EBITDA levels supporting the company’s expansion strategy.

Mobile View

Advance Metals Reports Broad Silver-Gold Intersections Confirm Resource Upside Potential at Yoquivo

Advance Metals reported broad silver-gold drill intersections at its Yoquivo Project in Chihuahua, Mexico, confirming strong mineralization continuity and indicating potential for a significant resource upgrade. The results support expanding the geological model and evaluating larger-scale development scenarios as the company works toward an updated JORC mineral resource estimate expected in 2026.

Luca Intersects 7.6 Metres of 16.1 g/t Gold at Tahuehueto Mine – Expanding High-Grade Mineralization Near Existing Workings

Luca Mining reported new drilling results from its Tahuehueto Mine in Durango, Mexico, intersecting 7.6 m grading 16.1 g/t gold equivalent, confirming high-grade breccia mineralization below current workings. The results demonstrate continuity in the Creston vein system and potential to expand near-mine resources, prompting a 40% increase in the 2026 drill budget to $3.5 million.

Pan American Silver Discovers New High-Grade Veins at the La Colorada Mine

Pan American Silver reported the discovery of at least four new high-grade silver veins at the La Colorada mine in Zacatecas, Mexico. Drilling between the Cristina and San Gerónimo systems returned strong intercepts, with 40% of holes exceeding 1,000 g/t silver. The Filomena, Nicolasa, Bernardina, and Josefina veins may expand mineral resources and support future high-grade development.

Columba drilling returns 10 meters of 503 gpt silver, 0.1% lead, 0.6% zinc and 9.88 meters of 319 gpt silver, 0.1% lead and 0.6% zinc from the Columba Drill Program

Kootenay Silver reported additional drill results from its Columba High-Grade Silver Project in Chihuahua, Mexico, including 10 m grading 503 g/t silver and 9.88 m grading 319 g/t silver from the Lupe Vein system. The ongoing drill program—expanded to 60,000 meters—is focused on step-out drilling to expand resources, currently estimated at 54.1 million inferred ounces of silver at 284 g/t.

Columba Drilling Returns 10 Meters of 503 gpt Silver, 0.1% Lead, 0.6% Zinc and 9.88 Meters of 319 gpt Silver, 0.1% Lead and 0.6% Zinc From the Columba Drill Program

Kootenay Silver reported additional drill results from its Columba High-Grade Silver Project in Chihuahua, Mexico, including 10 m grading 503 g/t silver and 9.88 m grading 319 g/t silver from the Lupe Vein system. The ongoing drill program—expanded to 60,000 meters—is focused on step-out drilling to expand resources, currently estimated at 54.1 million inferred ounces of silver at 284 g/t.

Regency Silver Confirms New Silver-Rich Zones Beneath Historic Mine; System Expands 125m Down Dip

Regency Silver reports that 2025 drilling at its Dios Padre project in Sonora, Mexico has identified new silver-rich zones beneath the historic mine, extending the system 125 m down dip. Highlight assays include 158 g/t silver with copper over 9 m and 5.4 g/t gold over 9 m, supporting continuity of mineralization and potential for substantial new silver-rich zones.

Vortex Metals Announces Non-Brokered Private Placement

Vortex Metals announced a non-brokered private placement to raise up to $850,000, issuing 17 million units at $0.05 per unit, each consisting of one common share and a warrant exercisable at $0.06 for three years. Proceeds will fund exploration at the Illapel Copper-Silver Project in Chile and provide working capital for the company.

Kootenay Silver Provides an Update on Activities

Kootenay Silver provided an update on its activities in Mexico, highlighting ongoing step-out drilling at the Columba High-Grade Silver Project in Chihuahua, which hosts 54.1 million inferred ounces of silver at 284 g/t. The company is also advancing a Preliminary Economic Assessment for the La Cigarra Project, with mine design, tailings, and cost studies underway and completion expected in mid-to-late Q2 2026.

Orex Minerals Inc. Announces Closing of Private Placement

Orex Minerals announced the closing of a non-brokered private placement to raise up to $5 million, issuing units priced at $0.165, each consisting of one common share and one warrant exercisable at $0.22 for 24 months. Proceeds will be used primarily for general working capital as the company advances its exploration partnerships and projects in Mexico and Canada.

Luca Strengthens Technical Leadership with Appointment of COO and Builds Team to Execute on Mine Optimizations

Luca Mining appointed Nick Shakesby as Chief Operating Officer, strengthening its technical leadership as it advances operational optimization and growth at its Campo Morado and Tahuehueto mines in Mexico. The company also named Dr. Jose Hernandez as VP Metallurgy and moved Ramón Mendoza to Chief Technical Officer, focusing on the Campo Morado Expansion study and mine plan update.

I Asked Rick Rule a Question the Mining Industry Keeps Avoiding | PDAC 2026 Part 1/3

Glenn Jessome of Silver Tiger Metals Inc. talks to Don Durrett | Metals Investor Forum | Feb 2026

JJ Jennex of Guanajuato Silver Company talks to Peter Krauth at the Metals Investor Forum in Toronto

Silver Demand Explosion: Solar, EVs & AI Are Draining Global Supply Faster Than You Think

Advance Metals (ASX:AVM) – Broad Silver Intervals Confirm Yoquivo Resource Potential

Rick Rule: Gold Price in War, Silver Strategy, Oil Stock Game Plan

Our company BYLSA DRILLING provides drilling services in a variety of environments, ranging from typical exploration sites to extreme topographic conditions, always with the highest quality and safety standards.