(All dollar amounts expressed in US dollars unless otherwise noted)

NYSE American: GPL | TSX: GPR

VANCOUVER, May 7, 2020 /PRNewswire/ – Great Panther Mining Limited (TSX:GPR; NYSE-A:GPL) (“Great Panther” or “the Company”) reports consolidated financial results for the first quarter (“Q1”) of 2020 reflecting the operations of its three wholly owned mines: the Tucano Gold Mine (“Tucano”) in Brazil, and the Topia Mine (“Topia”) and Guanajuato Mine Complex (the “GMC”) in Mexico. The Company will host a conference call and live webcast to discuss the results at 7.30am PDT/10.30am EDT on May 8, 2020. Dial-in and login details are provided at the end of this news release.

Q1 2020 Financial and Operating Highlights

- Revenue of $48.1 million, representing a 188% growth over Q1 2019;

- Mine operating earnings before non-cash items1 of $14.2 million ($0.05 per share);

- Adjusted EBITDA1 of $6.4 million;

- Cash flow from operating activities of $11.8 million ($0.04 per share);

- Production of 34,725 gold equivalent ounces (“Au eq oz”);

- Cash costs of $1,045 per payable gold ounce1; and,

- Cash and cash equivalents at March 31, 2020 of $38.8 million.

“We delivered significant growth in revenue, mine operating earnings and operating cash flow in the first quarter of 2020 as a result of the acquisition of Tucano last year. The team achieved a significant advance in stripping at Tucano completing a 36% increase in waste movement over the prior quarter which is strongly supportive of our guidance for 2020 and positions us well for 2021,” stated Rob Henderson, President and CEO. “In addition, we launched a $6.6 million, 55,000 metre exploration drill program at Tucano focused on the addition of new near-mine mineralized zones and extension of the mine life.”

“While our Mexican operations are temporarily suspended due to federal COVID-19 restrictions, Tucano in Brazil has not been impacted by any government restrictions and we continue to proactively and collaboratively work with authorities to ensure we have the appropriate protocols and safeguards to manage the risks of COVID-19 for our employees and communities.”

1 The Company has included the non-GAAP performance measures cost per tonne milled, cash cost per gold ounce sold, cash cost per payable silver ounce, AISC per gold ounce sold excluding corporate G&A expenditures, AISC per gold ounce sold, AISC per payable silver ounce, mine operating earnings before non-cash items, cost of sales before non-cash items, adjusted EBITDA, adjusted net loss and adjusted net loss per share throughout this document. Refer to the Non-GAAP Measures section of the Company’s MD&A for an explanation of these measures and reconciliation to the Company’s financial results reported in accordance with IFRS. As these are not standardized measures, they may not be directly comparable to similarly titled measures used by others.

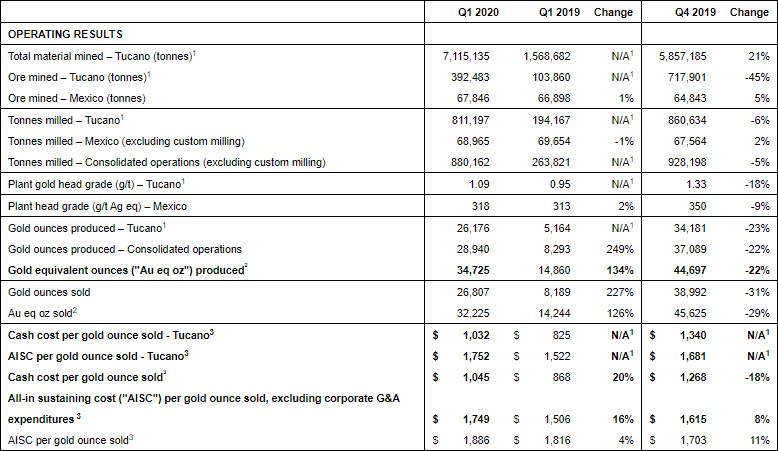

OPERATIONAL AND FINANCIAL HIGHLIGHTS

| 1 | The comparative data presented for Q1 2019 is for the period from March 5, 2019 to March 31, 2019, the period for which the Company owned Tucano following the acquisition of Beadell. |

