Highlights

- Successful completion of maiden drill program in the Copalquin gold silver district, Mexico (7,188m)

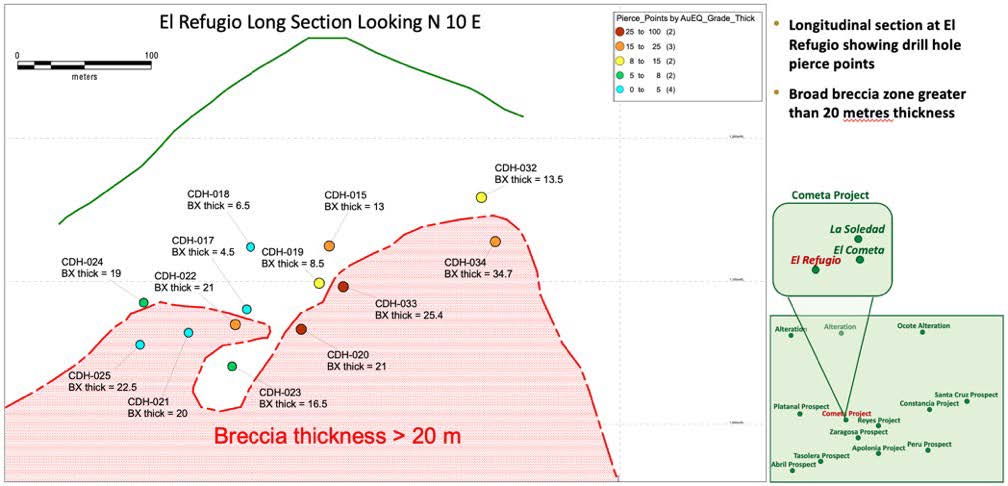

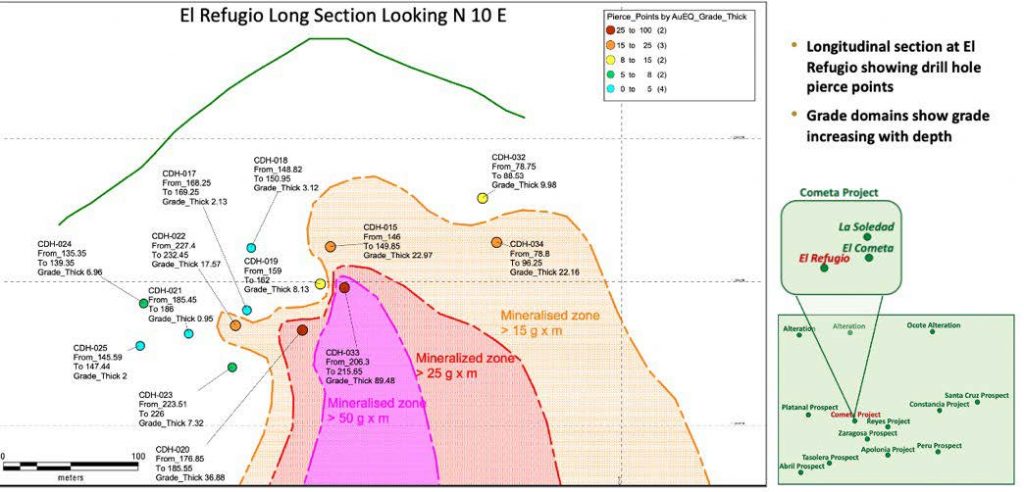

- At El Refugio, top of an epithermal system discovered with grade thickness increasing with depth

- Deeper drill intercept at the El Refugio target intersected high-grade and wider interval as predicted by the geologic model

- High-grade gold and silver results received for first drill holes at Los Reyes target, Reyes project, in the Copalquin District

