Highlights – Copalquin Gold-Silver, Mexico

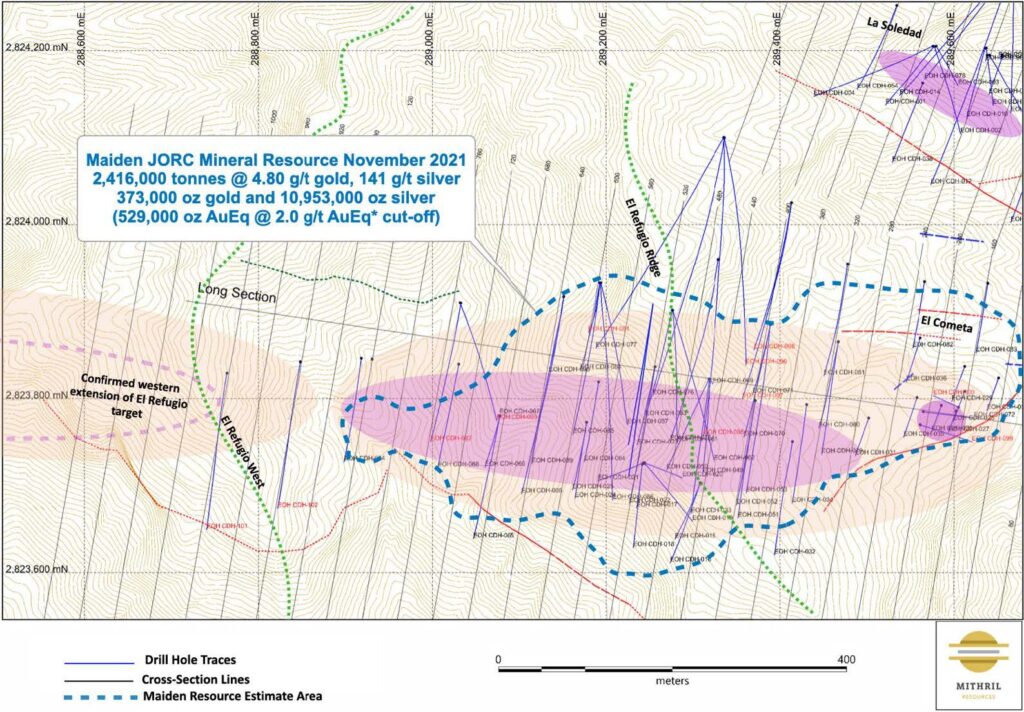

- A high-grade maiden JORC indicated and inferred mineral resource estimate (MRE) was delivered on schedule for the first drill target area of El Refugio–La Soledad in the Copalquin District, Mexico

- The maiden MRE, delivered within our first 14 months of drilling, highlights the high- quality gold and silver resource potential for the Copalquin District

- 2,416,000 tonnes @ 4.80 g/t gold, 141 g/t silver for 373,000 oz gold plus 10,953,000 oz silver (Total 529,000 oz AuEq*) using a cut-off grade of 2.0 g/t AuEq*

- 28.6% of the resource tonnage is classified as indicated

Mineral resource estimate El Refugio – La Soledad using a cut-off grade of 2.0 g/t AuEq*

Highlight drill Results received during the quarter

- 18.67m @ 9.64 g/t gold, 278.8 g/t silver from 144.0m, (CDH-094) including

- 9.30m @ 17.9 g/t gold, 482.2 g/t silver from 148.89m

- 2.00m @ 9.90 g/t gold, 122 g/t silver from 286.0m (CDH-085), including

- 1.00m @ 19.0 g/t gold, 209 g/t silver from 286.0m

- 12.29m @ 4.08 g/t gold, 85.2 g/t silver from 250.71m (CDH-086), including

- 1.50m @ 8.98 g/t gold, 137 g/t silver from 250.71m, and including

- 2.00m @ 15.35 g/t gold, 333 g/t silver from 258.0m

- 8.90m @ 0.97 g/t gold, 5.53 g/t silver from 252.1m (CDH-087), plus

- 3.00m @ 3.71 g/t gold, 79.0 g/t silver from 349.0m

- Metallurgical and mining study work commenced for El Refugio resource

- Targets expanded for the district scale Copalquin mining district 2022 exploration program

Highlights – Corporate

- Mithril advanced its 100% acquisition of the Copalquin Mining District mining concessions via its purchase option agreement to 25% by completing USD4m direct expenditure.

