- CASH BALANCE OF OVER $22 MILLION

- OVER $24 MILLION INVESTED IN CAPITAL AND EXPLORATION

- THIRD QUARTER LOSS OF $9.7 MILLION IS A RESULT OF

- LOWER METAL PRICES

- HIGHER DEPRECIATION EXPENSE DUE TO LOWER MINERAL RESERVE BASE

- BACK FORTY PROJECT FEASIBILITY STUDY WORK & PERMITTING EXPENSES

October 31, 2022 08:58 PM Eastern Daylight Time

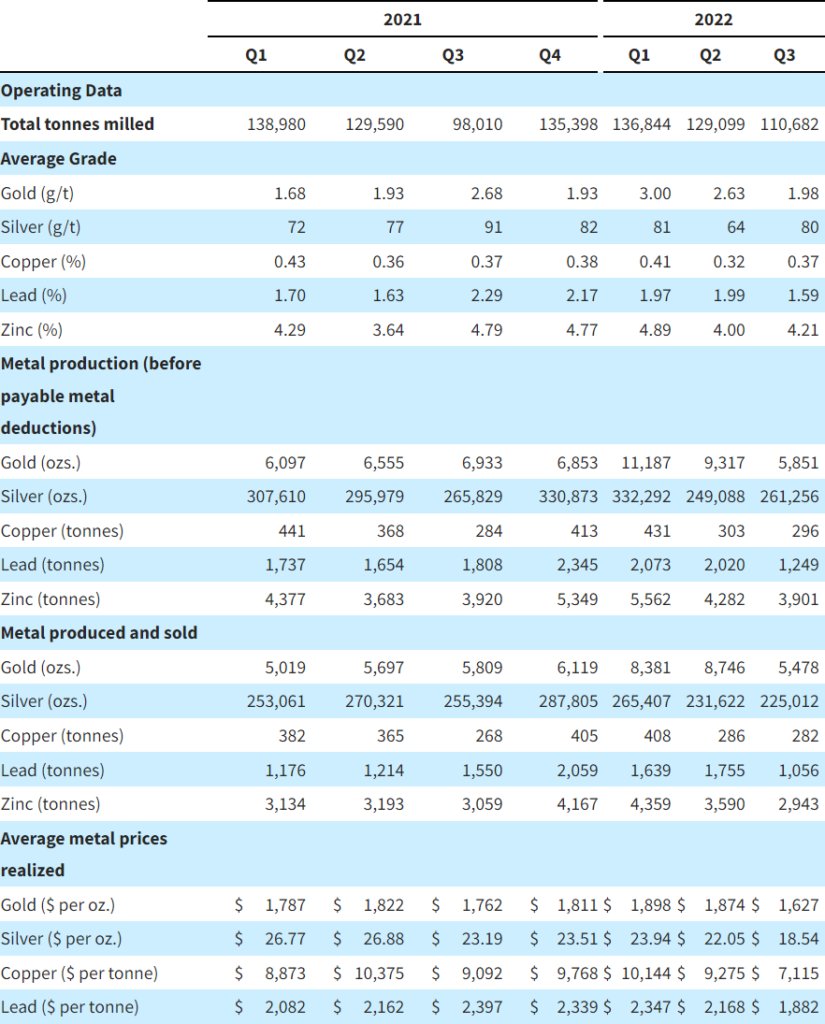

DENVER–(BUSINESS WIRE)–Gold Resource Corporation (NYSE American: GORO) (the “Company”) sold a total of 5,478 ounces of gold and 225,012 ounces of silver in Q3 2022 for a gold equivalent total of 8,042 ounces. Additionally, the Company sold 2,943 tonnes of zinc, 282 tonnes of copper, and 1,056 tonnes of lead.

Allen Palmiere, President and CEO said “The implementation of safety programs has been our top priority in 2021 and 2022 to address ground support and ventilation issues. The disciplined approach had an impact on production volumes, mine development and exploration. With that said, we are still on track to meet our 2022 guidance. We are putting safety first at the temporary cost of production. During the quarter we continued to advance the feasibility study and permitting initiatives at the Back Forty Project in Michigan.”

Q3 2022 HIGHLIGHTS

Additional highlights for the third quarter ended September 30, 2022, include:

- Our balance sheet remains strong, with $22.5 million in cash as of September 30, 2022. The decrease of $11.2 million since December 31, 2021, is after:

- year-to-date cash inflow of $7.9 million from operating activities, net of $16.2 million in income tax payments for tax years 2021 and 2022;

- $6.9 million investment in the Back Forty Project feasibility study and permitting work;

- investing Canadian dollar (“C$”) 2.4 million (or US dollar $1.7 million) in Maritime Resources Corp., ticker symbol “MAE.V” on the Toronto Stock Exchange—Venture Exchange (“TSX-V”), in exchange for 9.9% of the company’s issued and outstanding shares via a private placement;

- investing $14.1 million in capital expenditures; and

- distributing to shareholders $2.7 million in dividends ($0.9 million this quarter, totaling over $122 million since 2010).

