Azure has entered into tenement sale and joint venture agreements with entities controlled by Mr Mark Creasy (the Creasy Group) on several West Australian gold and nickel projects.

TURNER RIVER GOLD PROJECT: (70% Azure / 30% Creasy Group) – located adjacent and along strike to De Grey Mining’s (ASX:DEG) Mallina project – host to 2.2Moz gold and the Hemi gold discovery

- Unexplored 450km2 project with the right geology and structural setting

- Hosts 12 kilometres of strike of the fertile Berghaus Shear Zone along trend from Hemi discovery

ANDOVER NICKEL-COPPER PROJECT: (60% Azure / 40% Creasy Group) – hosts nickel-copper mineralisation discovered by the Creasy Group in 2018

- Layered mafic-ultramafic intrusive complex hosts nickel and copper sulphide mineralisation

- Creasy Group drilled significant grades and widths of

nickel and copper, including:

- ADRC002: 7m @ 2.62% Ni & 0.65% Cu within 26m @ 1.03% Ni & 0.46% Cu from 43m

- ADRC006: 2m @ 2.10% Ni & 0.44% Cu from 15m

- ADRC001: 4m @ 1.10% Ni & 0.80% Cu from 6m; 2m @ 1.77% Ni & 0.53% Cu from 62m

- No follow-up drilling has been conducted since this discovery in the 2018 program

MEENTHEENA AND COONGAN GOLD PROJECTS (70% Azure / 30% Creasy Group)

- Meentheena drilled for epithermal gold mineralisation – explored by Creasy Group since 1994

- Coongan adjoins Novo Resources’ Beatons Creek conglomerate-alluvial gold project

Azure is pleased to announce it has received binding commitments from institutional and sophisticated investors to raise $4.0M (before costs) at $0.10 per Share via a share placement (“Placement”) to support initial exploration activities on these new West Australian projects.

The Company’s largest shareholder, Deutsche Balaton Aktiengesellschaft will participate in the Placement, subject to the receipt of shareholder approval.

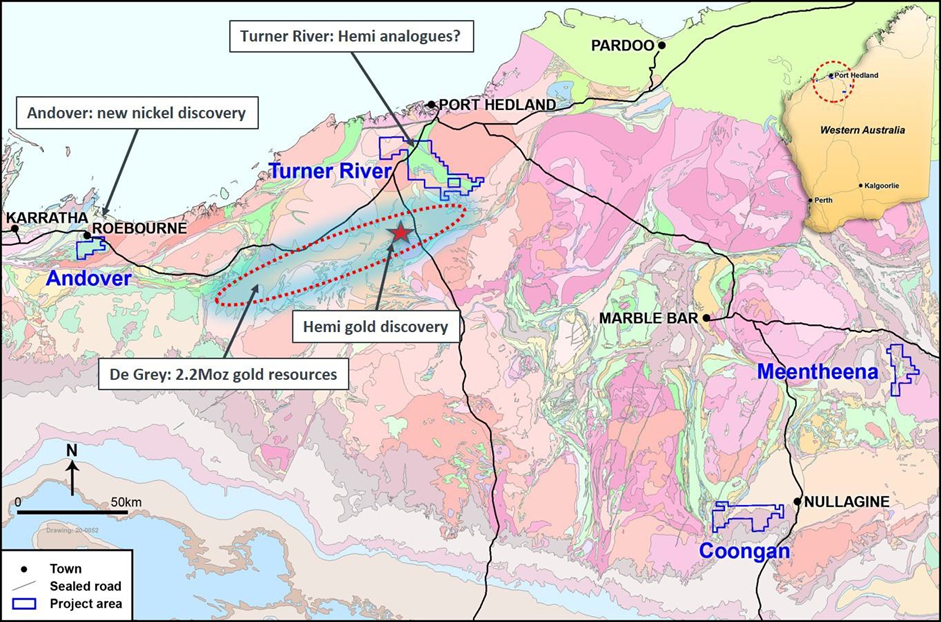

Azure Minerals Limited (ASX: AZS) (“Azure” or “the Company”) is pleased to advise that it has entered into two Tenement Sale and Exploration Joint Venture Agreements (“Agreements”) with entities controlled by prominent mining prospector Mr Mark Creasy (“Creasy Group”); one to acquire a 60% interest in the Andover nickel-copper project and another to acquire 70% interests in the Turner River, Meentheena and Coongan Gold Projects, located in the Pilbara region of Western Australia (see Figure 1).

