57.8 G/T GOLD AND 2,120 G/T SILVER RETURNED FROM NEW TARGET 6 AREA

– High-Grade Channel Sampling Results Inform New 2025 Drilling Plans –

Melbourne, Australia and Vancouver, Canada – TheNewswire – July 29th, 2025 – Mithril Silver and Gold Limited (“Mithril” or the “Company”) (TSXV: MSG) (ASX: MTH) is pleased to provide more exploration results for multiple targets at Mithril’s district scale Copalquin property, Durango State, Mexico.

Highlights

- New Target 6 high-grade assays received from channel sampling at historic Santa Cruz underground mine

- High-grade surface channel sampling continues to expand Target 5 ahead of first drilling mid-August 2025

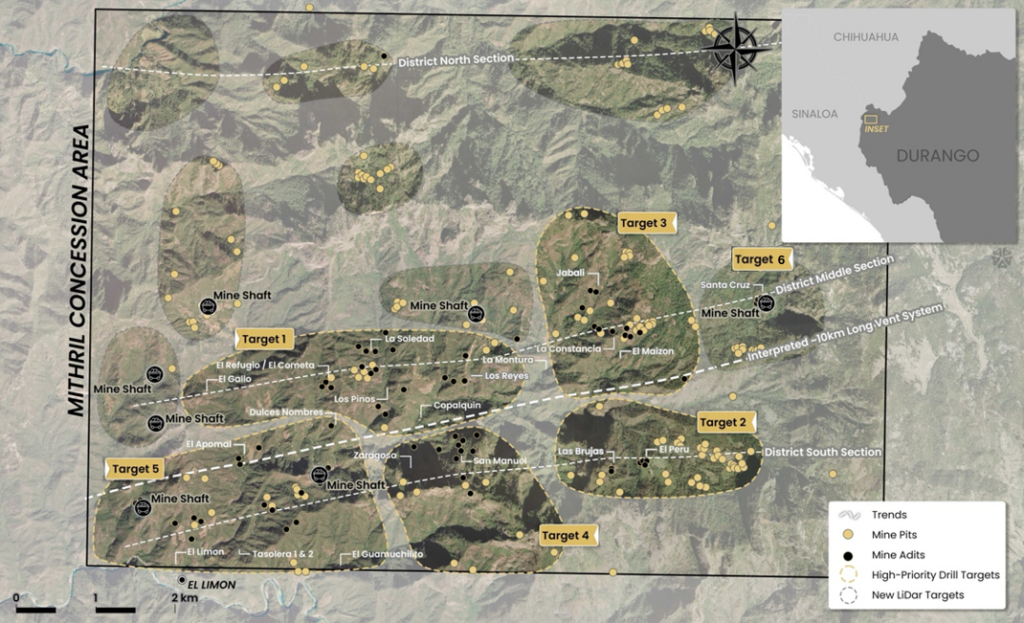

- Mineralised corridors now cover 2 km x 8 km over 1,200 m elevation profile within the 70km mining concession area

Backed by its recent capital raise, Mithril is fully funded to complete 45,000 metres of drilling over the next 12 months, with a third drill rig set to be added in early 2026 Highlight channel sample results from surface and underground at Targets 5 and 6

- 0.70 m @ 57.8 g/t gold, 2,120 g/t silver (814673; underground, Santa Cruz Level 1, T6)

- 0.80 m @ 17.4 g/t gold, 603 g/t silver (814674; underground, Santa Cruz Level 1, T6)

- 0.50 m @ 8.42 g/t gold, 188 g/t silver (814669; underground, Santa Cruz Level 1, T6)

- 0.70 m @ 23.2 g/t gold, 755 g/t silver (814665; underground, Santa Cruz Level 2, T6)

- 0.50 m @ 28.1 g/t gold, 233 g/t silver (814681; underground, Santa Cruz Level 2, T6)

- 0.50 m @ 14.35 g/t gold, 584 g/t silver (814658; underground, Santa Cruz Level 2, T6)

