By Muflih Hidayat on December 12, 2025

Mexico granting mining permits has emerged as a critical driver of investment acceleration in Latin America’s second-largest mining jurisdiction. The administrative streamlining under the current federal government represents a fundamental shift from traditional bureaucratic processes that historically delayed capital deployment. Furthermore, understanding mining permit fundamentals becomes essential for investors navigating this evolving regulatory landscape where efficiency improvements are reshaping operational timelines.

Regulatory Reform Architecture Driving Mexico’s Mining Permit Acceleration

Administrative streamlining under the current federal government has fundamentally restructured how Mexico granting mining permits operates across multiple institutional levels. The systematic approach to addressing accumulated regulatory backlogs demonstrates a coordinated effort between federal agencies that previously operated in relative isolation. This institutional alignment represents a departure from traditional bureaucratic silos that historically contributed to extended processing delays.

Enhanced Federal Coordination Mechanisms

The implementation of coordinated action between the Ministry of Economy, the Ministry of Environment and Natural Resources (SEMARNAT), and state-level authorities has created unprecedented institutional efficiency. Fernando Aboitiz, Head of the Extractive Activities Coordination Unit at the Ministry of Economy, confirmed that the administration inherited 176 stalled projects at the start of its term in October 2024.

Through accelerated review processes, officials resolved 110 of these cases, leaving 66 projects pending with a target completion of mid-2026 for full regulatory normalisation. This resolution rate of approximately 62.5% within 14 months indicates systematic procedural improvements, though specific innovations in review methodologies remain undisclosed in public communications.

The achievement suggests that institutional barriers rather than technical complexity were primary factors in previous delays. However, investors should consider investment risk assessment methodologies when evaluating opportunities in this rapidly evolving regulatory environment.

Timeline Compression Strategies and Performance Benchmarks

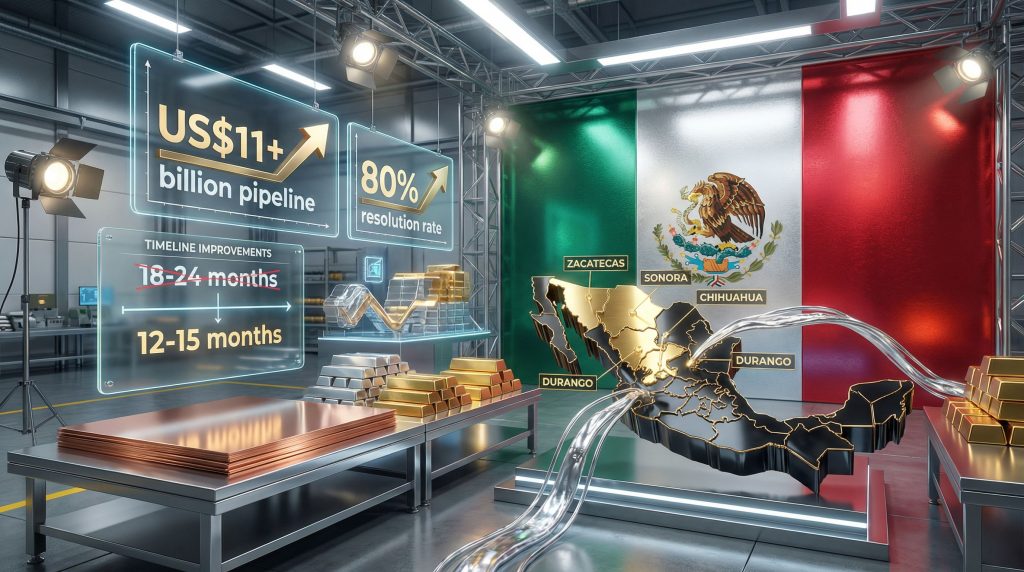

Environmental impact assessment processing has experienced significant acceleration, with traditional timelines of 18-24 months compressed to 12-15 months, representing efficiency gains of 25-33%. Land-use authorisation procedures have similarly improved from 12-18 months to 8-12 months, achieving 17-33% faster processing speeds.

These improvements reflect broader administrative modernisation efforts that extend beyond mining-specific regulations. The integration of digital tracking systems and inter-agency communication protocols has eliminated redundant review stages while maintaining compliance standards. Consequently, these developments align with broader executive permit reforms observed across North American jurisdictions.

Environmental Compliance Integration Within Accelerated Frameworks

Regulatory acceleration in Mexico granting mining permits has necessitated enhanced environmental safeguard mechanisms to ensure development proceeds without compromising ecological protection. The balance between speed and thoroughness requires sophisticated assessment protocols that can deliver comprehensive evaluations within compressed timeframes.

