OPOSURA PROJECT

Phase 1 Mining Campaign Completed at Oposura

- Phase 1 mining completed during the quarter, exceeding initial production targets

- Starter open pit produced an estimated 6,100 tonnes of ore at grades

of 13.4% Zn & 10.7% Pb, with both tonnage

and grades well above initial

expectations:

- Includes production of approximately 2,100 tonnes of ultra-high-grade ore grading 24.0% Zn & 18.3% Pb

- Trial processing of the first batch of ore commenced in late October

- Concentrates produced will be sold on spot market with strong interest already received from potential purchasers

ALACRÁN PROJECT

Azure Secures 100% Ownership of 32Moz Silver Project

- Azure regained 100% ownership of the Alacrán silver-gold project from Teck Resources

Limited (“Teck”)

- Teck becomes a substantial shareholder of Azure

- Alacrán underpinned by Mineral Resources of 32.2Moz of silver & 150,000oz of gold with strong potential for resource expansion

- Advanced silver and gold exploration underway around the Loma Bonita deposit with greenfields exploration occurring elsewhere on the property

- Drilling to expand Loma Bonita mineral resource will follow-up significant gold intersections1 that remain open, including:

- 47m @ 2.8g/t gold & 33g/t silver from surface in MDPC-131

- 67m @ 1.6g/t gold & 21g/t silver from surface in MDPC-096

OPOSURA PROJECT – (AZS 100% ownership)

PHASE 1 MINING CAMPAIGN EXCEEDS INITIAL PRODUCTION TARGET

Azure completed the first phase of the Company’s small-scale, multi-phase mining program at Oposura, delivering outstanding results.

Open pit mining selectively extracted near-surface, high-grade, massive zinc and lead sulphide mineralisation. Ore tonnages and grades significantly exceed the Mineral Resource estimate for this part of the deposit.

Azure commenced mining at Oposura in August and within two months had mined and stockpiled 6,100 tonnes of high-grade ore.

Based upon close-spaced Reverse Circulation (RC) grade control drilling and systematic stockpile sampling, average grades of the mined ore are estimated to be 13.4% zinc and 10.7% lead.

This significantly exceeds the estimated average East Zone open pit mine grade from the 2018 Oposura Scoping Study of 5.1% zinc and 2.6% lead, which augurs well for a future large-scale mining and processing operation.

An extended refurbishment program delayed the commencement of operations at the third-party San Javier processing plant, however wet commissioning has commenced. The Company has also identified a second plant in the district that may be suitable for processing Oposura ore and trial processing of a small batch of ore at that plant has commenced.

Steady state toll treatment of the Oposura ore is expected to start in December to produce separate zinc and lead-silver concentrates. Azure expects to sell the concentrates on the spot market to locally-based metals traders or smelters, several of which have expressed strong interest in these products.