- 0.70 m @ 9.06 g/t gold, 421 g/t silver (814664; underground, Santa Cruz Level 2, T6)

- 0.55 m @ 7.68 g/t gold, 437 g/t silver (814685; underground, Santa Cruz Level 2, T6)

- 0.80 m @ 7.11 g/t gold, 303 g/t silver (814657; underground, Santa Cruz Level 2, T6)

- 0.50 m @ 8.28 g/t gold, 77 g/t silver (814660; underground, Santa Cruz Level 2, T6)

- 0.50 m @ 27.9 g/t gold, 14 g/t silver (814239; surface, La Maquina, T5)

- 0.30 m @ 9.60 g/t gold, 608 g/t silver (814194; surface, La Cucaracha, T5)

“The spectacular high-grade results from Target 6, including 57.8 g/t gold and 2,120 g/t silver over 0.7m, underscore the exceptional potential of the Copalquin District,” commented John Skeet, Managing Director & CEO. “Our talented team continues to uncover new mineralised zones across multiple targets, and the large system is rapidly expanding.

Additionally, with roads completed and drill pads in place at Target 5, we are prepared to launch aggressive drilling in August 2025. The consistent scale and high-grades we’re encountering across the district solidifies Copalquin as one of the most compelling emerging gold-silver camps in Mexico’s Sierra Madre trend. With strong backing from our recent equity raise, we’re strategically funded to unlock the full potential of the district through accelerated exploration.”

