TORONTO, March 31, 2022 /CNW/ – Excellon Resources Inc. (TSX: EXN) (NYSE: EXN) and (FRA: E4X2) (“Excellon” or the “Company”) is pleased to report financial results for the three- and twelve-month periods ended December 31, 2021.

Q4 2021 Financial and Operational Highlights (compared to Q4 2020)

- Revenues of $9.3 million (Q4 2020 – $10.1 million)

- Gross loss of $1.3 million, which includes a non-cash charge of $1.6 million relating to future mine closure costs (Q4 2020 – profit of $2.7 million)

- Total cash cost net of byproducts per silver ounce payable increased to $15.61 (Q4 2020 – $12.73)

- All-in sustaining cost (“AISC”) per silver ounce payable increased to $24.82 (Q4 2020 – $21.49)

- Production cost per tonne increased to $314 per tonne (Q4 2020 – $252 per tonne)

2021 Financial and Operational Highlights (compared to 2020)

- Revenues of $38.0 million (2020 – $26.2 million, impacted by the Q2 2020 suspension mandated by the Government of Mexico in response to the COVID-19 pandemic (the “Suspension”))

- Gross profit of $4.5 million, which includes a non-cash charge of $1.6 million relating to future mine closure costs (2020 – profit of $1.6 million)

- Total cash cost net of byproducts per silver ounce payable decreased to $13.01 (2020 – $15.38)

- AISC per silver ounce payable decreased to $24.78 (2020 – $26.80)

- Production cost per tonne decreased to $291 per tonne (2020 – $299 per tonne)

- Record mined and processed tonnage, along with the most silver ounces produced since 2013

- Silver equivalent (“AgEq”) production increased by 23% to 2,017,639 oz (2020 – 1,639,310 AgEq oz)

- Net working capital totaled $0.3 million (excluding provision for litigation) as at December 31, 2021 (December 31, 2020 – $9.8 million), with cash and marketable securities of $4.5 million as at December 31, 2021 (December 31, 2020 – $10.7 million)

“During 2021, we realized a number of successes, while certainly encountering challenges,” stated Brendan Cahill, President and Chief Executive Officer. “Our mining operation delivered the second highest revenues in the operation’s history, after 2011 when silver prices averaged $34. Our team’s operational improvements delivered another record for tonnage processed and continued to improve on all health and safety measures. In particularly, we managed through another year of the pandemic effectively, while realizing vaccination rates of nearly 100%.

On the exploration front, we delivered a robust program that included the strong advancement of the Silver City project and the discovery of a new high-grade zone of readily mineable mineralization at Platosa. We also successfully advanced the permitting process at Kilgore to support this year’s upcoming drilling program.

Despite the successes of 2021, as we noted in early January, during Q1 2022 we have been assessing the longer-term viability of the Platosa Mine. Based on the results of this analysis, exploration work in Q4 2021 and Q2 2022 and consideration of current and expected economic factors, the Company now expects to wind down operations at Platosa during Q3 2022, subject to results from ongoing exploration programs. This determination, along with the previously disclosed judgment in respect of our subsidiary, San Pedro Resources, has resulted in an impairment and net loss on our income statement and non-cash impact on our balance sheet.

In the immediate term, we look forward to resolving the labour action at Platosa, resuming normal operations at Platosa and advancing the operation towards a responsible wind down in Q3 of this year. We are also pursuing a number of strategic opportunities that we believe will unlock significant value for our investors from each of the jurisdictions in which we are operating.”

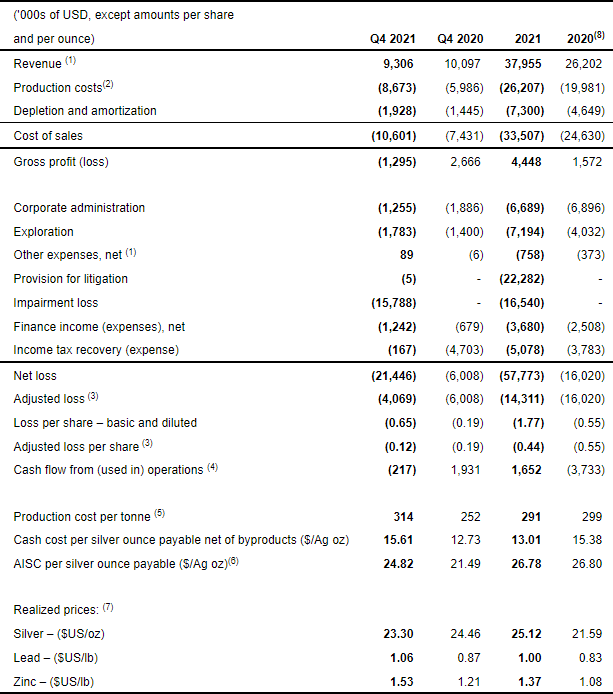

Financial Results

Financial results for the three- and twelve-month periods ended December 31, 2021 and 2020 were as follows:

- Revenues are net of treatment and refining charges (“TC/RCs”). Refer to Note 18 of the Q1 2021 Condensed Consolidated Financial Statements for detail of the comparative period reclassification of foreign exchange differences on provisionally priced sales.

- Q4 2021 production costs include a non-cash accrual of $1.6 million related to future mine closure.

- Q4 2021 adjusted loss and adjusted loss per share excludes impairment losses of $15.8 million and $1.6 million related to future mine closure accruals (included in production costs). Q3 2021 adjusted loss and adjusted loss per share excludes $22.3 million related to the Provision for litigation, the related $0.8 million impairment loss and $3.1 million deferred-tax asset derecognition expenses (included in income tax expense).

- Cash flow from operations before changes in working capital.

- Production cost per tonne includes mining and milling costs excluding depletion and amortization.

- AISC per silver ounce payable excludes general and administrative and share-based payment costs attributable to the Company’s non-producing projects. The comparative has been revised to conform with the current allocation.

- Average realized price is calculated on current period sale deliveries and does not include the impact of prior period provisional adjustments in the period.

- 2020 results were significantly impacted by the Suspension.

Revenues decreased by $0.8 million or 8% during Q4 2021 compared to Q4 2020, driven by a 4% decrease in AgEq ounces payable and a 5% decrease in the realized silver price, partly offset by 22% and 26% increases in realized lead and zinc prices, respectively. Revenues for the 12-month period increased by $11.8 million or 45%, driven by a 21% increase in AgEq ounces payable and 16%, 20% and 27% increases in realized silver, lead and zinc prices, respectively, compared to the prior year. Revenues for the comparative 12-month period were impacted by the Suspension.

Gross profit decreased by $4.0 million in Q4 2021 relative to Q4 2020, primarily driven by the $0.8 million decrease in revenue, $0.5 million increase in depletion and amortization and a $2.7 million increase in production costs, which included a non-cash accrual of $1.6 million related to future mine closure. Gross profit improved by $2.9 million for the 12-month period, driven by higher revenues of $11.8 million, partly offset by increased production, depletion and amortization costs (increased by $6.2 million and $2.7 million, respectively) following the Suspension in 2020.

General and administrative expense decreased by $0.6 million or 34% in Q4 2021 driven by lower share-based payment expenses in Q4 2021 ($0.2 million) and the $0.3 million expense relating to the Company’s initial listing on the NYSE American in Q3 2020. Overall, general and administrative expenses decreased by $0.2 million for 2021 reflecting decreases in share-based payment expenses ($0.3 million) and corporate development and legal costs ($0.5 million), partly offset by increases in salaries ($0.1 million) and higher insurance expense ($0.4 million) due to the listing on the NYSE American.

Exploration and holding expense increased by $0.4 million in Q4 2021, primarily reflecting increased drilling expenditures at the Silver City Project. Exploration programs were limited in 2020 by the initial outbreak of COVID-19 resulting in lower expenditures. In 2021, the Company invested exploration and holding costs of $3.2 million on Silver City in Saxony, Germany (2020 – $1.7 million), $2.4 million on Platosa and Evolución in Mexico (2020 – $1.6 million) and $1.6 million on Kilgore in Idaho, USA (2020 – $0.7 million).

Other expenses include realized and unrealized foreign exchange gains and losses, unrealized gains and losses on marketable securities and warrants, interest income and other non-routine income or expenses. Other expenses in Q4 2021 are consistent with Q4 2020. The 12-month variance of $0.4 million reflects changes in the values of marketable securities and warrants, which had unrealized gains of $0.6 million in 2020 but unrealized losses of $0.9 million in 2021, partly offset by a decrease in foreign exchange losses of $0.7 million between these periods.

