Key Information:

- Westoz Lithium Acquisition

- Formal binding share purchase agreement executed to acquire Westoz Lithium Pty Ltd (Westoz Lithium) for A$740,000 in cash and shares.

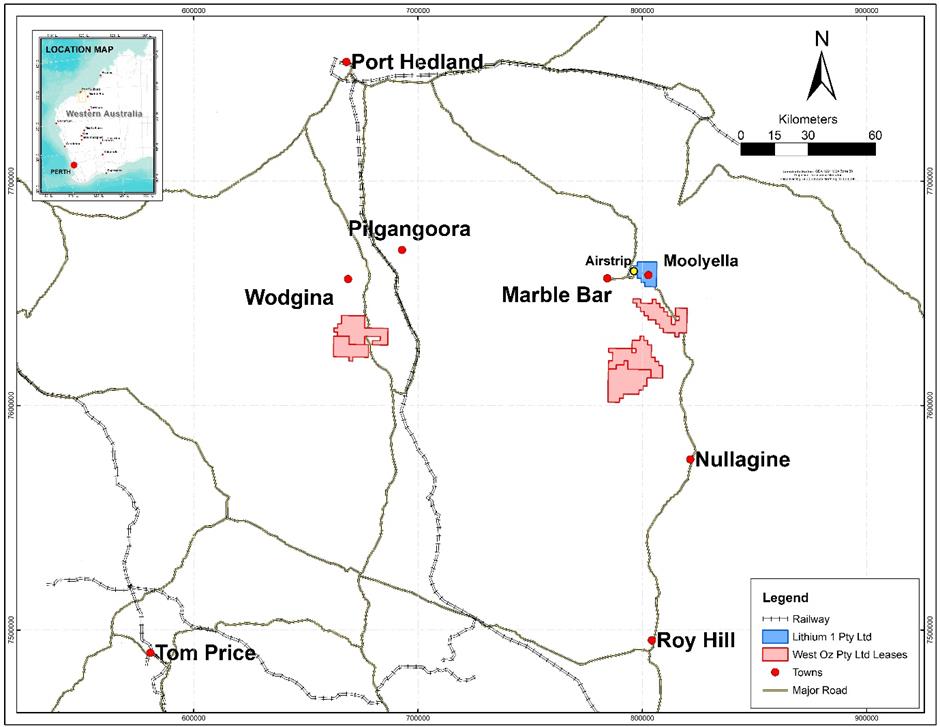

- Westoz Lithium owns approximately 1,400km2 of exploration license applications in the Pilbara and Gascoyne regions in Western Australia, considered highly prospective for lithium, located near two of the world’s largest hard rock lithium deposits, as well as rare earth elements and base metals.

- Data indicating potential for mineralised pegmatite outcrops in swarms across all tenements.

Consolidated Zinc Limited (Company or CZL) (ASX:CZL) is pleased to advise that further to its announcement on 30 March 2022, it has entered into a formal binding share purchase agreement (Acquisition Agreement) to acquire all of the shares held in Westoz Lithium (Acquisition). Westoz Lithium holds large exploration projects (Acquisition Projects) that are considered prospective for lithium, rare earth elements and base metals, all located in Western Australia.

The Acquisition is an exciting opportunity for the Company to diversify further into the battery minerals sector.

WESTOZ LITHIUM ACQUISTION

Westoz Lithium holds interests in the Acquisition Projects, which comprises approximately 1,400km2 of exploration license applications in the Pilbara and Gascoyne regions of Western Australia. The Pilbara Projects are highly prospective for lithium, rare earth elements and base metals and are situated near two of the world’s largest hard rock lithium deposits at Pilgangoora and Wodgina as well as the MBLP near Marble Bar.

ACQUISITION TERMS

The Company, Westoz Lithium and the current shareholders of Westoz Lithium, Paul Watts and Arnel Mendoza (Vendors) have executed the Acquisition Agreement to acquire 100% of the issued capital of Westoz Lithium from the Vendors. The Vendors are unrelated third parties of the Company.

In aggregate, the Vendors will receive A$740,000 for the Acquisition. On completion of the Acquisition Agreement (Completion), and subject to the Company receiving shareholder approval at its upcoming annual general meeting on 31 May 2022, the Vendors will be issued a total of 24,000,000 Shares, with an issue price of $0.025 per Share and aggregate value of A$600,000. Furthermore, within 5 Business Days of Completion, in order to clear outstanding shareholder loans owed by Westoz Lithium to the Vendors (Shareholder Loans), the Company will pay the sum of A$90,000 to Paul Watts and A$50,000 to Arnel Mendoza. Westoz Lithium and the Company will be released from any liability or claims in relation to the Shareholder Loans once the abovementioned payments are made to Paul Watts and Arnel Mendoza by the Company.

