Octavio Alvídrez, Chief Executive Officer, commented:

“I am pleased to report a strong operating and financial result in the first half of 2025. Our profitability has significantly improved, driven not only by favourable precious metals prices but also by a consistent operational performance and rigorous cost discipline. This has led to a substantial free cash flow generation. Our balance sheet remains robust, with ample liquidity, allowing us to declare an interim dividend of US20.8 cents per share in line with our policy. On the operational front, gold production saw impressive growth through optimised operations, particularly at Herradura, while silver production was partially impacted by the planned closure of San Julián DOB, and the lower contribution from the Fresnillo mine and the Silverstream. Looking ahead, we have increased gold production guidance for the year to reflect the continued strong performance at Herradura, and we have adjusted silver production guidance to reflect the end of Silverstream contributions following the buyback agreement with Peñoles. In terms of equivalent silver ounces, our 2025 guidance remains unchanged. These results highlight our steadfast focus on productivity, cost control, and creating lasting value for our shareholders.”

First half highlights

Financial highlights (1H25/1H24 comparisons)

- Adjusted Revenues[1] of US$1,982.9m, up 27.1%; mainly due to higher gold and silver prices, and increased volumes of gold sold, partly offset by a lower volume of silver sold.

- Revenues of US$1,936.2m, up 30.1%; driven by the increased adjusted revenues and lower treatment and refining charges.

- Adjusted production costs[2] of US$673.5m, down 20.2% over 1H24 primarily due to the devaluation of the Mexican peso vs. the US dollar, the net decrease in volumes of ore processed, mainly at Fresnillo, Herradura, and Ciénega, the decrease in adjusted production as a result of the closure of San Julián DOB, and the positive impact of efficiencies and cost reduction initiatives, mainly at Herradura.

- Cost of sales of US$913.2m, down 16.7% mainly as a result of the lower adjusted production costs and decreased depreciation, partly offset by the less favourable effect of the variation in change in inventories.

- Gross profit and EBITDA[3] of US$1,022.9m and US$1,102.1m, up 160.7% and 102.5%, respectively.

- Profit from continuing operations before net finance costs and income tax of US$860.8m, up 266.0%.

- Following operational and financial difficulties impacting silver production and the long-term viability of the Sabinas mine, and an evaluation of the options available, Peñoles has agreed to buy back the Silverstream Contract for US$40.0m, which results in a non-cash Silverstream loss, net of taxes, of US$133.0 million. See further information below.

- Profit for the period before income tax of US$660.3m, up 137.7%.

- Income tax expense and mining rights of US$192.8m, up 20.4%

- Profit for the period of US$467.6m, up 297.3% from US$117.7m.

- Basic and diluted EPS from continuing operations of US$53.4 cents per share, up 399.1% from US$10.7 cents per share.

- Adjusted EPS[4] of US$71.5 cents per share, up from US$4.4 cents per share in 1H24.

- Cash generated from operations, before changes in working capital, of US$1,103.6m, up 101.4%.

- Free cash flow[5] of US$1,026.1m in 1H25 (US$187.4m in 1H24).

- Strong balance sheet with cash and other liquid funds as at 30 June 2025 of US$1,823.0m (31 December 2024: $1,297.8m).

- Interim dividend of 20.8 US cents per share, totalling US$153.3m (1H24: US$47.2m).

Operational highlights (1H25/1H24 comparisons)

As disclosed in the 2Q25 production report on 23 July 2025:

- First half attributable silver production of 24.9 moz (including Silverstream), down 11.7% vs. 1H24 mainly due to the cessation of mining activities at San Julián DOB, a decrease in volume of ore processed, lower ore grade and decreased recovery rate at Ciénega and lower ore grade at Juanicipio.

- First half attributable gold production of 313.8 koz, up 15.9% vs. 1H24 mainly due to the optimisation of mine operation standards for better selectivity, which led to higher gold ore grade, and the additional gold contents recovered from the oxidised high grade ore deposited at the Herradura leaching pads. This was partly offset by the lower ore grade and decreased volumes of ore processed at Saucito and Ciénega, and the lower volume of ore processed at Fresnillo.

- Ongoing focus on safety, cost control, and productivity.

Highlights for 1H25

| Fresnillo plc H1 2025 Financial Summary | |||

|---|---|---|---|

| Metric | H1 2025 | H1 2024 | % Change |

| Silver production (koz) | 24,882 | 28,169 | (11.7) |

| Gold production (oz) | 313,840 | 270,872 | 15.9 |

| Total revenues (US$ million) | 1,936.2 | 1,488.3 | 30.1 |

| Adjusted revenues1 (US$ million) | 1,982.9 | 1,560.2 | 27.1 |

| Cost of Sales (US$ million) | 913.2 | 1,095.9 | (16.7) |

| Gross profit (US$ million) | 1,022.9 | 392.4 | 160.7 |

| Adjusted production costs2 (US$ million) | 673.5 | 844.2 | (20.2) |

| EBITDA3 (US$ million) | 1,102.1 | 544.2 | 102.5 |

| Silverstream effects (US$ million) | (190.1) | 66.5 | N/A |

| Profit for the period (US$ million) | 467.6 | 117.7 | 297.3 |

| Cash generated by operations before changes in working capital (US$ million) | 1,103.6 | 547.9 | 101.4 |

| Basic and Diluted EPS (US$) | 0.534 | 0.107 | 399.1 |

| Basic and Diluted EPS, excluding post-tax Silverstream revaluation effects (US$) | 0.715 | 0.044 | 1,525.0 |

| Dividend per ordinary share (US$) | 0.208 | 0.064 | 225.0 |

1 Adjusted revenues are revenues before adjustments for treatment and refining charges.

2 Adjusted production costs exclude non-cash items and other adjustments.

3 EBITDA is earnings before interest, taxes, depreciation, and amortization.

4 EPS is earnings per share.

* Silver production includes volumes realised under the Silverstream contract

1 Adjusted revenues are the revenues shown in the income statement adjusted to add back treatment and refining charges. The Company considers this is a useful additional measure to help understand underlying factors driving revenue in terms of volumes sold and realised prices

2 Adjusted production costs are calculated as cost of sales less depreciation, profit sharing, hedging, change in inventories and unproductive costs. The Company considers this a useful additional measure to help understand underlying factors driving production costs in terms of the different stages involved in the mining and plant processes, including efficiencies and inefficiencies as the case may be and other factors outside the Company’s control such as cost inflation or changes in accounting criteria.

3 Earnings before interest, taxes, depreciation and amortisation (EBITDA) is calculated as profit for the year from continuing operations before income tax, less finance income, plus finance costs, less foreign exchange gain/(loss), less revaluation effects of the Silverstream contract, less other operating income plus other operating expenses and depreciation.

4 The weighted average number of shares for H1 2025 and H1 2024 was 736.9m. See Note 8 in the Interim Consolidated Financial Statements.

Commentary on the Group’s results

Operating results

First half attributable silver production of 24.9 moz (including Silverstream) decreased 11.7% vs. 1H24, mainly due to the cessation of mining activities at San Julián DOB, a decrease in volume of ore processed, lower ore grade and decreased recovery rate at Ciénega and lower ore grade at Juanicipio.

First half attributable gold production of 313.8 koz, increased 15.9% vs. 1H24 mainly due to the optimisation of mine operation standards for better selectivity, which led to higher gold ore grade, and the additional gold contents recovered from the oxidised high grade ore deposited at the Herradura leaching pads. This was partly offset by the lower ore grade and decreased volumes of ore processed at Saucito and Ciénega, and the lower volume of ore processed at Fresnillo.

First half attributable by-product lead production decreased 5.2% vs. 1H24 mainly due to the lower ore grade and decrease in volumes of ore processed at Fresnillo and the cessation of mining activities at San Julián DOB, partly mitigated by the higher ore grade at Saucito.

First half attributable by-product zinc production decreased 3.2% vs. 1H24 mainly due to the cessation of mining activities at San Julián DOB and the lower ore grade, decreased recovery rate and lower volume of ore processed at Ciénega, partly mitigated by the higher ore grade at Saucito.

We are sad to report the tragic loss of two of our colleagues in separate fatal incidents, one at Ciénega in June and another at Juanicipio in July. We have redoubled our efforts to instill a safety culture, focusing on identifying preventive measures, training, and maintaining stringent adherence to our safety policies to provide a safer environment for our workforce and contractors.

Our safety indicators improved in 1H25, with the Total Recordable Injury Frequency Rate (TRIFR) and the Lost-time Injury Frequency Rate (LTIFR) decreasing to 6.98 (7.59 in FY 2024) and 4.40 (4.75 in FY 2024), respectively.

Peñoles to buy back Silverstream Contract

Fresnillo has agreed terms for Peñoles to buy back the Silverstream Contract (or “Agreement”) in exchange for US$40 million.

Over the lifetime of the Agreement, Peñoles has paid Fresnillo US$882 million for the approximately 52 million payable ounces of silver produced by the Sabinas mine. The Agreement was signed in 2007 and Fresnillo paid an initial consideration of US$350 million.

