Summary

- OMEX announced June 4th that the Environmental Report (EIA) for Oceanica was “completed and ready to be filed shortly”: as it is STILL not filed, this is clearly deliberate.

- We believe OMEX has chosen not to file the EIA because they know it will expose the project as environmentally and economically unviable: most mining projects die in this phase.

- OMEX appears to be desperately attempting to raise capital to cover a current cash balance under $2mm that is likely to be zero soon, as cash burn remains $3mm/month.

- An Oceanica capital raise would immediately be funneled to OMEX corporate to pay high compensation and ongoing cash burn, while diluting OMEX shareholders’ upside.

- Management statements now backtracking JP Morgan involvement: definitively NOT assisting OMEX on a capital raise for Oceanica, only potential “strategic” deals, which we are highly doubtful of.

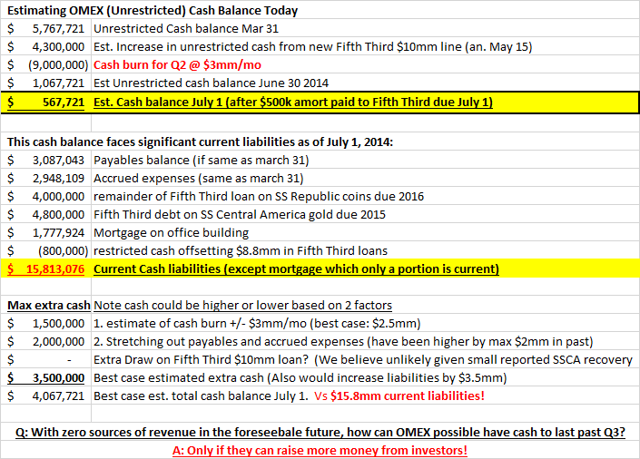

Update on Cash Balance Estimates at Odyssey Marine Exploration Inc.(OMEX):

(click to enlarge)

Our updated estimate of cash balances at Odyssey Marine Exploration (OMEX) makes us believe that we will be seeing lots more highly promotional, but empty press releases as desperation for more cash to pay their staggering cash burn increases. Given that the SS Central America recovered 1,000 oz in the first day and 5,000 ozs after 6 weeks of recovery (based on the $100,000 value @ $20/oz stated at the June 4 AGM), we believe it is unlikely that OMEX has been able to draw much more than the $4.8mm they announced on May 15th on their new Fifth Third credit line, which has stringent collateral requirements beyond the first $5mm. Further – we do not believe there is any prospect for monetizing this salvage until 2015 at the earliest: The receiver will take time to receive maximum value and will not care about the time pressure from rapid cash burn that OMEX is under.

What possibility does OMEX have to survive Q3 without filing for bankruptcy (We initially predicted an equity filing or bankruptcy raise Oct 31, 2013 within 12 months and continue to believe this is on track)?

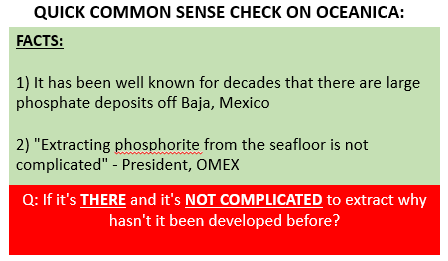

Sources re: Baja Phosphate deposits well known: 1967, 1989, 1980,2007

QUESTIONS:

Well, maybe…

Q: Does OMEX have proprietary technology to extract phosphate?

Q: Does OMEX have any phosphate mining experience?

Q: Does OMEX have unique political "in's" to get the permits?

Q: Did OMEX put large capital at risk that nobody else was willing to?

A: No evidence we are aware of for any of the above…

What situation makes more sense to you?

A) OMEX was simply the first to put 1+2 together and realize they could make a large economic project out of mining phosphate off the seafloor (which has never been done economically before)?

B) Oceanica is merely a recycled project that major strategic players have already evaluated and passed, where Mexico is happy to receive an est. $3mm+ per year in permitting fees that would give OMEX a vehicle to use grandiose terms like "Millions of Tonnes" and "World Class" in promotional press releases while they attempt to raise more capital from investors to fund their nonstop losses: funding egregious insider compensation (CEO, Greg Stemm had a record $1.311mm reported compensation in 2013: source) and lavish lifestyles?