The consideration for these acquisitions totals 40,000,000 Azure fully paid ordinary shares (“Shares”) with the issue of these Shares subject to shareholder approval. Post the placement and if this transaction is approved, the Creasy Group will emerge as Azure’s largest shareholder with a 19.1% interest, which includes the Creasy Group’s participation in the Placement by subscribing for 1.2 million shares.

Commenting on this acquisition, Azure’s Managing Director, Mr. Tony Rovira, said: “Due to the severity of the COVID-19 pandemic in Mexico and the uncertainty of future field operations, Azure sought gold and nickel projects in Western Australia to enable the Company to continue exploration activities.

“We’re delighted to have acquired these four exciting projects which have strong potential due to historical exploration results, underlying geology and project locations. This acquisition enables the Company to reduce risk by diversifying across commodities and jurisdictions, giving shareholders exposure to both the hottest gold exploration district in Western Australia and an advanced nickel-copper project.

“Andover is a highly prospective and very exciting base metal project with a nickel-copper discovery drilled by the Creasy Group demonstrating potentially economic grades and widths. The mineralisation is hosted in the Andover Complex, a layered mafic-ultramafic intrusive complex similar to the Gonneville Intrusive Complex which hosts the new Julimar nickel-copper-PGE discovery of Chalice Gold Mines.

“The Turner River Gold Project is located in the Mallina region which is rapidly emerging as a major gold province with the potential to be of world-class scale. The property is adjacent to De Grey’s project which contains the Hemi gold discovery plus gold resources of 2.2Moz in multiple shear-hosted deposits. Turner River hosts similar geology to De Grey’s ground, including 12km of the fertile Berghaus Shear and parallel structures associated with the Hemi deposit.

“Creasy Group have been Azure shareholders since 2003 and we are excited to take our relationship to the next level with this acquisition and to partner with him to explore and develop these exciting projects.

“It’s important for our shareholders to understand that our projects in Mexico remain an important core business for the Company, however, these new projects are an exceptional opportunity to explore quality ground in partnership with a proven world-class mine-finder.”

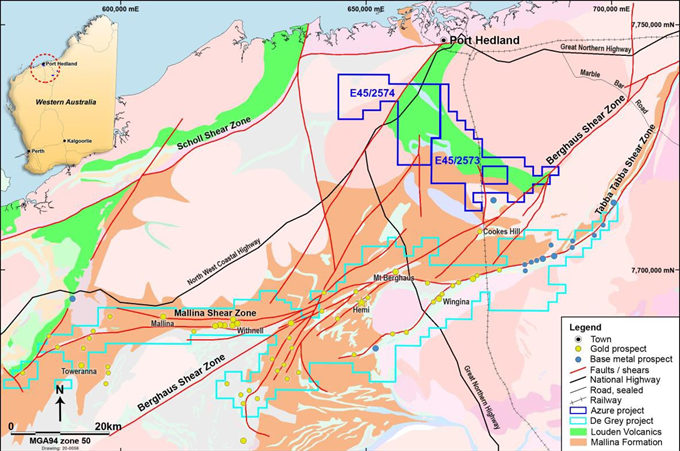

Figure 1: Locations of Azure’s new projects overlying map of Pilbara geology

ANDOVER NICKEL-COPPER PROJECT

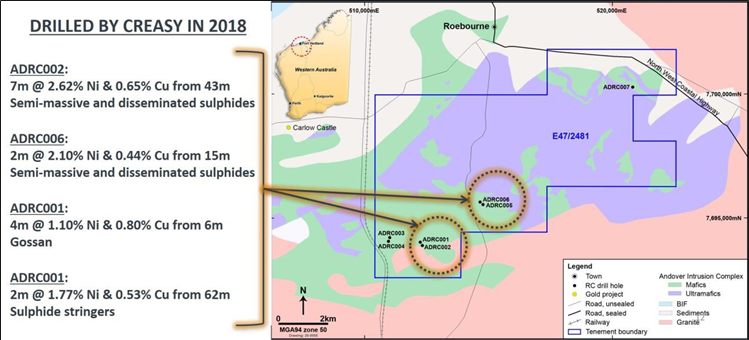

The Andover Nickel-Copper Project hosts nickel-copper sulphide mineralisation discovered by Creasy Group in 20181. Three holes testing two separate targets intersected significant nickel and copper sulphide mineralisation at shallow depths, with the best being:

ADRC002: 7m @ 2.62% Ni & 0.65% Cu within 26m @ 1.03% Ni & 0.46% Cu from 43m

ADRC006: 2m @ 2.10% Ni & 0.44% Cu from 15m

ADRC001: 4m @ 1.10% Ni & 0.80% Cu from 6m and 2m @ 1.77% Ni & 0.53% Cu from 62m

Figure 2: Andover mafic-ultramafic intrusive complex with the Creasy Group drill hole collar locations

The 70km2 project covers most of the Andover Mafic-Ultramafic Intrusive Complex (see Figure 2). Historical exploration has demonstrated that it hosts nickel, copper, cobalt, platinum and palladium mineralisation. Being a layered mafic-ultramafic intrusion, Andover is similar geologically to the Fraser Range Province (host to the Nova-Bollinger nickel-copper mine and Legend Mining’s Mawson nickel- copper discovery) and the Gonneville Intrusive Complex (host to Chalice Gold Mine’s Julimar nickel- copper-PGE discovery).

Andover is located 35km southeast of Karratha and immediately south of Roebourne with excellent local infrastructure such as airports, port access, railway, gas-fired grid power, sealed highways, and support services readily available. It is situated in a well-mineralised district, with Artemis Resources’ Carlow Castle gold-copper-cobalt deposit 3.5km to the west, the now-closed Radio Hill nickel-copper mine and plant 28km to the southwest, and the Sherlock Bay nickel deposit 30km to the east.

A VTEM survey flown in 2008 identified 14 high priority exploration targets considered likely to represent bedrock-hosted conductors. Follow-up ground EM surveys in 2012 on some of these targets provided further definition. Geological mapping of the EM conductor locations in the period 2013-2016 identified outcropping gossans and surface sampling returned anomalous values of nickel, copper and cobalt.

Creasy Group drilled seven RC holes (1,126m) in 2018 to test four targets characterised by coincident versatile time domain electromagnetic system (“VTEM”) and ground electromagnetic (“EM”) anomalies plus surface gossans containing anomalous nickel and copper. Six holes intersected sulphide mineralisation in mafic and ultramafic rocks. Three holes (ADRC001, 002 & 006) intersected disseminated and semi-massive nickel and copper sulphides with potentially economic grades and widths in two separate zones (see Figure 2). Mineralisation remains open in all directions.

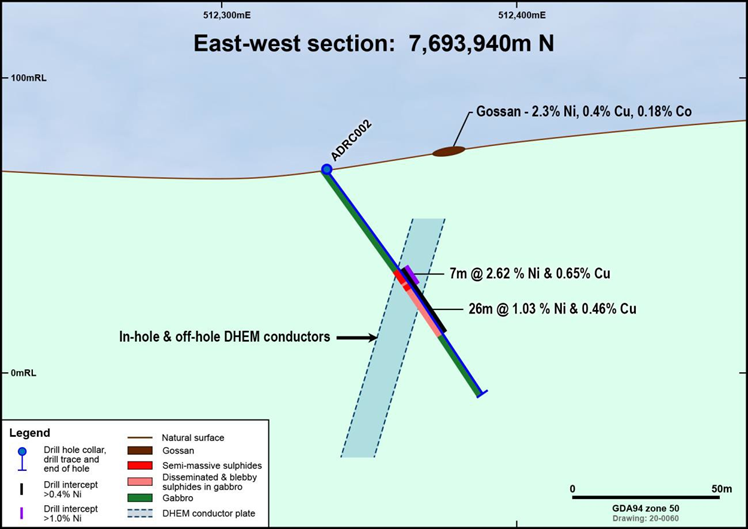

Downhole EM surveys identified the presence of both in-hole anomalies coincident with the sulphide-rich intervals and off-hole conductors indicating the presence of additional sulphide mineralisation, with hole ADRC002 demonstrating a very strong EM response (see Figure 3).

The successful intersections of nickel and copper sulphide mineralisation coincident with the airborne, surface and downhole conductor anomalies indicate that EM surveys are an effective targeting tool for buried sulphides within the Andover Complex.

