Key Information:

- The Plomosas Plant Refurbishment Project commenced and at 31 December:

- Major equipment items purchased and on-site or in-transit.

- Civil works commenced.

- Key plant operating team members recruited.

- Completion now expected in second half of February 2021.

- Operations impacted by lower-than-expected operator and equipment availability:

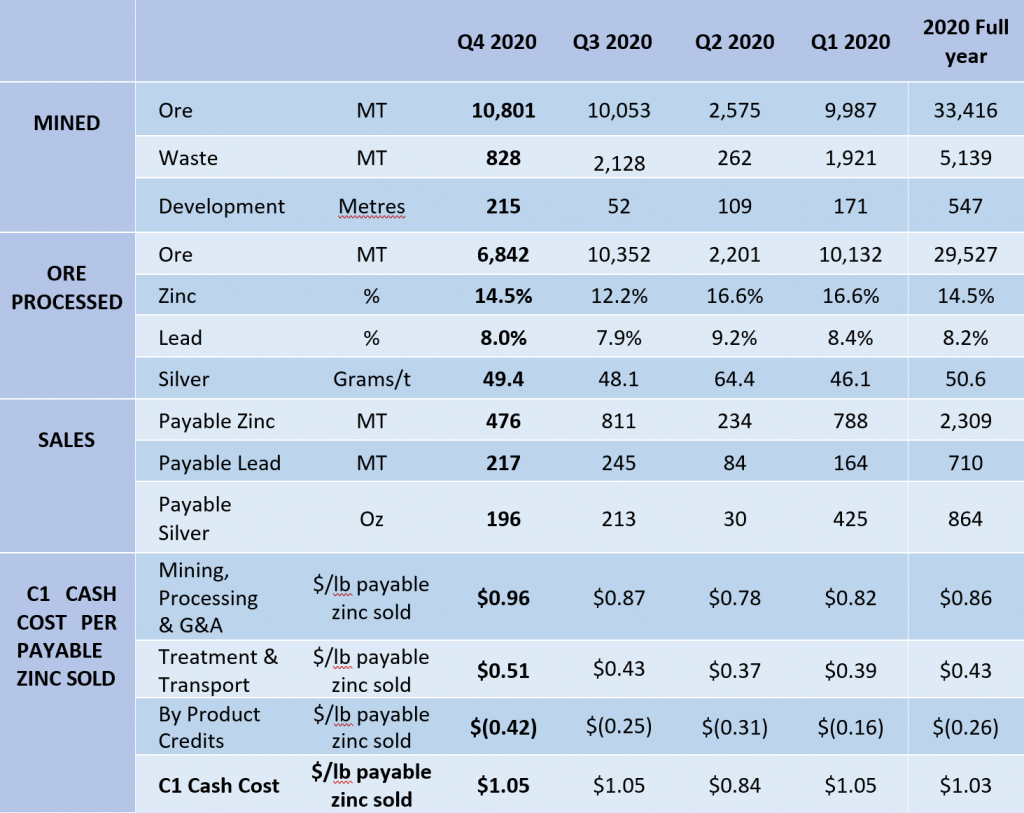

- 10,801 tonnes ore mined grading 14.5% zinc 8.00%, lead and 50 g/t silver.

- 6,842 tonnes of ore processed at 14.4% zinc, 8.02% lead and 50g/t silver.

- Payable metal sold, 476 tonnes of zinc and 217 tonnes of lead in concentrate.

- Inventory stockpiles at quarter end:

- Approximately 2,981 tonnes stockpiled underground.

- 4,705 tonnes of high-grade run-of-mine ore available for processing.

- 423 tonnes zinc concentrate & 45 tonnes lead concentrate available for sale.

- C1 cash cost for zinc produced $1.02/lb for the quarter, year to end 2020 $1.04/lb.

- C1 cash cost of payable zinc sold $1.05/lb for quarter, year to end 2020 $1.03/lb.