| 2 | Gold equivalent ounces are referred to throughout this document. For 2020, Au eq oz were calculated using a 1:90 Au:Ag ratio, and ratios of 1:0. 0006412 and 1:0. 0007554 for the price/ounce of gold to price/pound of lead and zinc, respectively, and applied to the relevant metal content of the concentrates produced, expected to be produced, or sold from operations. The ratios are reflective of average metal prices for 2020. Comparatively, Au eq oz for 2019 were calculated using a 1:80 Au:Ag ratio, and ratios of 1:0.000795 and 1:0.00102258 for the price/ounce of gold to price/pound of lead and zinc, respectively, and applied to the relevant metal content of the concentrates produced, expected to be produced, or sold from operations. The ratios are reflective of average metal prices for 2019. |

| 3 | The Company has included the non-GAAP performance measures cost per tonne milled, cash cost per gold ounce sold, cash cost per payable silver ounce, AISC per gold ounce sold excluding corporate G&A expenditures, AISC per gold ounce sold, AISC per payable silver ounce, mine operating earnings before non-cash items, cost of sales before non-cash items adjusted EBITDA, adjusted net loss and adjusted net loss per share throughout this document. Refer to the Non-GAAP Measures section of the Company’s MD&A for an explanation of these measures and reconciliation to the Company’s financial results reported in accordance with IFRS. As these are not standardized measures, they may not be directly comparable to similarly titled measures used by others. |

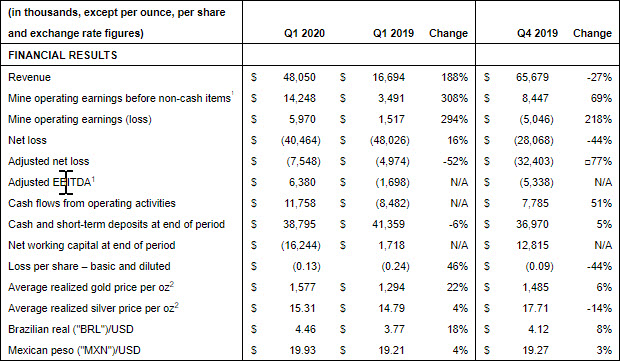

SUMMARY REVIEW OF FINANCIAL RESULTS OF THE FIRST QUARTER OF 2020

Revenue for the first quarter of 2020 was $48.1 million, an increase of 188% over Q1 2019, reflecting primarily the acquisition of Tucano. Tucano accounted for $38.0 million of revenue for the first quarter of 2020. Higher sales volume from the Mexican operations and higher realized gold and silver prices also contributed to the increase in revenue.

Mine operating earnings before non-cash items increased to $14.2 million ($0.05 per share) from $3.5 million ($0.02 per share) in the first quarter of 2019. The increase was also primarily attributed to the contribution of Tucano, which accounted for $13.1 million of mine operating earnings before non-cash items. Mine operating earnings (inclusive of amortization and other non-cash charges) increased to $6.0 million compared with $1.5 million in the same period in the prior year and includes amortization and depletion for Tucano since its acquisition.

Adjusted EBITDA for the first quarter of 2020 was $6.4 million ($0.02 per share). This compares to a negative Adjusted EBITDA of $1.7 million (-$0.01 per share) for Q1 2019.

Net loss for the quarter was $40.5 million ($0.13 per share). The net loss includes $26 million in mark-to-market adjustments on the Company’s derivative instruments, of which $23.6 million was unrealized, and a foreign exchange loss of $10.8 million, of which $9.5 million was unrealized. The mark-to-market adjustments primarily relate to the Company’s BRL/USD forward currency contracts, resulting from the significant weakening of the BRL against the USD and adjustments to the fair value of the Company’s gold put option contracts. The forward currency contracts mature over the period to February 2021 and reduce the Company’s exposure to foreign currency risk on a portion of the BRL costs at Tucano.

| 1 | The Company has included the non-GAAP performance measures cost per tonne milled, cash cost per gold ounce sold, cash cost per payable silver ounce, AISC per gold ounce sold excluding corporate G&A expenditures, AISC per gold ounce sold, AISC per payable silver ounce, mine operating earnings before non-cash items, cost of sales before non-cash items, adjusted EBITDA, adjusted net loss and adjusted net loss per share throughout this document. Refer to the Non-GAAP Measures section of the Company’s MD&A for an explanation of these measures and reconciliation to the Company’s financial results reported in accordance with IFRS. As these are not standardized measures, they may not be directly comparable to similarly titled measures used by others. |

| 2 | Average realized gold and silver prices are prior to smelting and refining charges. |

Adjusted net loss was $7.5 million, which excludes the unrealized losses on derivative instruments and foreign exchange, compared with a loss of $5.0 million for the first quarter of 2019.

