Highlight Results

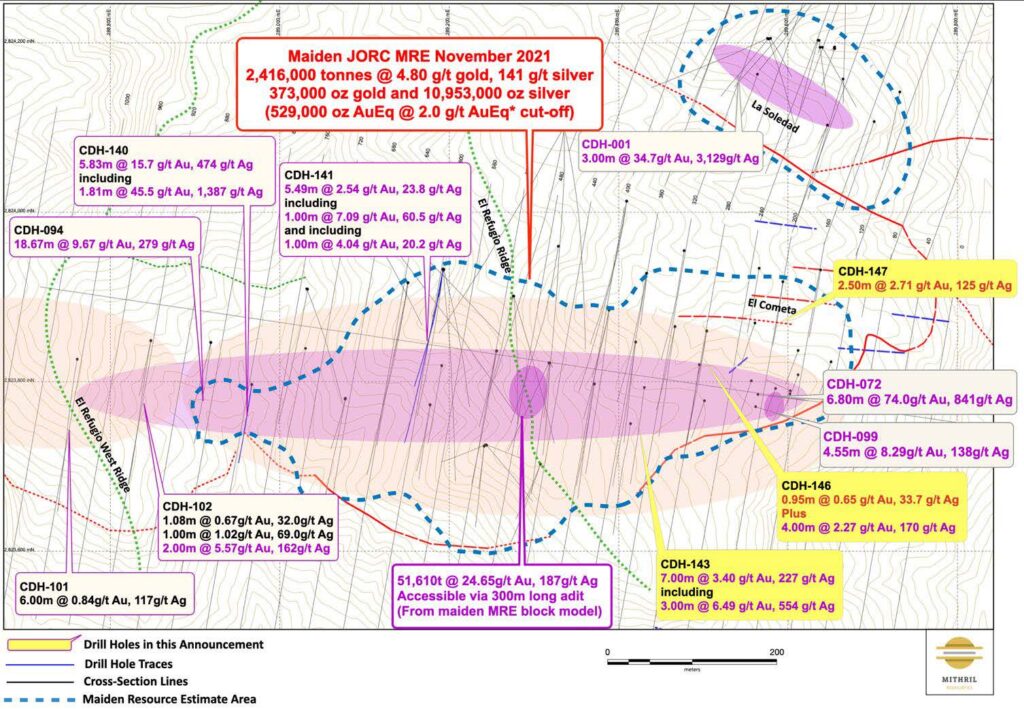

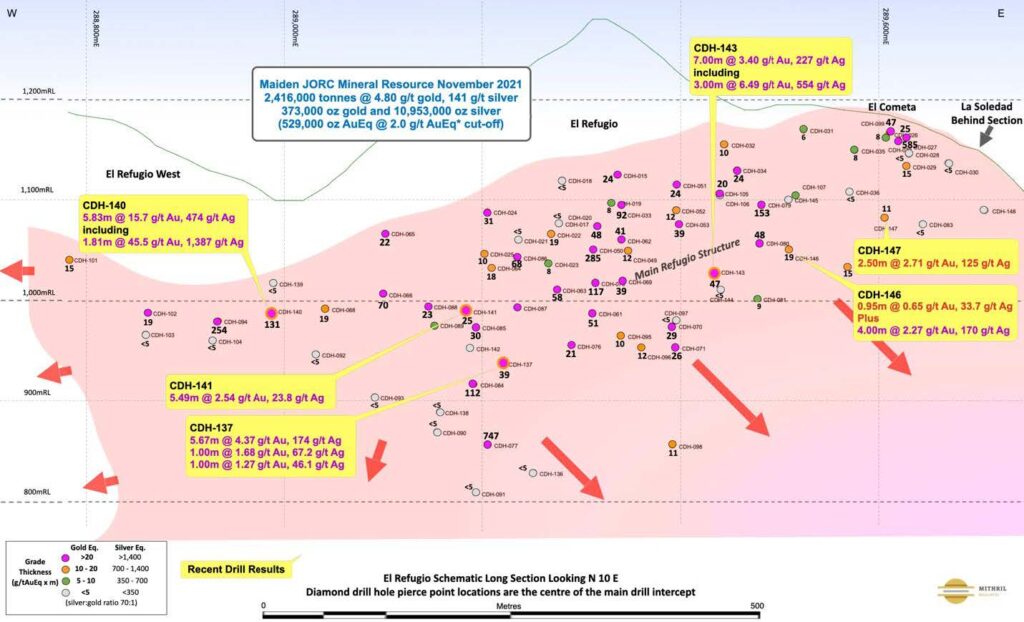

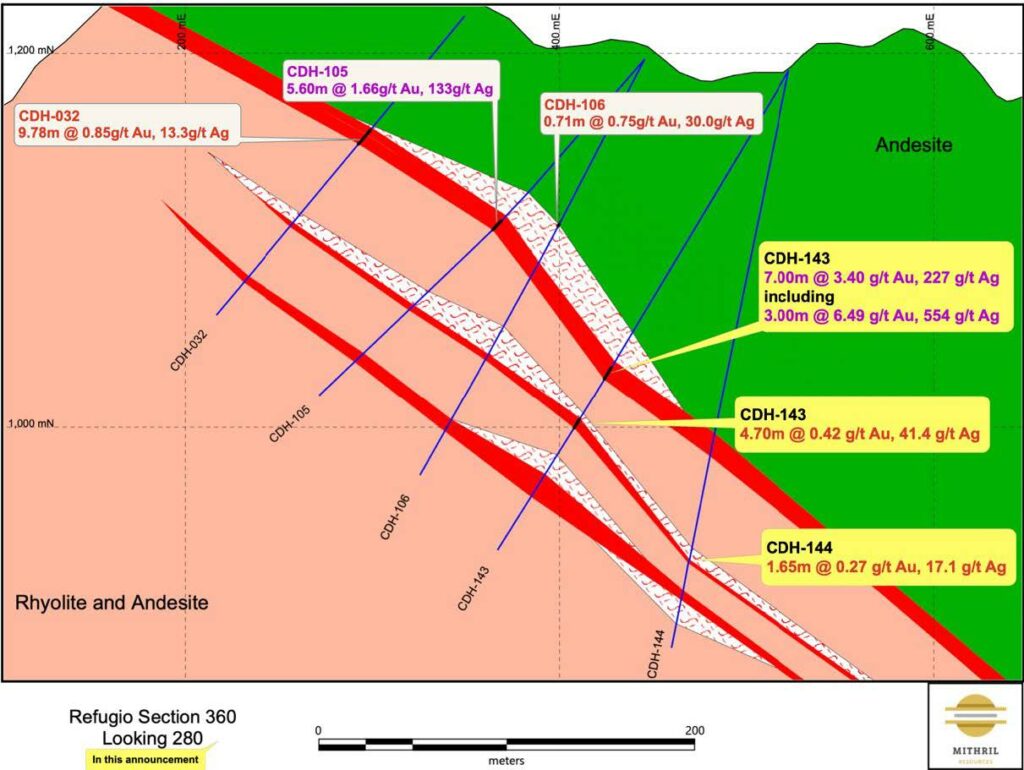

High-grade gold-silver intercepts at the eastern end of the El Refugio resource area, on sections 200 to 360