- Binding term sheet for sale of 90% interest in Limestone Well tenements. (ASX Announcement 12 October 2021) (Sale Agreement completed in January 2022 with cash proceeds of A$500,000)

- Appointment of Ms Claire Newstead-Sinclair as Company Secretary effective 1 December 2021

- In conjunction with this appointment, the Company relocated its Registered Office and Principal Place of Business to Vistra Melbourne, Level 4, 100 Albert Road South Melbourne, VIC 3205

- Cash at bank A$1.828m as of 31 December 2021 (excluding A$500,000 from Limestone Well sale)

- Mexican value added tax refunds continued throughout the quarter (plus a further ~A$180,000 received during January 2022)

Mithril Resources Ltd (ASX: MTH) (Mithril or the Company) is pleased to provide a quarterly update on activities at its Copalquin Gold Silver Project in Mexico for the period ending 31 December 2021.

El Refugio, Copalquin District, Mexico

In November 2021, the Company delivered its maiden JORC mineral resource estimate (MRE) as scheduled and meeting the expectation at this early stage in the exploration of the Copalquin Mining District. (ASX Announcement 17 November 2021). The full report can be found here – Copalquin District – Maiden Mineral Resource Estimate.

The maiden MRE is high-grade gold and silver and with 28% of the MRE tonnage in the indicated category. This is an excellent result from our first 14 months of drilling and demonstrates the district potential to deliver high-quality gold and silver resources as the exploration work progresses.

The maiden MRE has Mithril on track to become a highly profitable producer of gold and silver from high-grade resources and to prove up this multi-million ounce potential precious metals mining district.

| Tonnes (kt) | Tonnes (kt) | Gold (g/t) | Silver (g/t) | Gold Equiv.* (g/t) | Gold (koz) | Silver (koz) | Gold Equiv.* (koz) | |

| El Refugio | Indicated | 691 | 5.43 | 114.2 | 7.06 | 121 | 2,538 | 157 |

| Inferred | 1,447 | 4.63 | 137.1 | 6.59 | 215 | 6,377 | 307 | |

| La Soledad | Indicated | – | – | – | – | – | – | – |

| Inferred | 278 | 4.12 | 228.2 | 7.38 | 37 | 2,037 | 66 | |

| Total | Indicated | 691 | 5.43 | 114.2 | 7.06 | 121 | 2,538 | 157 |

| Inferred | 1,725 | 4.55 | 151.7 | 6.72 | 252 | 8,414 | 372 | |

| TOTAL | 2,416 | 4.80 | 141 | 6.81 | 373 | 10,953 | 529 |

Metallurgical test work and mining engineering work commenced during the quarter for the El Refugio MRE with drilling continuing to deliver expansionary intercepts beyond the MRE area.

*AuEq. = gold equivalent calculated using and gold:silver price ratio of 70:1. That is, 70 g/t silver = 1 g/t gold. The metal prices used to determine the 70:1 ratio are the cumulative average prices for 2021: gold USD1,798.34 and silver: USD25.32 (actual is 71:1) from kitco.com