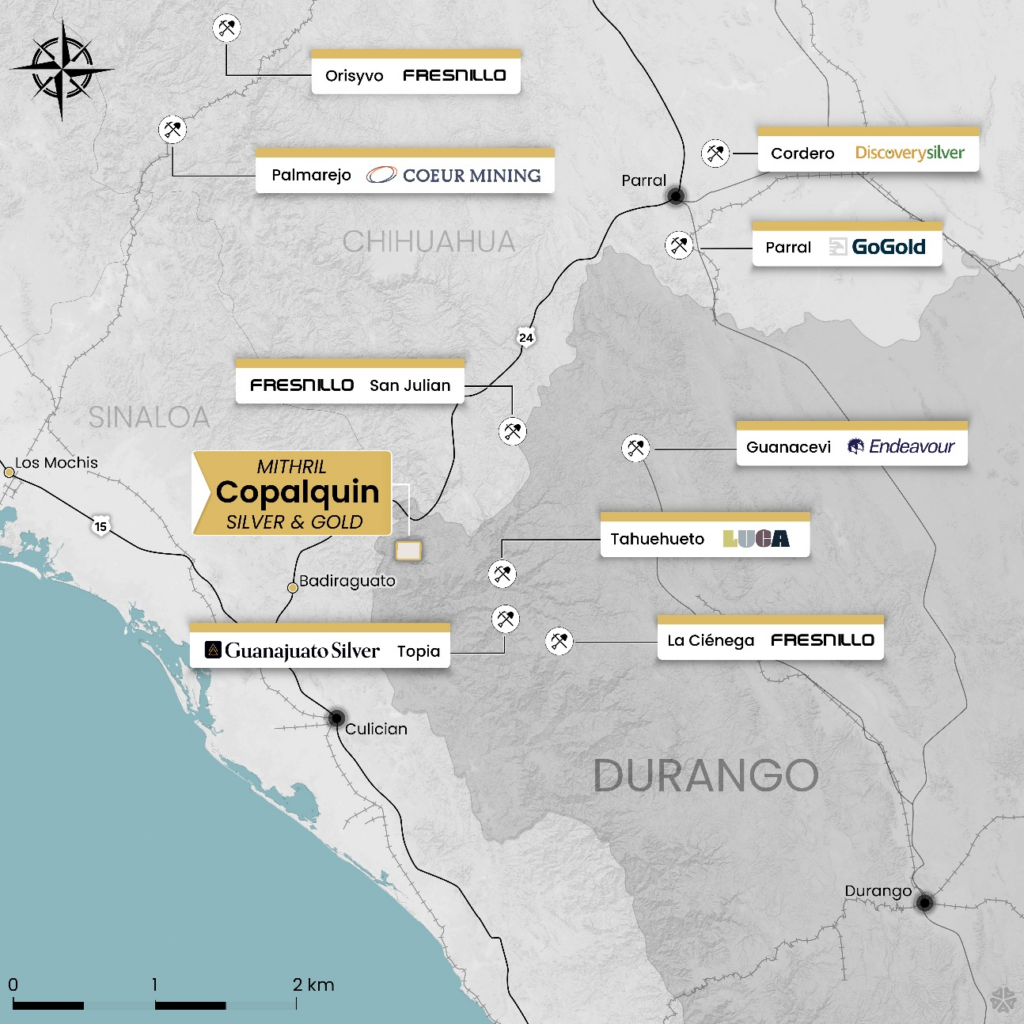

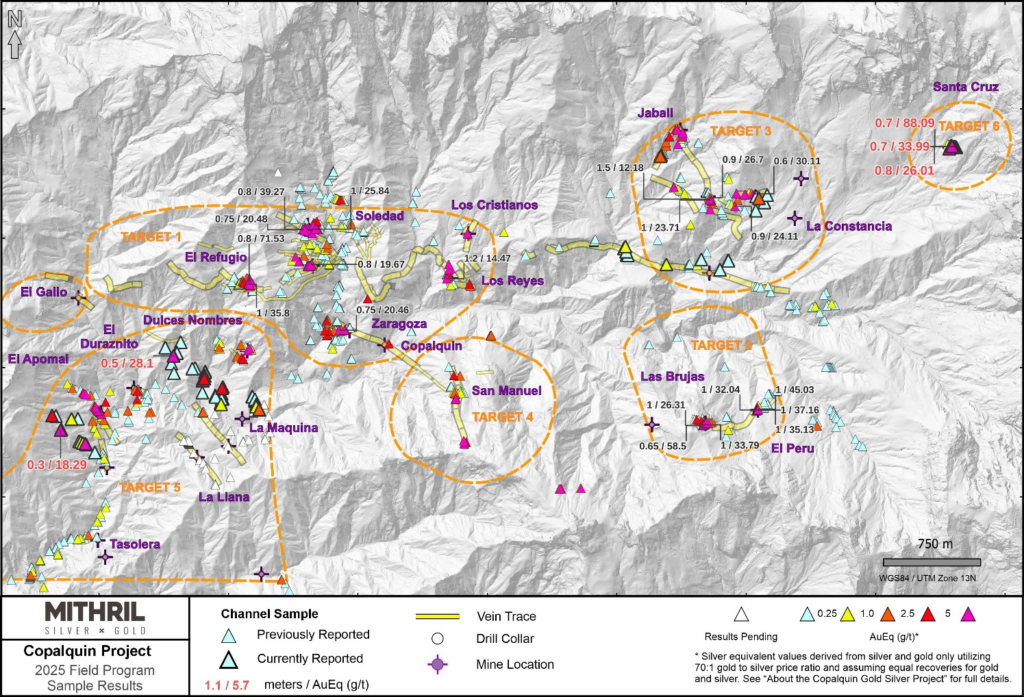

COPALQUIN GOLD-SILVER DISTRICT, DURANGO STATE, MEXICO

Click Image To View Full Size

With 100 historic underground gold-silver mines and workings plus 198 surface workings/pits throughout 70km2 of mining concession area, Copalquin is an entire mining district with high-grade exploration results and a maiden JORC resource. To date there are several target areas in the district with one already hosting a high-grade gold-silver JORC mineral resource estimate (MRE) at the Target 1 area (El Refugio-La Soledad)1 and a NI 43-101 Technical Report filed on SEDAR+, supported by a conceptional underground mining study completed on the maiden resource in early 2022 and metallurgical test work (see ASX Announcement 25 February 2022). There is considerable strike and depth potential to increase the resource at El Refugio and at other target areas across the district, plus the underlying geologic system that is responsible for the widespread gold-silver mineralisation.