Advanced Environmental Assessment Protocols

Mandatory environmental impact studies (MIA) through SEMARNAT continue to serve as the cornerstone of environmental compliance, though processing methodologies have been refined to eliminate administrative delays without reducing assessment quality. The integration of sustainability metrics in permit evaluation criteria reflects growing recognition that environmental compliance enhances rather than hinders long-term project viability.

Community consultation requirements for projects affecting indigenous territories remain stringent, with benefit-sharing protocols serving as essential components of permit approval processes. These requirements align with Mexico’s commitments under ILO Convention 169 and federal legislation protecting indigenous peoples’ rights.

Strategic Resource Governance Framework

The Mexican Geological Survey maintains control mechanisms for lithium and uranium exploration, with public-private partnership frameworks governing critical mineral development. Competitive bidding processes for strategic resource concessions ensure transparent allocation whilst maintaining state oversight of nationally important resources.

“Securing supply chains represents a national priority, with the administration committed to restarting large-scale exploration whilst streamlining pending procedures to facilitate investment amid challenging geopolitical conditions,” emphasised Minister of Economy Marcelo Ebrard. This strategic approach reflects the global significance of exploration licenses impact on international resource markets.

Regional Investment Activation Analysis

Mexico granting mining permits has generated disparate impacts across key mining regions, with certain states experiencing disproportionate investment activation due to local administrative efficiency and project pipeline characteristics. The geographic distribution of permit clearances reveals strategic patterns that reflect both resource geology and institutional capacity.

Zacatecas Investment Portfolio Leadership

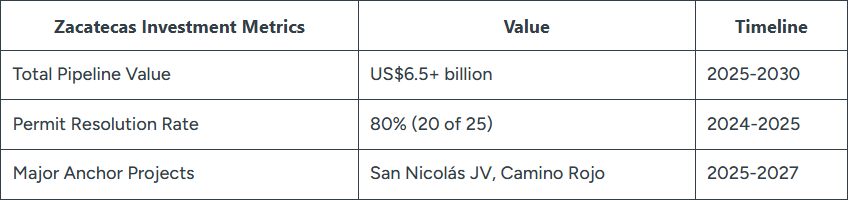

Zacatecas has emerged as the primary beneficiary of regulatory acceleration, with state officials identifying an investment portfolio exceeding US$6.5 billion through 2030. The state’s administrative performance demonstrates exceptional efficiency, with the local backlog reduced from 25 pending permits to just 5 within a single year, representing an 80% resolution rate.

Jorge Miranda, State Minister of Economy for Zacatecas, noted that this administrative momentum reflects coordinated state-federal cooperation that has eliminated traditional bureaucratic bottlenecks. The San Nicolás project, a joint venture between Agnico Eagle and Teck Resources valued at US$1.1 billion, represents the region’s largest single investment commitment and serves as an anchor for broader portfolio development.

The project’s advancement through feasibility engineering indicates successful navigation of preliminary assessment stages and progression toward pre-construction engineering documentation. This milestone represents substantial risk reduction and validates the effectiveness of streamlined permitting processes.

Furthermore, Orla Mining’s Camino Rojo extension secured environmental clearance to extend mine life by over 20 years. This approval required updated environmental impact assessments and represents significant operational continuity assurance.

Sonora Operational Reactivation Dynamics

Sonora’s mining sector has experienced immediate operational impacts from regulatory clearing, with 83 active projects currently under state monitoring. Silver Tiger’s El Tigre project exemplifies direct benefits, with construction scheduled for 2026 backed by US$180 million in investment commitments following permit resolution.

The state’s portfolio includes significant developments such as Southern Copper’s El Pilar project, which represents a component of the company’s US$10.2 billion national project pipeline according to their Q2 2025 reporting. This scale of investment commitment indicates institutional confidence in regulatory stability and processing predictability.

In addition, Heliostar Metals announced plans to restart mining at the Veta Madre Pit at La Colorada, targeting 43,000oz of gold reserves following permit acquisition. This operational restart demonstrates how regulatory acceleration enables dormant asset reactivation, multiplying investment impacts beyond new project development.

Chihuahua and Durango Development Corridors

Chihuahua’s government has mapped eight advanced projects with combined value of US$3.6 billion through 2030, anchored by large-scale assets including Discovery Silver’s Cordero and Fresnillo’s Orisyvo developments. This geographic concentration reflects both geological advantages and administrative efficiency in permit processing.

Meanwhile, Durango has experienced the release of over a dozen environmental permits, expected to accelerate development for companies including Avino Silver and Chesapeake Gold over the next two years. José Ricardo López, Durango’s Deputy Minister of Business Development, emphasised that maintaining regulatory momentum remains essential.