OPERATIONAL DETAILS OF MINING PROGRAM

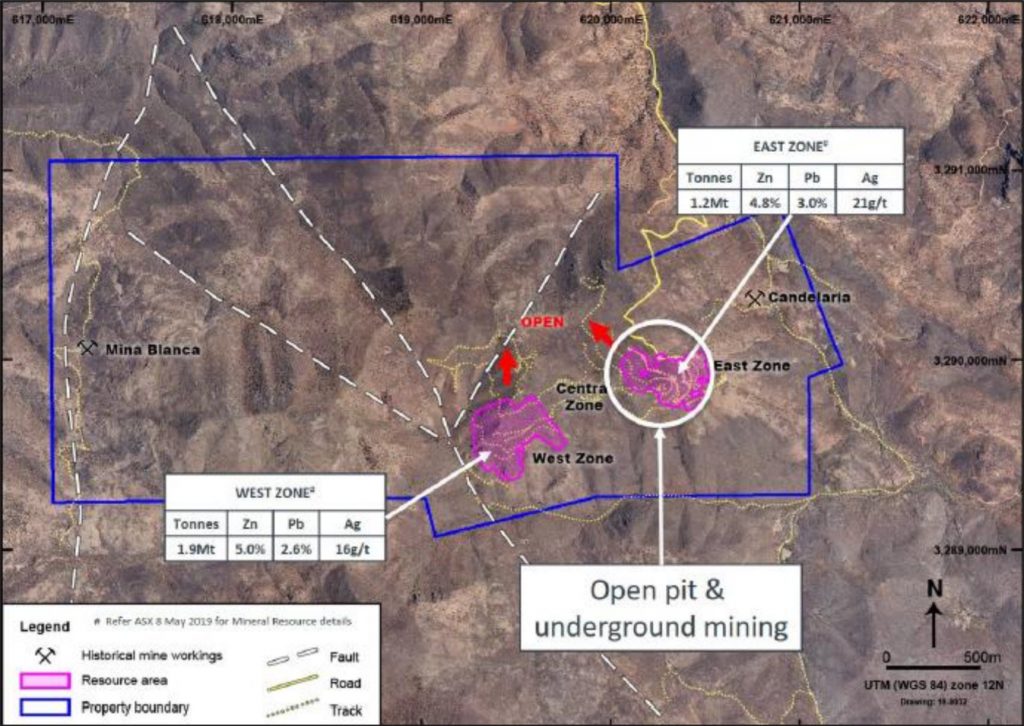

Mining focused on extracting easily accessible, high-grade massive sulphide mineralisation from the eastern side of the East Zone Mineral Resource (see Figures 1 & 2). In this location, the relatively flat-lying, high-grade massive sulphide ore zone varied in thickness from two to four metres and demonstrated excellent continuity.

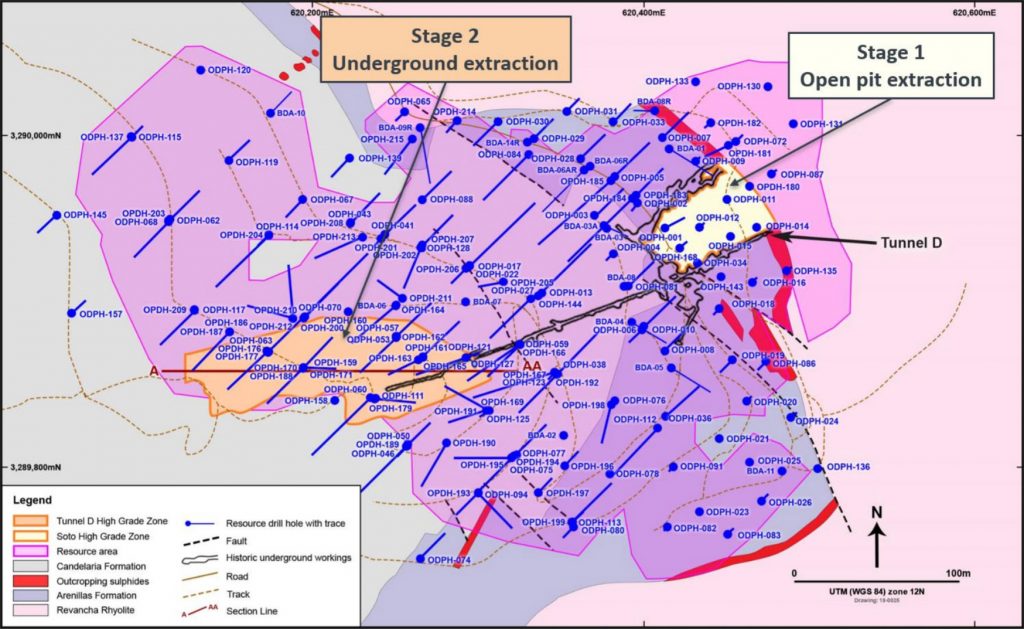

Mining consisted of a starter open pit (see Figure 3) to expose and extract massive sulphide ore which occurs at or very close to surface and which, in some places, was already fully exposed by historical prospecting activities. Overburden comprised weathered and unconsolidated rock which was removed by bulldozer and excavator with low mining costs.

Initially, the open pit was designed to extract approximately 1,000 tonnes of ore before transitioning into an underground mining phase. However once open pit mining commenced, significantly more ore at higher grades was identified than was originally estimated by the mineral resource drilling, which had an average hole spacing of approximately 25m x 25m.

Given the lower mining costs and higher production rates associated with open pit mining (as compared with underground mining), Azure extended the open pit mining phase.

A total of 6,100 tonnes of ore was excavated and stockpiled on site. Based upon RC grade control drilling (hole spacing of 4m x 4m) and systematic stockpile sampling, the grade of mined ore is estimated to be 13.4% Zn and 10.7% Pb.

Within the western part of the starter open pit, 2,100 tonnes of ultra-high-grade massive sulphide ore was mined (see Figure 4) at an average grade of 24.0% Zn and 18.3% Pb, with some parts of this zone containing zinc and lead grades exceeding a combined 50% Zn+Pb. This ultra-high-grade ore has been stockpiled separately and is being assessed as a potential Direct Shipping Ore (DSO) product.

