Summary

- Almaden Minerals just announced that it is spinning out all of its assets into a "SpinCo" except for its flagship Ixtaca Project..

- I think this is a good move generally, although it is not without risks. .

- For the time being I would hold off on buying shares unless I were attempting to time the gold/silver market..

- Valuation matters, but SpinCo stands out in my mind as the more compelling stock to own post spinoff.

An Overview of Almaden Minerals

Almaden Minerals (NYSEMKT:AAU) is a prospect generator focused on gold and silver assets, and its Ixtaca Project in Mexico in particular. Prospect generators come in many different forms, but they are all guided by the philosophy that finding and defining a mineral resource requires a different skill-set from developing and operating a mine. Consequently they decide to focus on the former, and they generate value from their properties by selling them to companies focused on developing and operating mines. In exchange prospect generators receive cash, or sometimes something that allows them to retain some interest in the project without laying out additional capital such as stock in the company or a royalty on the mine.

Almaden Minerals has operated as a royalty/exploration company, meaning that it has been selling its exploration properties in exchange for royalties. Often times it does this very early on in the mine's life and as a result many of its royalties are on project that will get nowhere. But there are exceptions to this. For instance it sold its Caballo Blanco Project at a relatively advanced stage, and up until a few weeks ago I thought that it would do the same with its flagship Ixtaca Project.

Back in June I suggested that investors were undervaluing the Ixtaca Project and that if Almaden were to sell the project and receive similar compensation as it did for the Caballo Blanco Project that the stock had significant upside potential. Thus I argued that such a deal would be a catalyst for the stock going forward.

However this changed recently. The company announced that it would be spinning out essentially all of its assets except for Ixtaca into a new company called "SpinCo." I will look at the deal in greater detail in a moment, but what the company is essentially doing is akin to a division of labor. SpinCo will be the exploration/royalty company–the prospect generator–whereas Almaden will be focused on developing one mine, and it will be classified among those junior miners which own large projects that have enormous potential and leverage to the gold/silver price, but which will cost more to develop than the company can come up with at the present time.

Let us first look at the specifics of the deal and then I will get into the pros and cons and the best course of action for shareholders in the current environment.

Spinning Out SpinCo

Each shareholder of Almaden will receive 0.6 shares of SpinCo for every one share of Almaden. According to the press release Spinco will consist of the following assets.

- A 2% NSR on the Tuligtic Property on which the Ixtaca Project is found. Recall that this is a large project in Mexico containing >4 million gold equivalent ounces using a 0.5 gpt. cutoff grade. Most of these ounces are in the measured and indicated categories. According to the updated PEA the project will operate under one of two scenarios. In the regular scenario there will be a $400 million initial capital expenditure and the mine will produce 130,000 oz. of gold and 7.8 million ounces of silver per year for 12 years. In the ramp-up scenario the company will spend $244 million in order to get the project going before expanding the project ($116 million). Since there will be less production in earlier years in this scenario the project has sufficient resources to produce for 15 years but only at 103,000 oz. of gold/year and 6.1 million ounces of silver/year. The second scenario doesn't have as good an IRR as the first but for those who expect the gold price to be weak before rising over time it makes sense, especially since $244 million is easier to raise than $400 million.

- A 1.5% NSR royalty on the Caballo Blanco Gold deposit, which is owned by Goldgroup Mining (OTCPK:GGAZF). In June I valued this royalty at $10 million but the gold price has fallen 10% so the royalty is worth about $9 million now.

- A 2% NSR royalty on the Elk Project owned by Gold Mountain Mining (TSE.V: GUM). The project will produce ~134,000 oz. of gold over 7 years or 297,000 ounces of gold over 9 years once it goes into production depending on the scenario (500 tpd. or 1,000 tpd.) . Gold Mountain Mining doesn't have the funds to commence either sized project but Almaden is a 40% shareholder and we could see a deal to bring this project into production.

- A portfolio on 21 royalties that are all in the exploration stage. They have no concrete quantifiable value for the time being but they can amount to a lot should they progress as mines.

- The El Cobre Copper-Gold Porphyry Project, which is an exploration-stage project with enormous potential.

- A portfolio of 20 other early exploration projects.

- Enough working capital to satisfy stock exchange requirements.

That leaves Almaden with the Ixtaca Project minus the 2% royalty and some cash/equivalents, although we don't know exactly how much.

SpinCo is going to be managed by Almaden's team of officers.

Why Make The Split?

There are a few reasons why the split makes sense.

The two most obvious to me are the following. First is the aforementioned division of labor. The prospect generator philosophy is based on the idea that exploration and development require two different skill sets. Almaden–whose only asset will be the development project Ixtaca–should be managed by a team of mining engineers, developers, experts on regulations and permitting, and those who are connected sufficiently to find financing. SpinCo should be managed by a team of geologists as presumably their primary goal is going to be to explore the El Cobre Copper-Gold Project.

