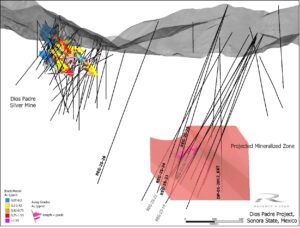

Regency Silver Commences 2026 Drill Program at Dios Padre Targeting Broad Zones of Sulphide-Specularite Bearing Breccia as Follow Up to Hole REG 25-26

Regency Silver Corp. (TSXV: RSMX, OTCQB: RSMXF) has commenced its 2026 drill program at the Dios Padre project in Sonora, Mexico. It targets broad sulphide-specularite bearing breccia zones as follow-up to hole REG-25-26 (~240m non-continuous mineralized interval, assays pending). Initial focus: minimum 4 holes (500-650m each) near REG-25-26, including REG-25-27 (50m above strongest zone), to test dip, strike, and expand the high-grade gold-copper-silver discovery.