As disclosed in Q3 2021, the Company received the formal written decision regarding the litigation involving the Company’s subsidiary, San Pedro Resources (“San Pedro”), in respect of the La Antigua mineral concession (the “Judgment”). The Company recorded a Provision for litigation of $22.2 million in Q3 2021 as required under IFRS’s International Accounting Standard 37 – Provisions, Contingent Liabilities and Contingent Assets (included in Other Expenses). The uncertainty related to the Judgment also contributed to the $0.8 million impairment loss and the $3.1 million deferred-tax asset derecognition (included in income tax expense). The Company continues to pursue avenues through its labour, community and government relationships and is investigating remedies under international law. In the interim, San Pedro continues to operate in the ordinary course (subject to the labour action noted below).

As announced on January 5, 2002, while the Company continued to aggressively drill to expand and define the mineral resource in recent years and throughout Q4 2021, current mining is entering an area of the deposit that steepens significantly, with fewer vertical-tonnes-per-metre than historically encountered. The Company has been assessing whether maintaining a consistent production schedule beyond mid-2022 at achievable dewatering rates and with acceptable capital expenditures is possible without additional mineralization being defined. Based on exploration results in Q4 2021 and Q1 2022, the Company currently expects to wind down operations at Platosa during Q3 2022, subject to results from ongoing exploration programs. As a result, the Company performed an impairment test on its Mexican operations and recorded an impairment loss of approximately $15.8 million as at December 31, 2021 (Q4 2020 – $Nil). In Q3 2021, the Company had recorded an impairment loss of $0.8 million on Miguel Auza reflecting the impact of the Judgment against San Pedro.

The primary component of net finance expense in Q4 2021 is $1.1 million of interest expense on the 5.75% secured convertible debentures (the “Convertible Debentures”) issued in Q3 2020, which are recorded at amortized cost and accreted to the principal amount over the term of the Convertible Debentures. This interest expense includes $0.4 million in coupon interest at a 10% rate, paid in common shares at the Company’s election (Q4 2020 – $0.4 million), and a non-cash $0.7 million accretion of the face value of the Convertible Debentures (Q4 2020 – $0.4 million).

Net finance expense of $3.7 million for 2021 is $1.2 million higher than the comparative period. Interest on the Convertible Debentures, increased by $2.2 million including $0.8 million relating to coupon interest (paid in shares), and $1.4 million relates to non-cash accretion interest expense. This increase was partially offset by a $0.4 million in unrealized loss on currency hedges in 2020, which have since been settled at a net realized loss of $40,000 and $0.7 million interest in 2020 on a $6 million credit facility that was repaid in Q3 2020.

Adjusted loss decreased by $1.9 million in Q4 2021 relative to Q4 2020, despite the $4.0 million decrease in gross profit discussed above, mainly driven by a $4.5 million decrease in income tax expense and a $0.6 million reduction in general and administrative expenses, partly offset by a $0.6 million increase in finance expense and a $0.4 million increase exploration expense. Adjusted loss decreased by $1.7 million in 2021 relative to 2020, mainly driven by the $2.9 million improvement in gross profit in 2021, discussed above, and a $1.8 million decrease in income tax expenses (after adjusting for the deferred-tax asset derecognition related to the provision for litigation), partially offset by an increase of $3.2 million in exploration and holding expenses and a $1.2 million increase in finance expenses.

Production cost per tonne increased by 25% in Q4 2021 relative to Q4 2020 due to a 6% decrease in tonnes milled in Q4 2021 and a 17% increase in production costs, as discussed above. Production cost per tonne decreased by 3% for 2021 as 2020 was impacted by the Suspension.

Total cash cost per silver ounce payable increased by 23% for Q4 2021 relative to Q4 2020, primarily driven by an 11% decrease in silver ounces payable and a 9% increase in cash costs net of by–product credits reflecting higher production costs. Total cash cost per silver ounce payable decreased by 15% for 2021, primarily driven by a 23% increase in silver ounces payable in 2021 as 2020 included negligible production in Q2 2020 due to the Suspension.

AISC per silver ounce payable increased by 15% in Q4 2021 relative to Q4 2020 due to the impacts of lower silver ounces payable (11%) and higher all-in sustaining costs ($0.2 million or 3%). AISC per silver ounce payable decreased 8% for 2021 relative to 2020, primarily driven by a 23% increase in silver ounces payable in 2021 as 2020 was impacted by the negligible production realized in Q2 2020 due to the Suspension.