Cash flow from operating activities increased to $11.8 million primarily reflecting the increase in mine operating earnings before non-cash items of $10.8 million.

Refer to the MD&A for the three months ended March 31, 2020 for more details of the financial results and for reconciliations of the Company’s non-GAAP performance measures to the nearest GAAP measure. The full version of the Company’s consolidated financial statements and MD&A can be viewed on the Company’s website at www.greatpanther.com or on SEDAR at www.sedar.com. All financial information is prepared in accordance with IFRS, except as noted in the Non-GAAP Measures section of the MD&A.

CASH COST AND ALL-IN SUSTAINING COSTS

The comparative consolidated operating results, cash cost and AISC for the three months ended March 31, 2019 reflect Tucano operations from the March 5, 2019 date of the completion of the acquisition, and a comparison to those of prior periods on an overall basis is not meaningful. Refer to the discussion of operating and cost metrics for the individual mines in the MD&A for the three months ended March 31, 2020.

For the first quarter of 2020, Tucano AISC per gold ounce sold was $1,752 compared with $1,522 for the first quarter of 2019 and exceeds the 2020 guidance of between $1,150 and $1,250 per gold ounce sold primarily due to the high volume of stripping. Tucano completed a significantly higher proportion of planned stripping for the operation in the first quarter of 2020 which is expected to benefit production for the remainder of 2020 and 2021. The lower stripping in subsequent quarters will also translate to a reduction in AISC.

Q1 2020 AISC for the GMC was $14.21 per payable silver ounce which compares to 2020 guidance of between $13.00 and $14.00 and represents a decrease of $5.72 per payable silver ounce compared with the first quarter of 2019. The decrease was primarily due to a decrease in cash cost ($4.99 per oz effect) and higher number of payable silver ounces which decreased the sustaining capital and sustaining exploration, evaluation and development (“EE&D”) elements of AISC on a per ounce basis ($1.47 per oz effect).

Further discussion of the Company’s cash cost and AISC can be found in the MD&A for the three months ended March 31, 2020. For the purposes of consolidated cash cost and AISC, the GMC and Topia are incorporated on the basis of Au payable sales, and other metals produced are treated as by-products. See the Non-GAAP Measures section of the MD&A for detailed reconciliations and computation of these measures.

CASH, SHORT-TERM DEPOSITS AND WORKING CAPITAL AT MARCH 31, 2020

At March 31, 2020, the Company had cash and short-term deposits of $38.8 million, compared with $37.0 million at December 31, 2019.

During the quarter ended March 31, 2020, cash flows from operating activities (after changes in non-cash working capital) contributed $11.8 million to cash and net financing activities contributed $8.1 million, which included $11.3 million proceeds from the gold doré prepayment facility with Samsung and $3.2 million in debt and lease payments were made. These cash inflows were partially offset by capital investments of $16.4 million in additions to plant and equipment, including $12.6 million of capitalized stripping costs at Tucano.

Net working capital was negative $16.2 million as at March 31, 2020, a decrease of $29.0 million from the start of the year. The negative net working capital is attributed to the mark-to-market adjustment on the Company’s non-deliverable BRL forward contracts at March 31, 2020. Removing the effect of the mark-to-market adjustments on the Company’s derivative instruments results in adjusted net working capital of $3.5 million.

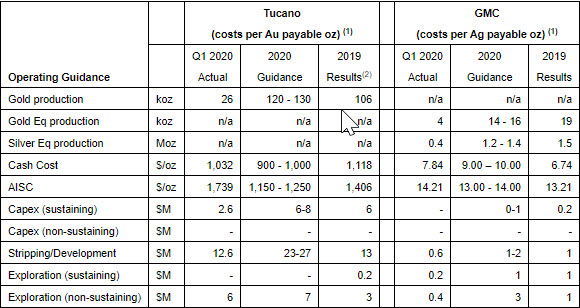

2020 GUIDANCE AND OUTLOOK

Great Panther previously provided production and cost guidance for Tucano and the GMC which remains unchanged. These two operations combined represented approximately 85% of 2019 production on a gold equivalent ounce basis. The Company has not provided guidance for Topia due to the previous decision to suspend tailings deposition at the mine’s Phase II tailings storage facility (“TSF”) and subsequent Mexican federal government restrictions on non-essential business activities in an effort to limit the spread of COVID 19.

Great Panther expects to provide Topia operating guidance and Company consolidated production and cost guidance by the end of the second quarter of 2020.