Is this even the first time someone has used this technique to raze money from investors? (…NO)

Here's one example:

Jan 24, 2007: PhosMex Records First Offshore Mineral Mining Concession Ever Granted by Mexico

This concession, granted for the next fifty years, covers 100 square miles. This new type of mining claim was made possible due to a recent change in the Mexican coastal mining law. The concession contains 250,000,000 tons of phosphate ore (P2O5), which in today's market is worth over 12 billion dollars. The phosphate rock deposit occurs over a wide area in waters approximately 120 feet deep in continental shelf coastal zones of the Mexican State of Baja del Sur de California. … Technological improvements during the past 25 years have made deeper offshore exploration and dredging commercially attractive. PhosMex Corporation believes, with current technology and the current price of phosphate, an offshore dredging operation will be very profitable in today's market, particularly given the location of this project and the markets this deposit can serve.

(emphasis ours)

WOW – looks familiar doesn't it?

Phosmex: DEAD

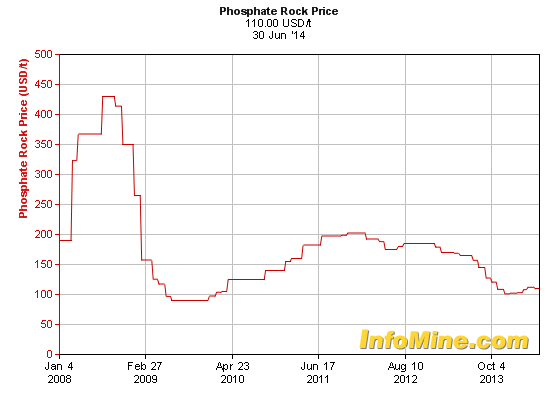

But maybe phosphate prices have increased since then?

No, phosphate prices have declined substantially.

OMEX Repeatedly Promises they will File the Environmental Impact Assessment (EIA) "shortly":

(emphasis ours)

November 7:

Odyssey subsequently traded services and expertise in development of the project for equity in the holding company (Oceanica) which owns the shares of the company in Mexico.

…We have retained an independent expert to advise us as to when we can and should disclose more details on the Oceanica deposit. We anticipate that this could happen within the next three to six months, but it could happen sooner if Odyssey's management, using advice from the independent expert, determines that additional disclosure is necessary or appropriate.

March 17 Conference Call:

-In PR: released preliminary assessment of Oceanica with "millions of tonnes" of ore…

(by UNNAMED "Qualified Person" who would have merely used data provided by OMEX).

"We anticipate Oceanica raising funds in 2014 to cover all or part of its own cash needs going forward." -OMEX CFO

President: The first part of your question was; do we anticipate potentially monetizing this investment prior to environmental approval. On that question, for some time now our advisors have beenrecommending that we wait for any significant monetization until environmental approvals are secure and simply that's because at that point the project will be completely de-risked and you would expect your evaluations to be higher

…In order to begin extraction you'd have to have an environmental approval from the government and that process is currently underway, so that should be the next up to look for; and as I mentioned earlier, as we can, we'll be continuing, I think, in the coming couple of months to release updates on where that project is.

…we expect another update to this NI43-101 price sometime in the coming quarter next 60 to 90 days

5-13-2014

We expect the official submission to be filed shortly

President: Over the past few months, Oceanica has been on a proactive outreach campaign to work with the government and local communities concerned with this project. To-date, these efforts have been instrumental in building strong supporting relationships.

…We're hopeful that if they [Oceanica] can get their deal done at the right valuation, which we think is very possible, then obviously, we have a receivable that's due to us, so that would actually result in cash coming to Odyssey at some point relatively soon thereafter.

CFO: Let me start off by making something very clear. We have no plans to do any equity raise with Odyssey stock. Concerning your question specifically, we believe that the cash we have on hand from operations and other non-dilutive financing alternatives will be sufficient to fund our 2014 plans and operations.