Figure 3: Cross section through drill hole ADRC002

Follow-up diamond drilling on these mineralised intersections was recommended at the time, however no further drilling has been carried out to date. Multiple other EM targets and surface gossans remain untested throughout the 70km2 property.

Azure plans diamond drilling to follow-up these two separate nickel-copper occurrences and to test additional geophysical and gossan targets.

Table 1: Best nickel-copper intersections drilled by Creasy Group at Andover in 2018

| Hole ID | From (m) | To (m) | Interval (m) | Lithology description | Ni (%) | Cu (%) | Co (%) |

| ADRC002 | 43 | 50 | 7 | Heavily disseminated and semi-massive sulphides | 2.62 | 0.65 | 0.09 |

| within | 43 | 69 | 26 | 1.03 | 0.46 | 0.04 | |

| ADRC006 | 15 | 17 | 2 | Heavily disseminated and semi-massive sulphides | 2.10 | 0.44 | 0.09 |

| and | 22 | 28 | 6 | Heavily disseminated sulphides | 0.45 | 0.39 | 0.03 |

| and | 34 | 40 | 6 | Stringer and disseminated sulphides | 0.31 | 0.55 | 0.02 |

| ADRC001 | 62 | 64 | 2 | Sulphide stringers in gabbro | 1.77 | 0.53 | 0.07 |

| and | 6 | 10 | 4 | Gossan with secondary copper mineralisation | 1.10 | 0.80 | 0.06 |

| and | 146 | 150 | 4 | Heavily disseminated sulphides | 0.57 | 0.34 | 0.02 |

TURNER RIVER GOLD PROJECT

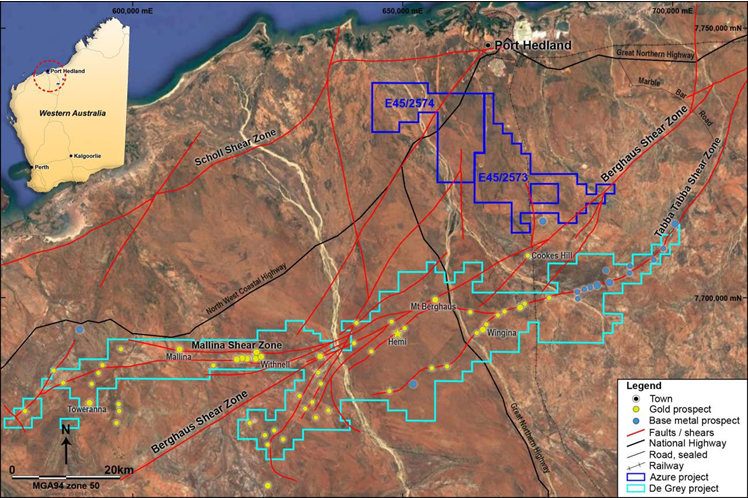

The Turner River Gold Project comprises two unexplored Exploration Licence applications covering 450km2 located just south of Port Hedland and within 7 kilometres of De Grey Mining’s Mallina Gold Project (2.2Moz of gold resources) at the closest point (see Figure 4).

Figure 4: Location plan for the Turner River Gold Project showing gold deposits/occurrences

The mostly sand-covered Turner River property contains sedimentary units of the Mallina Formation, granite intrusions and the Louden Volcanics, an Archean-age greenstone belt (see Figure 5). There are no indications of drilling or other historical exploration within the project area.

Figure 5: Turner River Gold Project showing geology, structural setting & gold deposits/occurrences

De Grey’s recent Hemi discovery, together with the 2.2Moz of gold resources hosted in multiple deposits throughout the Mallina project, demonstrate that substantial gold deposits can form with the confluence of granite intrusions into the Mallina sediments and major cross-cutting shear zones like the regionally- extensive Mallina and Berghaus Shear Zones.

Mallina sediments and granite intrusions are present in the Turner River property and comprise the same geological sequence and shear zones that occur in De Grey’s property. The Hemi gold discovery and the nearby Mt Berghaus (De Grey) and Cookes Hill (Haoma Mining) gold deposits are associated with the northeast trending Berghaus Shear Zone.

Further along strike to the northeast from these deposits the Berghaus Shear Zone crosses through the south-eastern part of the Turner River project area for approximately 12 kilometres, crossing both Mallina sediments and Louden Volcanics, making this area a priority exploration target.