- Gold exploration field work was completed some assays returned.

All references in this report are to US$, unless otherwise stated.

Consolidated Zinc Limited (CZL:ASX or “the Company”) is pleased to present its December 2020

Quarterly Activities Report.

PROCESSING PLANT REFURBISHMENT PROJECT

The refurbishment and expansion of the Plomosas plant to enable on-site processing and in-house management of plant operations commenced in October, following receipt of the permit for a tailings storage facility at the Plomosas site. The plant is being built to process 100tpd of ore initially, but the ball mill has a 200tpd capacity to facilitate future production expansion, planned for late 2021.

During the quarter:

- Key personnel were recruited including the Plant Manager and Maintenance Manager.

- The ball mill was purchased, relocated to site and awaits the maturing of the concrete plinth for final installation in January 2021.

- The crushing circuit was dry commissioned.

- The wet end of the plant was systematically assessed, and new motors acquired where needed.

The project was 65% complete at the end of the quarter however, unusual extreme winter weather delayed the tailings dam construction, and increasing cases of COVID-19 in the region impacted the Company’s ability to recruit and deploy the construction team.

CZL is now forecasting completion of the processing plant refurbishment in the second half of February 2021.

OPERATIONS – PLOMOSAS MINE, CHIHUAHUA STATE, MEXICO

Mining

During the quarter, 7,910 tonnes of ore were mined to surface at Plomosas, with a further 2,891 tonnes mined and stockpiled underground due to poor haul truck availability. Underground stockpiles contributed to the below budget mining rate by increasing manual material movement required at the mine face.

Equipment availability has improved with the appointment of a new Maintenance Manager and haulage capacity will be increased during Q1 2021 to bring this ore to the surface for processing. The Company plans to use both its refurbished Plomosas processing plant, and the third-party Aldama processing plant, to reduce stockpiles and improve operational performance.

The de-watering rate was higher than expected, reducing the water level by 5 meters during December. Installation of larger, two stage pumps had commenced which should increase the pumping rate to 10 metres/month when complete. The plan is to reduce the water level below Level 10 (740mRL) to allow mining access in 2022 to the super-rich Tres Amigos stopes which contains sulphide ore that has historically delivered 89% zinc recovery and 82% lead recovery.

Mining costs for the quarter averaged $73/t for ore hauled to the surface and stockpiled underground. This is higher than expected due to the direct and indirect effects of the pandemic on supplies and productivity.

Processing

During the quarter, 6,842 tonnes of ore grading 14.35% zinc, 8.02% lead and 50g/t silver, were processed at the Aldama toll processing plant. This was significantly below budget due to electricity supply and other operational issues resulting in 65% availability for the plant.

The recoveries of zinc-to-zinc concentrate averaged 75.2% during the quarter, ranging between 65% to 88% on a daily basis. The high variability was due to the numerous processing stoppages during the period, as well as changes in ore composition. Lead to lead concentrate recovery improved significantly during the quarter to 40.1% up from the prior quarter of 36.3% due to an increase in the percentage of sulphide in the ore.

At the end of the quarter, inventory stockpiles were 4,705 tonnes of run-of-mine and ore available for processing, and 423 tonnes of zinc concentrate and 45 tonnes of lead concentrate available for sale.

Operating Costs

The December 2020 quarter C1 operating costs were $1.05 per payable pound of zinc sold which was in line with the previous quarter ($1.05/lb). Operating costs were higher than expected due to:

- The intermittent operations and poor availability at the Aldama plant;

- The increased mining costs; and

- The general and administrative costs incurred to protect employees, and mitigate the risk to operations, from the worsening pandemic in Mexico.

Concentrate Sales

1,125 tonnes of zinc concentrate and 432 tonnes of lead concentrate were sold in the quarter.

423 tonnes of zinc concentrate and 45 tonnes of lead concentrate stockpiled at the end of the quarter have been sold subsequently.