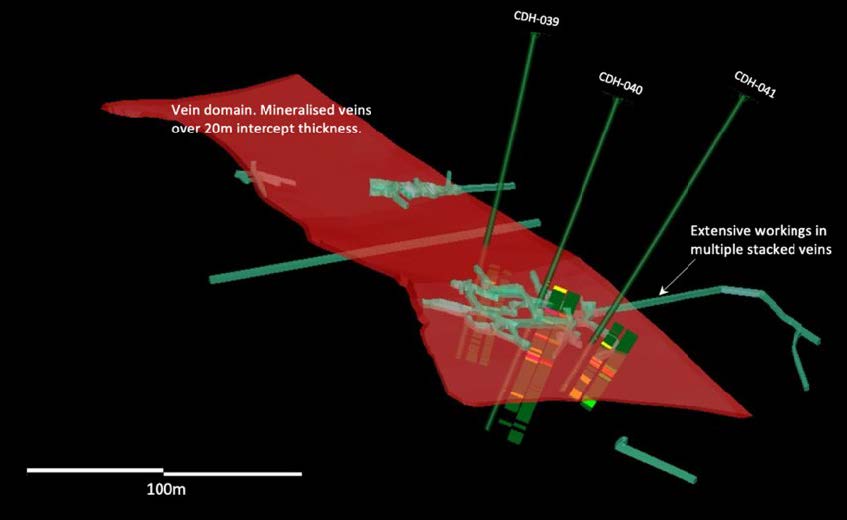

- The intercepts at the Los Reyes target were in the same low-angle structural zone that extends 1.5km west to El Cometa. The structural zone with mineralised veins occurs up to 20m wide at Los Reyes

- The drill data from the historic holes at the El Cometa target together with Mithril’s cross structure holes confirmed the existence of a shallow-dipping breccia-vein system. Mapping showed this vein system to continue east, 800m to the Los Pinos target and a further 500m to the Los Reyes target

- Cash at bank $1m as at 31 December with share placement completed post quarter end for $5m (before costs) for total cash of $6m

March Quarter Activities

- Drilling of the first deeper holes at the Refugio large epithermal system discovery, Cometa Project

- Soil sampling programs within the Cometa Project area at La Soledad West, El Indio and Zaragosa

- Drill program for H1 2021 at the Cometa Project targets and Reyes Project targets, Copalquin district

Mithril Resources Ltd (ASX: MTH) (Mithril or the Company) is pleased to provide an update on activities at its Copalquin Gold Silver Project in Mexico for the period ending 31 December 2020.

In December 2020 Mithril completed its maiden drill program completing 7,188 metres of HQ diamond core drilling using a man portable drill rig with helicopter assistance. The program was completed on time and within budget and achieved the goals for the 2020 exploration program in the Copalquin district.