- 7.00m @ 3.40 g/t gold, 227 g/t silver from 185.0m, (CDH-143), including

- 3.00m @ 6.49 g/t gold, 454 g/t silver from 189.0m, plus

- 4.70m @ 0.42 g/t gold, 41.0 g/t silver from 218.0m

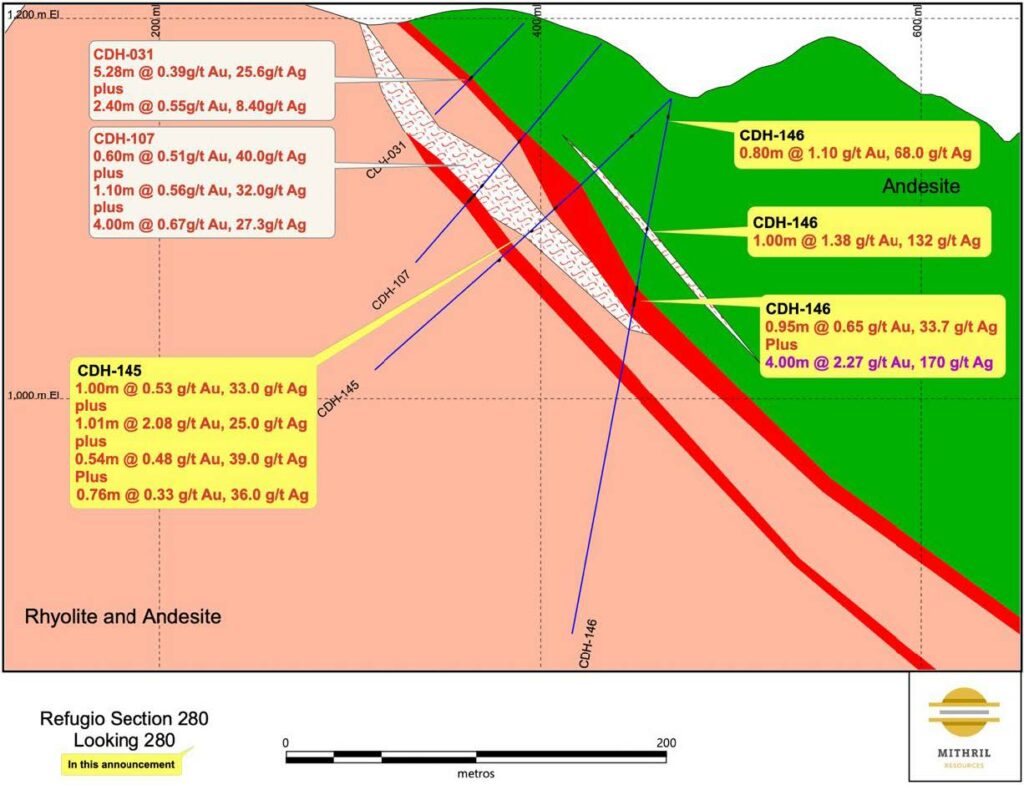

- 4.00m @ 2.27 g/t gold, 170 g/t silver from 106.0m, (CDH-146), plus

- Shallower intercepts of 1m up to 3.27g/t AuEq1

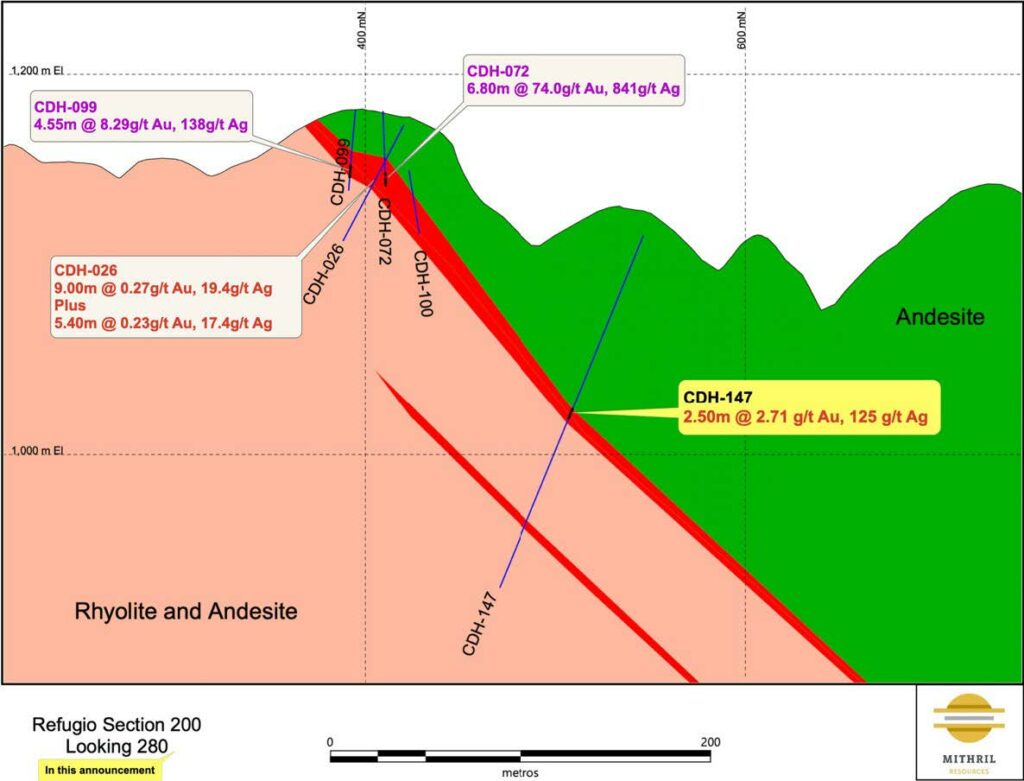

- 2.50m @ 2.71 g/t gold, 125 g/t silver from 71.5m, (CDH-147)

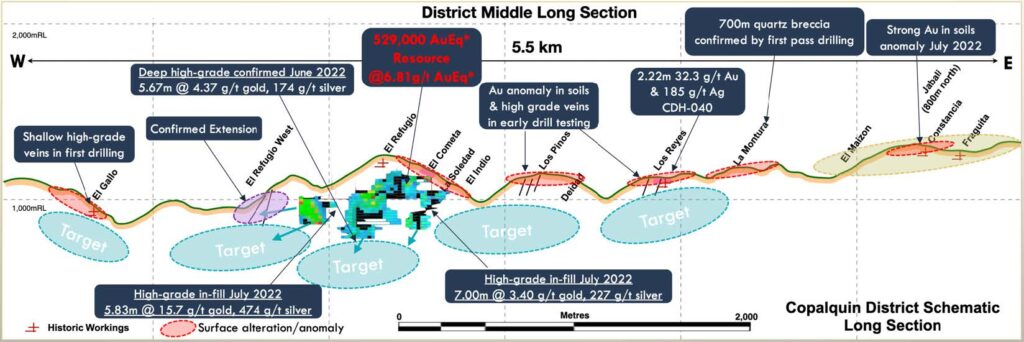

- The drill results in the eastern end of El Refugio are important in demonstrating gold-silver mineralisation in the structure up dip and closer to a potential interaction with the high-grade La Soledad structure as well as adding to the resource footprint

- A drill core relogging programme is underway which will enhance resource modelling work and drill program design for La Soledad-El Refugio and expansion east to Los Pinos

- Study work is progressing to optimise an initial development at the highly attractive maiden high-grade gold-silver resource at El Refugio

- Having invested over US$8m in direct exploration costs, Mithril has earned 50% interest in the Copalquin concessions as part of its exclusive option term to purchase 100% ownership, which extends by a further 3 years to August 2026