*FACT: OMEX share count increased post March 31 by at least 903,000 shares, most likely by 1.3mm shares as debt was repaid with shares issued at a 15% discount to market.

6-4-2014 AGM Presentation

Greg Stemm, CEO: The next step in this project will be the submission of the Environmental Impact Assessment. I am pleased to report thatthis filing – all 1,200 pages of it – is completed and ready to be filed shortly

…As we have mentioned previously, JP Morgan is representing this project for us with potential strategic investors and the development of a plan for maximizing shareholder value on the property. Rodney Miller, a Managing Director in JP Morgan's Mergers and Acquisitions Group and Jeffrey Price, Managing Director of their Chemical and Fertilizers Group in New York are representing the project and have been very helpful in developing our ongoing strategy for Oceanica.

Q: Why has OMEX repeatedly said they are going to file the EIA while they have not?

We believe they KNOW that they have no chance of receiving environmental approval and are attempting to raise money for Oceanica right now and are most likely deliberately not filing the EIA. We believe OMEX knows that if they provided proper transparency by filing the EIA and NI43-101 publicly, as other mining companies do, this project would rapidly be exposed as worthless and unviable.

Further, we believe OMEX is misrepresenting JP Morgan's involvement in order to borrow credibility from their name. Based on our market sources, JP Morgan is NOT helping with any Oceanica-specific capital raise and OMEX is currently attempting to hire a banker for this (Where's MAKO?). Rather, it has been now spun that JP Morgan is helping to negotiate for a potential "strategic deal".

We are highly skeptical of this as we have never heard of a bank like JP Morgan working on a "success-fee only" condition. Why would a strategic partner buy or partner with Oceanica when it could easily replicate its assets by simply leasing nearby property (see Phosmex above) for a nominal expense?

New Due Diligence On Oceanica:

We spoke with two consultants who had worked on the failed Magdalena bay phosphate project operated by Rofomex just south of Oceanica. Rofomex spent ~20 years and countless millions of dollars exploring the entire region, including taking offshore core samples. Instead of pursuing a plant in the current "Oceanica" concession, Rofomex chose the Magdalena bay area. Rofomex also (unsuccessfully) attempted to produce phosphate from the "Santo Domingo" onshore phosphate deposit which is literally the beach adjacent to Oceanica.

Mining phosphate both onshore and offshore in this area is not some new hidden idea or concept. It has been tried multiple times over decades and anyone with the internet and Google can see why it has never been done. This is not something that the bigger phosphate players have never heard of or don't know about. If you call anyone involved in this space they all have heard about ocean phosphate dredging projects and the failed Magdalena bay project.

Based on our discussions with consultants who worked hands-on on the Rofomex deposit, we believe the following are incrementally new and important points to our initial extensive report on Oceanica:

1. The cost to get any commercial project done for Oceanica is staggering and not even close to economic currently even if everything goes exactly as planned and on budget (which never happens in mining).

a. Consultant #1

i. Said the general rule of thumb for the cost of phosphate production is the facility for refining it into something commercially useful costs $100-120 per tonne. He said a 2m tonne plant would be pretty typical, so figure $200-240m for the plant alone. For this project though, you'd also need the ships, a port of some kind, etc. The total cost would depend on how much refining is done locally vs. higher shipping costs, but he would estimate at least $550m or so in startup capital costs but could easily be considerably more.

ii. For production costs, he estimated average operating expenses for phosphate mines globally are ~$65 per tonne. Then shipping costs for refined phosphate from "Oceanica" to the nearest market would cost at least another $15 per tonne. He said the cost just to take a boat like that through Panama canal is $15 per tonne so shipping to Florida or the gulf could easily be $20-25 per tonne alone.

iii. He said all of the salt would need to be removed from the raw phosphate slurry and that is not easy to remove plus it is corrosive in any facility: adding substantial additional material handling costs.

iv. None of this factors in that Mexico's mining tax is 7.5% of any pre-tax earnings (I believe before depreciation too).

v. All of the above assumes "best case" scenarios.

b. Consultant #2

i. Thinks all-in to go from nothing to fully functioning commercial production there would cost $750m to $1b

ii. Said IPHS had looked at producing in the area in both 2009 and then again in 2011-2012 and both times they found it was uneconomic as they didn't move forward.