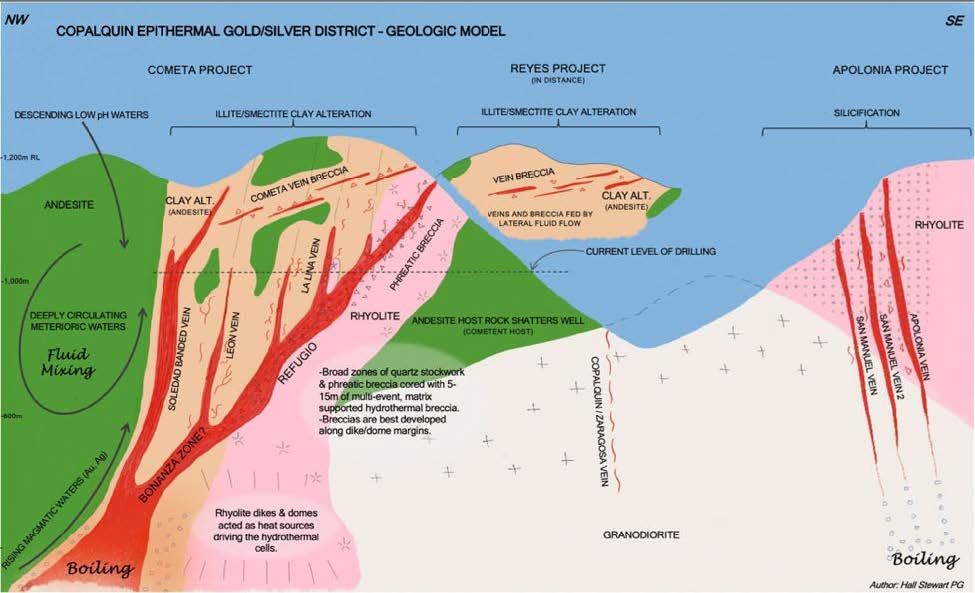

Additionally, the maiden drill holes at the El Refugio target have shown the area to be part of a large epithermal system for gold and silver. The broad quartz breccia zones punctuated with high grade gold-silver veins was drill tested over 300m, building the model of a large gold-silver system characterised by extensive surface alteration and rhyolite dome intrusions. This alteration is observed to extend at least 1.5km west of El Refugio in addition to the widespread alteration and rhyolitic dome intrusives in the Copalquin district. The very high grade La Soledad and Leon veins intercepted at the start of the program are also part of this larger epithermal system. The extension of the Cometa project at depth and along strike is a key feature of the exploration for 2021.