Mithril Resources Ltd (ASX: MTH) (Mithril or the Company) is pleased to provide exploration results for its 100% optioned Copalquin Gold Silver Project in Mexico where a maiden 529koz gold equivalent1 high-grade gold-silver JORC resource has been defined at El Refugio-La Soledad *(see ASX announcement 17 November 2021)

Mithril CEO and Managing Director, John Skeet, commented:

“The recent program of drilling at El Refugio has successfully extended and upgraded confidence both west and now east of the central El Refugio maiden resource area. Drilling continually intercepts high-grade mining widths as we progress work in this important part of the Copalquin Mining District. The drill core relogging program applying the past two years of drilling experience is opening up interpretation and opportunities, particularly for the more complex and high-grade La Soledad part of the maiden resource area and the eastern extension to Los Pinos. Drill core observations from the recent drilling point to significant ongoing resource depth potential for the major upwelling feeder zone at El Refugio as we progress the exploration program and development scenarios at Copalquin for resource expansion and gold-silver production.

El Refugio Drilling June-July 2022

Assay results have been received for the drilling completed on the eastern end of the El Refugio resource area. Importantly, core from these most recent holes have the first observed occurrences of platy quartz after calcite, a texture indicative of boiling and gold deposition. Late amethyst is also observed filling what was open space at the time of mineralisation. This texture is indicative of boiling. Visible silver minerals are commonly observed in the mineralised veins. Assay results include 7.00m @ 3.40 g/t gold, 227 g/t silver from 185.0m, (CDH-143), including 3.00m @ 6.49 g/t gold, 454 g/t silver from 189.0m, plus 4.70m @ 0.42 g/t gold, 41.0 g/t silver from 218.0m. 4.00m @ 2.27 g/t gold, 170 g/t silver from 106.0m, (CDH-146), plus shallower intercepts of 1m up to 3.27g/t AuEq and 2.50m @ 2.71 g/t gold, 125 g/t silver from 71.5m, (CDH-147).

The recent drilling at El Refugio has successfully intercepted the main structure and given further direction for future drilling to target the projected main upwelling feeder zone of the El Refugio hydrothermal system.

