Phase 1 mining program exceeds production target

HIGHLIGHTS:

- Starter open pit completed with an estimated 6,100 tonnes of ore mined at grades of 13.4% Zn & 10.7% Pb, with both tonnage and grades well above initial expectations

- Includes production of ultra-high-grade ore of approximately 2,100 tonnes grading 24.0% Zn & 18.3% Pb

- Ore processing to start in the December quarter and continue for 2-3 months

- Concentrates will be sold on spot market with strong interest already received from potential purchasers

Azure Minerals Limited (“Azure” or the “Company”) (ASX: AZS) is pleased to announce that the first phase of the Company’s small-scale mining program at its 100%-owned Oposura zinc-lead-silver mine in Sonora, Mexico, has been completed, delivering outstanding results.

Open pit mining selectively extracted near-surface, high-grade, massive zinc and lead sulphide mineralisation. Ore tonnages and grades significantly exceed the Mineral Resource estimate for this part of the deposit.

Azure Minerals Managing Director Tony Rovira said: “This has been a very impressive start to our small- scale mining program. To be getting more tonnes and much higher grades than we had expected gives us great confidence in the project as we advance Oposura toward large-scale mining and on-site processing.”

Over the past two months, 6,100 tonnes of high-grade ore were mined and stockpiled. Based upon close-spaced Reverse Circulation (RC) grade control drilling and systematic stockpile sampling, average grades of the mined ore are estimated to be 13.4% zinc and 10.7% lead. This significantly exceeds the estimated average East Zone open pit mine grade from the 2018 Oposura Scoping Study of 5.1% zinc and 2.6% lead, which augurs well for a future large-scale mining and processing operation.

Wet commissioning of the toll treatment processing plant was delayed due to an extended refurbishment program, but has now commenced. Oposura ore throughput is scheduled to start in the December quarter. Azure will produce separate zinc and lead-silver concentrates and expects to sell them on the spot market to locally-based metals traders or smelters, several of which have expressed strong interest in these products.

When delivered, positive cash flow will support funding of the Definitive Feasibility Study into a large- scale mining and on-site processing operation and provide general working capital.