El Refugio Target, Cometa Project

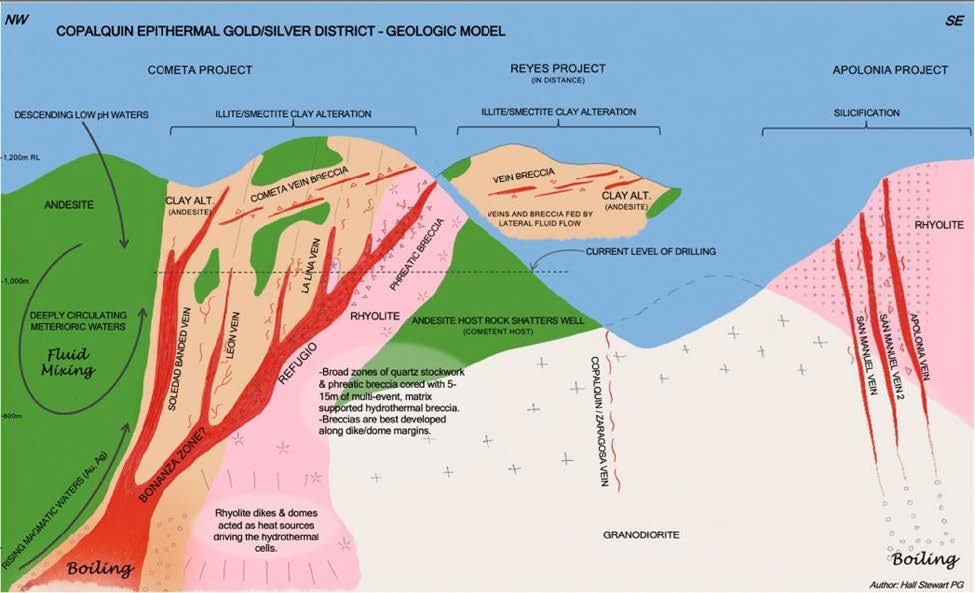

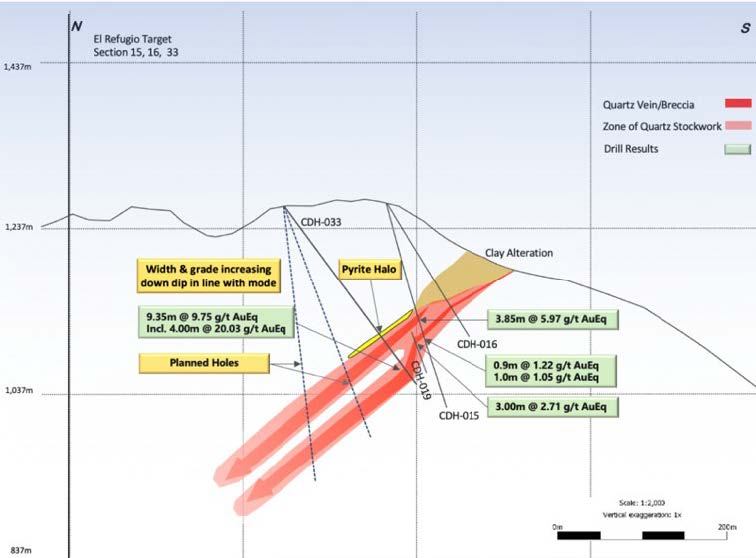

Drilling at the epithermal system discovery at El Refugio, Cometa Project was completed with assays received and reported during the quarter. The drilling discovered what is interpreted to be the top of a large epithermal system for gold and silver in this part of the Copalquin district. The results from the last hole drilled at El Refugio confirmed the promise of higher grades and thicker intercepts deeper on the structure as predicted by the geologic model (Figure 1).

Drill hole CDH-033 intercepted high-grade gold and silver deeper in the structure previously intercepted by drill hole CDH-015, CDH-020 and the other holes at Refugio. There is abundant fine-grained pyrite above the zone and more chalcedony is observed in the intercept as well as milled fragments of chalcedony in the breccia which were likely derived from deeper in the system (multiple mineralisation events).

- Hole CDH-033 intercepted 9.35m @ 9.57 g/t AuEq.1 (7.84 g/t gold and 138.07 g/t silver) from 206.3m, including 4.0m @ 20.03 g/t AuEq.1 (16.44 g/t gold and 286.75 g/t silver)

The mineralogy and textures observed in the core indicate the existence of stacked boiling zones and multiple mineralisation events. El Refugio is very near the upwelling zone of a hydrothermal cell where the breccia zone reaches widths of up to 30 meters true width.

Deeper drilling in January 2021, will further test the geologic model at the El Refugio target. Favourable surface alteration has been observed to the west of El Refugio, extending the exploration area across two ridges. Extensive soil sampling and mapping in this area commenced in January 2021.

Other drill hole highlights for the El Refugio target drilling at the Cometa Project during the quarter included:

- Hole CDH-022 intercepted 5.05m @ 3.48 g/t AuEq1 (1.93 g/t gold and 123.7 g/t silver) from 227.4m, including 2.15m @ 5.03 g/t AuEq 1 (4.81 g/t gold and 128.13 g/t silver).

- Hole CDH-024 intercepted 15.75m @ 2.05 g/t AuEq1 (1.59 g/t gold and 36.57 g/t silver) from 223.6m including 5.96m @ 3.93 g/t AuEq1 (3.27 g/t gold and 53.33 g/t silver) including 1.0m @ 16.63 g/t AuEq1 (14.75 g/t gold and 150.0 g/t silver); plus 4.0m @ 1.74 g/t AuEq1 (1.10 g/t gold and 51.38 g/t silver including 0.8m @ 6.18 g/t AuEq1 (3.87 g/t gold and 185.0 g/t silver).

- Hole CDH-025 intercepted 7.0m @ 1.22 g/t AuEq1 (0.80 g/t gold and 33.56 g/t silver) from 131m, including 2.0m @ 2.68 g/t AuEq1 (1.81 g/t gold and 69.6 g/t silver); plus 1.85m @ 1.08 g/t AuEq1 (0.43 g/t gold and 51.8 g/t silver). The intercepts are within a broad low-grade zone of 27.44m @ 0.66 g/t AuEq1 (0.41 g/t gold and 19.8 g/t silver).

- Hole CDH-015 intercepted a broad mineralised zone and within that the reportable intercept of 3.85m @ 5.97 g/t AuEq1 (4.48 g/t gold and 119.3 g/t silver) from 146m, including 2.15m @ 8.66 g/t AuEq1 (6.32 g/t gold and 186.7 g/t silver).

- Hole CDH-020 intercepted 8.70m @ 4.24 g/t AuEq1 (3.07 g/t gold and 93.6 g/t silver) from 176.85m, including 2.9m @ 9.82 g/t AuEq1 (7.52 g/t gold and 184.3 g/t silver) from 176.85m; plus 1.50m @ 6.55 g/t AuEq1 (5.08 g/t gold and 117.5 g/t silver).