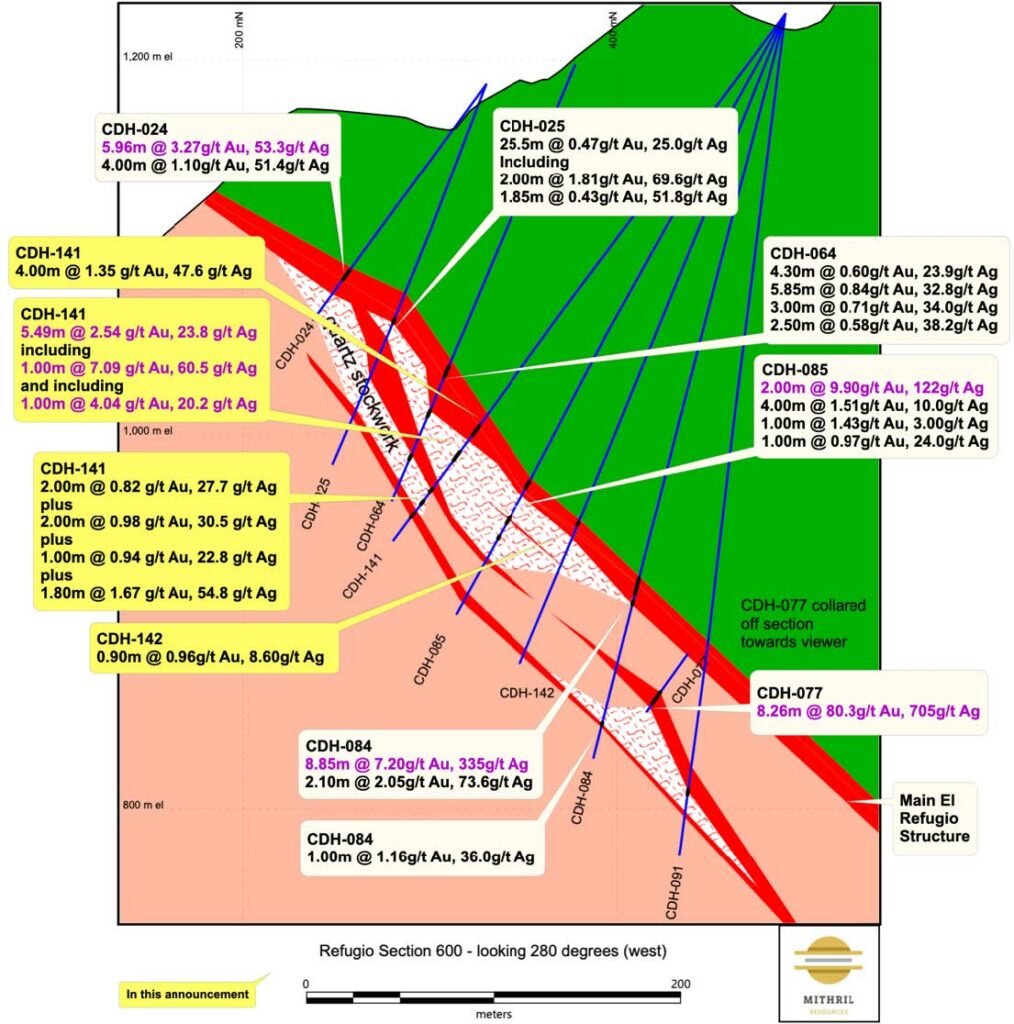

El Refugio Drilling May-June 2022

In May-June 2022, a program of six drill holes at El Refugio was completed, with three drilled from a location slightly oblique to the main structure, in order to reduce the length of the drill holes to reach the targeted depth. The program successfully achieved the objective of locating the main structure and confirming high-grade gold and silver on the western side of the El Refugio resource area while providing additional information for the location of the upwelling feeder zone. The previously reported intercept in hole CDH-137 of 5.67m @ 4.37 g/t gold, 174g/t silver from 331.33m, (CDH-137), including 1.67m @ 9.64 g/t gold, 399 g/t silver from 331.33 plus 1.00m @ 1.68 g/t gold, 67.2 g/t silver from 367.0m and 1.00m @ 1.27 g/t gold, 46.1 g/t silver from 370.0m filled a gap down dip on section 560 and drill hole CDH-136 confirms the downdip extension with some further high-grade gold and silver mineralisation and multiple intercepts.

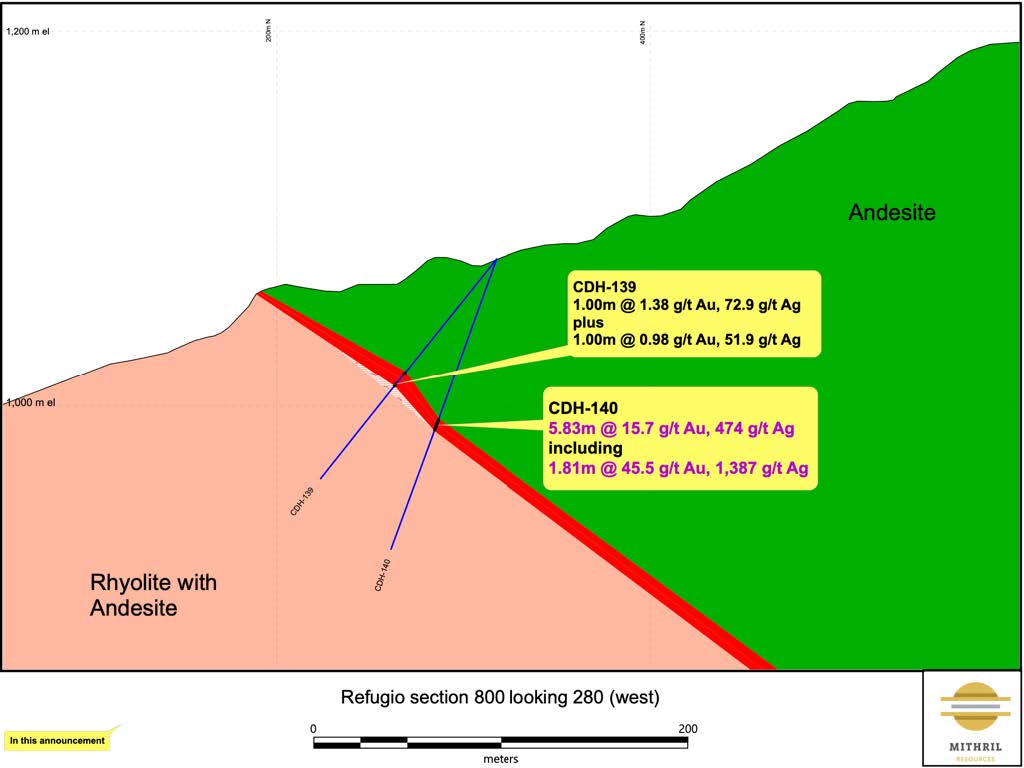

The first drill holes on section 800 were reported with exceptional high-grade gold and silver intercepts in this western side of the El Refugio resource area with 5.83m @ 15.7 g/t gold, 474 g/t silver from 91.77m, (CDH-140), including 1.81m @ 45.5 g/t gold, 1,387 g/t silver from 93.77m down dip of hole CDH-139 (Figure 7). This supports the high- grade previously intercepted 40m west by drill hole CDH-094 with 18.87m @ 9.67g/t gold, 279g/t silver.