All financial information is prepared in accordance with IFRS, and all dollar amounts are expressed in U.S. dollars unless otherwise specified. The information in this press release should be read in conjunction with the Company’s audited condensed consolidated financial statements for the years ended December 31, 2021 and 2020, and associated management discussion and analysis (“MD&A”) which are available from the Company’s website at www.excellonresources.com and under the Company’s profile on SEDAR at www.sedar.com and EDGAR at www.sec.com/edgar.

The discussion of financial results in this press release includes references to “cash flow from operations before changes in working capital items”, “production cost per tonne”, “cash cost per silver ounce payable”, and “AISC per silver ounce payable”, which are non-IFRS performance measures. The Company presents these measures to provide additional information regarding the Company’s financial results and performance. Please refer to the Company’s MD&A for the years ended December 31, 2021 and 2020, for a reconciliation of these measures to reported IFRS results.

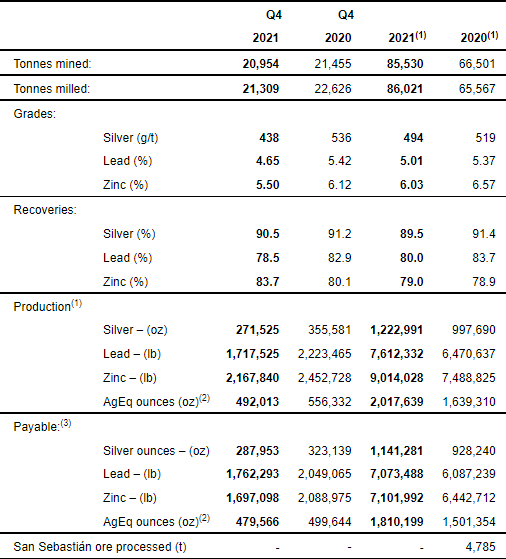

Operating Results & Outlook

Operating performance for the periods indicated below was as follows:

- Period deliveries remain subject to assay and price adjustments on final settlement with concentrate purchaser. Data has been adjusted to reflect final assay and price adjustments for prior-period deliveries settled during the period.

- AgEq ounces established using average realized metal prices during the respective period applied to the recovered metal content of the concentrates to calculate the revenue contribution of base metal sales during the period.

- Payable metal is based on the metals delivered and sold during the period, net of payable deductions under the Company’s offtake arrangements, and will therefore differ from produced ounces.

The Company’s Mexican operations delivered records for mined and processed tonnage in 2021, along with the most silver ounces produced since 2013. In Q4 2021, the Company recorded its sixth consecutive quarter of over 20,000 tonnes mined and milled following the restart in late Q2 2020 – a first since production commenced in 2005.

Head grades were lower in Q4 2021 compared to Q4 2020 due to higher mining dilution and variation in manto mineralization. Overall, silver, lead and zinc grades decreased 5%, 7% and 8%, respectively, compared to 2020.

Silver, lead and zinc production decreased by 24%, 23% and 12%, respectively, relative to Q4 2020 driven by lower feed grades and recoveries. The Suspension resulted in lower AgEq production for 2020 compared to 2021.

As discussed above, underground and surface drilling continued throughout Q1 2022, however based on the recent drilling results and consideration of current and expected economic factors, the Company expects to wind down operations at Platosa during Q3 2022, subject to results from ongoing exploration programs.

On March 7, 2022 the Company reported that the Sindicato Nacional Minero Metalúrgico (the “Platosa Union”) commenced a labour action at the Platosa Mine in Durango, Mexico. The Company is in discussions with the Platosa Union and is committed to reaching a fair settlement and returning to production in the immediate term.

Management Change

The Company is also pleased to announce the appointment of Daniel Hall as Chief Financial Officer effective April 1, 2022. Alfred Colas is stepping down as Chief Financial Officer effective April 1, 2022 to pursue an opportunity outside of the mining industry.

Mr. Cahill stated, “Dan Hall has been Corporate Controller since October 2019 and has driven improved financial reporting and controls and has demonstrated strong leadership in the finance team since joining the Company. We are pleased to welcome him into senior management and look forward to working with him on our strategic plans going forward.”