Just east of El Refugio at the El Cometa target, a fence of shallow holes was drilled across the structure and perpendicular to the historic drill holes by UC Resources in 2004. The drilling has shown the structure to be continuous along strike and to host veins with erratic high-grade gold and silver. It is a complex vein system that requires further work to understand.

Holes drilled by UC Resources in 2004 to confirm the drilling completed by Bell Coast Capital Corp. in 1998 included the following intercept in UC-03. It is important to note that all the holes drilled by UC Resources and Bell Coast were drilled parallel to the El Cometa structure, intercepting high-grade veins. Mithril concludes that UC’s work is reliable (43-101 compliant), but that the high-grade values are discontinuous and erratically distributed within the El Cometa structure. This may be due to supergene enrichment of gold in the near surface environment.

UC Resources reported drill hole UC-03, 17.77m @ 45.2 g/t gold and 117.7 g/t silver from 30.42m including 5.52m @ 144.26 g/t gold and 328.63 g/t silver 2.

Shallow drill holes at the El Cometa target towards the El Refugio target

- Hole CDH-004 intercepted 14.85m @ 1.45 g/t AuEq.1 (0.85 g/t gold and 47.9 g/t silver) from 82.10m, including 1.3m @ 8.94 g/t AuEq.1 (5.07 g/t gold and 308.9 g/t silver).

- Hole CDH-032 intercepted 9.78m @ 1.02 g/t AuEq.1 (0.85 g/t gold and 13.3 g/t silver) from 78.75m.

Shallow drilling perpendicular to the historic drilling at the El Cometa target has intercepted the structure near surface with continuity along strike for almost 300m;

- Hole CDH-027 intercepted 11.7m @ 2.04 g/t AuEq.1 (1.16 g/t gold and 70 g/t silver) from 10.9m, including 1.0m @ 10.12 g/t AuEq.1 (7.17 g/t gold and 236 g/t silver) and 1.0m @ 3.51 g/t AuEq.1 (1.27 g/t gold and 179.0 g/t silver).

- Hole CDH-029 intercepted 2.9m @ 4.63 g/t AuEq.1 (1.93 g/t gold and 215.72 g/t silver) from 29.6m

- Hole CDH-031 intercepted 5.28m @ 0.71 g/t AuEq.1 (0.39 g/t gold and 25.56 g/t silver) from 35.72m

- Hole CDH-035 intercepted 10.15m @ 0.74 g/t AuEq.1 (0.55 g/t gold and 15.47 g/t silver) from 42.0m, including 1.0m @ 4.62 g/t AuEq.1 (3.75 g/t gold and 69.6 g/t silver)

The drill data from the historic holes at the El Cometa target together with Mithril’s cross structure holes confirm the existence of a shallow-dipping breccia-vein system that hosts discontinuous high-grade veins. Mapping shows this vein system to continue east, 800m to the Los Pinos target and a further 500m to the Los Reyes target.

At the Los Reyes target, the first drill holes were completed 1,300m east of El Cometa and within the same vein structure. The scout drill holes intercepted the extensive low angle structure with high-grade gold and silver. Hole CDH- 040 intercepted 2.22m @ 34.6 g/t AuEq.1 (32.35 g/t gold and 184.8 g/t silver) from 91.55m (CDH-040), including 1.22m @ 61.1 g/t AuEq.1 (58.6 g/t gold and 203 g/t silver) plus 0.70m @ 10.9 g/t AuEq.1 (9.3 g/t gold and 125 g/t silver) from 75.9m plus 1.20m @ 3.11 g/t AuEq.1 (2.05 g/t gold and 85 g/t silver) from 84.82m.

Hole CDH-041 is located 40 metres south-east of hole CDH-040 and intercepted 3.0m @ 3.9 g/t AuEq.1 (2.86 g/t gold and 83.8 g/t silver) from 103m, including 0.6m @ 11.9 g/t AuEq.1 (9.79 g/t gold and 165.0 g/t silver).