Additionally, the Louden greenstone belt is prospective for more conventional structurally controlled gold mineralisation, a concept that to date remains relatively untested in this district.

The extensive sand cover, minimal historical exploration, proximity to De Grey’s strongly mineralised project area and gold deposits, favourable rock types and fertile structural setting all highlight the significant potential for Turner River to host substantial gold mineralisation.

Azure will undertake geophysical surveys and reconnaissance drilling within this unexplored project as soon as the tenements are granted.

MEENTHEENA AND COONGAN GOLD PROJECTS

The Meentheena and Coongan gold exploration projects are located in the eastern Pilbara. Meentheena is located approximately 80km east of Marble Bar with easy access via the sealed Marble Bar to Telfer Gold Mine road and Coongan is located 8km to the west of Nullagine (see Figure 1).

Meentheena covers 223km2 and the project area has been explored by the Creasy Group for more than 25 years. It is prospective for epithermal-style gold mineralisation and geological mapping and geochemical sampling over several years defined a large (~20km2) zone of epithermal alteration at surface. Strongly anomalous gold and silver values and high levels of the pathfinder minerals arsenic, antimony and mercury are associated with silica flooding, quartz and sulphide veining, and crackle breccias indicative of an epithermal event.

The Creasy Group have drill-tested this zone with five RC holes totalling 2,204m and one 706m diamond core hole. Several holes intersected epithermal-style alteration, veining and brecciation with anomalous precious metals and pathfinder elements. Azure plans to undertake further exploration, initially comprising surface studies followed by drilling.

Coogan covers an area of 141km2. It is situated immediately west of Nullagine and adjoins the western boundary of Novo Resources’ Beatons Creek Conglomerate Gold Project (current resources of 903,000oz @ 2.53g/t Au in conglomerate, alluvial and reef gold2). Until recently a joint venture with Creasy related entities, Novo announced (15 June 2020) that it had consolidated sole ownership of the Beatons Creek project by acquiring the Creasy Group interests.

There are numerous mineral occurrences and deposits reported in the immediate vicinity of Coongan, including gold to the northwest and east, copper to the north, Channel Iron Deposits (CID) to the south and tin, tantalum and lithium to the east. The project is considered prospective for alluvial and conglomerate-hosted gold similar to that at Beatons Creek and also bedrock-hosted primary gold mineralisation.

Exploration recently undertaken by the Creasy

Group focused on the western

half of the project area and

comprised surface geochemical sampling (stream sediment and rock chip) and a

close-spaced detailed aeromagnetic survey. Numerous

target areas were identified that warrant follow-up with infill stream sediment

sampling, soil sampling, detailed rock chip sampling and geological mapping. In

addition, the eastern half of the property requires similar reconnaissance

exploration and an aeromagnetic survey. Next stage exploration programs are

being planned and will be executed in the coming tenement year.

Key Terms of the Tenement Sale and Exploration Joint Venture Agreements

Turner River, Meentheena and Coongan Tenement Sale and Exploration Joint Venture Agreement

Azure to acquire 70% interests in the following tenements and applications:

- Exploration Licence Application 45/2573 & Exploration Licence Application 45/2574 (“Turner River”) – consideration is 1,600,000 Shares ;

- EL 45/5036 (“Meentheena”) – consideration is 8,800,000 Shares; and

- EL 46/1156 (“Coongan”) – consideration is 5,600,000 Shares,

from each of Croydon Gold Pty Ltd (“Croydon”), Youanmi Metals Pty Ltd and Vaalbara Resources Pty Ltd respectively, with all of the Shares forming the consideration to be issued to Yandal Investments Pty Ltd (“Yandal”). Each of these entities form part of the Creasy Group which will retain a 30% interest.

Andover Tenement Sale and Exploration Joint Venture Agreement

Azure to acquire a 60% interest in the following tenement and application from Croydon (with Creasy Group to retain 40%):

- EL 47/2481 & Exploration Licence Application 47/4314 (“Andover”) – consideration is 24,000,000 Shares to be issued to Yandal.

Total consideration and terms for this acquisition are:

- Azure will issue to the Creasy Group or its nominee 40,000,000 Shares; and

- Azure will sole fund exploration and free-carry the Creasy Group’s interests under both agreements through to execution of a Mining Venture Agreement including the completion of any bankable feasibility studies.

