Phase II drilling continues, and the Company is fully funded for 2022

Vancouver, British Columbia–(Newsfile Corp. – June 13, 2022) – Silver Dollar Resources Inc. (CSE: SLV) (OTCQX: SLVDF) (“Silver Dollar” or the “Company”) is pleased to report the initial assay results from the Phase II drilling ongoing at the underexplored Noria portion of the La Joya Silver Project (the “Property”) located in the state of Durango, Mexico.

Key Highlight:

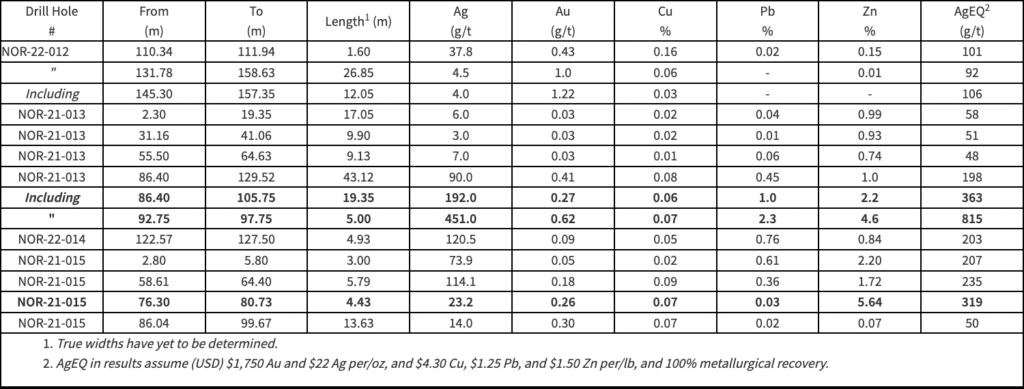

- Hole NOR-22-013 returned the highest grades to date at the new Brazo Discovery, intersecting 815 grams per tonne (g/t) silver equivalent (AgEQ) over 5 metres (m) within a broader interval of 363 g/t AgEQ over 19.35 m starting at 86.4 m downhole.

Phase I drilling consisted of 2,424 metres of drilling completed over 11 holes with analytical results previously reported (See news releases of March 24, 2022 and May 4, 2022).

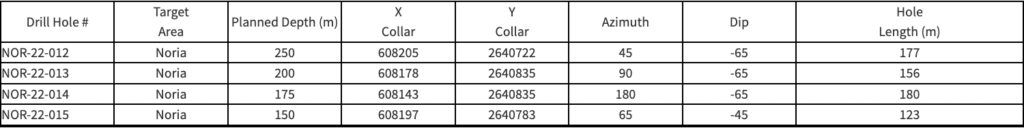

A total 1,899 metres of drilling over 10 holes have been completed to date in Phase II drilling (See drill plan map). Drill core logging and sampling of all holes is ongoing with samples being submitted in batches for analysis. The results reported below are for the first four holes of the Phase II program.

Phase II Drilling Objectives and Discussion

Hole NOR-22-012 was a 30 m step back targeting the gold zone identified in NOR-22-009 (0.66 g/t gold (Au) over 58.84 m from 75.83 m downhole). Mineralization encountered included an intercept with 1.00 g/t Au over 26.85 m from 131.78 m downhole. While the interval in NOR-22-012 is approximately half the width of the interval in NOR-22-009 it is 42% higher in grade, (See: cross-section).

Hole NOR-22-013 was a -20° steeper inclined hole beneath the silver-zinc (Ag-Zn) zone identified in NOR-22-008 (89.59 g/t AgEQ over 125.3 m from surface including 267.56 g/t AgEq over 10.47 m from 70.53 m downhole), with NOR-22-013 targeting the higher-grade mineralization 35 m further down dip. The high-grade polymetallic mineralization of note begins with 363.29 g/t AgEQ over 19.35 m from 86.4 m downhole (See: cross-section).