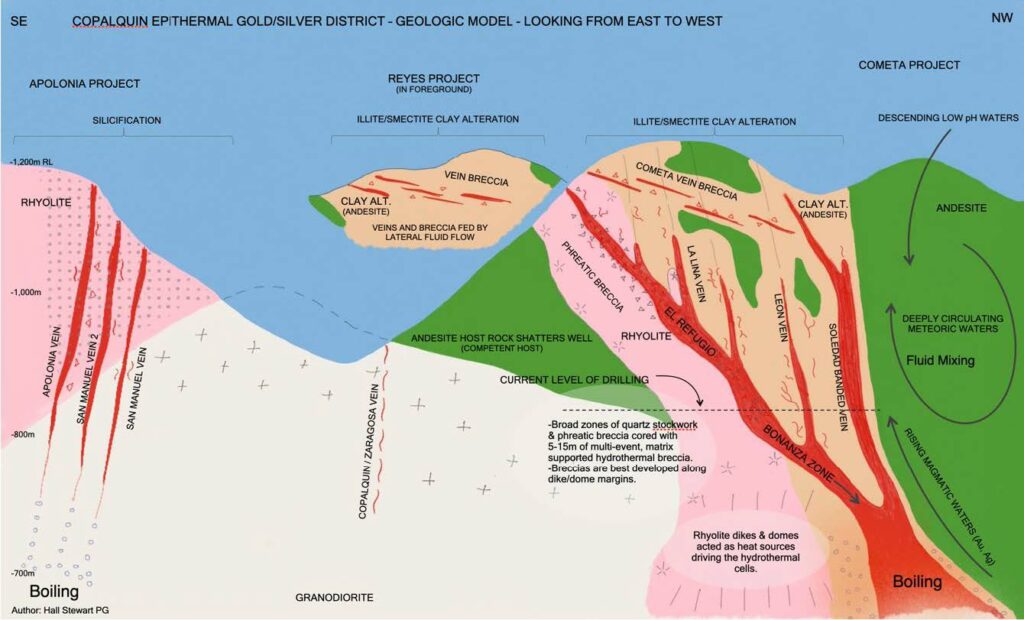

In early November, (ASX Announcement 5 November 2021) assays for drill holes CDH-085 to CDH-090 plus CDH-094 were received. Holes CDH-085 to CDH-090 were drilled to complete the database for the maiden MRE. Drilling has continued at El Refugio, with a series of deeper holes and holes further to the west. On the western side of the centre ridge, the structure is stronger at depth and has continued across the valley to the next ridge with the excellent high- grade intercept from drill hole CDH-094 (18.67m @ 9.64 g/t gold, 278.8 g/t silver from 144.0m including 9.30m @ 17.9 g/t gold, 482.2 g/t silver from 148.89m, plus 3.00m @ 1.88 g/t gold, 61.7 g/t silver from 137m).

Drilling stopped mid-December 2021for the Christmas break and recommenced early January 2022.

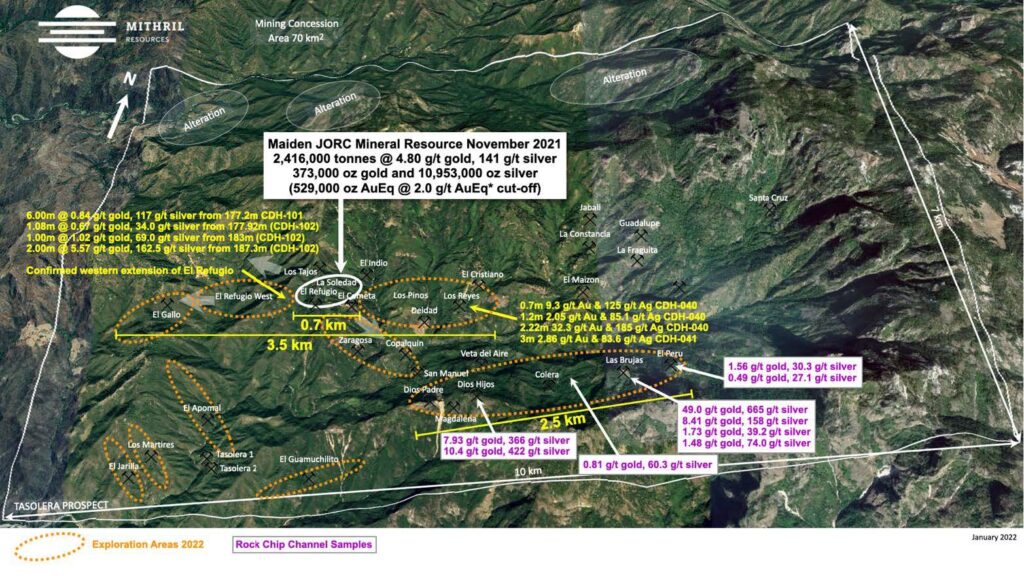

Copalquin District Exploration

With November to June being the best time to conduct field programs at Copalquin (due to the dry weather and low vegetation cover) soil sampling, mapping and rock chip sample programs commenced on several of the target areas in the district where there are known historic mines and workings (shown by the orange ellipses in Figure 2 above). The program of work will continue next quarter as we continue to evaluate and rank the multiple drill targets in the district.