With the first phase of the small-scale mining program successfully completed, mining was suspended to allow this first batch of ore to be processed to ensure the production of marketable concentrates. A significant quantity, amounting to about 2,000 tonnes, of broken stocks of high-grade massive sulphide ore remains exposed in the floor and walls of the open pit and is available for immediate extraction upon recommencement of mining.

Azure plans a second phase of open pit mining to be undertaken following a successful processing operation producing saleable concentrates. This mining will provide a stable western face for portal access for the planned underground mining operation. The portal and subsequent drive will access the historical Tunnel D which will be side-stripped to provide 3m x 3m mechanised access to the western high-grade zone (see Figure 2). Underground development will be undertaken in ore to offset establishment costs prior to selectively mining the high-grade ore zone by the room and pillar method.

Figure 1: Oposura Project with East Zone & West Zone Mineral Resources

Figure 2: East Zone showing Mineral Resource and small-scale mining locations

Figure 3: Open pit mining operations in the East Zone, looking west

Figure 4: Mining ultra-high-grade (+40% Zn+Pb) massive zinc and lead sulphide ore in the East Zone open pit

ALACRÁN PROJECT – (AZS 100% ownership)

100% OWNERSHIP OF 32Moz SILVER PROJECT SECURED

Azure regained 100% ownership of the Alacrán silver-gold project from Minera Teck S.A. de C.V., a subsidiary of Canadian mining company Teck Resources Limited (“Teck”), with Teck becoming a substantial shareholder of Azure.

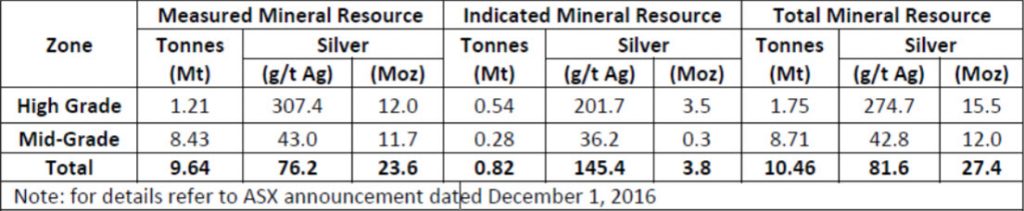

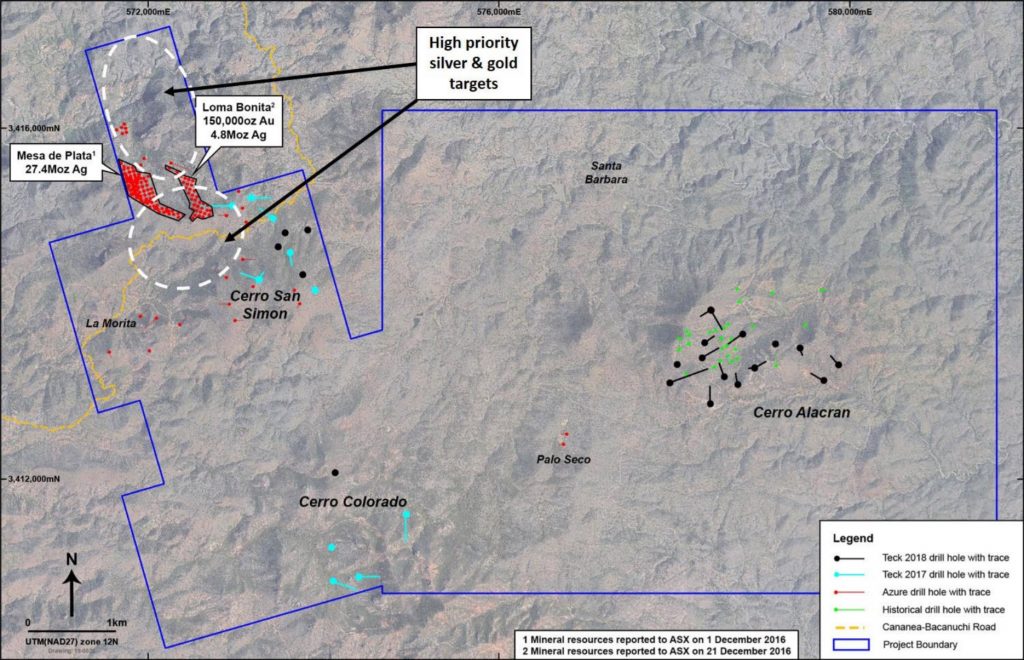

Azure’s previous exploration on Alacrán in 2015 and 2016 discovered the near-surface, high-grade Mesa de Plata silver deposit (refer to Table 1 for Mineral Resource) and the adjacent Loma Bonita gold-silver deposit (refer to Table 2 for Mineral Resource) (see Figure 5). These resources total:

Mesa de Plata: 27.4Moz silver in 10.5Mt @ 82g/t Ag

- Includes an at-surface high-grade zone of: 15.5Moz silver in 1.8Mt @ 275g/t Ag Loma Bonita: 150,000oz gold & 4.8Moz silver in 5.4Mt @ 0.9g/t Au & 28g/t Ag

Table 1: Mesa de Plata Mineral Resource (in accordance with the 2012 JORC Code)

Table 2: Loma Bonita Mineral Resource (in accordance with the 2012 JORC Code)

Figure 5: Locations of Mesa de Plata and Loma Bonita deposits and areas of priority exploration

BACKGROUND

In December 2014, Azure and Teck entered into an agreement whereby Azure could acquire 100% ownership of the Alacrán Project from Teck by sole-funding US$5 million of exploration expenditure over a four-year period. Teck would retain a back-in right which could be exercised within two months of Azure reaching the earn-in milestone.

Within two years, in October 2016, Azure announced that the Company had met the expenditure requirement and thereby earned 100% ownership of the Alacrán Project. During this period, Azure discovered two deposits; the Mesa de Plata silver deposit and the Loma Bonita gold-silver deposit.

In December 2016, Teck exercised its right to earn back a 51% interest in the project by sole-funding US$10 million of exploration expenditure over a four-year period from 2017 to 2020. Teck’s focus was to explore for significant copper deposits and, while porphyry-hosted copper mineralisation was confirmed at Cerro Alacrán (refer ASX: 6 May 2019), it did not meet Teck’s expectations for further testing.

In May 2019, Azure announced that it had accepted a right of first offer proposal from Teck for Azure to acquire all of Teck’s rights and interests in the Alacrán Project. With execution of the sale and purchase agreement, Azure regained 100% ownership and control of Alacrán by issuing to Teck 27,545,566 ordinary fully paid shares that resulted in Teck (and its affiliates) owning 19.9% of Azure’s outstanding shares on a post-issuance basis, a 0.5% NSR royalty on the project, and a participation right on the proceeds of any sale of the project within a five year period (refer ASX 16 May 2019 for full details of the transaction).

SILVER & GOLD EXPLORATION UNDERWAY ON ALACRÁN PROJECT

Azure has commenced advanced-stage silver and gold exploration on areas surrounding the Mesa de Plata and Loma Bonita deposits, with greenfields exploration occurring elsewhere on the property.

Drilling to expand the initial Loma Bonita resource will follow-up significant gold intersections that indicate the deposit remains open (ASX: 28 September & 15 November 2016), including:

- 47m @ 2.8g/t gold & 33g/t silver from surface in MDPC-131

- 67m @ 1.6g/t gold & 21g/t silver from surface in MDPC-096

Mesa De Plata Silver Deposit

The Mesa de Plata silver deposit outcrops as a strongly silicified, flat-lying horizon which forms a prominent ridge. Silver mineralisation starts at surface with the mineralised zone having a true thickness of up to 80 metres.

The deposit is highlighted by the outcropping High-Grade Zone which contains Measured and Indicated resources of more than 15 million ounces of silver with an average grade of 275g/t Ag. Covering an area of 400m x 150m, this 20m-thick, strongly silicified, silver-rich zone is the uppermost part of the deposit and forms a prominent ridge capping.

There is widespread exposure of this ultra-high-grade silver mineralisation at surface (see Figure 6), making it very attractive from a mining economics point of view.

Figure 6: Outcropping ultra-high-grade (+1,000g/t Ag) silver mineralisation on Mesa de Plata

Some of the better drill intersections from the High-Grade Zone (ASX: 16 September, 13 November & 23 December 2016) include:

- 9.0m @ 1,235g/t Ag from 1.5m in LM-09

- 10.5m @ 1,044g/t Ag from 2.0m in MDPD-001

- 18.7m @ 530g/t Ag from 28.8m in MDPD-002

- 13.5m @ 738g/t Ag from surface in MDPC-034

Azure’s updated Mineral Resource for Mesa de Plata is shown in Table 1. Notably, 85% of the silver ounces within the deposit are classified in the Measured category, with the remainder classified as Indicated resources. This demonstrates the strong internal continuity and uniformity of silver mineralisation throughout the deposit.