OPERATIONAL DETAILS

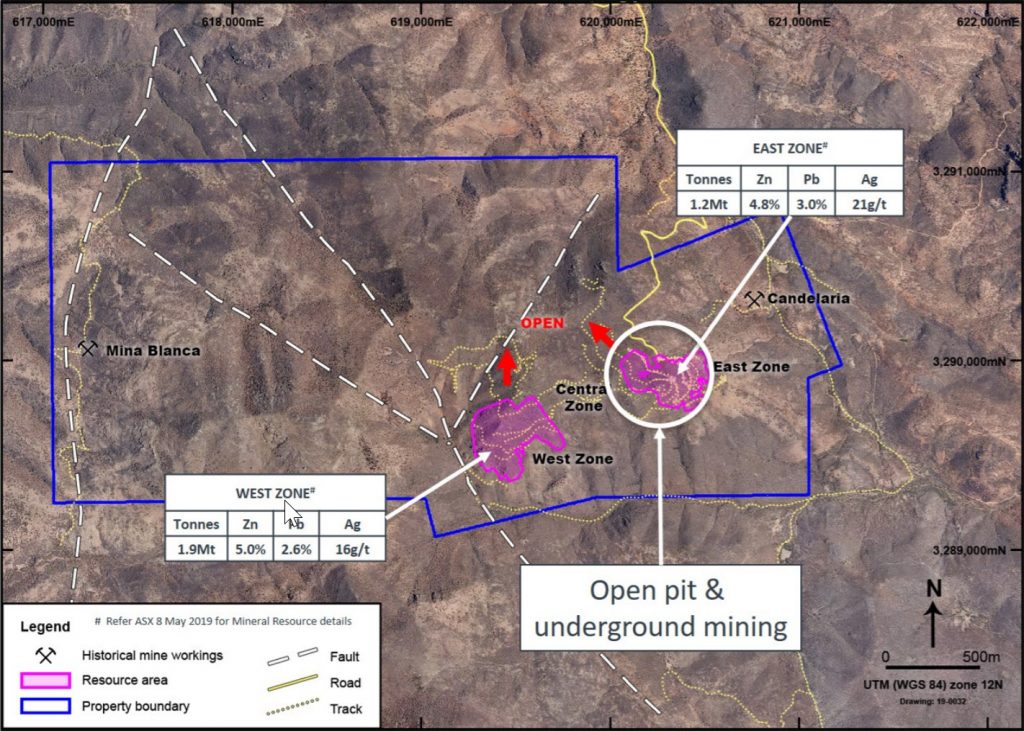

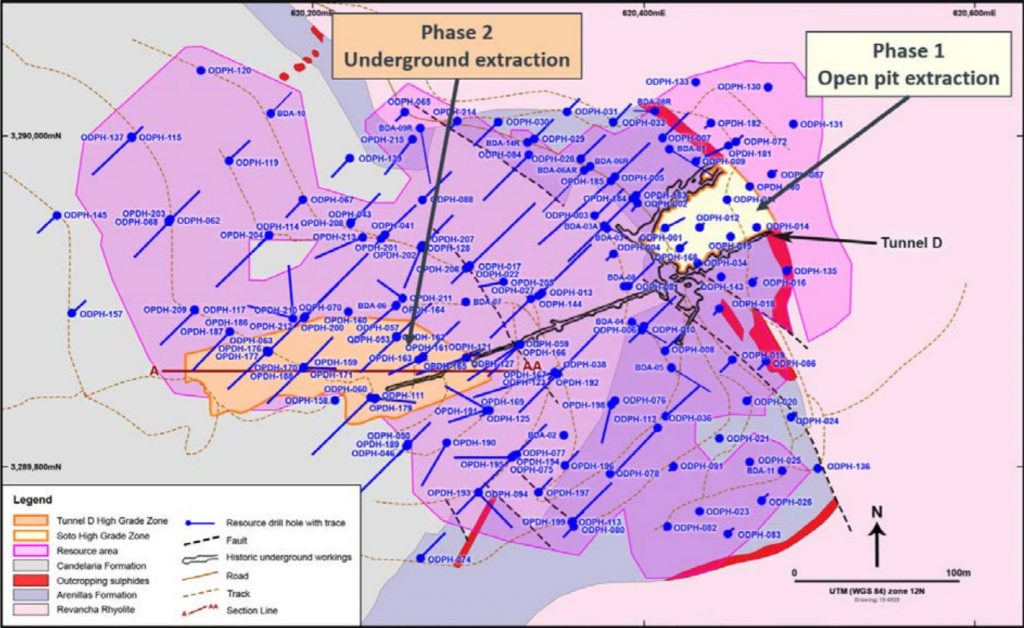

The small-scale mining program focused on extracting near-surface, easily accessible, high-grade massive sulphide mineralisation from the eastern side of the East Zone Mineral Resource (see Figures 1 & 2).

Mining consisted of a starter open pit (see Figure 3) to expose and extract massive sulphide ore which occurs at or very close to surface and which, in some places, was already fully exposed by historical prospecting activities. Overburden comprised weathered rock which was removed by bulldozer and excavator, with minimal drilling and blasting required, ensuring low mining costs.

Initially, the open pit was designed to extract approximately 1,000 tonnes of ore before moving into an underground mining phase. However once open pit mining commenced, significantly more ore at higher grades was identified than was originally estimated by the mineral resource drilling (hole spacing of approximately 25m x 25m). Given the lower mining costs and higher production rates associated with open pit mining (as compared with underground mining), Azure extended the open pit mining phase. A total of 6,100 tonnes of ore was excavated and stockpiled on site. Based upon RC grade control drilling (hole spacing of 4m x 4m) and systematic stockpile sampling, the grade of mined ore is estimated to be 13.4% Zn and 10.7% Pb.

Within the open pit, the relatively flat-lying, high-grade massive sulphide zone varied in thickness from two to four metres and demonstrated excellent continuity of the overall mineralised horizon and the internal high-grade, massive sulphide zones.