Background

On 12 November 2024 Fresnillo announced it had received notification from Peñoles, the owner and operator of the Sabinas mine, that the mine was experiencing operational and financial difficulties impacting silver production and the long-term viability of the mine and consequently of the Agreement. Under the Agreement, Peñoles has the unilateral right to close the mine or indefinitely suspend the mine operations. In such a situation, only a very modest payment, as outlined below, would be due to Fresnillo.

Fresnillo and Peñoles immediately set up a working group to identify a realistic and sustainable solution for the Sabinas mine and the Agreement. Strategic options for the mine considered at the time, given the financial profile of the mine whereby revenues did not cover its operational costs nor the obligations imposed by the Agreement, were: i) changing the terms and conditions of the Silverstream Agreement (increasing the strike price), ii) the transfer of ownership of the mine to Fresnillo (becoming the owner and operator) and other ownership structures, in lieu of the Agreement, or iii) immediate suspension of mine operations for an indefinite period.

In January, following a period of thorough analysis, and based on the information provided by the Sabinas team, including related to the most recent reserves report at the time and cut-off grade, Fresnillo’s technical team, together with Peñoles, defined a new mine plan and sequencing programme. This included mine development, ore volumes, ore grade, recovery rates, sustaining capex, operating costs and cashflow amongst other factors, while also taking into account potential blue sky growth prospects within the Sabinas licence area.

Fresnillo reported a revaluation loss of the Agreement, net of its amortisation and before taxes, of US$182.3 million in its 2024 accounts (published on 4 March 2025), valuing the Agreement at US$258 million before taxes, which was consistent with the expected value of the Sabinas mine at that time.

More recently Fresnillo received an updated reserves report from Peñoles for the Sabinas mine, certified independently by SRK Consulting, which used a rigorous criteria, including higher cut-off grades and analysis of new infill exploration data. This showed a significant reduction in reserves from previous reports (more than 50%). In light of this new information, a revised mine plan and sequencing programme were drawn up which materially impacted future production and free cash flow projections. It became clear the mine was facing more significant challenges than the January review identified.

Subsequently, using the same modelling exercise to value the Sabinas mine, with validation from SRK Consulting, which included the working assumption of Fresnillo as operator being able to increase operating efficiencies by c.35%, through better equipment utilisation, lower absenteeism and other cost savings, Fresnillo, together with Peñoles, determined a new value of the Sabinas mine to be in the range of US$47 to US$50 million (excluding Silverstream settlement payments), substantially below previous estimates. Based on the above analysis and after careful consideration, Fresnillo does not see any realistic prospect of increasing the expected value of the mine in this way nor the possibility of continuing with the Agreement in its current form.

The Board of Fresnillo considered all of the strategic options and determined there to be considerable operational, regulatory, community and financial risk with taking ownership of the mine and concluded that the risk/reward profile was not in line with the Company’s interests, while a mine closure or indefinite suspension of mine operations would result in an immediate end to payments under the Silverstream and only a deferred payment of approximately US$8.6 million due in 2032.

This narrowed the strategic alternatives considered by both parties to: a one-off payment (buyback price) to end the Agreement, or immediate mine closure or indefinite suspension of mine operations, which would have a material impact on the different stakeholders of the Sabinas mine, including workforce and communities. Following negotiations, both parties agreed that US$40 million would be a fair buyback price for ending the Agreement, whilst removing any associated future risk, and provide optionality to Peñoles to avoid a disorderly closure, which could also have indirect adverse consequences for Fresnillo, or suspension of the mine and continue to operate it if they so choose.

Rationale for the Buyback

The decision to end the Agreement therefore follows a comprehensive review by Fresnillo and its independent advisers SRK, of the ongoing operational and financial issues at the Sabinas mine. After carefully considering the strategic options, the Board has concluded that ending the contract through this buyback transaction is the best option for the Company and its shareholders.

The Independent Directors of Fresnillo have received financial advice from BofA Securities in relation to the consideration payable by Peñoles to Fresnillo to buy back the Silverstream agreement.

The Independent Directors believe the valuation offered by the buyback of the Silverstream Agreement is fair and in the best interests of Fresnillo shareholders given the considerable challenges identified.

Therefore, post period end, Fresnillo will receive a one-off payment (buyback price) of US$40 million from Peñoles to buy back the Silverstream Agreement and has written down the value of the Agreement held on the balance sheet to US$40 million as of 30th of June, creating a non-cash US$133.0 million loss after tax and net of the period’s profit amortisation in the 2025 half year income statement. The cash effect will be an inflow of US$40 million in 2H25.

This buyback will result in no production from the Silverstream being recorded in the second half of 2025 nor in subsequent years, though guidance remains unchanged, with 2025 silver production expected to be in the lower part of the range.

Financial results

Total revenue increased by 30.1% to US$1,936.2 million in 1H25, mainly due to higher gold and silver prices and increased volumes of gold sold, partly offset by the decrease in silver ounces sold.

The average realised silver price increased 21.9% from US$27.6 per ounce in 1H24 to US$33.7 per ounce in 1H25, while the average realised gold price rose 45.8%, from US$2,171.9 per ounce in 1H24 to US$3,167.6 per ounce in 1H25. The average realised zinc by-product price remained at US$122.3 cents per pound, while the average realised lead price decreased to US$88.6 cents per pound, down 7.8% vs 1H24.

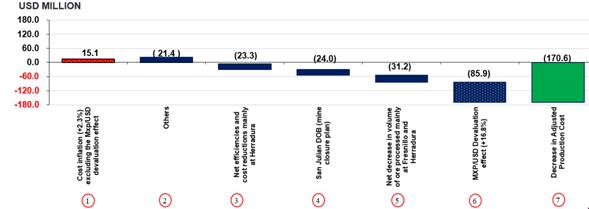

Adjusted production costs[6] decreased by 20.2% to US$673.5 million in 1H25. The US$170.6 million decrease resulted primarily from the devaluation of the Mexican peso vs. the US dollar, the net decrease in volumes of ore processed, mainly at Fresnillo, Herradura and Ciénega, the decrease in adjusted production as a result of the closure of San Julián DOB, and the favourable impact of efficiencies and cost reduction initiatives, mainly at Herradura.

Depreciation decreased 20.6%, primarily due to the closure of San Julián DOB, and to a lesser extent, decreased amortisation of capitalised mining works and lower depletion factors at Saucito and Ciénega.

These favourable effects were partly offset by the less favourable effect of the variation in the change in inventories in 1H25.

The factors mentioned above resulted in a 16.7% decrease in cost of sales compared with 1H24.

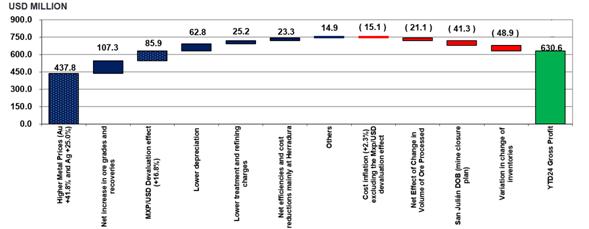

The increase in revenues, together with the decrease in cost of sales, resulted in a 160.7% increase in gross profit to US$1,022.9 million in 1H25.

Driven by an increase in gross profit, EBITDA increased by 102.5%, with EBITDA margin rising from 36.6% in 1H24 to 56.9% in 1H25. Similarly, profit from continuing operations before net finance costs and income tax increased from US$235.1 million in 1H24 to US$860.8 million in 1H25.

The total Silverstream effect recorded in the 1H25 income statement was a net loss of US$190.1 million, before taxes (see “Peñoles to buy back Silverstream Contract” section below).

Despite the Silverstream effect loss, profit from continuing operations before income tax increased 137.7% from US$277.8 million in 1H24 to US$660.3 million in 1H25.

Income tax expense for the period was US$122.2m, up 36.5% from US$89.5 million in 1H24. The effective tax rate, excluding the special mining rights, was 18.5% (1H24: 32.2%), which was below the 30% statutory tax rate. This variance resulted from the revaluation of the Mexican peso/US dollar spot exchange rate on the tax value of assets and liabilities and the effect of the inflation rate (Mexican Consumer Price Index) that impacted the inflationary uplift of the tax base for assets and liabilities.

Profit for the period increased from US$117.7 million in 1H24 to US$467.6 million in 1H25, a 297.3% increase half-on-half as a result of the factors described above. Profit due to non-controlling interests increased 89.0% to US$73.8 million, reflecting the profit generated at Juanicipio, where MAG Silver owns 44% of the outstanding shares. Accordingly, the profit attributable to equity shareholders of the Group was US$393.8 million, a 400.7% increase half-on-half.

Excluding the effects of the Silverstream, profit for the period increased from US$71.2 million to US$600.6 million, up 743.5%.

Cash generated by operations before changes in working capital increased by 101.4% to US$1,103.6 million, mainly as a result of the higher profit from continuing operations generated in the year.

Other proceeds included US$149.5 million from the sale of MAG Silver shares previously held by Fresnillo.

Capital expenditure in 1H25 totalled US$157.9 million, a 7.3% decrease over 1H24. Investments during the period included mine development and stripping, purchase of in-mine equipment, construction of a leaching pad at Herradura, the deepening of the Jarillas shaft at Saucito and investments in tailings dams.