With the district-wide gold and silver occurrences and rapid exploration success, it is clear the Copalquin District is developing into another significant gold-silver district like the many other districts in this prolific Sierra Madre Gold-Silver Trend of Mexico.

Click Image To View Full Size

Copalquin District Exploration Progress Update

Surficial and underground channel sampling at Target 3, 5 and 6 Areas have continued to deliver excellent results, with several channel samples intersecting high-grade gold and silver within broad, outcropping vein systems (Figures 2, 3).

Drilling is continuing at Target 1 ahead for the resource update for this target in the second half of 2025.

The second drill is currently completing a program of holes at the Zaragoza historic mine area near the eastern side of the Target 5 area before commencing the first 5,000 metre drill program at Target 5 in August 2025.

Click Image To View Full Size

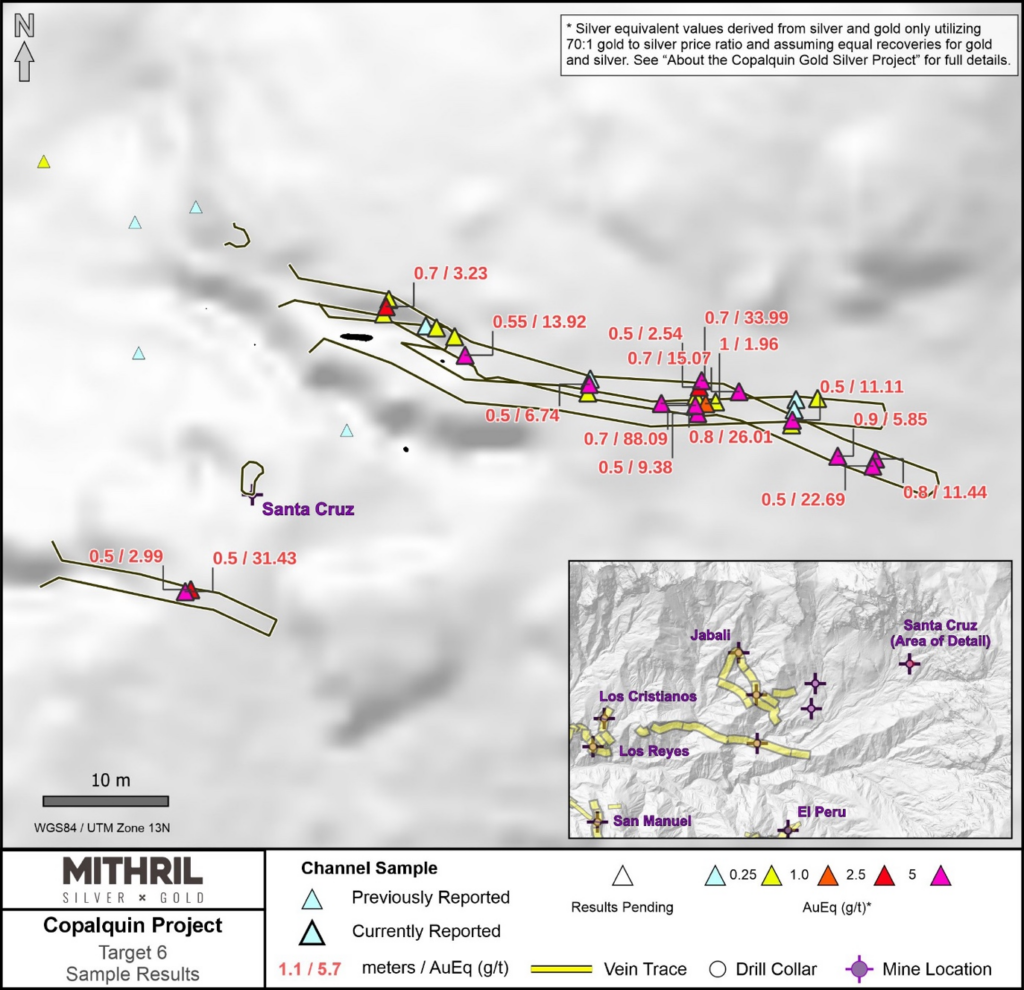

Target 6 is a recently defined zone located 1.4 km east of Target 3 (see Figure 3). Within the Target area lies the historic Santa Cruz mine which hosts east-west trending, subvertical mineralized quartz veins and northwest trending quartz breccias. Sampling of the underground workings has yielded numerous high-grade gold and silver listed below (see Figure 4), including 0.70 m @ 57.8 g/t gold, 2,120 g/t silver and 0.70 m @ 23.2 g/t gold, 755 g/t silver. Mapping and sampling of the Target 6 area is ongoing.

- 0.70 m @ 57.8 g/t gold, 2,120 g/t silver (814673; underground, Santa Cruz Level 1)

- 0.70 m @ 23.2 g/t gold, 755 g/t silver (814665; underground, Santa Cruz Level 2)

- 0.50 m @ 28.1 g/t gold, 233 g/t silver (814681; underground, Santa Cruz Level 2)

- 0.80 m @ 17.4 g/t gold, 603 g/t silver (814674; underground, Santa Cruz Level 1)

- 0.50 m @ 14.35 g/t gold, 584 g/t silver (814658; underground, Santa Cruz Level 2)

- 0.70 m @ 9.06 g/t gold, 421 g/t silver (814664; underground, Santa Cruz Level 2)

- 0.55 m @ 7.68 g/t gold, 437 g/t silver (814685; underground, Santa Cruz Level 2)

- 0.80 m @ 7.11 g/t gold, 303 g/t silver (814657; underground, Santa Cruz Level 2)

- 0.50 m @ 8.42 g/t gold, 188 g/t silver (814669; underground, Santa Cruz Level 1)

- 0.50 m @ 8.28 g/t gold, 77 g/t silver (814660; underground, Santa Cruz Level 2)

- 0.50 m @ 3.94 g/t gold, 196 g/t silver (814683; underground, Santa Cruz Level 2)

- 0.90 m @ 4.50 g/t gold, 94.2 g/t silver (814659; underground, Santa Cruz Level 2)

- 0.70 m @ 1.78 g/t gold, 102 g/t silver (814687; underground, Santa Cruz Level 2)

- 0.50 m @ 2.18 g/t gold, 56.9 g/t silver (814679; underground, Santa Cruz Level 2)

- 0.50 m @ 1.45 g/t gold, 76.6 g/t silver (814663; underground, Santa Cruz Level 2)

- m @ 1.04 g/t gold, 64.1 g/t silver (814672; underground, Santa Cruz Level 1)