Core Relogging Program

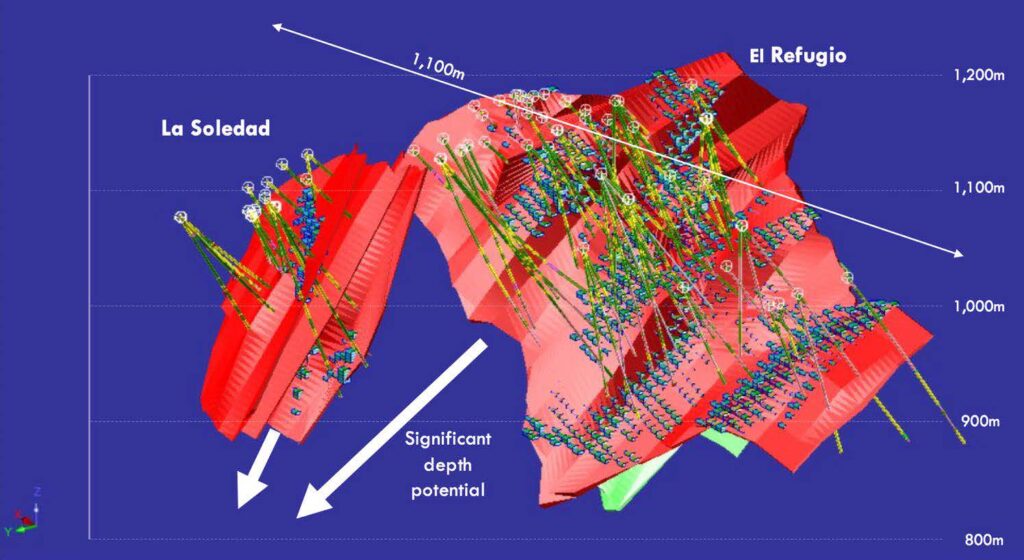

The core relogging program is underway for La Soledad and El Refugio drilling which will enable the geologic interpretation to be updated using the most recent knowledge developed for this important part of the Copalquin Mining District. This information is being used to update the database and to further develop the geologic model for design of the next round of drilling to continue to develop this significant deposit, aiming to extend the resource growth deeper and towards a possible interaction between the main El Refugio and La Soledad structures.

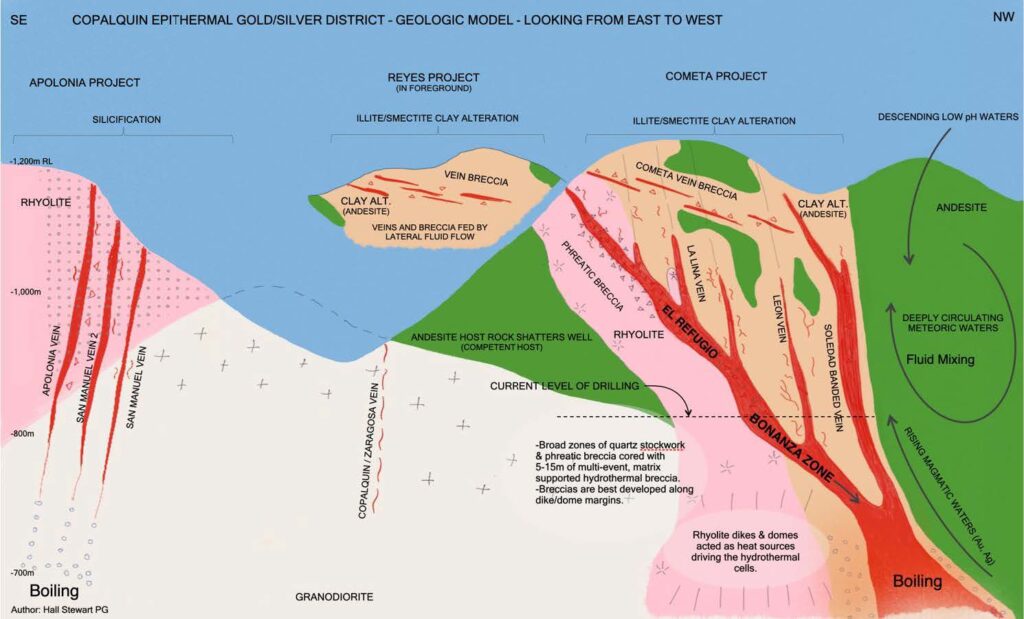

The above figure shows an oblique view of the La Soledad-El Refugio vein and block models with traces of drill holes to date. Recent drill logs and results show significant depth potential of this major system and also indicate the general location of the El Refugio upwelling feeder zone and this is consistent with the epithermal gold-silver model shown in the figure below and further supported by the recent drill log observations.

Scoping Study Work

Work is progressing to assess the first stage development options to optimally exploit the high-grade El Refugio resource. Recent drilling has been spaced across the strike of the mineralized zone to infill strategic areas. There are options to reduce the mine development meterage and to take advantage of topography and high-grade zones within the El Cometa-El Refugio resource on the eastern side of the deposit to potentially produce attractive development economics including low initial capital requirements and short payback period. Mining