Other uses of funds during the period were dividends paid of US$501.0 million (US$31.0 million in 1H24), income tax, special mining rights and profit sharing paid of US$255.4 million (US$71.4 million in 1H24), and dividends paid to non controlling interests in subsidiaries of US$59.4 million (US$ nil 1H24).

Fresnillo plc continued to maintain a solid financial position during the period with cash, cash equivalents and short-term investments of US$1,823.0 million as of 30 June 2025, increasing 40.5% versus 31 December 2024 and 163.8% versus 30 June 2024.

Interim Dividend

The Board of Directors has declared an interim dividend of 20.8 US cents per Ordinary Share totalling US$153.3 million, which will be paid on 17 September 2025 to shareholders on the register on 15 August 2025. The dividend will be paid in UK pounds sterling unless shareholders elect to be paid in US dollars. This interim dividend is higher than the previous period due to the increase in profit in 1H25, and remains in line with the Group’s dividend policy. This decision was made after a comprehensive review of the Group’s financial situation, ensuring that the Group is well placed to meet its current and future financial requirements, including its development and exploration projects.

As previously disclosed, the corporate income tax reform introduced in Mexico in 2014 created a withholding tax obligation of 10% (including to foreign nationals). The 2025 interim dividend will be subject to this withholding obligation.

Outlook

Attributable silver production guidance for 2025, and expected production for 2026 and 2027, have been adjusted for the Silverstream buyback, with no further Silverstream contribution from 2H25 onwards.

Silver production guidance for 2025, and silver production expectations for 2026 and 2027, for all other operations remain unchanged.

2025 gold production guidance has been increased to reflect the better performance at Herradura. 2025 lead and zinc production guidance remain unchanged, as well as gold, lead and zinc production expectations for 2026 and 2027.

| Fresnillo plc Production Guidance Update 2025-2027 | ||||

|---|---|---|---|---|

| Metric | Previous Guidance 2025 | Updated Guidance 2025 | Expected 2026 | Expected 2027 |

| Attributable silver production, incl. silverstream (moz) | 49.0 to 56.0 | 47.5 to 54.5 | 45 to 51 | 45 to 51 |

| Attributable gold production (koz) | 525 to 580 | 550 to 590 | 515 to 565 | 535 to 595 |

| Attributable lead production (kt) | 56 to 62 | 56 to 62 | 54 to 59 | 51 to 57 |

| Attributable zinc production (kt) | 93 to 103 | 93 to 103 | 85 to 95 | 93 to 103 |

| Silver eq. (moz)1 | 91 to 102 | 91 to 102 | 88 to 98 | 90 to 101 |

1 Silver equivalent ounces calculated using assumed metal prices; refer to company disclosure for details.

Exploration expenses for 2025 are expected to be c. US$190 million.

Capex for 2025 has been revised from US$530 million to US$450 million primarily due to delays in development and the construction of ventilation robbins at Saucito and the installation of the conveyor belt at Juanicipio, the resequencing of sustaining capex and through extending the life of current in-mine equipment.

Analyst Presentation

Fresnillo plc will be hosting a webcast presentation for analysts and investors today at 9:00am (GMT). A link to the webcast will be made available on Fresnillo’s homepage: www.fresnilloplc.com or can be accessed directly here:

https://kvgo.com/IJLO/Fresnillo_1H25_Interim_Results

For those unable to access the webcast, a conference line will also be provided, please pre-register here:

https://www.netroadshow.com/events/login?show=833d4ea7&confId=84777

For further information, please visit our website: www.fresnilloplc.com or contact:

| Fresnillo plc Investor Relations Contact Information | |

|---|---|

| Contact | Details |

| Fresnillo plc | — |

| London Office, Gabriela Mayor, Head of Investor Relations | Tel: +44(0)20 7339 2470 |

| London Office, Mark Mochalski | — |

| Mexico City Office, Ana Belém Zárate | Tel: +52 55 52 79 3206 |

| Sodali | — |

| Peter Ogden | Tel: +44(0)20 7250 1446 |

ABOUT FRESNILLO PLC

Fresnillo plc is the world’s largest primary silver producer and Mexico’s largest gold producer, listed on the London and Mexican Stock Exchanges under the symbol FRES.

Fresnillo plc has eight operating mines, all of them in Mexico – Fresnillo, Saucito, Juanicipio, Ciénega, Herradura, Soledad-Dipolos1, Noche Buena2 and San Julián Veins and four advanced exploration projects – Orisyvo, Rodeo, Guanajuato and Tajitos as well as a number of other long term exploration prospects.

Fresnillo plc has mining concessions and exploration projects in Mexico, Peru and Chile.

Fresnillo plc’s goal is to maintain the Group’s position as the world’s largest primary silver company and Mexico’s largest gold producer.

1 Operations at Soledad-Dipolos are currently suspended.

2 Mineral extraction concluded in May 2023, however leaching of gold content inventories at the leaching pads continues.

FORWARD LOOKING STATEMENTS

Information contained in this announcement may include ‘forward-looking statements’. All statements other than statements of historical facts included herein, including, without limitation, those regarding the Fresnillo Group’s intentions, beliefs or current expectations concerning, amongst other things, the Fresnillo Group’s results of operations, financial position, liquidity, prospects, growth, strategies and the silver and gold industries are forward-looking statements. Such forward-looking statements involve risk and uncertainty because they relate to future events and circumstances. Forward-looking statements are not guarantees of future performance and the actual results of the Fresnillo Group’s operations, financial position and liquidity, and the development of the markets and the industry in which the Fresnillo Group operates, may differ materially from those described in, or suggested by, the forward-looking statements contained in this document. In addition, even if the results of operations, financial position and liquidity, and the development of the markets and the industry in which the Fresnillo Group operates are consistent with the forward-looking statements contained in this document, those results or developments may not be indicative of results or developments in subsequent periods. A number of factors could cause results and developments to differ materially from those expressed or implied by the forward-looking statements including, without limitation, general economic and business conditions, industry trends, competition, commodity prices, changes in regulation, currency fluctuations (including the US dollar and Mexican Peso exchanges rates), the Fresnillo Group’s ability to recover its reserves or develop new reserves, including its ability to convert its resources into reserves and its mineral potential into resources or reserves, changes in its business strategy and political and economic uncertainty.

H1 2025 Operational Review

Production

| Fresnillo plc Production Summary H1 2025 vs H1 2024 | |||

|---|---|---|---|

| Metric | H1 2025 | H1 2024 | % Change |

| Silver (koz) | 23,943 | 27,155 | -11.8 |

| Silverstream production (koz) | 940 | 1,014 | -7.3 |

| Total Silver production (koz) | 24,882 | 28,169 | -11.7 |

| Gold (oz) | 313,840 | 270,872 | 15.9 |

| Lead (t) | 30,182 | 31,830 | -5.2 |

| Zinc (t) | 53,651 | 55,397 | -3.2 |

First half attributable silver production of 24.9 moz (including Silverstream) decreased 11.7% vs. 1H24, mainly due to the cessation of mining activities at San Julián DOB, a decrease in volume of ore processed, lower ore grade and decreased recovery rate at Ciénega and lower ore grade at Juanicipio.

First half attributable gold production of 313.8 koz, increased 15.9% vs. 1H24 mainly due to the higher ore grade and the additional gold inventories processed at Herradura, partly offset by the lower ore grade and decreased volumes of ore processed at Saucito and Ciénega and the lower volume of ore processed at Fresnillo.

First half attributable by-product lead production decreased 5.2% vs. 1H24 mainly due to the lower ore grade and decrease in volumes of ore processed at Fresnillo and the cessation of mining activities at San Julián DOB, partly mitigated by the higher ore grade at Saucito.

First half attributable by-product zinc production decreased 3.2% vs. 1H24 mainly due to the cessation of mining activities at San Julián DOB and the lower ore grade, decreased recovery rate and lower volume of ore processed at Ciénega, partly mitigated by the higher ore grade at Saucito.

Fresnillo mine production

| Fresnillo plc Fresnillo Mine Production and Ore Grades H1 2025 vs H1 2024 | |||

|---|---|---|---|

| Metric | H1 2025 | H1 2024 | % Change |

| Ore Processed (t) | 1,040,826 | 1,211,992 | -14.1 |

| Production | |||

| Silver (koz) | 5,151 | 5,259 | -2.1 |

| Gold (oz) | 19,831 | 23,155 | -14.4 |

| Lead (t) | 10,464 | 12,625 | -17.1 |

| Zinc (t) | 22,213 | 22,928 | -3.1 |

| Ore Grades | |||

| Silver (g/t) | 170 | 151 | 12.6 |

| Gold (g/t) | 0.80 | 0.80 | 0.0 |

| Lead (%) | 1.20 | 1.21 | -0.8 |

| Zinc (%) | 2.85 | 2.59 | 10.0 |

| Pyrite Concentrates Processed (t) | 38,606 | 31,388 | 23.0 |

| Production (Pyrite Concentrates) | |||

| Silver (koz) | 754 | 613 | 23.0 |

| Gold (oz) | 958 | 671 | 42.8 |

First half silver production decreased 2.1% vs 1H24 respectively, driven by the decrease in volume of ore processed due to the lower contribution from Candelaria, East and San Alberto, partly mitigated by the higher ore grade.