2 The

UC Resources news releases

were reported to the Canadian

market under the NI43-101 guidelines and signed off by a qualified person.

The drill results cannot

be verified by Mithril and

they cannot be used for JORC

compliant resource and reserve

estimations. The releases are

available on the Mithril Resources website under Historic Drilling Reports.

The structural zone with mineralized veins occurs up to 20 metres wide at Los Reyes. Mineralized veins within the broad zone are separated by zones below reportable cut-off grade.

Importantly, the intercept in hole CDH-040 confirmed the existence of very high-grade domains within the El Cometa – Los Reyes low angle structure, often within broader lower grade zones.

Closer spaced drilling in the El Cometa-Los Reyes structure will increase probability of intercepting the high-grade gold and silver domains.

Two scout drill holes were completed at the Los Pinos target, Reyes project. Hole CDH-043 was a 15m vertical hole drilled from the same drill pad to confirm geometry of the structure. CDH-043 was not assayed. The drill pad for hole CDH-042 and CDH-043 was built 17 meters from the planned coordinates and appears to have been drilled entirely in the footwall of the target structure. Los Pinos is a strong target area as highlighted by the 2018 soil sampling program. Drilling at this target is planned for 2021 following the completed and interpretation of the soil sampling program to the west of Los Pinos, at El Indio.

Three holes were completed at the La Constancia target within the Constancia Project. The three holes intercepted discrete veins within granodiorite host rock. Future drilling at La Constancia will target the vein structure further north. Within the Constancia Project, there is over 1.5km of vein mapped at surface. This is an early stage and prospective exploration project for gold and silver.

At the Apolonia Project, one kilometre south of the Reyes Project, two holes were completed targeting the near vertical veins beneath the historic San Manuel mine workings. The veins are known to change dip to the east and to the west. It appears that these first two holes have not intercepted the San Manuel veins due to the veins dipping away from the drills holes at this elevation. The next holes at San Manuel are designed to intercept the veins from the other side of the target at the same elevation.

The veins, stopes and extensive historic sampling in the San Manuel workings indicate significant past production from San Manuel mine. There is historic infrastructure in the area consisting of an aerial tramway and the ruins of a flotation mill below the San Manuel mine, part of the Apolonia Project. The historic workings cover approximately 75 metres vertically and 200 metres of strike.

Australian Projects

To ensure the Company maintains its focus on the Copalquin Gold Silver Project, Mithril has exploration partners to farm-in, sole fund and operate exploration activities on its Australian assets. These include:

- Great Boulder Resources (GBR.ASX) at the Lignum Dam Project;

- Auteco Minerals (AUT.ASX) at the Limestone Well Project;

- Carnavale Resources (CAV.ASX) at the Kurnalpi Project; and

- CBH Resources Limited (“CBH”) at the Billy Hills Zinc Project.

Having farm-in exploration partners solely fund all exploration costs, ensures that the Mithril tenements are kept in good standing for the duration of the respective partnership agreements with the potential to benefit from prospectivity and exploration upside.

Billy Hills Zinc (Billy Hills)

- Mithril 100%; and

- CBH Resources Limited earning up to 80% interest by completing expenditure of A$4M over 5 years.

The binding farm-in Heads of Agreement (Agreement) is conditional upon Mithril obtaining a Heritage Clearance to drill the Firetail Prospect. Mithril worked with the traditional owners of Billy Hills to obtain the necessary clearance however due to the outbreak of COVID-19, all dealings with Aboriginal communities in the area ceased for an indefinite period in order to protect the health of the local population. Mithril and CBH remain committed to the Project and agreed to extend the period, to satisfy the Agreement’s Condition Precedent, first from May 2020 to November 2020 and during the quarter a second extension to March 2021, in recognition of the current circumstances.