Second, the split gives investors a choice between two investment theses. Almaden will now be focused on Ixtaca, and Ixtaca's value is going to be highly leveraged to gold and silver prices. Yes there will be other drivers and as the company hits various milestones in developing the project the stock will gain in value. But movements in the gold and silver markets will be the primary drivers. Meanwhile SpinCo will have gold/silver leverage seeing that it owns royalties on Ixtaca, Caballo Blanco and Elk, but these royalties are not going to have a major impact on SpinCo's value until they are nearly generating cash-flow. SpinCo will be an exploration company and its shares will rise as the company finds more metal and fall as it fails to do so. It will also have exploration optionality in its portfolio of early-stage exploration royalties. Should these projects turn into something significant then SpinCo will benefit substantially. Thus the impetus behind each investment will be different, and those investors who want to focus on one or the other can sell shares in one or the other company once the split takes place in order to buy shares in the other.

Third–and this follows from #2–each company separately can be a takeover target. Almaden will appeal to mid-tier mining companies looking for gold-silver projects now that these companies don't have to worry so much about what to do with the company's exploration and royalty assets. Ixtaca would fit well in a portfolio such as Argonaut Gold's (OTCPK:ARNGF), Alamos Gold's (NYSE:AGI), New Gold's (NYSEMKT:NGD), and a plethora of others. SpinCo could be a target for a company such as Osisko Gold Royalties (OTC:OKSKF) which focuses precisely on royalties and exploration in Canada and Mexico.

Risks/Concerns

Generally I like what Almaden is doing, although I do want to point a couple of things out to the reader that could pose issues. The first is the cost of doing such a deal. Almaden is vague about this and it could turn out that this deal costs a few million dollars, which is a lot to Almaden which has a valuation of $70 million and ~$10 million in cash/equivalents.

The second is, ironically, something that management points out as a positive in the press release. Management suggests in the press release that this deal will make it so that the market can appropriately value the Ixtaca Project. The idea here is that because analysts believe that Almaden will sell the project rather than develop it that it is worth less. Furthermore the royalties and exploration projects are difficult to value because there are no concrete metrics regarding anything having to do with future production. This makes the company in general more difficult to value and as a result investors are hesitant to step into the stock. So the thinking here is that the sum of the parts is worth more than the whole.

Maybe this is the case, but in this particular environment I'm skeptical. The reason is that the recent decline in gold and silver prices has resulted in a complete lack of interest in companies that focus on one or two large projects that require far more capital to develop than they can get their hands on. We can point to several such companies that have seen their share prices tank from Victoria Gold (OTCPK:VITFF) to Chesapeake Gold (OTCPK:CHPGF) and Midas Gold (OTCQX:MDRPF). Almaden shares have actually fared quite well by comparison, and given the decline in metals prices and the acutely adverse impact that this has on the NPV of such projects (high capex, high NPV) one could argue that the royalty and exploration assets have helped to cushion the blow. The spinoff strategy could therefore create a lot of selling pressure in Almaden and the value of the sum of the parts might wind up being less than the value of the whole–at least while the precious metals market remains out of favor.

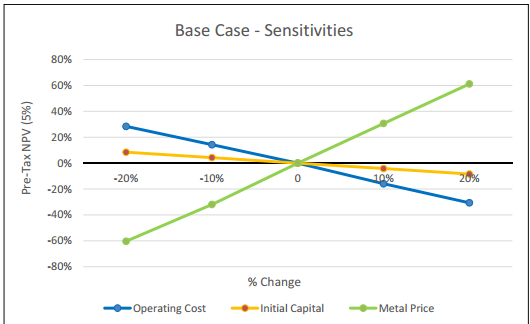

We can see this illustrated in the sensitivity analysis found in the recent PEA for Ixtaca. Note that metal prices are down more than 10% from the base case scenario (gold $1,320/oz. and silver $21/oz).

(Source: Ixtaca PEA)

Note that we're already looking at a ~40% decline in NPV based on recent price action. The fear that gold and silver prices can fall even further can put enormous pressure on shares of Almaden, making the spinoff ineffectual, or at least poorly timed.

The Bottom Line: Trading Almaden Minerals

I still think Almaden has quality assets and that it is a company worth owning be it in one part or two. But for now my concerns lead me to the conclusion that investors should wait for the dust to settle and for the two companies to trade separately for a few weeks. I would also avoid the stock for the time being unless you are intent on owning both post-spinoff companies and unless you are timing the gold/silver market.

Furthermore, investors should keep in mind that there are several assets out there that are similar to Ixtaca, and even if–after the dust settles–Ixtaca offers good value there are a lot of choices for investors looking for large, late stage development projects in the gold and silver space meaning that Almaden may not be the best choice. Unfortunately I cannot get into specific comparisons or valuation scenarios because we don't know how the stock is going to trade post-spinoff.

On the other hand SpinCo faces far less competition. There aren't many players in the royalty/exploration space. This is a double edged sword because it could lead investors to bid shares up too much, which is good if you own them and bad if you want to own them.

With that being said, and given my proclivity for royalty companies I want to focus on SpinCo coming out of this. We don't know how the stock will trade and how the market will value the company coming out of this–which is why I want to wait and reanalyze the company when the time comes–but SpinCo could be a good way for investors to get involved in an inexpensive royalty/exploration company with a handful of royalties on advanced stage projects that have quantifiable values as well as exploration potential and embedded optionality.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.