Mine development rates decreased 2.4% half on half to an average of 3,033m per month in 1H25 (1H24: 3,109m per month), primarily due to lower equipment availability in 1Q25, which was reverted in 2Q25.

First half by product gold production decreased 14.4% vs IH24 mainly as a result of the decrease in volume of ore processed.

The silver ore grade in 2025 is expected to be in the range of 160 to 180 g/t, while the gold ore grade is estimated to be between 0.60 to 0.70 g/t.

Saucito mine production

| Fresnillo plc Saucito Mine Production and Ore Grades H1 2025 vs H1 2024 | |||

|---|---|---|---|

| Metric | H1 2025 | H1 2024 | % Change |

| Ore Processed (t) | 1,151,176 | 1,174,570 | -2.0 |

| Production | |||

| Silver (koz) | 6,734 | 6,811 | -1.1 |

| Gold (oz) | 31,437 | 37,658 | -16.5 |

| Lead (t) | 13,615 | 10,566 | 28.9 |

| Zinc (t) | 21,411 | 15,603 | 37.2 |

| Ore Grades | |||

| Silver (g/t) | 206 | 203 | 1.5 |

| Gold (g/t) | 1.12 | 1.29 | -13.2 |

| Lead (%) | 1.38 | 1.05 | 31.4 |

| Zinc (%) | 2.38 | 1.72 | 38.4 |

| Pyrite Concentrates Processed (t) | 34,880 | 45,034 | -22.5 |

| Production (Pyrite Concentrates) | |||

| Silver (koz) | 262 | 233 | 12.4 |

| Gold (oz) | 538 | 667 | -19.3 |

First half silver production slightly decreased 1.1% vs. 1H24 mainly due to the lower volume of ore processed as a result of the reduced contribution from the West and Central areas and, to a lesser extent, the lower recovery rate. This was partly mitigated by the higher silver ore grade from additional cut and fill stopes with high silver content.

First half by-product gold production decreased 16.5% vs. 1H24 respectively, mainly due to the lower ore grade and decreased volume of ore processed.

Mine development rates decreased 14.5% half on half to an average of 2,439m per month in 1H25 (1H24: 2,854m per month), primarily due to lower availability of contractors’ bolting equipment.

The silver ore grade for 2025 is expected to be in the range of 200-220 g/t, while the gold grade is estimated to be between 0.90-1.10 g/t.

Juanicipio – Attributable

| Fresnillo plc Juanicipio Mine Production and Ore Grades H1 2025 vs H1 2024 | |||

|---|---|---|---|

| Metric | H1 2025 | H1 2024 | % Change |

| Ore Processed (t) | 380,538 | 370,875 | 2.6 |

| Production | |||

| Silver (koz) | 4,859 | 5,280 | -8.0 |

| Gold (oz) | 11,294 | 10,744 | 5.1 |

| Lead (t) | 5,619 | 4,741 | 18.5 |

| Zinc (t) | 9,500 | 8,510 | 11.6 |

| Ore Grades | |||

| Silver (g/t) | 423 | 488 | -13.3 |

| Gold (g/t) | 1.23 | 1.26 | -2.4 |

| Lead (%) | 1.66 | 1.46 | 13.7 |

| Zinc (%) | 3.12 | 2.74 | 13.9 |

| Pyrite Concentrates Processed (t) | 3,995 | 0 | N/A |

| Production (Pyrite Concentrates) | |||

| Silver (koz) | 54 | 0 | N/A |

| Gold (oz) | 74 | 0 | N/A |

Attributable first half silver production decreased vs 1H24 mainly due to the lower ore grade in accordance with the mine plan, partly offset by the higher volume of ore processed.

Attributable first half gold production increased 5.1% vs 1H24 due to the improved recovery rate and higher volume of ore processed, partly offset by the lower ore grade.

In 2Q25, production of pyrites concentrate at Juanicipio started, with attributable production of 54,147 silver ounces and 73.5 gold ounces during the period.

The silver ore grade in 2025 is expected to be in the range of 380-430 g/t, while the gold grade is estimated to be between 1.2-1.4 g/t.

Ciénega mine production

| Fresnillo plc Ciénega Mine Production and Ore Grades H1 2025 vs H1 2024 | |||

|---|---|---|---|

| Metric | H1 2025 | H1 2024 | % Change |

| Ore Processed (t) | 482,599 | 519,542 | -7.1 |

| Production | |||

| Gold (oz) | 17,678 | 20,668 | -14.5 |

| Silver (koz) | 1,653 | 2,581 | -36.0 |

| Lead (t) | 484 | 1,634 | -70.4 |

| Zinc (t) | 527 | 1,644 | -67.9 |

| Ore Grades | |||

| Gold (g/t) | 1.24 | 1.34 | -7.5 |

| Silver (g/t) | 133 | 179 | -25.7 |

| Lead (%) | 0.22 | 0.48 | -54.2 |

| Zinc (%) | 0.30 | 0.59 | -49.2 |

First half gold production decreased 14.5% vs. 1H24 respectively, mainly due to the lower volume of ore extracted from areas such as Jessica Transversal and Vetas Angostas with higher ore grades, and the depletion of Taspana.

First half silver production decreased 36.0% vs. 1H24 driven by the lower ore grade and decreased recovery rate due to the higher portion of oxides processed at the flotation plant following the depletion of sulphides from the Taspana. The lower volume of ore processed also contributed to the decrease in silver production.

While metallurgical testwork is ongoing to find alternatives to increase recovery in oxides, positive exploration results are expected to provide higher gold production than had been anticipated during 2H25, partly offsetting lower silver production.

The gold and silver ore grades for 2025 are estimated to be in the ranges of 1.1-1.3 g/t and 130-150 g/t, respectively.

San Julián Veins production

| Fresnillo plc San Julián Mine Veins Production and Ore Grades H1 2025 vs H1 2024 | |||

|---|---|---|---|

| Metric | H1 2025 | H1 2024 | % Change |

| Ore Processed Veins (t) | 616,058 | 592,646 | 4.0 |

| Production Veins | |||

| Gold (oz) | 25,919 | 24,326 | 6.5 |

| Silver (koz) | 4,218 | 4,061 | 3.9 |

| Ore Grades Veins | |||

| Gold (g/t) | 1.37 | 1.35 | 1.5 |

| Silver (g/t) | 234 | 234 | 0.0 |

First half gold and silver production increased vs. 1H24 driven by the increased volume of ore processed due to the ongoing optimisation of the maintenance programme, and the higher ore grades.

Silver and gold ore grades in 2025 are expected to be in the ranges of 210-230 g/t and 1.10-1.30 g/t, respectively.

Herradura mine production

| Fresnillo plc Herradura Mine Production and Ore Grades H1 2025 vs H1 2024 | |||

|---|---|---|---|

| Metric | H1 2025 | H1 2024 | % Change |

| Ore Processed (t) | 10,125,225 | 10,451,639 | -3.1 |

| Total Volume Hauled (t) | 48,504,399 | 49,234,362 | -1.5 |

| Production | |||

| Gold (oz) | 197,431 | 141,686 | 39.3 |

| Silver (koz) | 255 | 219 | 16.4 |

| Ore Grades | |||

| Gold (g/t) | 0.71 | 0.63 | 12.7 |

| Silver (g/t) | 1.22 | 1.18 | 3.4 |

First half production increased vs. 1H24 driven by the optimisation of mine operation standards for better selectivity, which led to higher gold ore grade but lower volume of ore processed. In addition, gold contents recovered from the oxidised high grade ore deposited at the leaching pads in 4Q24 complemented production.

The average gold ore grade in 2025 is expected to be in the range of 0.50-0.70 g/t.

Noche Buena mine production

First half gold production totalled 8,680 ounces, a 14.9% decrease when compared with 1H24. As previously announced, mining activities concluded in May 2023, and the closure plan continues as expected.

Below we provide an update on other projects which are expected to contribute to our medium and long term growth. These projects have not yet been approved by the Board and are subject to ongoing internal review. However, certain minor works and exploration activities might be in progress in preparation for Board approval and as such, are included within the 2024 approved capex and exploration budget.

Advanced exploration projects

Rodeo

Rodeo is an open pit, heap leaching gold project located in central Durango state. 1.4 million ounces of gold occur in a volcanic rock-hosted disseminated ore body showing thorough oxidation down to depths exceeding 200 metres. Good metallurgical recoveries have been obtained from ores coming from a projected low strip ratio open pit.

After formalising agreements with the intervening communities during 2024, a drilling programme started in 1H25, focused on obtaining additional samples for detailed metallurgical investigations and to test for extensions of mineralisation; 5,417 metres have been collared, proving good continuity of the ore bodies. Additional underexplored targets will be drilled as well during 2H25.

After completion of the drilling programme and the metallurgical test work, an update of the mineral resources estimation and associated preliminary economic assessment will follow, incorporating considerations for development layout, water and energy supply, and other technical issues currently under investigation. Results are expected during mid-year 2026. A region-wide community and government engagement programme continues to be strengthened; an excellent response from involved parties has been received.