TABLE 1. QUARTER ENDED 31 DECEMBER 2020 PRODUCTION STATISTICS

Health, Safety and Environment

There were no reportable environmental or safety incidents during the quarter.

During the quarter, the incidence of COVID-19 in and around the city of Chihuahua increased, resulting in the area being designated as a “red zone” by the Mexican government. All nonessential businesses were required to close however mining was considered an essential business.

The company has strengthened its pandemic procedures and policies including mandatory PCR negative test results for employees and contractors to return to work after each rest break. Access of visitors to Plomosas remains restricted.

The majority of reported Covid-19 cases amongst our workers have

been asymptomatic, with no serious illness reported

in the quarter. The Chihuahua

office remains closed,

and the Plomosas mine and

Aldama plant remain open and operating.

EXPLORATION

Exploration continued during the quarter with a regional mapping program and follow-up of mineralised structures and anomalies identified in previously.

A total of 67 samples were taken of which 48 assays from the Don Lucas and Potrero anomalies had been returned by quarters end. There was little of significance in this batch leading to a downgrading of the prospectivity for economic gold mineralisation at the Potrero and Don Lucas Anomaly areas.

Assay results are pending for 19 rock chip samples, including 10 samples from the Enrique and La Chona areas where high grade soil samples were previously returned. Refer to ASX announcements dated 30 January 2020 and 23 April 2020 for further details.

Refer to the ASX market announcement dated 28 January 2021 for full details of the gold exploration samples and assays.

The regional mapping program has also encountered significant base metal prospective structures and geology along trend (approximately 500 metres) from the high-grade stopes of the Juarez mine. This has led to the development of a new theory of the structural control of the base metal mineralisation within the mine. This suggests a ~30m fault displacement of several parallel ore zones which were historically mined in high grade stopes such as Las Espadas. This was not identified at the time when historic mining ceased. This theory will be tested during 2021 and, if correct, suggests the potential for defining high-grade base metal mineralisation in close proximity to existing mine workings.

CORPORATE

Capital Consolidation

The Company’s securities were consolidated on a fifteen (15) for one (1) basis (“Consolidation”) as approved by shareholders at the general meeting held on 14 December 2020.

For full details of the Consolidation refer to the ASX market announcement dated 21 December 2020.

Capital Raising

A fully underwritten non-renounceable pro-rata entitlement issue to raise A$2,038,291 (before costs) to fund the process plant refurbishment and the tailing storage facility closed on 13 October 2020, over-subscribed.

Cash

Closing cash at the end of the quarter

was $0.716 million (prior quarter $0.372million).

During the quarter, $0.404 million of capital expenditure was incurred on the refurbishment of the Plomosas plant.

Trade Receivables and Payables

Trade receivables due from the sale of zinc and lead concentrates was $0.286 million (prior quarter

$0.368 million) and the VAT refundable was $1.176 million (prior quarter $1.033 million).

The VAT refunds are recovered through a combination of cash refunds and offsetting against any monthly VAT payable. Covid-19 restrictions have negatively impacted the timing of VAT cash refunds.

The estimated sale value of the zinc and lead concentrate stockpiles at the end of the quarter is

$0.336 million (prior quarter $0.097 million), based on provisional assays and commodity prices on 31 December 2020.

Trade payables at the end of the quarter were US$2.912 million (prior quarter $2.667 million). Trade payables includes approximately US$1.15 million invoiced by a former contractor but disputed by the Company.

Convertible Notes

During the quarter, all convertible notes on issue were redeemed (principal A$1,127,826 plus accrued interest).

Unsecured borrowings

The Company has A$0.100 million unsecured loan facilities fully drawn (prior quarter A$0.100 million) from an entity related to Mr Andrew Richards (non-executive Chairman), with a maturity date of 30 June 2021 and an interest rate of 10.0% per annum.

Payments to Related Parties

During the quarter, payments totalling US$87,000 were made to directors for salaries, directors fees and superannuation.