Click Image To View Full Size

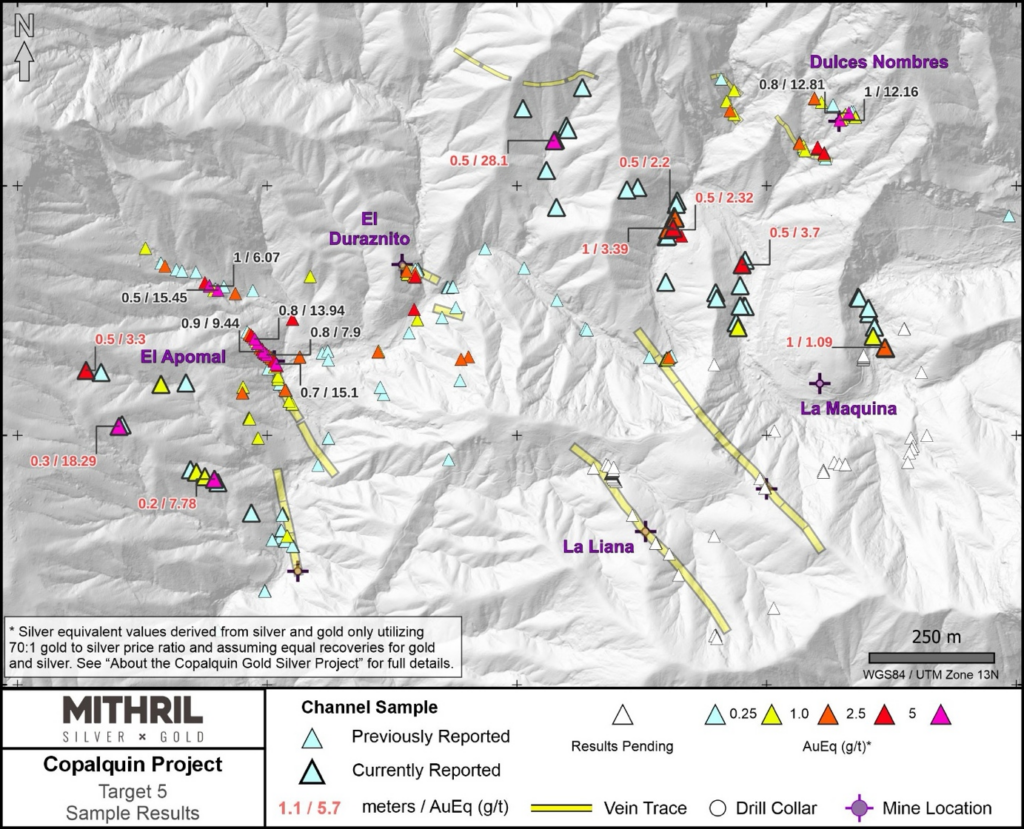

Ongoing mapping at Target 5 — including the La Cucaracha, La Maquina, Apomal and Veta Azul— continues to identify additional vein systems and underground workings, significantly expanding the Target 5 area both along strike and across strike (Figure 5). Several of the mapped veins display good continuity, with some traceable for over 600 metres. The vein system is predominantly striking northwest-southeast with veins in the southwest of the target area dipping to the southwest and veins in the northeast dipping to the northeast (Figure 5). Target 5 veins mapped to date, are hosted in granodiorite and are situated at a lower elevation in the system at 650 – 900 m compared with the mineralised zones at Target 1 (900 – 1,150 m), Target 2 (1,500 – 1,700 m) and Target 6 (~1800 m).

Click Image To View Full Size

Surface and underground channel sampling continues to return anomalous gold and silver values, with numerous assay results still pending.

Complete sample results are presented in Table 2.

Significant gold and silver Target 5 channel sampling highlights include:

- 0.50 m @ 27.9 g/t gold, 14 g/t silver (814239; surface, La Maquina)

- 0.30 m @ 9.60 g/t gold, 608 g/t silver (814194; surface, La Cucaracha)

- 0.20 m @ 2.02 g/t gold, 403 g/t silver (814198; surface, La Cucaracha)

- 0.50 m @ 3.54 g/t gold, 11.3 g/t silver (814212; surface, La Maquina)

- m @ 1.08 g/t gold, 162 g/t silver (814224; surface, La Maquina)

- 0.50 m @ 1.04 g/t gold, 158 g/t silver (814191; surface, La Cucaracha)

- 0.50 m @ 0.28 g/t gold, 143 g/t silver (814220; surface, La Maquina)

Base metal sulphides have been observed in veins at La Maquina (Figure 5).

- 1.00m @ 0.09 g/t gold, 70 g/t silver, 1.22 % Pb, 1.83 % Zn (814260; surface, La Maquina)

An exploration road to the Target 5 area to provide access for drill pads is complete. Drilling is expected to commence in Target 5 in early August, 2025.