Australian Projects

To ensure the Company maintains its focus on the Copalquin Gold Silver Project, Mithril has exploration partners to farm-in, sole fund and operate exploration activities on its Australian assets. These include:

- Great Boulder Resources (GBR.ASX) at the Lignum Dam Project;

- Auteco Minerals (AUT.ASX) at the Limestone Well Project;

- Carnavale Resources (CAV.ASX) at the Kurnalpi Project; and

- CBH Resources Limited (“CBH”) at the Billy Hills Zinc Project.

Having farm-in exploration partners solely fund all exploration costs, ensures that the Mithril tenements are kept in good standing for the duration of the respective partnership agreements with the potential to benefit from prospectivity and exploration upside.

Billy Hills Zinc (Billy Hills)

- Mithril 100%; and

- CBH Resources Limited earning up to 80% interest by completing expenditure of A$4M over 5 years.

- Native title clearance for the first phase of drilling has been granted, scheduled to commence Q2 2022.

Kurnalpi Project (Kurnalpi)

- Mithril 100%; and

- Carnavale Resources earning an initial 80% interest by keeping the tenements in good standing over three years and paying Mithril A$250,000 cash.

- No work was undertaken during the quarter.

Lignum Dam Project (Lignum)

- Mithril 100%; and

- Great Boulder Resources earning up to 80% by completing expenditure of A$1M over four years.

- Great Boulder carried out a program of auger geochemical sampling over nickel and gold prospective rock types.

Limestone Well Project (Limestone)

- Mithril 100% reducing to 10% (see below)

- In October 2021, Mithril announced the execution of a binding term sheet for the sale of 90% interest in the Limestone Well tenements to its farm-in partner, Auteco Minerals for a payment of A$500,000 in cash. For details of the term sheet please refer to the ASX Announcement 12 October 2021

CORPORATE

In late November, the Company announced the appointment of Ms Claire Newstead-Sinclair as Company Secretary, replacing Mr Adrien Wing effective 1 December 2021 (ASX Announcement 23 November 2021).

The Board of Directors thanked Mr Adrien Wing for his significant contributions during his time with the Company. Mr Wing provided tremendous support to the Company during his earlier tenure as Director, as well as to the Board as Company Secretary.

Ms Newstead-Sinclair is a Chartered Accountant and Member of the Governance Institute of Australia at the Corporate Business Service Provider, Vistra Australia. Ms Newstead-Sinclair has been CFO and Company Secretary for several ASX listed and unlisted public and private companies in a range of industries including biotechnology, healthcare and mineral exploration.

In conjunction with this appointment the Company has relocated its Registered Office and Principal Place of Business to: Vistra Melbourne Level 4, 100 Albert Road South Melbourne, VIC 3205 Australia.

In November, Managing Director and CEO John Skeet delivered an investor presentation virtually at the Noosa Mining Conference. (ASX Announcement 11 November 2021)

Other

In mid-October, the Company advised that it had increased its interest in the Copalquin mining concessions to 25%, as it progresses its 100% purchase option for the concessions. (ASX Announcement 15 October 2021).

The milestone was reached during the 3rd quarter with cumulative direct expenditure of US$4 million on the concessions. Ten million fully paid Mithril shares was issued to the vendor, Compañia Minera Copalquin S.A. de C.V. as per the purchase option agreement. The next milestone in progress is 50% interest in the concessions via a further

US$4 million of direct expenditure. The terms of the purchase option are detailed in the ASX release 25 November 2019.

Mithril is committed to advancing its option to acquire 100% interest in the Copalquin concessions and remains fully funded to continue its expansive drill program and progress study and test work.

Also in October, a binding term sheet was executed for the sale of 90% interest in it Limestone Well tenements for cash proceeds of A$500,000 (ASX Announcement 12 October 2021)

CASH

Cash reserves as of 31st January 2021 was A$1.828m (excluding A$500,000 from Limestone Well sale due Q1 2022)

Mexican value added tax refunds continued throughout the quarter (plus a further ~A$190,000 has been received during January 2022)

RELATED PARTY PAYMENTS

In line with its obligations under ASX Listing Rule 5.3.5, Mithril Resources Limited notes that the only payments to related parties of the Company, as advised in the Appendix 5B for the period ended 31 December 2021, pertain to payments to directors for fees, salary and superannuation.

