Oroco Private Placement Oversubscribed

Oroco Resource Corp. is pleased to announce that the non-brokered private placement financing announced by the Company on February 5, 2025, is now oversubscribed due to strong investor demand.

Oroco Resource Corp. is pleased to announce that the non-brokered private placement financing announced by the Company on February 5, 2025, is now oversubscribed due to strong investor demand.

Zacatecas Silver CEO and Director, Eric Vanderleeuw, stated: “As we focus on advancing our silver assets, our technical team has designed a program aimed at expanding the current resource while following up on multiple high-grade intercepts drilled outside the known resource area.”

Net profit in the quarter fell 6.5% to $686.5 million, from revenues which were up 13% to $3.85 billion. Analysts polled by LSEG had forecast a net profit of $945 million from revenues of $4.04 billion.

McEwen Mining closed an upsized $110 million offering of 5.25% convertible senior unsecured notes due 2030, including a full $15 million option exercise. The notes carry an initial conversion price of ~$11.25 (≈30% premium) and a capped call could raise it to $17.30, reducing dilution. Proceeds will partially repay high-interest debt and fund growth plans, especially at the Fox Complex.

SilverCrest Metals Inc. is pleased to announce that the Supreme Court of British Columbia has granted the final order in connection with the Company’s plan of arrangement with Coeur Mining, Inc. whereby Coeur will, among other things, indirectly acquire all of the issued and outstanding SilverCrest shares.

“That tariff is not justified,” said Ebrard. “It’s unfair according to President Trump’s own arguments. Because we, I repeat, have more (steel) imports than exports.”

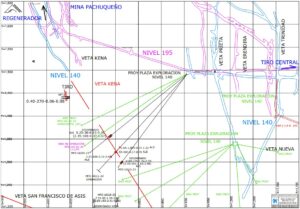

President and CEO Fred Davidson commented, “We are pleased with these additional excellent drill results from the recently discovered Kena Vein South which has now been drilled over 150 metres length and remains open for further drilling. The close proximity of the new vein to current active mine workings has allowed for rapid and low cost mine development.”

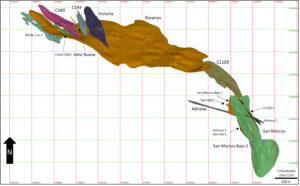

Silver Tiger Metals Inc. intersected high-grade silver in underground drilling at El Tigre Project, Sonora, Mexico: Hole ET-24-627 returned 3.0 m of 1,526.3 g/t AgEq within broader 17.3 m of 309.0 g/t AgEq in the Sulfide Zone. Additional intercepts reported; targeting underground potential post-PFS.

Greg McKenzie, President and CEO, commented, “We are incredibly pleased with this latest resource update. We achieved a material 107% increase in Indicated Resources and there was also a significant increase in Inferred Resources at La Parrilla.”

Defiance Silver Corp. (Feb 11, 2025) closed the second tranche of a private placement, raising C$1,560,600 via 7,803,000 units at C$0.20 each (each unit: 1 share + ½ warrant at C$0.35/24 months). Combined with first tranche (C$732,200), total C$2,292,800; third tranche planned for overall C$3.3M. Proceeds for exploration and working capital.

Mexico Mining Center © 2021 / All Rights Reserved