2. They both state there is essentially no way to do this without serious environmental impact if for no other reason than just the processing

a. There are several ways of processing phosphate, but all of them have serious environmental concerns. Neither the fatty reagents typically used or the less environmentally friendly amine reagents floated with the sand would be without environmental consequence and virtually impossible to keep this entirely removed from the environment.

b. If they do any processing on land there, anything 75-100 microns or less would have to be discarded back into the water and that could cloud the water with unclear environmental consequences.

c. Even if they produce a semi concentrate offshore and pump the leftover slurry back to the bottom of the ocean, it may not impact the water quality too much at the surface, but anything on the seafloor would be dead for at least a few acres, depending on currents, etc. This assumes no chemicals are used and just simple dewatering.

d. According to one of the consultants, Rofomex spent ~$70m (in ~1975-1980 dollars!) and had made several attempts to produce phosphate in Magdalena bay, but all failed and they eventually gave up and sunk their dredge ship.

e. Both consultants seemed to think that some processing would have to occur onsite or the shipping costs would be far too high for this project to ever be economic. In fact, the Rofomex plant was a floating barge, which was literally intentionally sunk after the project completely failed, resulting in a complete loss of capital.

3. Back in 2009, the local Mexicans were already "not happy" with IPHS proposed phosphate project in the area directly adjacent to Oceanica and was one reason why IPHS dropped plans to pursue any project in that area.

a. If locals were not happy with a previously proposed project in the same area, put forth by more credible and financially stronger company IPHS, how could the local Mexican community possibly find Oceanica acceptable?

Potential Oceanica investors need to conduct serious due diligence to verify the extraordinary claims by OMEX

Any potential investors in Oceanica need to do their own proper due diligence and we present the above as helpful guides for what questions to ask. Some additional key questions to ask:

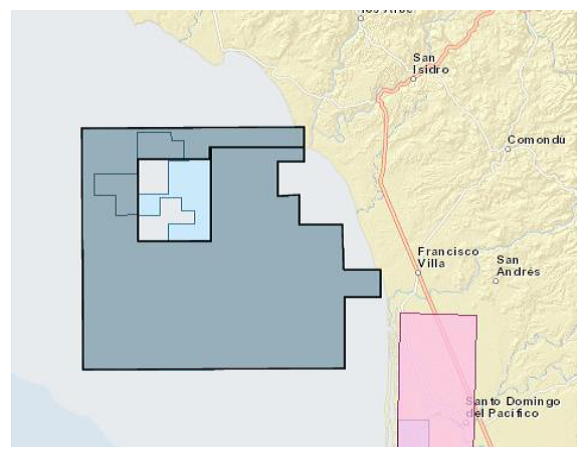

1. In our original Oceanica report, we demonstrated that the "Oceanica" deposit overlaps and apparently conflicts with other offshore mineral concessions. Has OMEX resolved these serious conflicts or explained them to investors?

Source – More details at omextruth.com in Oceanica report on Innophos overlapping concession

2. In addition to the overlapping mineral concessions, our previous report explained there also seems to be overlapping tourism, fishing and seafloor rights as well. Has OMEX and Oceanica received written authorization from the owners of these conflicting concessions? Has OMEX received written proof from the 8-10 Mexican regulatory bodies involved? How about the countless fishing co-operatives who have already indicated they are opposed and plan to fight this project?

a. Fishing opposition appears to be the key reason a Namibian phosphate project was shot down.

b. Has OMEX disclosed to Oceanica investors the position of the local SEMARNAT office that has jurisdiction over this project? If not, why have Oceanica investors not contacted this SEMARNAT office directly? Baja is an incredible place with great weather and I would encourage any Oceanica investors to visit the SEMARNAT office in La Paz and check in with some of the fishing co-ops in Ulloa bay to get an honest view of the insurmountable opposition this project faces.

c. The local community appears to be aware and vehemently opposed to "Oceanica" (see signature #219) with plans to strongly fight it, why has this not been openly disclosed by OMEX to investors?

d. Why has OMEX still not addressed the issue of who the true directors are of DNA, Ltd., Oceanica's partner based in Panama? Claims of required local directors for "regulatory purposes" are easily discredited with a Google search as Panama corporations do not require local directors as Bermuda does, in contrast for example.