Orisyvo

Orisyvo is a world-class, high-sulphidation epithermal, disseminated gold deposit located in the Sierra Madre mountains of Chihuahua state, hosting open-pit constrained total resources of 9.6 million ounces of gold.

Prefeasibility-level studies were completed during 1H25, focusing on the development of an underground operation targeting the high-grade core of the ore deposit. Preliminary trade-off studies of energy and water supply, road access, mineral processing, and tailings storage facilities have been completed. Although results were positive, it is expected that the Orisyvo development will take longer than expected, mostly due to challenges associated with the potentially large capital expenditure and the mining rates required to increase production volumes, along with the timing of the ongoing environmental permitting and indigenous consultation processes required. Additional detailed work is ongoing to address these issues. The land acquisition strategy and the community and government engagement programme are advancing as scheduled with good results.

Tajitos

Tajitos is a low strip ratio open-pit, heap-leach, disseminated gold project located in the Herradura Corridor of northwestern Sonora state, hosting a resource of 1.0 million ounces of gold, 90% in the indicated category.

In 1H25, a third stage of column metallurgical test work was completed over three resource domains, yielding positive results that will be applied to the ongoing update of the mineral resource estimation. Results of a new preliminary economic assessment are expected at the end of the year. Environmental studies associated with the potential development of this project are advancing well, along with our regional community relations programme and the evaluation of alternatives for water and energy supply and potential synergies with the existing infrastructure of the Herradura operations.

The exploration of the western portion of the district continued, collaring 5,755 metres of core and reverse circulation drilling during 1H25, testing additional targets for both disseminated and vein-type gold mineralisation, delivering promising results.

Guanajuato

Guanajuato is a historic, world-class gold and silver epithermal vein field stretching more than 40 kilometres along the central Mexican state of Guanajuato. During 1H25, exploration was focused on the southern part of the district, with exploration drilling amounting to 46,442 metres of step-out holes from the known mineralisation. Simultaneously, scoping level studies are advancing as scheduled, including metallurgical investigations, environmental permitting, and mining and processing alternatives, supported by our community engagement programmes.

Exploration continued in the central portion of the district at a slower pace, with 3,791 metres of core drilling completed at the Torres and Peregrina areas.

Exploration

Exploration drilling meterage completed by Fresnillo plc during 1H25 amounted to 359,268 metres, 82% of which was devoted to brownfields targets. The focus of the mine exploration teams lies on infill drilling to upgrade the resources category from inferred to indicated, to foster reserve replenishment, and on infill drilling of reserves to improve their certainty for short and medium-term mine planning. At Ciénega, emphasis was also put on resource extension drilling over a recently discovered new set of veins. Brownfields exploration is also carried out by the Exploration Division, devoting 40% of its drilling metres for the period to the evaluation of targets around the Fresnillo and San Julián districts and the Tajitos and Central Guanajuato projects.

In 1H25, greenfield exploration in Mexico included 4,027 and 1,499 metres drilled at the Lucerito and Candameña projects. In Peru, 2,059 metres were completed at the Chiclayo project with modest results, and a strengthened community relations plan is active throughout the country, focusing on two promising projects. In Chile, 1,546 core drilling metres were completed at Capricornio, a joint-venture project with SQM, and an environmental study was submitted to allow for continued exploration over several underexplored targets remaining in the district.

Evaluation of Fresnillo properties in Mexico, Peru, and Chile is advancing to continue strengthening and optimising our portfolio; some selected third-party projects are under evaluation as well in the three countries where we operate.

In the first six months, US$76.7 million of exploration expenses were recorded in the income statement, a similar amount to that invested in 1H24. Total risk capital invested in exploration for the full year 2025 is expected to be US$190 million.

Related party transactions

Details of related party transactions that have taken place in the first six months of the current financial year are detailed in note 16 of the interim consolidated financial statements.

Sustainability performance

At Fresnillo, our purpose – to contribute to the wellbeing of people through the sustainable mining of silver and gold – shapes both our long-term vision and our daily actions, with a clear focus on the issues most material to our business and stakeholders. Next, we outline the progress we’ve made in the first half of 2025, as we continue evolving toward a more responsible, resilient, and inclusive mining model.

People

Our workforce is essential to fulfilling our organisational purpose. We aim to foster an inclusive culture that values diversity and empowers all employees to reach their full potential.

Workforce figures remained largely stable during the first half of 2025, as shown in Tables 1 and 2.

Table 1. Workforce composition

| Fresnillo plc Workforce Composition June 2025 vs December 2024 | |||

|---|---|---|---|

| Metric | As at June 30, 2025 | As at December 31, 2024 | % Change |

| Unionised employees | 5,532 | 5,588 | -1.00 |

| Non-unionised employees | 1,597 | 1,591 | 0.38 |

| Total unionised and non-unionised employees | 7,129 | 7,179 | -0.70 |

| Unionised and non-unionised women (%) | 14.80 | 14.57 | — |

| Contractors | 10,838 | 10,916 | -0.71 |

| Total workforce | 17,967 | 18,095 | -0.71 |

| Total women (%) | 12.76 | 12.46 | — |

Table 2. Turnover

| Fresnillo plc Workforce Turnover June 2025 vs June 2024 | ||

|---|---|---|

| Metric | As at June 30, 2025 | As at June 30, 2024 |

| Voluntary turnover (%) | 2.06 | 4.16 |

| Total turnover (%) | 3.77 | 6.87 |

We met our 2025 gender representation targets ahead of schedule at the end of 2024, reaching 12% of our workforce and 8% of managerial roles held by women. Building on this momentum, we continued to strengthen female participation across operations. As of June 2025, women represented 14.80% of unionised and non-unionised employees (up from 14.57% as of December 2024) and 12.76% of our total workforce, including contractors (compared to 12.46% as of December 2024). We are currently defining the next phase of our gender equity strategy.

Earlier this year, Herradura received the highest distinction of the Women in Mining (WIM) Seal – an initiative by WIM Mexico that evaluates workplace infrastructure, policies, and practices from a gender perspective. Building on this recognition, we are scaling our efforts through a comprehensive programme aligned with the Women’s Empowerment Principles (WEPs), aiming to embed a gender lens across processes and decision-making.

As part of this approach, we have established an Inclusion Committee composed of representatives from all mining units, exploration, and corporate offices. Its purpose is to drive alignment, prioritise initiatives with operational relevance, and support the integration and advancement of women in our industry.

Safety

Safety is a fundamental value – one rooted in our deep respect for life and embodied in the daily practice of our ‘I Care, We Care’ philosophy. We prioritise the health, safety, and overall wellbeing of our workforce by fostering a culture of care, accountability, and prevention.

Between 2018 to June 2025, we achieved a 66% reduction in Total Recordable Injury Frequency Rates (TRIFR), and a 49% reduction in Lost Time Injury Frequency Rates (LTIFR) per million hours worked. In the first half of 2025, we continued to improve our performance compared to the previous year:

· TRIFR decreased to 6.98, from 7.59 in 2024

· LTIFR decreased to 4.40, from 4.75 in 2024

Despite this progress, our results are overshadowed by the loss of two of our colleagues – one at Ciénega, and another at Juanicipio in July. We extend our deepest condolences to their family, friends and colleagues. These losses confront us with a painful truth: our work remains unfulfilled as long as lives are at risk. We are conducting thorough investigations to determine the root causes and to ensure the conditions that led to these regrettable events are not repeated.

Table 3. TRIFR and LTIFR performance*

| Fresnillo plc Safety Performance Metrics June 2025 vs December 2024 | |||

|---|---|---|---|

| Metric | As at June 30, 2025 | As at December 31, 2024 | % Change |

| Total Recordable Injury Frequency Rates (TRIFR) | 6.98 | 7.59 | -8.04 |

| Lost Time Injury Frequency Rates (LTIFR) | 4.40 | 4.75 | -7.37 |

| Fatal accidents | 1 | 2 | -50.00 |

* Frequencies for every 1,000,000 hours worked

Our ‘I Care, We Care’ philosophy addresses inherent risks through five strategic pillars: leadership, accountability, behaviours risk competencies, system risks competencies, and learning environment. The technical components prioritise critical risk management – those with the potential for fatalities or serious harm – whilst the operational framework ensures that all risks are addressed systematically. They also aim to establish critical controls and performance standards across all business process, empowering personnel to make responsible decisions in their daily work. Some of the highlights of the period across these pillars are:

1) Leadership:

- Advanced the deployment of Leadership Practices across the chain of command, including business partners.

- Continued to consolidate Leadership Practices’ quality by coaching team leaders, including union representatives and health and safety commissions.

- Launched pilots to assess the quality of Leadership Practices.

2) Accountability:

- Strengthened engagement with business partners – both contract owners and representatives – through quarterly performance reviews, recognition schemes, and accountability processes.

3) Behaviour risk competencies:

- Held operational workshops on ‘Behaviours in the Face of Risk’, combining classroom theory, practical field exercises, and one-on-one coaching sessions with safety specialists.

- Conducted capacity building training for middle management and business partners on risk recognition and management.

- Developed and rolled-out the ‘I Care, We Care’ verification process and standard.

4) System risk competencies:

- Implemented pilots to begin testing job-specific verification tools.