He argued that continued legal certainty regarding permits will determine whether projections convert into realised investment levels. This emphasis reflects the critical importance of regulatory continuity in sustaining investment confidence.

Economic Impact Projections and Capital Deployment Analysis

The US$11+ billion investment pipeline activated by Mexico granting mining permits represents approximately 15-20% of the country’s total annual mining sector investment capacity. This indicates significant sectoral growth potential that aligns with broader mining innovation trends reshaping global resource development.

Direct Investment Multiplier Effects

Capital deployment projections indicate that immediate investment commitment will generate substantial indirect economic activity through supply chain integration and service provider engagement. The geographic concentration of projects in Zacatecas, Sonora, Chihuahua, and Durango creates regional economic hubs with enhanced infrastructure utilisation and workforce development opportunities.

Employment generation estimates suggest significant job creation across technical, operational, and support functions, with indirect employment multipliers potentially doubling direct workforce impacts. The infrastructure development requirements to support expanded operations will necessitate additional capital investment in transportation, utilities, and processing facilities.

Investment Risk Assessment Framework

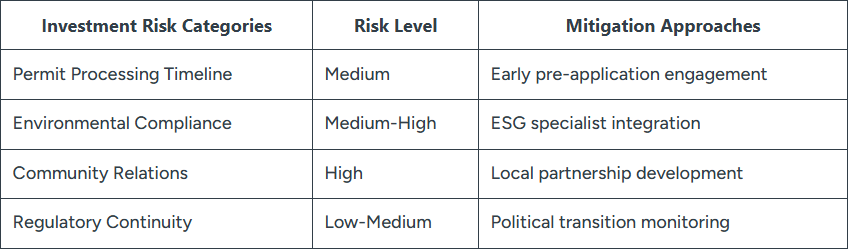

The regulatory acceleration creates both opportunities and considerations for investment evaluation methodologies. While processing speed improvements reduce regulatory risk, investors must assess the sustainability of administrative efficiency gains through potential political transitions and evolving environmental standards.

Concession Term Restructuring and Strategic Implications

Recent modifications to concession duration structures have introduced new dynamics in Mexico granting mining permits that require careful evaluation by long-term investors. The transition from 50-year to 30-year initial terms with 25-year renewal options represents a fundamental shift in investment planning horizons and risk assessment methodologies.

Competitive Bidding Integration Impact

The integration of public bidding processes for renewal procedures introduces competitive elements that may affect long-term project economics. Companies must now demonstrate continued operational excellence and community engagement to secure renewal opportunities, creating incentives for sustained performance throughout initial concession periods.

This competitive framework ensures that renewal decisions incorporate both technical capabilities and social responsibility metrics, potentially favouring operators with strong environmental, social, and governance (ESG) performance records. The weighting of competitive and social criteria in concession awards reflects broader governmental priorities for sustainable resource development.

Legal Certainty Improvements vs. Shortened Terms

Although initial concession periods have been reduced, the overall legal framework provides enhanced certainty through standardised renewal processes and performance benchmarks. This trade-off between term length and process predictability requires sophisticated financial modelling to assess net present value implications for major projects.

The integration of environmental compliance costs into project economics has become more predictable due to standardised assessment criteria and transparent evaluation methodologies. Community engagement requirements, whilst increasing operational complexity, provide clearer pathways for social licence maintenance.

Global Supply Chain Security Positioning

Mexico’s mining acceleration initiative positions the country strategically within evolving global supply chain security frameworks, particularly regarding North American manufacturing integration and critical mineral availability. The geopolitical context of resource access has elevated mining sector development beyond purely economic considerations.

USMCA Supply Chain Integration Opportunities

The United States-Mexico-Canada Agreement (USMCA) creates preferential frameworks for regional supply chain integration that enhance the strategic value of Mexico granting mining permits. Critical mineral security has become a national priority for North American partners, creating long-term demand stability for Mexican mining operations.

Mexico’s positioning amid US-China trade tensions provides competitive advantages for minerals destined for North American manufacturing sectors, including automotive, electronics, and renewable energy infrastructure. This geopolitical premium enhances project economics beyond traditional commodity price considerations.

According to Mexico Business News, the government’s commitment to resolving the permit backlog has unlocked significant investment potential previously constrained by regulatory delays.

Competitive Jurisdictional Analysis

Regulatory efficiency improvements have enhanced Mexico’s competitiveness relative to other major mining jurisdictions including Canada, Australia, and Peru. Foreign direct investment attraction strategies now emphasise both resource quality and administrative predictability as dual competitive advantages.