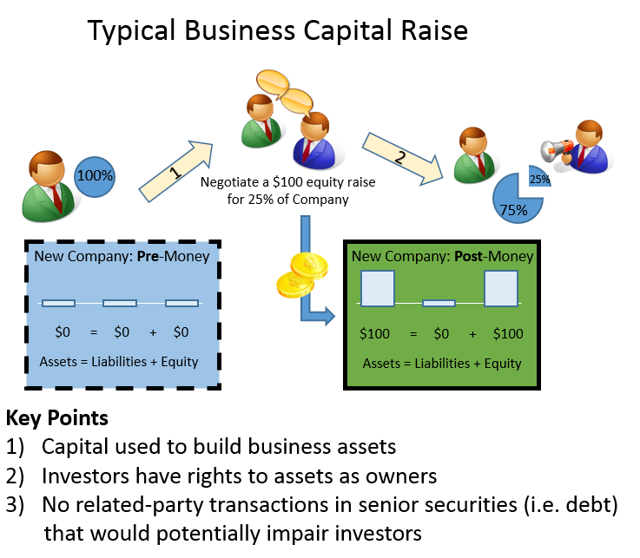

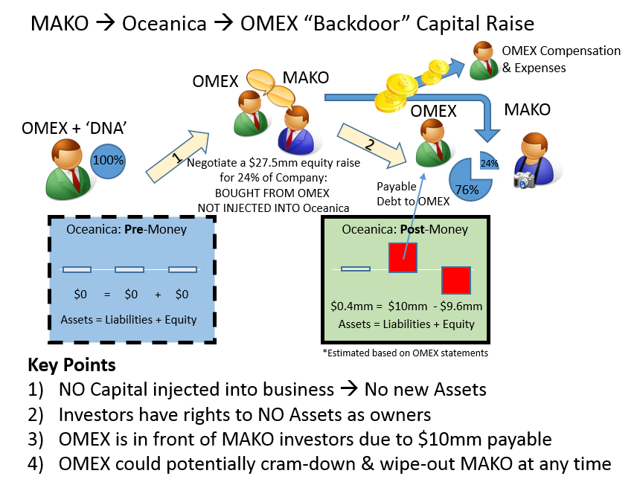

What might a Capital Raise for Oceanica Look like?

Firstly, we do commend OMEX on its cleverness in continuing to avoid the SEC and its securities registration requirements for capital raises. OMEX has been uniquely clever in our experience at using controlled or influenced private companies (Neptune: the source of nearly all 2012 OMEX revenue, and Oceanica more recently) to raise money using unregistered securities to ultimately pay compensation and expenses at the parent company.

We believe a raise here would look like a funnel: As MAKO found out, they paid $27.5mm for pieces of paper that gives them ownership in a company with $400k cash (according to last CC) and $10mm of liabilities to OMEX, which also controls the company. OMEX has clearly stated on their last conference call in May that they intend to repay the $10mm owed to OMEX corporate once Oceanica raises capital. In other words, this transaction would potentially accomplish nothing more than funneling money to OMEX corporate and would likely ultimately be completely worthless to Oceanica shareholders despite any "seniority" the unregistered paper may be labeled with

As a reminder, here is the highly unusual capital raise structure used by Oceanica / OMEX that we believe leaves investors in a disadvantageous position vs. a typical structure:

With cash balances dwindling towards zero and what we see as virtually zero chance to survive Q3 without an equity raise, expect increasingly promotional and desperate press releases from OMEX. Now is the time to truly start asking questions and demanding transparency from OMEX after months of empty promises to file the EIA and expose the true details of this Oceanica project: How is it any different than those recycled in the past that ended in total wipeout for investors?

Additional disclosure: Full disclaimer and background at omextruth.com