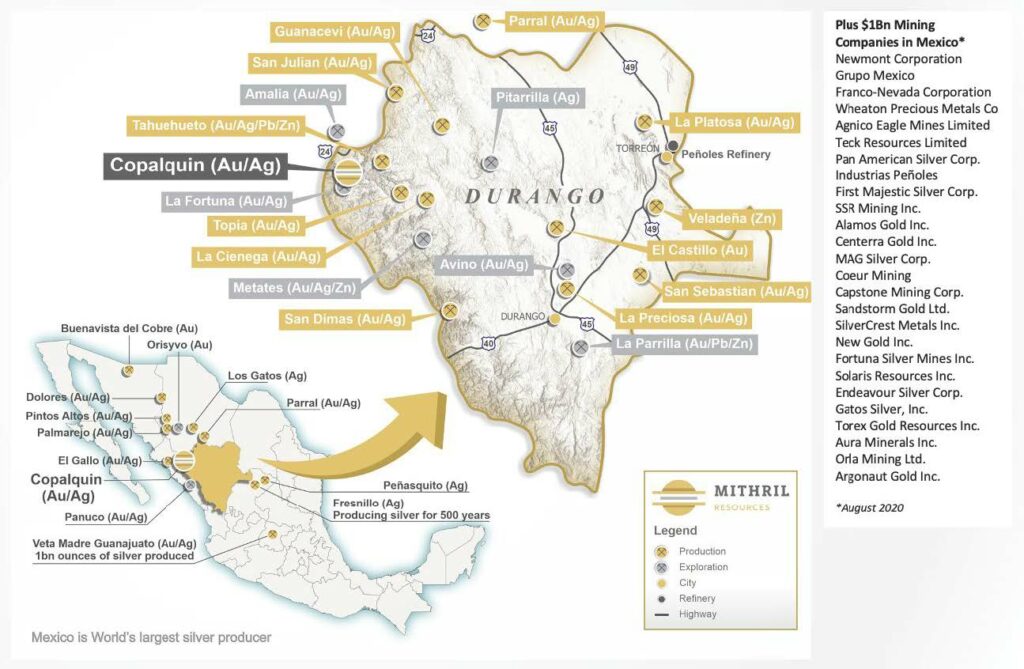

ABOUT THE COPALQUIN GOLD SILVER PROJECT

The Copalquin mining district is located in Durango State, Mexico and covers an entire mining district of 70km2 containing several dozen historic gold and silver mines and workings, ten of which had notable production. The district is within the Sierra Madre Gold Silver Trend which extends north-south along the western side of Mexico and hosts many world-class gold and silver deposits.

Multiple mineralisation events, young intrusives thought to be system-driving heat sources, widespread alteration together with extensive surface vein exposures and dozens of historic mine workings, identify the Copalquin mining district as a major epithermal centre for Gold and Silver.

Mithril Resources is earning 100% interest in the Copalquin District mining concessions via a purchase option agreement detailed in ASX announcement dated 25 November 2019.

-ENDS-

Released with the authority of the Board. For further information contact:

| John Skeet, Managing Director and CEO [email protected] +61 435 766 809 | Mark Flynn, Investor Relations [email protected] +61 416 068 733 |

Competent Persons Statement

The information in this report that relates to sampling techniques and data, exploration results and geological interpretation has been compiled by Mr Hall Stewart who is Mithril’s Chief Geologist. Mr Stewart is a certified professional geologist of the American Institute of Professional Geologists. This is a Recognised Professional Organisation (RPO) under the Joint Ore Reserves Committee (JORC) Code.

Mr Stewart has sufficient experience of relevance to the styles of mineralisation and the types of deposits under consideration, and to the activities undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the Joint Ore Reserves Committee (JORC) Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Mr Stewart consents to the inclusion in this report of the matters based on information in the form and context in which it appears. The Australian Securities Exchange has not reviewed and does not accept responsibility for the accuracy or adequacy of this release.

Original Article: https://investi.com.au/api/announcements/mth/febd90c3-63a.pdf