- Issued updates to key safety standards (Leadership Practices, Incident Management, and Safe Work Protocols) focused on both critical and general risks.

- Introduced a new technical performance standard for the safe handling of explosives and blasting operations.

5) Learning environment:

- Continued reinforcement of transversal learning from significant safety events.

- Strengthened the ‘I Care, We Care’ Operational Committee, including binding commitments and participatory verifications to evaluate risk control performance and the implementation of technical standards.

We strive toward our aspirational goal of zero fatalities by continuously strengthening the systems and practices that bring our ‘I Care, We Care’ philosophy to life. This approach reflects our unwavering commitment to safe operations, supports a mature preventive safety culture, and protects the wellbeing of our workforce.

Health

We prioritise the health, safety, and overall wellbeing of our workforce by fostering a safe and healthy work environment.

In recent years, our health strategy has evolved beyond traditional occupational health programmes, establishing five lines of action to promote a healthier, safer, and more productive workplace:

1. Health surveillance

2. Integral wellbeing

3. Industrial care

4. Development and innovation

5. Emergency preparedness

Mental health continues to be a growing area of focus in the company. To support this commitment, we hired full-time psychologists and a mental health coordinator to lead all related initiatives. This team also delivers Behavioural Awareness Process (BAP) workshops – a group intervention based on a cognitive-behavioural approach, designed to strengthen participants’ psychological, emotional, and social capabilities, fostering mature behaviour and an assertive attitude. Additional responsibilities include brief and emergency care, emotional crisis support, psychological consultations, and psychometric assessments for new hires.

Under our health surveillance strategy, we conducted periodic medical screenings and examinations in 1H25, representing 24% of our annual target. We also continued preventive efforts focused on female-specific conditions through gynaecological check-ups. To help ensure safe operations and workforce alertness, regular alcohol and drug testing was carried out across our operations.

Environment

We optimise resource consumption to reduce environmental impact and take accountability for our footprint.

As part of our ongoing efforts to replace groundwater consumption with treated wastewater in the Fresnillo District, the Proaño water potabilization plant was inaugurated earlier in the year, with the participation of state government officials and company representatives. The project will benefit families in the region by improving access to clean water, as treated mine water will supplement the local potable water system.

Beyond water resource management, we continued advancing our biodiversity commitments. During the period, Herradura renewed its agreement with the Sonora State Commission for Ecology and Sustainable Development (CEDES) to conserve the Sonoran pronghorn, a protected species native to the region. The agreement sets out joint actions to preserve and restore the pronghorn population in its natural habitat through monitoring, ecosystem protection, environmental education, and sustainable management programmes.

Marking the launch of our high-potential environmental strategy, we released the Critical Environmental Risk Portfolio – a tool designed to help each site identify its most critical environmental risks and implement standardised and consistent critical controls to prevent adverse impacts.

In parallel, we are sustaining our efforts on climate mitigation and energy transition. We maintained renewable electricity consumption at similar levels to 2024 ( 86.6%), exceeding our 2030 target of 75%. Nevertheless, we anticipate a small decrease towards the year end, due to the depletion of the energy inventory of Eólica de Coahuila windfarm, but do not consider this decrease material.

Understanding future consumption patterns is also essential to support our decarbonisation targets, we are also strengthening and documenting our energy demand forecasting through a multidisciplinary approach, aligned with mine development and expected consumption increases tied to infrastructure changes in our mines and plants. As we continue to refine this process in connection with our Life of Mine (LOM) plans, we aim to gain greater clarity on potential growth scenarios and future energy needs.

Tailings Storage Facilities

We implement best practices in governance and engineering across our Tailings Storage Facilities (TSFs), with a firm commitment to safeguarding local communities and the environment through responsible waste management.

Our facilities are developed in accordance with our Tailings Management System (TMS), which incorporates international best practices from the Canadian Dam Association (CDA), Mining Association of Canada (MAC), International Commission on Large Dams (ICOLD) and the International Council on Mining and Metals (ICMM). The TMS ensures designs are grounded in site-specific data and tailings characterisation, applying the best available technologies and standards.

In recent years, we have strengthened our approach to TSF planning and design, with a focus on long-term capacity, operational safety, and alignment with the LOM of each site. Reflecting this long-term approach, several strategic milestones were achieved during the first half of 2025:

- At Juanicipio, the construction of cell 2 was completed in June. Planning is already underway for the next facility.

- At Herradura, the construction of TSF2 Stage 1 began in early 2025, with additional stages to follow.

- At Ciénega, elevation works of TSF3 were completed in May, increasing storage capacity.

- At San Julián, we finalised the engineering design for its next raise, with construction set to begin shortly.

- At Fresnillo, construction of the new TSF Fátima Norte is underway. This will enable development of Fátima Sur, a larger, long-term facility.

Community Relations

We earn and maintain the trust of local communities through meaningful engagement, support for their most pressing priorities, and accountability for our impacts – strengthening our social licence to operate.

We maintain our social licence to operate by engaging local communities through respectful, trust-based relationships rooted in a deep understanding of their culture, traditions, and local priorities. Community participation begins in the early stages of exploration and continues throughout the lifecycle of our operations – extending beyond mine closure.

In collaboration with civil society and government partners, we implement strategic programmes aligned with the UN Sustainable Development Goals (SDGs). These initiatives focus on improving access to education, supporting development and wellbeing, strengthening public health, expanding water access, and conserving biodiversity and ecosystems.

During the first half of 2025, we continued to advance our Social Involvement programme, which is designed to reinforce the connection between our personnel and local communities. Through clear, values-based communication, we aim to highlight our role as a responsible corporate citizen. We also involved our business partners in these efforts, encouraging their participation in community engagement activities and the promotion of human rights and responsible conduct.

The following initiatives reflect our alignment with the UN Sustainable Development Goals, structured across key themes relevant to our operations’ local context. Together, these efforts reflect our commitment to creating long-term value for people, the environment, and the communities where we operate.

SDG 3: Good Health and Wellbeing

In collaboration with the UNAM Foundation, we conducted Community Health Campaigns in Ciénega, San Julián, and the Fresnillo District. These campaigns provided dental services, optometry consultations – including the distribution of corrective lenses – and physiotherapy sessions, benefitting nearly 4,500 individuals.

We also continued implementing the Leaders on the Horizon programme with our partner FutbolMas, which promotes community development through sports. The programme fosters values such as peace, resilience, self-esteem, leadership, and integrity among children and youth. During the period, we concluded the first phase of the programme in La Lagunita, near San Julián. In Guanajuato, implementation neared completion, while in Herradura, we continued to organise socio-sports activities and manage an inter-school sports league. We also maintained operations at our baseball and basketball academies, along with the Santos-Fresnillo football academy.

SDG 6: Clean Water and Sanitation

To help address water scarcity in high-stress regions, we advanced infrastructure projects and collaborated with civil society and government partners. In Herradura, we completed the rehabilitation of wells in the La Almita and 15 de Septiembre communities and continued supporting water access for Mineral de Peregrina, Mineral del Cedro, and Calderones.

In Ciénega, we maintained water delivery to local collection points. In San Julián, we are making progress on consolidating a collective water system in partnership with AC FORMAC and the Chihuahua state government. In Saucito del Poleo, we continue to support local authorities in securing a replacement well to ensure continued water availability.

Sustainable Development Goal 4: Quality Education

We sponsored five teams in the Laguna Regional FIRST Robotics competition. Notably, Kanaritech 9499, composed of Tarahumaran students from the Sierra of Chihuahua and linked to our Orysivo project, received the Judges’ Award for outstanding performance.

Through our Excellence Scholarship Programme, which now includes additional universities via new collaboration agreements, we continued to support academic achievement. During the 2024-2025 academic year, ten students graduated from partner public universities. 17 more are currently enrolled at La Salle University (Laguna and Northwest campuses), including one recent graduate from Caborca, Sonora.

We continued delivering educational programmes in partnership with academic institutions and local education authorities. Under the ‘PREST MATH’ initiative – implemented with INNOVEC and the education ministries of Chihuahua and Sonora – we delivered training and digital learning modules to strengthen primary-level mathematics in Herradura and San Julián. In the Fresnillo District, the programme was temporarily paused due to internal adjustments within the Zacatecas Education Ministry.

The ‘Picando Letras’ programme remained active in Herradura and Ciénega, in partnership with Ensamble Alejandría. This initiative promotes reading comprehension and includes the ‘Tools for Peacebuilding’ module, which supports stress reduction and emotional wellbeing for children and youth in vulnerable settings. In the Fresnillo District, the programme remains paused due to similar circumstances.

Sustainable Development Goal 8: Decent Work and Economic Growth

We promote sustainable local development by supporting entrepreneurship and skills-building initiatives in partnership with NGOs, civil society, and all levels of government. In Herradura, we launched training workshops for 20 entrepreneurs in collaboration with Pro Empleo, with a second group starting in the Fresnillo District. Development consultancies for small businesses remained ongoing in Ciénega and San Julián.

In the Fresnillo District, we also continued skills development programmes in coordination with the Rural Development Education Brigade 46 and the municipal DIF, contributing to the entrepreneurial skills.