ABOUT THE COPALQUIN GOLD SILVER PROJECT

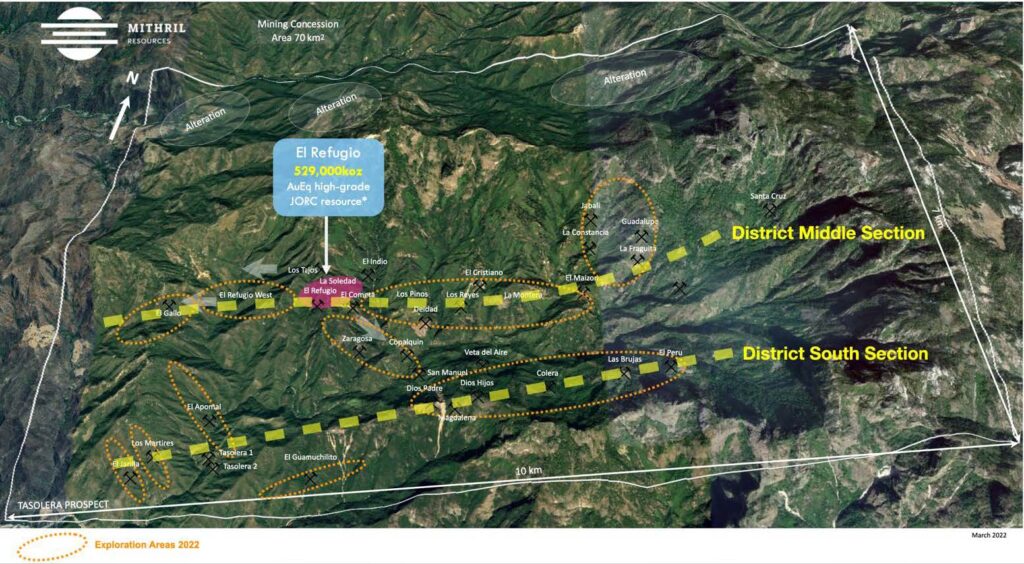

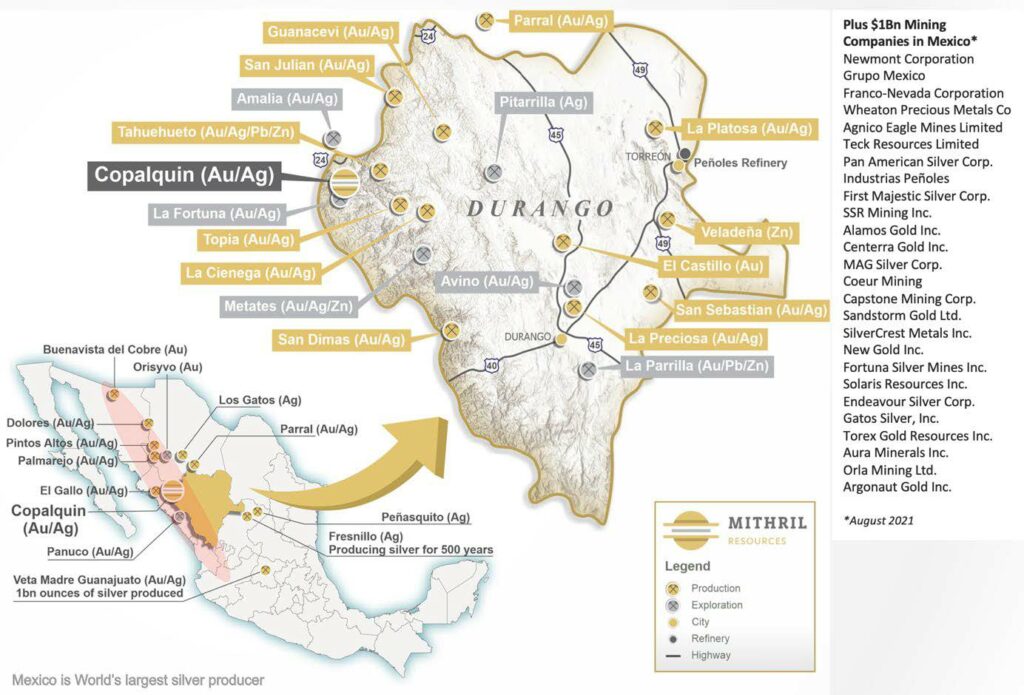

The Copalquin mining district is located in Durango State, Mexico and covers an entire mining district of 70km2 containing several dozen historic gold and silver mines and workings, ten of which had notable production. The district is within the Sierra Madre Gold Silver Trend which extends north-south along the western side of Mexico and hosts many world-class gold and silver deposits.

Multiple mineralisation events, young intrusives thought to be system-driving heat sources, widespread alteration together with extensive surface vein exposures and dozens of historic mine workings, identify the Copalquin mining district as a major epithermal centre for Gold and Silver.

Within 15 months of drilling in the Copalquin District, Mithril delivered a maiden JORC mineral resource estimate demonstrating the high-grade gold and silver resource potential for the district. This maiden resource is detailed below (see ASX release 17 November 2021).