- The Don David Gold Mine safety program aims to bolster the overall health and safety culture.

- There were no lost time incidents during the third quarter of 2022.

- The year-to-date lost time injury frequency rate per million hours of 2.76 is substantially below the Camimex (Mexican Chamber of Mines) benchmark of 5.281.

- During the third quarter of 2022, production, mine development, and exploration were deliberately and temporarily slowed to improve safety specific to ground support and ventilation.

- Working capital was $28.9 million at September 30, 2022, $0.4 million lower than at December 31, 2021. The decrease is primarily due to a decrease in cash discussed above.

- Total cash cost for the quarter was $1,103 per gold equivalent (“AuEq”) ounce (after co-product credits) and Total all-in sustaining cost for the quarter was $1,831 per AuEq ounce (after co-product credits). Both non-GAAP measures were higher in the quarter due to the impact of lower co-product credits as a result of lower base metal prices 2

Trending Highlights

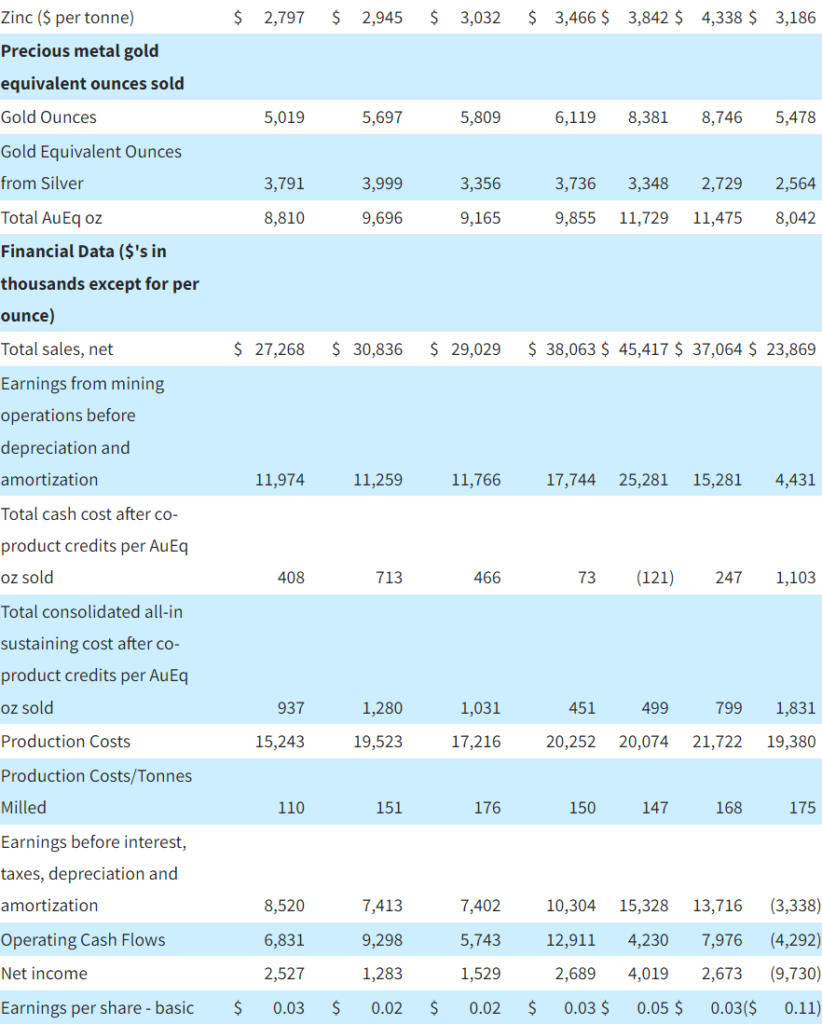

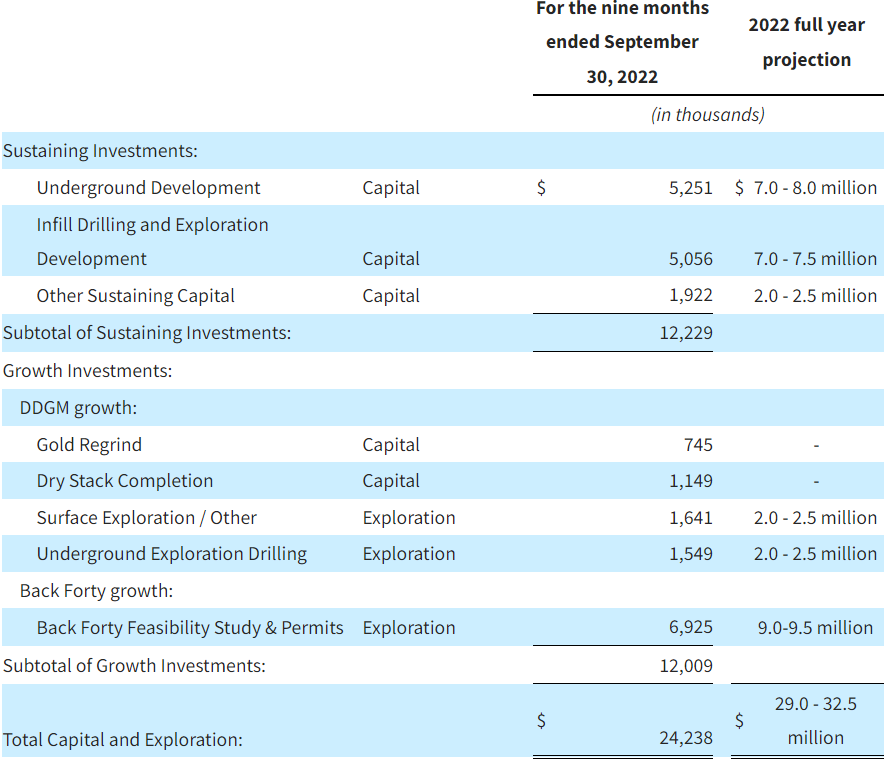

2022 Capital and Exploration Investment Summary

The Company’s investment in Mexico continued in the third quarter of 2022 totaling $17.3 million year-to-date. Our investment in Mexico is focused on favorably impacting our environment, social and governance programs while creating operational efficiencies and longevity. At the Back Forty Project, $6.9 million has been invested in feasibility and permitting initiatives year-to-date.

Underground and Exploration Development:

Mine development during the quarter included ramps and access to different areas of the deposit, ventilation shafts, and exploration development drifts. A total of 3,210 meters of development, at a cost of $7.5 million (864 meters at a cost of $2.2 million in the third quarter), was completed during the year through September 30, 2022. Through September 30, 2022, underground mine development was $5.3 million and exploration development was $2.2 million (included in Infill Drilling and Exploration Development in the table above). As part of ongoing safety initiatives, the Company also invested in additional ground support and improved ventilation for the mine, which deliberately but temporarily slowed underground and exploration development. We plan to invest a total of $7.0 million to $8.0 million in underground development and an additional $3.5 million to $4.0 million in exploration development in 2022.

Back Forty Feasibility and Permitting:

Work on the optimized feasibility study progressed during the third quarter of 2022. Mine planning, process plant design and site layout and infrastructure were significantly completed during the quarter. Current initiatives are focused on finalizing the financial models with operating and capital costs, which may be subject to some volatility due to the inflationary market conditions. Environmental and cultural resource considerations have been a key factor in the overall project design. On August 5, 2022, the Company was invited by Michigan’s Department of Environment, Great Lakes and Energy to participate in a Scoping Environmental Impact Assessment Meeting to present the initial site plan and other key improvements being incorporated into the Back Forty Project’s optimized feasibility study. This was an opportunity to meet with tribal representatives to promote the Back Forty Project, which is focused on favorably impacting our environment, social and governance programs, while identifying economic and operational efficiencies. The feasibility study work for the Back Forty Project progressed during the third quarter of 2022. Work related to metallurgy and the economic model is expected to continue into 2023. Permit applications will not be submitted with state agencies in Michigan until the completion of the feasibility study.

Q3 2022 Conference Call

The Company will host a conference call Tuesday, November 1, 2022 at 10:00 a.m. Eastern Time.

The conference call will be recorded and posted to the Company’s website later in the day following the conclusion of the call. Following prepared remarks, Allen Palmiere, President and Chief Executive Officer, Alberto Reyes, Chief Operating Officer and Kim Perry, Chief Financial Officer will host a live question and answer (Q&A) session. There are two ways to join the conference call.

To join the conference via webcast, please click on the following link:

https://app.webinar.net/no36p6L10ja

To join the call via telephone, please use the following dial-in details:

Participant Toll Free: +1 (888) 886-7786

International: +1 (416) 764-8658

Conference ID: 96525237

Please connect to the conference call at least 10 minutes prior to the start time using one of the connection options listed above.

About GRC:

Gold Resource Corporation is a gold and silver producer, developer, and explorer with its operations centered on the Don David Gold Mine in Oaxaca, Mexico. Under the direction of an experienced board and senior leadership team, the company’s focus is to unlock the significant upside potential of its existing infrastructure and large land position surrounding the mine in Oaxaca, Mexico and to develop the Back Forty Project in Michigan, USA. For more information, please visit GRC’s website, located at www.goldresourcecorp.com and read the company’s Form 10-K for an understanding of the risk factors associated with its business.

1 https://www.camimex.org.mx/index.php/estadisticas/Seguridad

2 See Management’s Discussion and Analysis of Financial Condition and Results of Operations – Non-GAAP Measures below for a reconciliation of non-GAAP measures to applicable GAAP measures.

Contacts

Kim Perry

Chief Financial Officer

[email protected]

www.GoldResourcecorp.com

Original Article: https://goldresourcecorp.com/news-releases/gold-resource-corporation-announces-financial-resu-4801/