Sustainable Development Goal 15: Life on Land

In recognition of World Environment Day, we organised our annual Environmental Fairs across all mining units. These events featured educational and cultural activities aimed at fostering environmental awareness and promoting sustainable practices.

In Ciénega, we led a clean-up campaign with participation from employees, business partners, students, and community members. At our exploration offices and the Guanajuato project, we carried out a reforestation campaign in collaboration with the University of Guanajuato and local communities. In Herradura and the Fresnillo District, efforts focused on school-based environmental talks and awareness activities delivered in partnership with local governments and NGOs.

FINANCIAL REVIEW

The interim consolidated financial statements of the Group for the six months ended 30 June 2025 have been prepared in accordance with IAS 34 Interim Financial Reporting as issued by the IASB and as adopted by the UK. All comparisons refer to the first halves of 2025 and 2024, unless otherwise noted. The financial information and half year on half year variations are presented in US dollars, except where indicated. Management recommends reading this section in conjunction with the Interim Financial Statements and their accompanying Notes.

INCOME STATEMENT

| Fresnillo plc Financial Performance H1 2025 vs H1 2024 | ||||

|---|---|---|---|---|

| Metric | H1 2025 (US$ million) | H1 2024 (US$ million) | Amount Change (US$ million) | % Change |

| Adjusted revenue7 | 1,982.9 | 1,560.2 | 422.7 | 27.1 |

| Total revenue | 1,936.2 | 1,488.3 | 447.9 | 30.1 |

| Cost of sales | 913.2 | 1,095.9 | (182.7) | (16.7) |

| Gross profit | 1,022.9 | 392.4 | 630.6 | 160.7 |

| Exploration expenses | 76.7 | 77.2 | (0.5) | (0.7) |

| Operating profit | 860.8 | 235.2 | 625.6 | 266.0 |

| EBITDA8 | 1,102.1 | 544.2 | 557.9 | 102.5 |

| Income tax expense, including special mining rights | 192.8 | 160.1 | 32.7 | 20.4 |

| Profit for the period | 467.6 | 117.7 | 349.9 | 297.3 |

| Profit for the period, excluding post-tax Silverstream effects | 600.6 | 71.2 | 529.4 | 743.5 |

| Basic and diluted earnings per share (US$/share)5 | 0.534 | 0.107 | 0.427 | 399.1 |

| Basic and diluted earnings per share, excluding post-tax Silverstream effects (US$/share) | 0.715 | 0.044 | 0.671 | 1,525.0 |

5 EPS is earnings per share.

7 Adjusted revenue is revenue before adjustments for treatment and refining charges.

8 EBITDA is earnings before interest, taxes, depreciation, and amortization.

The Group’s financial results are largely determined by the performance of our operations. However, there are other factors such as a number of macroeconomic variables, that lie beyond our control and which affect financial results. These include:

METALS PRICES

The average realised silver price increased 21.9% from US$27.6 per ounce in 1H24 to US$33.7 per ounce in 1H25, while the average realised gold price rose 45.8%, from US$2,171.9 per ounce in 1H24 to US$3,167.6 per ounce in 1H25. The average realised lead by-product price decreased to US$88.6 cents per pound, down 7.8% vs 1H24, while the average realised zinc by-product price remained stable at US$122.3 cents per pound.

MX$/US$ EXCHANGE RATE

| Fresnillo plc Mexican Peso Spot Exchange Rate Impact June 2025 vs December 2024 | |||

|---|---|---|---|

| Metric | As at June 30, 2025 | As at December 31, 2024 | Impact |

| Exchange rate (MXN per US dollar) | $18.89 | $20.27 | The 6.8% spot devaluation had an adverse effect on deferred taxes and special mining rights. |

| Fresnillo plc Average Mexican Peso Exchange Rate Impact H1 2025 vs H1 2024 | |||

|---|---|---|---|

| Metric | H1 2025 | H1 2024 | Impact |

| Average exchange rate (MXN per US dollar) | $19.98 | $17.10 | The 16.8% devaluation had a positive effect of US$85.9 million on the Group’s costs denominated in Mexican pesos (approximately 45% of total costs) when converted to US dollars. |

COST deFLATION

The Mexican Consumer Price Index for 1H25 was 1.8%. However, to evaluate the Group´s cost inflation for the period, we calculate the unit price increase for each component of adjusted production costs and take into consideration their weighted average within the Group’s basket. In 1H25, this resulted in a cost deflation (decrease in unit price) of 8.2% (including the positive effect of the average devaluation of the Mexican peso vs. US dollar). Underlying cost inflation (cost inflation excluding the devaluation of the Mexican peso vs. US dollar) was 2.3%. The main components of our cost inflation (including the effect of the devaluation of the Mexican peso vs. US dollar) basket are listed below:

Labour

Unionised employees received on average a 7% increase in wages in Mexican pesos, while non-unionised employees received on average a 6% increase in wages in Mexican pesos; when converted to US dollars, this resulted in a weighted average labour deflation of 8.8%.

Energy

Electricity

The weighted average cost of electricity in US dollars decreased 7.2% from US$8.50 cents per kw in 1H24 to US$7.89 cents per kw in the same period of 2025, reflecting the average generating cost of the Comisión Federal de Electricidad (CFE), the national utility.

Diesel

The weighted average cost of diesel in US dollars decreased 12.5% to 103.24 US cents per litre in 1H25, compared to 117.97 US cents per litre in 1H24. This resulted primarily from the devaluation of the Mexican peso vs. US dollar.

Contractors

Agreements are signed individually with each contractor company and include specific terms and conditions that cover not only labour, but also operating materials, equipment and maintenance, amongst others. Contractor costs are mainly denominated in Mexican pesos and are an important component of our total production costs. In 1H25, increases per unit (i.e. per metre developed/ per tonne hauled) granted to contractors, resulted in a weighted average decrease of 2.6% in US dollars, after considering the devaluation of the Mexican peso vs. US dollar.

Maintenance

Unit prices of spare parts for maintenance decreased by 9.3% on average in US dollar terms.

The effects of the above external factors, combined with the Group’s internal variables, are further described below through the main line items of the income statement.

REVENUE

CONSOLIDATED REVENUE 1

| Fresnillo plc Revenue Metrics H1 2025 vs H1 2024 | ||||

|---|---|---|---|---|

| Metric | H1 2025 (US$ million) | H1 2024 (US$ million) | Amount Change (US$ million) | % Change |

| Adjusted revenue9 | 1,982.9 | 1,560.2 | 422.7 | 27.1 |

| Treatment and refining charges | (46.8) | (72.0) | 25.2 | (35.0) |

| Total revenue | 1,936.2 | 1,488.3 | 447.9 | 30.1 |

9 Adjusted revenue is revenue before adjustments for treatment and refining charges.

Adjusted revenue increased by US$422.7 million mainly due to the higher gold and silver prices and increased volumes of gold sold, partly offset by the decrease in silver ounces sold. Total revenue increased by 30.1% to US$1,936.2 million in 1H25.

ADJUSTED REVENUE11 BY METAL

| Fresnillo plc Adjusted Revenue by Metal H1 2025 vs H1 2024 | ||||||||

|---|---|---|---|---|---|---|---|---|

| Metric | H1 2025 (US$ million) | H1 2025 (%) | H1 2024 (US$ million) | H1 2024 (%) | Volume Variance (US$ million) | Price Variance (US$ million) | Total Net Change (US$ million) | % Change |

| Gold | 959.8 | 48.4 | 580.3 | 37.2 | 117.2 | 262.4 | 379.5 | 65.4 |

| Silver | 827.7 | 41.7 | 774.0 | 49.6 | (121.7) | 175.4 | 53.6 | 6.9 |

| Lead | 59.6 | 3.0 | 67.7 | 4.3 | (3.0) | (5.1) | (8.1) | (12.0) |

| Zinc | 135.9 | 6.9 | 138.2 | 8.9 | (0.5) | (1.9) | (2.3) | (1.7) |

| Total adjusted revenue | 1,982.9 | 100 | 1,560.2 | 100 | (8.7) | 431.4 | 422.7 | 27.1 |

ADJUSTED REVENUE BY Mine

The contribution by mine to Adjusted revenues is outlined in the table below. This is expected to change further in the future, as new projects are incorporated into the Group’s operations and as precious metals prices fluctuate.