“On behalf of the Board, we thank Alfred for his efforts as CFO and wish him well in his next role.”

Daniel Hall, CPA, CA joined Excellon as Corporate Controller in 2019 and has been responsible for financial reporting, treasury, internal controls, tax, IT systems and all operational finance functions. Prior to joining Excellon, Mr. Hall had 12 years of experience with Deloitte LLP in South Africa, Bermuda, and Canada specializing in public company reporting and complex accounting matters, with a focus on global mining companies. Daniel is a Chartered Accountant, a member of the Institute of Chartered Professional Accountants of Ontario, and holds a Bachelor of Commerce degree with a post graduate specialization in Accounting and Finance from Rhodes University in South Africa.

COVID-19 Update

In 2021, none of the Company’s projects were suspended or restricted. Although the Company believes the risk for business interruption remains low, unexpected interruptions could still occur given the uncertainty surrounding the recurring wave of rising cases in certain regions where the Company operates and considering the surge in the “Omicron” variant of the virus. Government vaccination programs for COVID-19 are underway in all of the regions in which the Company operates. Vaccination programs are now progressing well in Mexico, with 99% of the Company’s workforce double-vaccinated and 37% triple-vaccinated.

About Excellon

Excellon’s vision is to create wealth by realizing strategic opportunities through discipline and innovation for the benefit of our employees, communities, and shareholders. The Company is advancing a precious metals growth pipeline that includes: Platosa, Mexico’s highest-grade silver mine since production commenced in 2005; Kilgore, a high quality advanced exploration gold project in Idaho with strong economics and significant growth and discovery potential; and an option on Silver City, a high-grade epithermal silver district in Saxony, Germany with 750 years of mining history and no modern exploration. The Company also aims to continue capitalizing on current market conditions by acquiring undervalued projects.

Additional details on Excellon’s properties are available at www.excellonresources.com.

Forward-Looking Statements

The Toronto Stock Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of the content of this Press Release, which has been prepared by management. This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 27E of the Exchange Act. Such statements include, without limitation, statements regarding the impact of the COVID-19 pandemic on the Company’s operations and results, the outcome and impact of the legal action in Mexico (including the dismissal of the appeal by the federal courts of Mexico on July 1, 2021) in respect of the La Antigua mineral concession that is part of the Evolución Property in Zacatecas, mineral resources estimates, the future results of operations, performance and achievements of the Company, including potential property acquisitions, the timing, content, cost and results of proposed work programs, the discovery and delineation of mineral deposits/resources/reserves, geological interpretations, the potential of the Company’s properties, proposed production rates, potential mineral recovery processes and rates, business and financing plans, business trends and future operating revenues. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward looking statements as a result of various factors, including, but not limited to, the ability of the Company to maintain normal operations during the COVID-19 pandemic, the outcome and impact of the legal action in Mexico (including the dismissal of the appeal by the federal courts of Mexico on July 1, 2021) in respect of the La Antigua mineral concession that is part of the Evolución Property in Zacatecas, variations in the nature, quality and quantity of any mineral deposits that may be located, significant downward variations in the market price of any minerals produced, the Company’s inability to obtain any necessary permits, consents or authorizations required for its activities, to produce minerals from its properties successfully or profitably, to continue its projected growth, to raise the necessary capital or to be fully able to implement its business strategies. All of the Company’s public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials. This press release is not, and is not to be construed in any way as, an offer to buy or sell securities in the United States.

Cautionary Note to U.S. Investors: The terms “mineral resource,” “measured mineral resource,” “indicated mineral resource” and “inferred mineral resource,” as used on Excellon’s website and in its press releases are Canadian mining terms that are defined in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ from the requirements of the United States Securities and Exchange Commission (the “SEC”) applicable to United States domestic and certain foreign reporting companies under Subpart 1300 of Regulation S-K (“S-K 1300”). Accordingly, information included in this press release that describes the Company’s mineral resources estimates may not be comparable with information made public by United States and certain foreign companies subject to the SEC’s reporting and disclosure requirements of S-K 1300.

SOURCE Excellon Resources Inc.

For further information: Excellon Resources Inc., Brendan Cahill, President & Chief Executive Officer, (416) 364-1130, [email protected]

Original Article: https://www.newswire.ca/news-releases/excellon-reports-q4-and-annual-2021-financial-results-894440506.html