Within the western part of the open pit, 2,100 tonnes of ultra-high-grade massive sulphide ore was mined (see Figure 4) at an average grade of 24.0% Zn and 18.3% Pb (a combined 42.3% Zn+Pb), with some parts of this zone containing zinc and lead grades exceeding a combined 50% Zn+Pb. This ultra- high-grade ore was stockpiled separately as a potential Direct Shipping Ore (DSO) product.

With a successful first phase of the small-scale mining program, mining was suspended with high- grade massive sulphide ore remaining exposed in the floor and walls of the open pit. A significant quantity of broken stocks of high-grade ore remains exposed and available for immediate extraction upon recommencement of the operation, once successful ore processing is underway and marketable concentrates produced.

Following a second phase of open pit mining to extract broken ore stocks and other easily accessible ore, underground mining will commence. The open pit mining has enabled the western pit wall to be cut back to provide a stable face for portal access for the planned underground mining operation. The portal and subsequent drive will access the historical Tunnel D which will be side-stripped to provide 3m x 3m mechanised access to the western high-grade zone (see Figure 2). Underground development will be undertaken in ore to offset establishment costs prior to selectively mining the high-grade ore zone by the room and pillar method.

Figure 1: Oposura Project with East Zone & West Zone Mineral Resources

Figure 2: East Zone showing Mineral Resource and small-scale mining locations

Figure 3: Open pit mining operations in the East Zone, looking west

Figure 4: Mining ultra-high-grade (+40% Zn+Pb) massive zinc and lead sulphide ore in the East Zone open pit

-ENDS-

For enquiries, please contact:

| Tony Rovira Managing Director Azure Minerals Limited Ph: +61 8 9481 2555 | Media & Investor Relations Michael Weir / Cameron Gilenko Citadel-MAGNUS Ph: +61 8 6160 4903 |

or visit www.azureminerals.com.au

Competent Person Statements:

Information in this report that relates to previously reported Exploration Results has been crossed-referenced in this report to the date that it was originally reported to ASX. Azure Minerals Limited confirms that it is not aware of any new information or data that materially affects information included in the relevant market announcements.

Information in this report that relates to Mineral Resources for the Oposura Project is extracted from the report “Azure Expands Oposura Mineral Resource” created and released to the ASX on 8 May 2019 and is available to view on www.asx.com.au. Azure Minerals Limited confirms that it is not aware of any new information or data that materially affects information included in the relevant market announcement, and that all material assumptions and technical parameters underpinning the estimates in the announcement continue to apply and have not materially changed.

Cautionary Statement – Production Targets:

The proposed mining and processing operation referred to in this announcement is based on lower-level technical and economic assessments of the Trial Mining Study (ASX: 5 June 2019), which is insufficient to support estimation of Ore Reserves or to provide assurance of an economic development case at this stage, or to provide certainty that the conclusions will be realised. Furthermore, the Company cautions that there is no certainty that the forecast production targets will be realised. Production targets referred to in this Report are underpinned by Mineral Resource estimates which have been prepared by competent persons in accordance with the requirements of the JORC Code. The production targets in this report are sourced 100% from resources classified in the Indicated Mineral Resource category. The stated production targets are based on the Company’s current expectations of future results or events and should not be solely relied upon by investors when making investment decisions.

Caution Regarding Forward Looking Statements and Forward-Looking Information:

This announcement contains forward looking statements and forward-looking information which are based on assumptions and judgments of management regarding future events and results. Such forward-looking statements and forward-looking information involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any anticipated future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the actual market prices of zinc and lead, the actual results of current exploration, the availability of debt and equity financing, the volatility in global financial markets, the actual results of future mining, processing and development activities, receipt of regulatory approvals as and when required and changes in project parameters as plans continue to be evaluated.

Except as required by law or regulation (including the ASX Listing Rules), Azure Minerals undertakes no obligation to provide any additional or updated information whether as a result of new information, future events or results or otherwise. Indications of, and guidance or outlook on, future earnings or financial position or performance are also forward-looking statements.

Source: https://azureminerals.com.au/wp-content/uploads/2019/09/190923.pdf