Hole NOR-22-014 was a 32 m step back from NOR-22-013 that returned mineralization of lesser grade and width than at higher elevations in the section; however, the results do indicate a continuation of the mineralizing event that remains open at depth and along strike (See: cross-section).

Hole NOR-22-015 was drilled in the 100 m gap between the Au and Ag-Zn zones to establish continuity between the zones and better understand the zonation. While the mineral distribution in this hole is intermittent, it shows characteristics of the gold-rich zone to the south and the Ag-Zn mineralization to the north (See: cross-section).

Table 1: A summary of downhole drill intersection results for the first four holes of the Phase II program.

“Phase II drilling continues to test the extensions of the wide intervals of mineralization intersected in Phase I, with hole NOR-22-013 returning the highest grades to date at the new Brazo Discovery,” said Mike Romanik, president of Silver Dollar. “Drilling is ongoing and additional results will be reported as received.”

Table 2: Drillhole Details

Procedure, Quality Assurance / Quality Control, and Data Verification

The diamond drill core (HQ size) was geologically logged, photographed, and marked for sampling. Core designated for sampling was sawn in half with a diamond blade core saw. One-half of the core was sealed in plastic bags and shipped for analysis. The remaining half portion was returned to the core trays for storage and/or for metallurgical test work.

The sealed and tagged sample bags were transported to the ActLabs facility in Zacatecas, Mexico where the samples were crushed and 200-300-gram pulp samples prepared with ninety percent passing Tyler 150 mesh (106μm). The pulps were assayed for gold using a 30-gram charge by fire assay (Code 1A2 and/or FA450) and over limits greater than 10 grams per tonne were re-assayed using a gravimetric finish (Code 1A3 and/or FA550). Silver and multi-element analysis was completed using total digestion (Code 1F2 Total Digestion ICP). Over limits greater than 100 grams per tonne silver were re-assayed using a gravimetric finish (Code 8-Ag FA-GRAV Ag).

Quality assurance and quality control (“QA/QC”) procedures monitor the chain of custody of the samples and include the systematic insertion and monitoring of appropriate reference materials (certified standards, blanks, and duplicates) into the sample strings. The results of the assaying of the QA/QC material included in each batch were tracked to ensure the integrity of the assay data. All results stated in this announcement have passed Silver Dollar’s QA/QC protocols.

Mike Kilbourne, P.Geo., an independent Qualified Person as defined in NI 43-101, has reviewed and approved the technical contents of this news release on behalf of the Company.

About the La Joya Project

The La Joya Property is situated approximately 75 kilometres directly southeast of the state capital city of Durango in a prolific mineralized region with past-producing and operating mines including Grupo Mexico’s San Martin Mine, Industrias Penoles’s Sabinas Mine, Pan American Silver’s La Colorada Mine, and First Majestic’s La Parrilla and Del Toro Silver Mines. For additional information on the Property click on the image below to watch the two-minute video.

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/7232/127466_403605e714501848_001full.jpg

About Silver Dollar Resources Inc.

Silver Dollar is a mineral exploration company that completed its initial public offering in May 2020 and is fully funded for 2022 with approximately $8.5 million in the treasury. The Company’s projects are located in two of the prolific mining jurisdictions in the world and include the advanced exploration and development stage La Joya Silver Project in the state of Durango, Mexico; and the discovery-stage Pakwash Lake and the Longlegged Lake properties in the Red Lake Mining District of Ontario, Canada. The Company has an aggressive growth strategy and is actively reviewing potentially accretive acquisitions with a focus on drill-ready projects in mining-friendly jurisdictions internationally.

For additional information, you can download our latest presentation by clicking here and you can follow us on Twitter by clicking here.

ON BEHALF OF THE BOARD

Signed “Michael Romanik”

Michael Romanik,

President, CEO & Director

Silver Dollar Resources Inc.

Direct line: (204) 724-0613

Email: [email protected]

179 – 2945 Jacklin Road, Suite 416

Victoria, BC, V9B 6J9

Forward-Looking Statements:

This news release may contain “forward-looking statements.” Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Any forward-looking statement speaks only as of the date of this news release and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.