Completion of the Acquisition Agreement is subject to the following conditions (Conditions):

- (Due Diligence): The Company notifying the Vendors that the Company has satisfactorily competed due diligence on Westoz Lithium and the Acquisition Projects, including technical, financial and legal due diligence; and

- (Approvals): the Company obtaining any shareholder, regulatory and stock exchange approvals required under the ASX Listing Rules and the Corporations Act (as applicable), in relation to the Acquisition, including in relation to any debt or equity fundraising activities.

The other terms of the Acquisition Agreement, including in relation to pre-Completion activities, warranties, indemnities, confidentiality and termination are considered customary for an agreement of this nature.

Although the Acquisition Agreement has been executed, there is no guarantee that the Conditions will be satisfied. If the Conditions are satisfied, it is expected that Completion will occur in the second quarter 2022.

DETAILS OF WESTOZ LITHIUM ACQUISITION

The Company has executed the Acquisition Agreement to acquire 100% of the issued capital in Westoz Lithium, the holder of the Acquisition Projects, which includes approximately 1,000 km2 of highly prospective exploration license applications (ELAs) in the Pilbara region of northern Western Australia and approximately 400 km2 base metal prospect in the Gascoyne Region of Western Australia (Wandagee).

The Pilbara ELAs are considered highly prospective for lithium and are located, adjacent and near two of the world’s largest hard rock lithium deposits namely Pilgangoora operated by Pilbara Minerals Ltd (ASX:PLS) and Wodgina operated by Mineral Resource Ltd (ASX: MIN). Global Lithium Resources Ltd (ASX:GL1) Marble Bar Lithium Project (MBLP) containing the Archer deposit is also located to the immediate north of the eastern ELA’s.

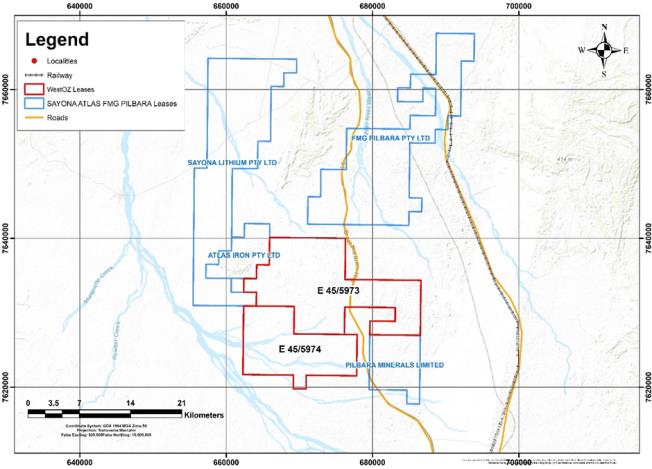

South Wodgina

The South Wodgina ELAs (E45/5973 and E45/5974) are located approximately 150km south of Port Hedland, adjacent to Wodgina Li-Ta operation.

Pilgangoora and Wodgina are located near the south- western boundary of the East Pilbara Terrane of the Pilbara Craton. The western flank of the East Pilbara Terrane forms part of a globally significant pegmatite province extending over 120 km by 30km containing widespread rare and critical metal mineralisation.

The South Wodgina ELAs lie along the south-west extension of the Lithium/Tantalum deposits of the Wodgina operation. The area is characterised by swarms of pegmatite intrusions which contain Lithium-Caesium-Tantalum as well as some rare earth elements (REE) known as LCT-type pegmatites.