Great Panther’s 2020 operating guidance for Tucano and the GMC compared with actual 2019 results and first quarter of 2020 results is as follows:

| (1) | Cash costs and AISC are calculated net of by-product credits. |

| (2) | 2019 results for Tucano are reflective of the period under Great Panther ownership beginning March 5, 2019 |

| (3) | Topia 2020 operating guidance is to be provided by the end of the second quarter of 2020, as further detailed under the Topia section below. |

Further information on the Company’s 2020 guidance can be obtained by referring to the Outlook section of the Company’s 2019 MD&A dated March 30, 2020.

Coricancha

Coricancha has been on care and maintenance as the Company evaluates conditions for a restart of the mine. The evaluation has included a preliminary Economic Assessment (“PEA”) completed in 2018 and a bulk sample program completed in June 2019. In the fourth quarter of 2019, the Company initiated a limited mining and processing campaign of approximately 25,000 tonnes. These activities were temporarily suspended in accordance with the Peruvian government-mandated restrictions associated with the 15-day National State of Emergency announced on March 16, 2020 in response to the coronavirus respiratory disease, COVID-19, and the effective period was subsequently extended to April 12, 2020 and recently was further extended until May 10, 2020. Once the restrictions are lifted, the Company plans to resume the processing campaign and continue with its evaluation activities.

General Uncertainty due to COVID 19 Measures

The Company has been closely monitoring the effects of the spread of the coronavirus respiratory disease (“COVID-19”) with a focus on the jurisdictions in which the Company operates and its head office location in Canada.

The rapid worldwide spread of COVID-19 has resulted in governments implementing restrictive measures to curb the spread of COVID-19. During this period of uncertainty, Great Panther’s priority is to safeguard the health and safety of personnel and host communities, support and enforce government actions to slow the spread of COVID-19 and to assess and mitigate the risks to our business continuity.

The Company has implemented a COVID-19 response plan that includes a number of measures to safeguard against the spread of the virus at its offices and sites. These include requirements to report infection or contact with those infected, restrictions on international travel and any non-essential domestic travel, alternative work arrangements, hygiene precautions and physical distancing practices among others.

Great Panther is also maintaining regular communications with its suppliers, customers and business partners to monitor any potential risks to its ongoing operations. Mining and processing operations at Tucano continue uninterrupted at this time. The Company has been in dialogue with the relevant government authorities, including communication regarding the enhanced safety protocols that have been implemented to mitigate the risk of COVID-19 cases at Tucano and surrounding communities. The Company has prepared contingency plans in the event that there is a full or partial shutdown and is prepared to act quickly to implement them. As of the date of this press release, the Company is aware that the State of Amapa in Brazil where Tucano is located is reporting increased rates of COVID-19 infection and the Company is aware of two employees who have tested positive for the COVID-19 virus. In a cautionary effort to both protect its employees and ensure continued operations, the Company implemented stronger segregation measures to protect plant and mine employees in a manner that will permit operations while ensuring safety. In the event authorities seek to restrict operations to mitigate the spread of COVID-19, the Company will endeavour to do so in a manner to satisfy authorities without a complete shutdown of operating activities. This may involve the curtailment of only mining operations and while continuing to process ore stockpile for which the Company has a reserve of three months. If authorities take measures to restrict activities, there is no guarantee that the Company can avoid a full shutdown of operations.

WEBCAST AND CONFERENCE CALL TO DISCUSS THE FIRST QUARTER 2020 FINANCIAL RESULTS

A webcast and conference call will be held on Friday, May 8, 2020 at 7.30am PDT/10.30am EDT. Shareholders, analysts, investors and media are invited to join by logging in or calling in five minutes prior to the start time.

Live webcast and registration: www.greatpanther.com

| Vancouver: | 604 638 5340 |

| U.S. and Canada toll-free: | 1 800 319 4610 |

| International toll: | +1 604 638 5340 |

A replay of the webcast will be available on the Webcasts section of Great Panther’s website approximately one hour after the conference call. Audio replay will be available for four weeks by calling the numbers below using the replay access code 4525.

| Vancouver: | 604 638 9010 |

| U.S. and Canada toll-free: | 1 800 319 6413 |

| International: | +1 604 638 9010 |

ABOUT GREAT PANTHER

Great Panther Mining Limited is an intermediate gold and silver mining and exploration company trading on the Toronto Stock Exchange under the symbol GPR, and on the NYSE American under the symbol GPL. Great Panther’s operations include the Tucano Gold Mine in Brazil, and the Topia Mine and Guanajuato Mine Complex, comprising the San Ignacio and Guanajuato mines, in Mexico. It also owns the Coricancha Mine in Peru which is currently on care and maintenance.