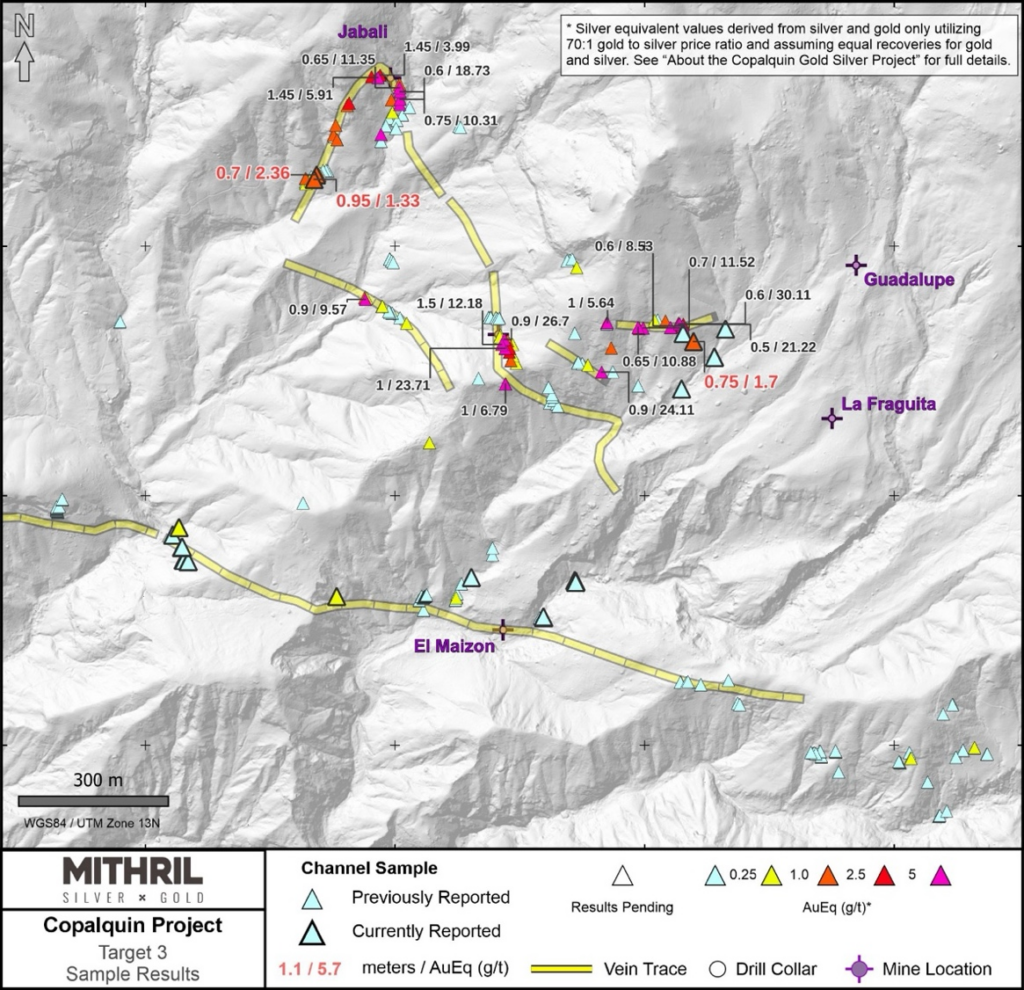

Mapping and sampling of Target 3, which includes the Jabali, Constancia, San Antonio, and Guadalupe mines, has revealed a network of mineralized veins (Figure 6). While many of these veins exhibit limited continuity, they occur in various orientations, with a dominant northwest strike over a cumulative strike length of 1km. Channel sampling from both surface and underground workings has returned numerous high-grade gold and silver values, highlighting the potential of the area. Notably, the Jabali mine hosts veins characterized by abundant amethyst, suggesting a distinct mineralogical signature that may be useful for further vectoring.

Mapping and sampling will continue in the area to fully develop drill targeting.

Complete sample results are presented in Table 2.

Significant gold and silver Target 3 channel sampling highlights include:

- 0.70 m @ 1.41 g/t gold, 66.6 g/t silver (814587; surface, Jabali, T3)

Click Image To View Full Size

ABOUT THE COPALQUIN GOLD SILVER PROJECT

The Copalquin mining district is located in Durango State, Mexico and covers an entire mining district of 70km2 containing several dozen historic gold and silver mines and workings, ten of which had notable production. The district is within the Sierra Madre Gold Silver Trend which extends north-south along the western side of Mexico and hosts many world-class gold and silver deposits.