| Fresnillo plc Adjusted Revenue by Mine H1 2025 vs H1 2024 | |||||

|---|---|---|---|---|---|

| Metric | H1 2025 (US$ million) | H1 2025 (%) | H1 2024 (US$ million) | H1 2024 (%) | % Change |

| Herradura | 623.4 | 31.4 | 305.4 | 19.6 | 104.1 |

| Juanicipio | 377.3 | 19.0 | 309.0 | 19.8 | 22.1 |

| Saucito | 358.6 | 18.1 | 327.0 | 21.0 | 9.7 |

| Fresnillo | 293.3 | 14.8 | 260.6 | 16.7 | 12.5 |

| San Julián (Veins) | 216.0 | 10.9 | 159.1 | 10.2 | 35.8 |

| Ciénega | 98.7 | 5.0 | 113.4 | 7.3 | (13.0) |

| Noche Buena | 16.0 | 0.8 | 20.7 | 1.3 | (22.7) |

| San Julián (DOB) | (0.3) | 0.0 | 65.0 | 4.1 | (100.5) |

| Total | 1,982.9 | 100 | 1,560.2 | 100 | 27.1 |

VOLUMES OF METAL SOLD

| Fresnillo plc Volumes of Metal Sold by Mine H1 2025 vs H1 2024 | |||||

|---|---|---|---|---|---|

| Metric | H1 2025 | H1 2025 % Contribution | H1 2024 | H1 2024 % Contribution | % Change |

| Silver (koz) | |||||

| Juanicipio | 7,714 | 31.5% | 8,267 | 28.9% | -6.7 |

| Saucito | 4,906 | 20.0% | 5,551 | 19.4% | -11.6 |

| Fresnillo | 4,346 | 17.7% | 4,644 | 16.2% | -6.4 |

| San Julián (Veins) | 4,024 | 16.4% | 3,910 | 13.7% | 2.9 |

| Ciénega | 1,340 | 5.5% | 2,346 | 8.2% | -42.9 |

| Pyrites from Saucito | 1,073 | 4.4% | 1,437 | 5.0% | -25.3 |

| Pyrites from Fresnillo | 735 | 3.0% | 595 | 2.1% | 23.5 |

| Herradura | 254 | 1.0% | 211 | 0.7% | 20.4 |

| Pyrites from Juanicipio | 97 | 0.4% | 0 | 0.0% | 100.0 |

| Noche Buena | 1 | 0.0% | 2 | 0.0% | -50.0 |

| San Julián (DOB)* | (5) | 0.0% | 1,663 | 5.8% | -100.3 |

| Total silver (koz) | 24,485 | — | 28,626 | 100% | -14.5 |

| Gold (oz) | |||||

| Herradura | 195,291 | 64.5% | 134,998 | 52.0% | 44.7 |

| Saucito | 25,273 | 8.3% | 33,349 | 12.8% | -24.2 |

| San Julián (Veins) | 24,913 | 8.2% | 23,619 | 9.1% | 5.5 |

| Juanicipio | 17,847 | 5.9% | 16,095 | 6.2% | 10.9 |

| Ciénega | 15,847 | 5.2% | 19,193 | 7.4% | -17.4 |

| Fresnillo | 15,800 | 5.2% | 18,741 | 7.2% | -15.7 |

| Noche Buena | 4,870 | 1.6% | 9,065 | 3.5% | -46.3 |

| Pyrites from Saucito | 1,952 | 0.6% | 3,353 | 1.3% | -41.8 |

| Pyrites from Fresnillo | 941 | 0.3% | 658 | 0.3% | 43.0 |

| Pyrites from Juanicipio | 131 | 0.0% | 0 | 0.0% | 100.0 |

| San Julián (DOB)* | 17 | 0.0% | 492 | 0.2% | -96.5 |

| Total gold (oz) | 302,882 | 100% | 259,563 | 100% | 16.7 |

| Lead (t) | |||||

| Fresnillo | 9,189 | 39.1% | 11,146 | 34.9% | -17.6 |

| Saucito | 4,906 | 20.9% | 9,589 | 30.0% | -48.8 |

| Juanicipio | 9,045 | 38.5% | 7,698 | 24.1% | 17.5 |

| Ciénega | 328 | 1.4% | 1,508 | 4.7% | -78.2 |

| San Julián (DOB)* | 4 | 0.0% | 2,027 | 6.3% | -99.8 |

| Total lead (t) | 23,472 | 100% | 31,968 | 100% | -26.6 |

| Zinc (t) | |||||

| Fresnillo | 18,640 | 37.0% | 18,827 | 36.8% | -1.0 |

| Saucito | 17,575 | 34.9% | 13,132 | 25.6% | 33.8 |

| Juanicipio | 13,801 | 27.4% | 12,286 | 24.0% | 12.3 |

| Ciénega | 434 | 0.9% | 1,357 | 2.6% | -68.0 |

| San Julián (DOB)* | (53) | -0.1% | 5,612 | 11.0% | -100.9 |

| Total zinc (t) | 50,397 | 100% | 51,214 | 100% | -1.6 |

* San Julián (DOB) data may include specific operational or accounting adjustments; refer to company disclosure for details.

*Final adjustments to sales volumes from 2024.

TREATMENT AND REFINING CHARGES

Similar to previous years, the 2025 treatment and refining charges[10] (TRCs) per tonne and per ounce are currently being negotiated with Met-Mex (Peñoles’ smelter and refinery) in accordance with international benchmarks and will apply retrospectively from January 2025. We expect these negotiations to conclude in 2H25.

Treatment charges per tonne of lead and zinc concentrate and silver refining charges decreased in dollar terms by 46.6%, 56.8% and 23.0%, respectively. These factors, combined with the lower volumes of zinc concentrates, partly offset by the higher volumes of lead concentrates shipped from our mines to Met-Mex, resulted in a 35.0% decrease in treatment and refining charges set out in the income statement in absolute terms when compared to 1H24.

COST OF SALES

| Fresnillo plc Cost of Sales H1 2025 vs H1 2024 | ||||

|---|---|---|---|---|

| Metric | H1 2025 (US$ million) | H1 2024 (US$ million) | Amount Change (US$ million) | % Change |

| Adjusted production costs11 | 673.5 | 844.2 | (170.6) | (20.2) |

| Depreciation | 241.4 | 304.2 | (62.8) | (20.6) |

| Profit sharing | 7.9 | 6.0 | 1.9 | 31.7 |

| Change in inventories | (9.6) | (58.5) | 48.9 | (83.6) |

| Cost of sales | 913.2 | 1,095.9 | (182.7) | (16.7) |

11 Adjusted production costs exclude non-cash items and other adjustments; refer to company disclosure for details.

Cost of sales decreased 16.7% to US$913.2 million in 1H25. The main factors driving the US$182.7 million decrease are listed below:

- Adjusted production costs decreased by US$170.6 million as shown in the graph below:

The ongoing efforts to implement cost reduction initiatives continued to generate positive results in 1H25, driving US$23.3 million worth of net operating efficiencies. These included efficiencies and cost reduction initiatives (-US$38.9 million) at Herradura driven by the optimisation of haulage distances, and at Saucito and Ciénega as a result of lower cost of development contractors. This achievement was partly offset by inefficiencies (+US$15.6 million) at Fresnillo and Juanicipio due to increased maintenance costs.

- Depreciation (-US$62.8 million) due to the decreased depreciation of the asset base at San Julián DOB as it reached the end of its life in 2024, and to a lesser extent, decreased amortisation of capitalised mining works and lower depletion factors at Saucito and Ciénega.

These positive effects were partly offset by:

- The variation in the change in inventories had a negative effect of US$48.9 million versus 1H24 primarily due to an increase in inventories at Fresnillo, Saucito and Juanicipio net of the consumption of inventories at Herradura, whereas in 1H24 an increase in the weighted average cost of inventories on the leaching pads at Herradura was registered (see notes 2c and 5 to the financial statements).

COST PER TONNE, CASH COST PER OUNCE AND ALL-IN SUSTAINING COST (AISC)

Cost per tonne is a key indicator to measure the effects of changes in production costs and cost control performance at each mine. This indicator is calculated as total production costs, plus ordinary mining rights, less depreciation, profit sharing and exchange rate hedging effects, divided by total tonnage processed. We have included cost per tonne hauled/moved as we believe it is a useful indicator to thoroughly analyse cost performance for the open pit mines.

| Fresnillo plc Cost per Tonne by Mine H1 2025 vs H1 2024 | ||||

|---|---|---|---|---|

| Mine | Metric | H1 2025 | H1 2024 | % Change |

| Fresnillo | US$/tonne milled | 123.10 | 114.68 | 7.3 |

| Saucito | US$/tonne milled | 107.26 | 139.87 | -23.3 |

| Juanicipio | US$/tonne milled | 110.07 | 119.72 | -8.1 |

| San Julián (Veins) | US$/tonne milled | 128.29 | 108.19 | 18.6 |

| Ciénega | US$/tonne milled | 113.49 | 128.83 | -11.9 |

| Herradura | US$/tonne deposited | 20.40 | 26.47 | -22.9 |

| Herradura | US$/tonne hauled | 4.80 | 6.02 | -20.3 |

Fresnillo: Cost per tonne increased 7.3% to US$123.1 in 1H25, driven mainly by the increase in repairs and maintenance costs, and increased consumption of milling balls, the lower volume of ore processed, and the underlying cost inflation. This was mitigated by the favourable effect of the 16.8% devaluation of the Mexican peso vs the US dollar.

Saucito: Cost per tonne decreased 23.3% to US$107.3, primarily due to the decrease in the volume of by products with high gold and silver contents purchased from Met-Mex (smelting and refining company), the favourable effect of the 16.8% devaluation of the Mexican peso vs the US dollar, and the decrease in metres developed (see Saucito in 1H25 Operational Review).

Juanicipio: Cost per tonne decreased due to the favourable effect of the 16.8% devaluation of the Mexican peso vs the US dollar and the increase in volume of ore processed, partly offset by the higher maintenance costs and the underlying cost inflation.