CAUTIONARY STATEMENT ON FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of Canadian securities laws (together, “forward-looking statements”). Such forward-looking statements may include, but are not limited to, statements regarding (i) the Company’s production guidance and ability to meet its production guidance, (ii) expectations of cash cost, AISC, capital expenditures, and other expenditures (iii) the exploration potential of Tucano, Topia, the GMC and Coricancha, (iv) the results of the geotechnical review of UCS and the Company’s plans for continued mining at UCS, (v) the Company’s plans to convert existing resources to reserves and its future mining plans, including the expected life of the Company’s mines, (vi) the accuracy of the Company’s mineral reserve and resource estimates; (vii) the Company’s near-mine and regional exploration programs and ability to discover new resources at Tucano; (viii) the Company’s expectations that metallurgical, environmental, permitting, legal, title, taxation, socio-economic, political, marketing or other issues will not materially affect the estimates or mineral reserves and mineral resources or its future mining plans, and (ix) expectations regarding the receipt of a permit for the Topia Phase III TSF and the Company’s ability to find alternatives to store tailings until Phase III is permitted (or recommencement of tailings deposition at Phase II) and to continue operations at Topia.

These forward-looking statements and information reflect the Company’s current views with respect to future events and are necessarily based upon a number of assumptions that, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include: continued operations at Tucano in accordance with the Company’s mine plan; the accuracy of the Company’s mineral reserve and mineral resource estimates and the assumptions upon which they are based; ore grades and recoveries; prices for silver, gold, and base metals remaining as estimated; currency exchange rates remaining as estimated; capital, decommissioning and reclamation estimates; prices for energy inputs, labour, materials, supplies and services (including transportation); all necessary permits, licenses and regulatory approvals for the Company’s operations are received in a timely manner, including the permit for the Phase III Topia TSF; the Topia TSF can be remediated as planned and the Company’s ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements expressed or implied by such forward-looking statements to be materially different. Such factors include, among others, risks and uncertainties relating to: the inherent risk that estimates of mineral reserves and resources may not be accurate and accordingly that mine production will not be as estimated or predicted; gold, silver and base metal prices may decline or may be less than forecasted; fluctuations in currency exchange rates (including the U.S. dollar to Brazilian real exchange rate) may increase costs of operations; operational and physical risks inherent in mining operations (including pit wall collapses, tailings storage facility failures, environmental accidents and hazards, industrial accidents, equipment breakdown, unusual or unexpected geological or structural formations, cave-ins, flooding and severe weather) may result in unforeseen costs, shut downs, delays in production and exposure to liability; planned exploration activities may not result in conversion of existing mineral resources into mineral reserves or discovery of new mineral resources; potential political and social risks involving Great Panther’s operations in a foreign jurisdiction; the potential for unexpected costs and expenses; employee relations; relationships with, and claims by, local communities and indigenous populations; the Company’s ability to obtain all necessary permits, licenses and regulatory approvals in a timely manner; changes in laws, regulations and government practices in the jurisdictions in which the Company operates; legal restrictions related to mining; the inability to remediate the UCS pit at Tucano and the Topia TSF as planned; diminishing quantities or grades of mineral reserves as properties are mined operating or technical difficulties in mineral exploration, changes in project parameters as plans continue to be refined, and other risks and uncertainties, including those described in respect of Great Panther, in its annual information form for the year ended December 31, 2019 and material change reports filed with the Canadian Securities Administrators available at www.sedar.com and reports on Form 40-F and Form 6-K filed with the Securities and Exchange Commission and available at www.sec.gov.

There is no assurance that these forward-looking statements will prove accurate or that actual results will not vary materially from these forward-looking statements. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. Accordingly, readers are cautioned not to place undue reliance on forward looking statements. Forward-looking statements and information are designed to help readers understand management’s current views of our near and longer term prospects and may not be appropriate for other purposes. The Company does not intend, nor does it assume any obligation to update or revise forward-looking statements or information, whether as a result of new information, changes in assumptions, future events or otherwise, except to the extent required by applicable law.

SOURCE Great Panther Mining Limited

Original Article: https://www.prnewswire.com/news-releases/great-panther-reports-first-quarter-2020-financial-results-301055572.html