Infrastructure connectivity to key markets provides additional competitive benefits, with Mexico’s proximity to major North American consumption centres reducing transportation costs and delivery times. These logistical advantages compound regulatory improvements to create comprehensive investment attractiveness.

Implementation Challenges and Sustainability Considerations

Despite significant progress in Mexico granting mining permits acceleration, several structural challenges could potentially impede sustained improvement in processing efficiency. Understanding these limitations enables more accurate assessment of long-term regulatory trajectory and investment planning assumptions.

Administrative Capacity Constraints

Sustained permit processing speed improvements require adequate administrative staffing and technological infrastructure to manage increased application volumes. The transition from backlog clearance to ongoing operational efficiency presents different resource allocation challenges that may test institutional capacity.

Technology integration needs for digital permit tracking and management systems represent ongoing investment requirements that must be maintained through political transitions and budget cycles. Inter-agency coordination mechanisms require continued institutional support to prevent reversion to previous siloed operations.

Environmental and Social Licence Sustainability

Community opposition management requires ongoing attention to consultation process effectiveness and benefit-sharing agreement implementation. The quality of stakeholder engagement often determines long-term operational sustainability beyond initial permit acquisition.

Environmental monitoring capacity and compliance enforcement mechanisms must scale with increased mining activity to maintain ecological protection standards. Water resource allocation challenges in arid mining regions represent particular concerns that require sophisticated management approaches.

As reported by BNamericas, the government has successfully reduced the permit backlog by 50%, demonstrating tangible progress in administrative efficiency.

Investment Evaluation Framework for Mining Opportunities

Evaluating opportunities created by Mexico granting mining permits requires comprehensive due diligence frameworks that account for both traditional mining investment criteria and new regulatory dynamics. The acceleration of permit processing creates time-sensitive opportunities that demand rapid but thorough evaluation methodologies.

Due Diligence Enhancement Strategies

Early engagement in pre-application phases can maximise benefits from accelerated processing timelines whilst ensuring comprehensive environmental and social impact preparation. ESG specialist integration from project inception has become essential for navigating enhanced sustainability requirements and community consultation processes.

Local partnership establishment and benefit-sharing agreement development serve both risk mitigation and operational enhancement functions. These relationships provide crucial intelligence regarding regulatory processes and community dynamics that can influence permit success probability.

Portfolio Allocation and Risk Management

Diversification across multiple states and commodity types can reduce concentration risk whilst capturing benefits from regional variations in administrative efficiency. Staged investment approaches aligned with permit milestone achievements allow for risk management whilst maintaining exposure to acceleration benefits.

Exit strategy planning must incorporate new concession renewal requirements and competitive bidding processes that may affect asset transferability and valuation. These considerations require integration into initial investment structuring and ongoing portfolio management decisions.

Regulatory Normalisation Timeline and Future Evolution

The pathway to full regulatory normalisation by mid-2026 requires successful resolution of the remaining 66 pending projects whilst establishing sustainable operational procedures for ongoing permit processing. This timeline represents a critical test of institutional capacity and political commitment to mining sector development.

Performance Benchmarking and Continuous Improvement

The establishment of performance benchmarks and continuous improvement mechanisms will determine whether current efficiency gains can be sustained beyond the initial backlog clearance period. Regular evaluation of processing times, approval rates, and stakeholder satisfaction provides data for ongoing system optimisation.

Technology adoption roadmaps for permit processing digitisation represent essential infrastructure for maintaining efficiency gains. International best practice integration and regulatory modernisation require ongoing investment in institutional capabilities and staff development.

Political Transition Risk Assessment

Mining policy continuity through political transitions represents a key uncertainty factor that requires ongoing monitoring and assessment. The institutional embedding of efficiency improvements through standard operating procedures and technological systems can provide some insulation from political volatility.

Minister Ebrard’s acknowledgement of the Mexican Mining Chamber (CAMIMEX) as one of the government’s closest partners in addressing regulatory issues suggests institutional relationships that may provide continuity through administrative changes. The development of sustainable stakeholder engagement frameworks represents crucial investment in long-term policy stability.

Consequently, investors must carefully evaluate whether current administrative momentum can be sustained beyond the initial reform period. The successful completion of the remaining pending projects will serve as a crucial indicator of institutional capacity and policy commitment.

Investment decisions should consider multiple risk factors and consult with qualified financial and legal professionals familiar with Mexican mining regulations and international investment law. This analysis is based on publicly available information and should not be construed as investment advice.

Original Article: https://discoveryalert.com.au/mexico-mining-permits-investment-acceleration-2025/