Multiple mineralisation events, young intrusives thought to be system-driving heat sources, widespread alteration together with extensive surface vein exposures and dozens of historic mine workings, identify the Copalquin mining district as a major epithermal centre for Gold and Silver.

Within 15 months of drilling in the Copalquin District, Mithril delivered a maiden JORC mineral resource estimate demonstrating the high-grade gold and silver resource potential for the district. This maiden resource is detailed below (see ASX release 17 November 2021)^ and a NI 43-101 Technical Report filed on SEDAR+

- Indicated 691 kt @5.43 g/t gold, 114 g/t silver for 121,000 oz gold plus 2,538,000 oz silver

- Inferred 1,725 kt @4.55 g/t gold, 152 g/t silver for 252,000 oz gold plus 8,414,000 oz silver

(using a cut-off grade of 2.0 g/t AuEq*)

- 28.6% of the resource tonnage is classified as indicated

Table 1 Mineral resource estimate El Refugio – La Soledad using a cut-off grade of 2.0 g/t AuEq*

| Mineral Resources | ||||||||

|---|---|---|---|---|---|---|---|---|

Tonnes (kt) | Tonnes (kt) | Gold (g/t) | Silver (g/t) | Gold Eq.* (g/t) | Gold (koz) | Silver (koz) | Gold Eq.* (koz) | |

El Refugio | Indicated | 691 | 5.43 | 114.2 | 7.06 | 121 | 2,538 | 157 |

Inferred | 1,447 | 4.63 | 137.1 | 6.59 | 215 | 6,377 | 307 | |

La Soledad | Indicated | – | – | – | – | – | – | – |

Inferred | 278 | 4.12 | 228.2 | 7.38 | 37 | 2,037 | 66 | |

Total | Indicated | 691 | 5.43 | 114.2 | 7.06 | 121 | 2,538 | 157 |

Inferred | 1,725 | 4.55 | 151.7 | 6.72 | 252 | 8,414 | 372 | |

Data reflects mineral resources as of 08:10 AM MST, July 29, 2025. *Gold Equivalent (AuEq) calculated using a gold price of $1,800/oz and silver price of $22/oz.

* In determining the gold equivalent (AuEq.) grade for reporting, a gold:silver price ratio of 70:1 was determined, using the formula: AuEq grade = Au grade + ((Ag grade/70) x (Ag recovery/Au recovery)). The metal prices used to determine the 70:1 ratio are the cumulative average prices for 2021: gold USD1,798.34 and silver: USD25.32 (actual is 71:1) from kitco.com. At this early stage, the metallurgical recoveries were assumed to be equal (93%). Subsequent preliminary metallurgical test work produced recoveries of 91% for silver and 96% for gold (ASX Announcement 25 February 2022) and these will be used when the resource is updated in the future. In the Company’s opinion there is reasonable potential for both gold and silver to be extracted and sold.

^ The information in this report that relates to Mineral Resources or Ore Reserves is based on information provided in the following ASX announcement: 17 Nov 2021 – MAIDEN JORC RESOURCE 529,000 OUNCES @ 6.81G/T (AuEq*), which includes the full JORC MRE report, also available on the Mithril Resources Limited Website.

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original market announcement and that all material assumptions and technical parameters underpinning the estimates in the relevant market announcement continue to apply and have not materially changed. The company confirms that the form and context in which the Competent Person’s findings are presented have not been materially modified from the original market announcement.

Mining study (conceptual) and metallurgical test work supports the development of the El Refugio-La Soledad resource with conventional underground mining methods indicated as being appropriate and with high gold-silver recovery to produce metal on-site with conventional processing.

Mithril is currently exploring in the Copalquin District to expand the resource footprint, demonstrating its multi-million-ounce gold and silver potential. Mithril has an exclusive option to purchase 100% interest in the Copalquin mining concessions by paying US$10M on or any time before 7 August 2028.

-ENDS-