Kurnalpi Project (Kurnalpi)

- Mithril 100%; and

- Carnavale Resources earning an initial 80% interest by keeping the tenements in good standing over three years and paying Mithril A$250,000 cash.

In September 2020, Carnavale undertook a small drilling program at its Grey Dam Nickel Project (including on Mithril tenements) following a Fixed Loop Electromagnetic (FLEM) geophysical surveying over ultramafic/mafic sequences prospective for Kambalda style nickel sulphide, similar to the nearby Black Swan and Silver Swan Nickel Mines. The drilling confirmed and enhanced the understanding of the geology of the drilled area. The geochemistry and multi- element assay results remain positive for the development of nickel sulphide mineralisation within the project area (see Carnavale’s ASX Announcement 6th November 2020).

Carnavale’s Grey Dam Nickel Project includes Mithril’s Kurnalpi Project Tenements in which it is earning an initial 80% interest. Carnavale’s September 2020 drill program included drilling on the Mithril tenements (see Carnavale’s ASX Announcement 11th September 2020).

Lignum Dam Project (Lignum)

- Mithril 100%; and

- Great Boulder Resources earning up to 80% by completing expenditure of A$1M over four years.

Great Boulder Resources did not announce any work progress within the Mithril tenements during the quarter.

Limestone Well Project (Limestone)

- Mithril 100%;

- Auteco Minerals can earn up to an 80% interest in the project by completing exploration expenditure of A$2.5 million over five years; and

- Following drilling (see Auteco’s ASX Announcement 14th October 2019), Auteco elected to continue sole-funding the exploration work at Limestone Well by completing exploration expenditure of $1.5M by August 2021 to earn an initial 60% interest.

Auteco Minerals did not announce any work progress within the Mithril tenements during the quarter.

Outlook for the Next Quarter

The Company’s primary objective for the March 2021 Quarter is the recommencement of exploration in the Copalquin district, Mexico and continuation of drilling at the Cometa Project.

Cash

The Company has cash reserves of as at 31 December 2020 of $1m plus its post quarter share placement, raising $5m (before costs).

Corporate

All resolutions considered at the Annual General Meeting on 24 November 2020 were put to a vote on a Poll, called by the Chairman, and were passed.

Related Party Payments

In line with its obligations under ASX Listing Rule 5.3.5, Mithril Resources Limited notes that the only payments to related parties of the Company, as advised in the Appendix 5B for the period ended 30 June 2020, pertain to payments to directors for fees, salary and superannuation.

-ENDS-

Released with the authority of the Board.

For further information contact:

John Skeet

Managing Director and CEO

[email protected]

+61 435 766 809

Mark Flynn

Investor Relations

[email protected]

+61 416 068 733

Competent Persons Statement

The information in this report that relates to sampling techniques and data, exploration results and geological interpretation has been compiled by Mr Hall Stewart who is Mithril’s Chief Geologist. Mr Stewart is a certified professional geologist of the American Institute of Professional Geologists. This is a Recognised Professional Organisation (RPO) under the Joint Ore Reserves Committee (JORC) Code.

Mr Stewart has sufficient experience of relevance to the styles of mineralisation and the types of deposits under consideration, and to the activities undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the Joint Ore Reserves Committee (JORC) Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Mr Stewart consents to the inclusion in this report of the matters based on information in the form and context in which it appears. The Australian Securities Exchange has not reviewed and does not accept responsibility for the accuracy or adequacy of this release.

About the Copalquin District, Mexico

The Copalquin mining district is located in Durango State, Mexico and covers an entire mining district of 70km2 containing several dozen historic gold and silver mines and workings, ten of which had notable production. The district is within the Sierra Madre Gold Silver Trend which extends north-south along the western side of Mexico and hosts many world class gold and silver deposits.

Multiple mineralisation events, young intrusives thought to be system-driving heat sources, widespread alteration together with extensive surface vein exposures and dozens of historic mine workings, identify the Copalquin mining district as a major epithermal centre for Gold and Silver.

Original Article: https://investi.com.au/api/announcements/mth/5ad1aace-5b7.pdf