The acquisition of the interests noted above under each of the Tenement Sale and Exploration Joint Venture Agreements (“Sale Interest”) are subject to the receipt by the Company of shareholder approval for the issue of Shares and the execution of relevant deeds of assignment and assumption in relation to various third party agreements applicable to the tenements and applications to the extent of the interest acquired by the Company by 30 November 2020. Shareholders of Azure will be asked to approve the issue of Shares under the agreements at a meeting which is expected to be held in mid-August 2020. Upon the receipt of shareholder approval and issuance of the Shares, Creasy Group’s (or its nominee) holding in Azure Minerals will increase to approximately 19.1%, from its current 3.0% holding.

An exploration joint venture will be formed under each of the agreements on completion of the acquisition of the Sale Interests.

Azure will be the manager of the Joint Venture unless it relinquishes its position and withdraws as manager, becomes insolvent, is in material default of the agreement where this is not remedied within 60 days or the management committee terminates the manager’s appointment.

Each party is entitled to appoint 2 representatives to the management committee of the joint venture with the voting power of each party to be in accordance with the percentage interest of the party with Azure having a controlling vote while its sole funds the projects. All matters at meetings of the management committee will be decided by a majority of votes except the following matters which require a unanimous decision: disposal of joint venture property, exploration outside the tenements and applications, abandonment or surrender of any part of the tenements or applications, settlement of claims in excess of $50,000 or borrowing more than $50,000 in relation to the tenements and application which has not been approved in the budget. A representative appointed by Azure will be appointed as Chairman of the management committee.

After the execution of a Mining Joint Venture Agreement each party will be required to contribute their proportion of costs or risk dilution of their interest. If the Creasy Group elects not to participate and fund its share or fails to sell its interest, its interest will be converted to a 2% net smelter royalty however, this interest will be reinstated if under any bankable feasibility study 70% of the first 24 months of the budget or 20% of the total estimate budget has not been expended or contractually committed within 3 years.

The agreements otherwise contain terms and conditions standard for agreements of their nature

Placement

The Company has received binding commitments from professional and sophisticated investors to raise gross proceeds of A$4 million by way of a share placement. Proceeds of the Placement will be used to fund initial exploration at these new gold and nickel projects, fund ongoing exploration at the Alacrán silver, gold and copper project in Mexico, for working capital, and to pay costs of the capital raising.

Canaccord Genuity (Australia) Limited acted as Sole Lead Manager to the Placement.

Under the Placement, a total of 40.0 million shares will be issued at a price of $0.10 per share. This represents a 7.0% discount to the 15 day volume weighted average price (VWAP) of the Company’s shares and a 2.1% premium to the 30 day VWAP on the days which trades were recorded leading up to this announcement.

Shares issued under the Placement (except those to be issued to the Company’s largest shareholder Deutsche Balaton Aktiengesellschaft) utilise the Company’s existing placement capacity pursuant to Listing Rule (“LR”) 7.1A (16,000,000 shares) and LR 7.1 (7,000,000 shares) and are expected to be issued on Thursday 23rd July 2020. Deutsche Balaton Aktiengesellschaft will participate in the Placement subject to the receipt of shareholder approval pursuant to LR 10.11 by subscribing for 17,000,000 Shares, thereby increasing its shareholding interest to 18.0%.

-ENDS-

Authorised for release by Mr Brett Dickson, Company Secretary.

For enquiries, please contact:

| Tony Rovira Managing Director Azure Minerals Limited Ph: +61 8 9481 2555 [email protected] | Media & Investor Relations Michael Weir / Cameron Gilenko Citadel-MAGNUS Ph: +61 8 6160 4903 |

or visit www.azureminerals.com.au for further information and announcements.

COMPETENT PERSON STATEMENT

Information in this report that relates to Exploration Results for the Andover, Turner River, Coongan and Meentheena Projects is based on information compiled by Mr Tony Rovira, who is a Member of The Australasian Institute of Mining and Metallurgy and fairly represents this information. Mr Rovira has sufficient experience relevant to the style of mineralisation and type of deposit under consideration, and to the activities undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the Joint Ore Reserves Committee (JORC) Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Mr Rovira is a full-time employee and Managing Director of Azure Minerals Limited and consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

Original Article: https://azureminerals.com.au/wp-content/uploads/2020/07/200717b.pdf