The Mesa de Plata deposit, including the High-Grade Zone, remains open to the west but is constrained in this direction by the concession boundary. To the north and east the mineralised zone has been truncated by erosion, however mineralisation remains open to the south.

Potential for repetitions of Mesa de Plata exist further to the north (see Figure 5) where outcropping vuggy silica forms similar-looking silicified ridges. Further exploration is planned for this area.

Azure previously carried out metallurgical and mineral processing testwork on the Mesa de Plata mineralisation, as well as commencing mining, infrastructure, power, water, community and environmental studies as part of an overall project development study.

Study results demonstrate good potential for a simple, relatively low-cost, open pit mining operation with silver extraction by a combination of gravity separation and flotation, or heap leach / CIL processing. This study was suspended in late-2016 due to Teck’s decision to back-in to the project. Azure will restart metallurgical studies now that the Company has regained full operational control of the project.

Loma Bonita Gold & Silver Deposit

The Loma Bonita deposit is situated approximately 200 metres to the east of the Mesa de Plata silver deposit. Mineralisation extends for over 750 metres north-south and up to 300 metres east-west, and the true width of the mineralised zone exceeds 100 metres in some places.

Azure’s previous drilling campaign at Loma Bonita was suspended in December 2016 when Teck re- entered into the project via a back-in right. At that time, an initial Loma Bonita Mineral Resource of 150,000oz of gold and 4.8Moz of silver was estimated (refer Table 2). This back-in right has now been extinguished with Azure regaining 100%-ownership of Alacrán, enabling the Company to recommence resource expansion drilling.

The deposit is constrained by erosion into a valley on its western flank but is unconstrained by landform features to the north, south and east. Further drilling in those areas, and at depth, could significantly increase the resource. This is supported by drill intersections that confirm the mineralisation remains open in the following directions:

To the east: MDPC-131 intersected 47.2m @ 2.79g/t Au & 33g/t Ag (ASX: 15 November 2016); To the south: MDPC-098 intersected 24.4m @ 0.72g/t Au & 13g/t Ag (ASX: 28 September 2016); To the north: MDPC-135 intersected 16.8m @ 1.17g/t Au & 86g/t Ag (ASX: 15 November 2016). The Company’s main priority is to restart drilling at Loma Bonita to expand gold and silver resources. Applications for environmental approval and site access have been submitted and drilling will commence as soon as approvals have been received, which are expected late in the December quarter.

Additional drilling is also being planned for less-advanced targets where exploration has identified anomalous gold and silver mineralisation from surface sampling. Prospects that show good potential include:

- Palo Seco Sur: surface sampling grades up to 1,119g/t silver and 1.27g/t gold (ASX: 16 May 2016);

- south of the Cerro Alacrán copper porphyry: sampling of historical mine workings returned grades up to 3,675g/t silver, 24.1g/t gold, 2.3% copper, 33.5% lead and 21.0% zinc (ASX: l8 October 2019).

–ENDS–

For enquiries, please contact:

| Tony Rovira Managing Director Azure Minerals Limited Ph: 61 8 9481 2555 | Media & Investor Relations Michael Weir / Cameron Gilenko Citadel-MAGNUS Ph: +61 8 6160 4903 |

or visit www.azureminerals.com.au

Competent Person Statements:

Information in this report that relates to previously reported Exploration Results has been crossed- referenced in this report to the date that it was reported to ASX. Azure Minerals Limited confirms that it is not aware of any new information or data that materially affects information included in the relevant market announcements.

Information in this report that relates to Mineral Resources for the Oposura Project is extracted from the report “Azure Delivers Robust Initial Mineral Resource at Oposura” created and released to the ASX on 4 July 2018 and is available to view on www.asx.com.au. Azure Minerals Limited confirms that it is not aware of any new information or data that materially affects information included in the relevant market announcement, and that all material assumptions and technical parameters underpinning the estimates in the announcement continue to apply and have not materially changed.

The information in this report that relates to Mineral Resources for the Mesa de Plata and Loma Bonita deposits on the Alacrán Project are extracted from the respective reports “Mesa de Plata Mineral Resource Upgraded” and “Loma Bonita Mineral Resource” created and released to the ASX on 1 December 2016 and 21 December 2016 respectively and are available to view on www.asx.com.au . Azure Minerals Limited confirms that it is not aware of any new information or data that materially affects information included in the relevant market announcement, and that all material assumptions and technical parameters underpinning the estimates in the announcement continue to apply and have not materially changed.

Original Article: https://azureminerals.com.au/wp-content/uploads/2019/10/191031.pdf