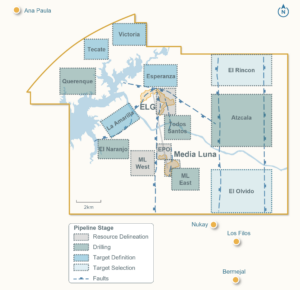

Torex Gold Reports Excellent Drilling Results from EPO

Torex Gold Resources Inc. reported strong drilling results from the EPO deposit’s northern extension at the Morelos Complex, Mexico. Highlights include 55.18 gpt AuEq over 20.1 m (ML24-1049DA) and 6.17 gpt AuEq over 15.0 m (ML24-1048D). The 2024 program added 233,000 oz AuEq to Inferred Resources. Drilling aims to expand resources and extend production beyond 2035, with first EPO production expected by late 2026.