- 2,416,000 tonnes @ 4.80 g/t gold, 141 g/t silver for 373,000 oz gold plus 10,953,000 oz silver (Total 529,000 oz AuEq*) using a cut-off grade of 2.0 g/t AuEq*

- 28.6% of the resource tonnage is classified as indicated

| Tonnes (kt) | Tonnes (kt) | Gold (g/t) | Silver (g/t) | Gold Equiv.* (g/t) | Gold (koz) | Silver (koz) | Gold Equiv.* (koz) | |

| El Refugio | Indicated | 691 | 5.43 | 114.2 | 7.06 | 121 | 2,538 | 157 |

| Inferred | 1,447 | 4.63 | 137.1 | 6.59 | 215 | 6,377 | 307 | |

| La Soledad | Indicated | – | – | – | – | – | – | – |

| Inferred | 278 | 4.12 | 228.2 | 7.38 | 37 | 2,037 | 66 | |

| Total | Indicated | 691 | 5.43 | 114.2 | 7.06 | 121 | 2,538 | 157 |

| Inferred | 1,725 | 4.55 | 151.7 | 6.72 | 252 | 8,414 | 372 | |

| TOTAL | 2,416 | 4.80 | 141 | 6.81 | 373 | 10,953 | 529 |

*AuEq. = gold equivalent calculated using and gold:silver price ratio of 70:1. That is, 70 g/t silver = 1 g/t gold. The metal prices used to determine the 70:1 ratio are the cumulative average prices for 2021: gold USD1,798.34 and silver: USD25.32 (actual is 71:1) from kitco.com. Actual metal prices have not been used in resource estimate, only the price ratio for the AuEq reporting.

Mining study and metallurgical test work supports the development of the El Refugio-La Soledad resource with conventional mining methods indicated as being appropriate and with high gold-silver recovery to produce metal on-site with conventional processing.

Mithril is currently exploring in the Copalquin District to expand the resource footprint in 2022 to demonstrate its multi-million ounce gold and silver potential.

Mithril Resources is earning 100% interest in the Copalquin District mining concessions via a purchase option agreement detailed in ASX announcement dated 25 November 2019.

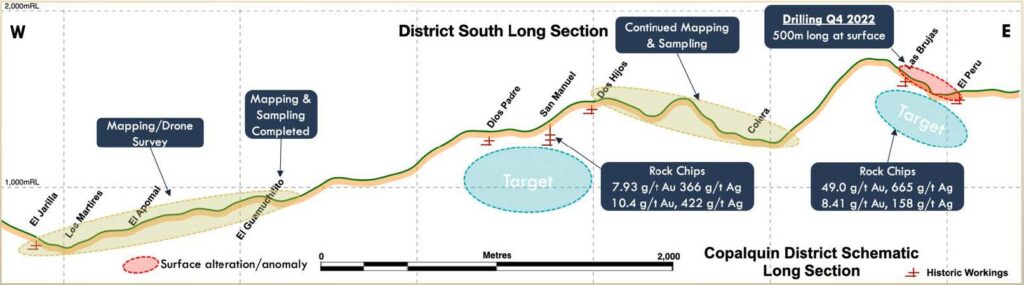

District South Section

The Las Brujas-El Peru target is drill ready following positive results from the rock chip sampling program from within the historic mine working and the soils sampling program that revealed a good gold and silver anomaly. The historic mine workings at Las Brujas and at El Peru are connected by a 500m long surface trace of quartz vein.

Mapping and rock chip sampling of a north-south oriented structure at El Guamuchilito has been completed. Aerial drone surveying will continue until the end of the dry season usually around mid-late June.

-ENDS-

Released with the authority of the Board. For further information contact:

John Skeet

Managing Director and CEO

[email protected]

+61 435 766 809

Mark Flynn

Investor Relations

[email protected]

+61 416 068 733

Competent Persons Statement

The information in this report that relates to sampling techniques and data, exploration results and geological interpretation has been compiled by Mr Hall Stewart who is Mithril’s Chief Geologist. Mr Stewart is a certified professional geologist of the American Institute of Professional Geologists. This is a Recognised Professional Organisation (RPO) under the Joint Ore Reserves Committee (JORC) Code.

Mr Stewart has sufficient experience of relevance to the styles of mineralisation and the types of deposits under consideration, and to the activities undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the Joint Ore Reserves Committee (JORC) Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Mr Stewart consents to the inclusion in this report of the matters based on information in the form and context in which it appears.

The information in this report that relates to metallurgical test results, mineral processing and project development and study work has been compiled by Mr John Skeet who is Mithril’s CEO and Managing Director. Mr Skeet is a Fellow of the Australasian Institute of Mining and Metallurgy. This is a Recognised Professional Organisation (RPO) under the Joint Ore Reserves Committee (JORC) Code.

Mr Skeet has sufficient experience of relevance to the styles of mineralisation and the types of deposits under consideration, and to the activities undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the Joint Ore Reserves Committee (JORC) Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Mr Skeet consents to the inclusion in this report of the matters based on information in the form and context in which it appears. The Australian Securities Exchange has not reviewed and does not accept responsibility for the accuracy or adequacy of this release.

The Australian Securities Exchange has not reviewed and does not accept responsibility for the accuracy or adequacy of this release.

Original Article: https://www.investi.com.au/api/announcements/mth/5edab029-10c.pdf