This announcement was authorised for issue to the ASX by the Directors of the Company. For further information please contact:

Brad Marwood

Managing Director

08 9322 3406

ABOUT CONSOLIDATED ZINC

Consolidated Zinc Limited (ASX: CZL) owns 100% of the historic Plomosas Mine, located 120km from Chihuahua City, Chihuahua State. Chihuahua State has a strong mining sector with other large base and precious metal projects in operation within the state. Historical mining at Plomosas between 1945 and 1974 extracted over 2 million tonnes of ore grading 22% Zn+Pb and over 80g/t Ag. Only small-scale mining continued to the present day and the mineralised zones remain open at depth and along strike.

The company has recommenced mining at Plomosas and is committed to exploit the potential of the high-grade Zinc, Lead and Silver Mineral Resource through the identification, exploration and exploitation of new zones of mineralisation within and adjacent to the known mineralisation with a view to identify new mineral resources that are exploitable.

Caution Regarding Forward Looking Statements and Forward-Looking Information:

This report contains forward looking statements and forward-looking information, which are based on assumptions and judgments of management regarding future events and results. Such forward-looking statements and forward-looking information involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any anticipated future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the actual market prices of zinc and lead, the actual results of current exploration, the availability of debt and equity financing, the volatility in global financial markets, the actual results of future mining, processing and development activities, receipt of regulatory approvals as and when required and changes in project parameters as plans continue to be evaluated.

Except as required by law or regulation (including the ASX Listing Rules), Consolidated Zinc undertakes no obligation to provide any additional or updated information whether as a result of new information, future events or results or otherwise. Indications of, and guidance or outlook on, future earnings or financial position or performance are also forward-looking statements.

Production Targets:

Production targets referred to in this report are underpinned by estimated Mineral Resources which have been prepared by competent persons in accordance with the requirements of the JORC Code. The production targets in this report are sourced from both Indicated and Inferred Mineral Resources and it should be noted that there is a low geological confidence associated with Inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources or that the production target will be realised.

There is a low level of geological confidence associated with Inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of indicated mineral resources or that the production target itself will be realised. The stated production target is based on the Company’s current expectations of future results or events and should not be solely relied upon by investors when making investment decisions. Further evaluation work and appropriate studies are required to establish sufficient confidence that this target will be met.

Competent Persons’ Statement

The information in this report that relates to exploration results, data collection and geological interpretation is based on information compiled by Mr Duncan Greenaway (M.Sc.Hons), MAIMM Mr Greenaway is a Member of the Australasian Institute of Mining & Metallurgy).

Mr Greenaway has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity that is being undertaken to qualify as Competent Person as defined in the 2012 edition of the ‘Australasian Code for Reporting of Exploration Results, Minerals Resources and Ore Reserves’ (JORC Code). Mr Greenaway consents to the inclusion in this announcement of the matters based on their information in the form and context in which it appears.

The information in this report that relates to Mineral Resources is based on, and fairly represents information and supporting documentation prepared by Mr Andrew Richards a Competent Person who is a Member of the Australasian Institute of Mining and Metallurgy and Member of the Australian Institute of Geoscientists. Mr Richards is a Director of the Company.

Mr Richards has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Mr Richards has approved the Statement as a whole and consents to its inclusion in this report in the form and context in which it appears.

The information in this report that relates to the Mineral Resources were first reported by the Company in compliance with JORC 2012 in market release dated 29 April 2020.

The Company confirms that it is not aware of any new information or data that materially affects the information included in the market announcements referred to above and further confirms that all material assumptions and technical parameters underpinning the ore reserve and mineral resource estimates contained in those market releases continue to apply and have not materially changed.

Original Article: https://www.consolidatedzinc.com.au/wp-content/uploads/2021/01/CZL-Quarterly-Report-Dec-2020-Final-ASX-lodgement.pdf