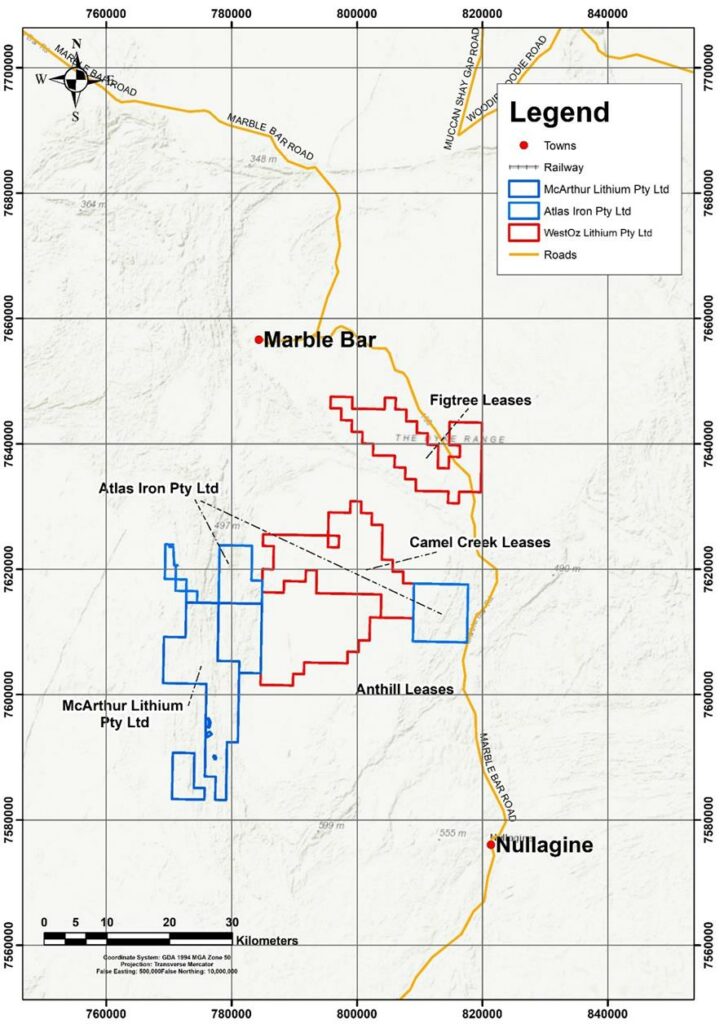

Marble Bar

The Marble Bar ELA’s (E45/5972, E45/5987 and E45/5986) are located approximately 80km south of Marble Bar, close to Global Lithium’s MNLB Project. They lie along the sealed highway and approximately 280km south-east of Port Hedland.

The Moolyella tin and tantalum deposits also lie directly north and have been historically mined over 100 years. The Numbana Monzogranite complexes that outcrop in the district are known to host lithium-bearing pegmatites which have been largely unexplored due to the past focus on base metal and gold exploration. The Anthill, Camel Creek, and Fig Tree ELAs of the Westoz acquisition lie within a corridor of known lithium and REE mineralisation. The 670 km2 holding has been under explored for LCT pegmatite type deposits and thus the Company considers it prospective for new discoveries.

Wandagee

The Wandagee Project is located approximately 150km northeast of Carnarvon and 45km east of the Minilya Bridge Roadhouse, in the Gascoyne Region of Western Australia. The Wandagee Project consists of one ELA (E09/2499) covering an area of ~400km2. The ELA is prospective for Zinc-Lead-Silver/Copper-Lead-Silver base metals and has limited exploration undertaken in the past.

This announcement was authorised for issue to the ASX by the Directors of the Company. For further information please contact:

Brad Marwood

Managing Director

08 6400 6222

ABOUT CONSOLIDATED ZINC

Consolidated Zinc Limited (ASX: CZL) owns 100% of the historic Plomosas Mine, located 120km from Chihuahua City, Chihuahua State. Chihuahua State has a strong mining sector with other large base and precious metal projects in operation within the state. Historical mining at Plomosas between 1945 and 1974 extracted over 2 million tonnes of ore grading 22% Zn+Pb and over 80g/t Ag. Only small-scale mining continued to the present day and the mineralised zones remain open at depth and along strike.

The company has recommenced mining at Plomosas and is committed to exploit the potential of the high-grade Zinc, Lead and Silver Mineral Resource through the identification, exploration, and exploitation of new zones of mineralisation within and adjacent to the known mineralisation with a view to identify new mineral resources that are exploitable.

Caution Regarding Forward Looking Statements and Forward-Looking Information:

This report contains forward looking statements and forward-looking information, which are based on assumptions and judgments of management regarding future events and results. Such forward-looking statements and forward-looking information involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any anticipated future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the actual market prices of zinc and lead, the actual results of current exploration, the availability of debt and equity financing, the volatility in global financial markets, the actual results of future mining, processing and development activities, receipt of regulatory approvals as and when required and changes in project parameters as plans continue to be evaluated.

Except as required by law or regulation (including the ASX Listing Rules), Consolidated Zinc undertakes no obligation to provide any additional or updated information whether as a result of new information, future events, or results or otherwise. Indications of, and guidance or outlook on, future earnings or financial position or performance are also forward-looking statements.

Westoz Lithium Competent Person Statement:

The information in this report that relates to exploration results, data collection and geological interpretation is based on information compiled by Mr Brad Marwood. Mr Marwood is a Fellow of the Australasian Institute of Mining and Metallurgy and Member of the Australian Institute of Geoscientists

Mr Marwood has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity that is being undertaken to qualify as Competent Person as defined in the 2012 edition of the ‘Australasian Code for Reporting of Exploration Results, Minerals Resources and Ore Reserves’ (JORC Code). Mr Marwood consents to the inclusion in this announcement of the matters based on their information in the form and context in which it appears.

Original Article: https://www.consolidatedzinc.com.au/wp-content/uploads/2022/05/20220516-Westoz-Lithium-executed-agreement-FINAL-ASX-LODGEMENT.pdf