VANCOUVER, British Columbia, Nov. 07, 2025 (GLOBE NEWSWIRE) — Endeavour Silver Corp. (“Endeavour” or the “Company”) (NYSE: EXK; TSX: EDR) announces its financial and operating results for the three and nine months ended September 30, 2025. All dollar amounts are in US dollars ($).

“Endeavour Silver delivered a strong third quarter, highlighted by a significant increase in production and robust revenue growth,” commented Dan Dickson, Chief Executive Officer. “With silver equivalent production up 88% year-over-year and operating cash flow more than doubling, we continue to demonstrate the strength of our mining operations and our team’s commitment to operational excellence. With the recent achievement of commercial production at Terronera in October, we are excited about the Company’s future growth and the combined performance of our four operating mines in the coming quarters.”

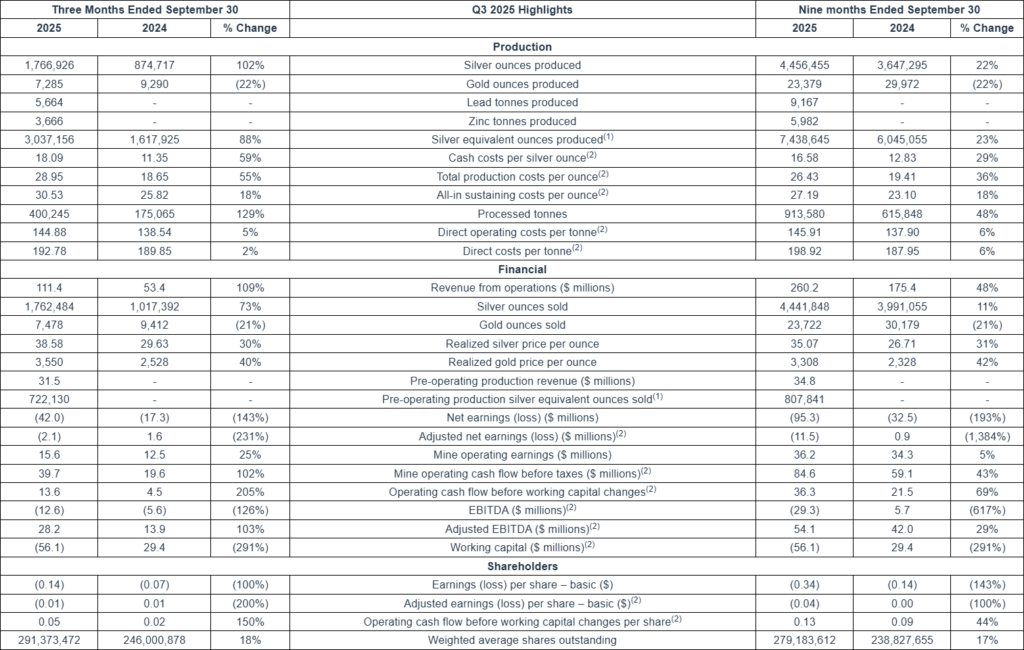

Q3 2025 Highlights

- Increased Production Output and Capacity: 1,766,926 ounces (“oz”) silver and 7,285 oz gold for 3.0 million oz of silver equivalent (“AgEq”)(1). Production was 88% higher than the same period in 2024 and excludes Terronera.

- Higher oz Sold with Higher Realized Prices: $94.5 million from the sale of 1,762,484 oz of silver and 7,478 oz of gold at average realized prices of $38.58 per oz silver and $3,550 per oz gold. Revenue from operations is 77% higher than in the same period in 2024.

- Strong Mine Operating Cash Flow: $39.7 million in operating cash flow before working capital changes(2), 102% higher than the same period in 2024.

- Operating Costs Impacted by Higher Realized Prices: Cash costs(2) of $18.09 per oz payable silver and all-in sustaining costs(2) of $30.53 per oz, net of by-product credits were 59% and 18% higher, respectively, than the same period in 2024, partially driven by the impact of higher royalties, higher profit participation and higher cost of third-party mineralized material.

- Strong Cash Position: $57.0 million in cash as of September 30, 2025.

- Higher Adjusted EBITDA: Adjusted EBITDA of $28.2 million compared to $13.9 million in the same quarter in 2024 due higher metal prices, the new contribution from Kolpa and the negative impact of the Trunnion failure in Q3 2024.

- Terronera Declares Commercial Production: During the third quarter, the plant experienced only eight days of downtime, while consistently exceeding an average of 90% of the designed nameplate capacity of 2,000 tonnes per day, and metal recoveries of at least 90% projected, therefore commercial production was announced effective October 1, 2025. (See news release dated October 16, 2025 here).

Financial Overview

(1) Silver equivalent (AgEq) is calculated using an 80:1 Ag:Au ratio, 60:1 (Ag:Pb) ratio, 85:1 (Ag:Zn) ratio and 300:1 (Ag:Cu) ratio.

(2) These are non-IFRS financial measures and ratios. Further details on these non-IFRS financial measures and ratios are provided at the end of this press release and in the MD&A accompanying the Company’s financial statements, which can be viewed on the Company’s website, on SEDAR+ at www.sedarplus.com and on EDGAR at www.sec.gov.

Direct operating costs per tonne in Q3 2025 increased to $144.88, slightly higher than $138.54 in Q3 2024. This increase was caused by the addition of Kolpa which incurs relatively higher direct operating costs per tonne, and higher direct operating costs per tonne at Bolañitos as a result of lower throughput.

Consolidated cash costs per silver ounce, net of by-product credits, were $18.09 in Q3 2025, a 59% increase compared to $11.35 in Q3 2024. The increase was primarily driven by a shift in the ratio of silver to gold production at Bolañitos and Guanaceví, with lower grades of gold leading to lower by-product credits and therefore higher cash costs net of by-product credits. The impact of higher realized prices is also observed as higher royalty costs, higher profit participation costs, and higher costs of purchased third-party material negatively impacted the underlying cash costs. Furthermore, the volume of third-party material purchased was 87% higher in the current period compared to the same period in 2024, which negatively impacts the underlying cash costs, but drives a higher quantity of ounces being produced.

All-In Sustaining Costs (AISC) per silver ounce in Q3 2025 were $30.53, 18% higher than $25.82 in Q3 2024. This increase was driven by a higher AISC at Bolañitos, caused by higher cash costs net of by-product credits, as well as higher corporate general and administrative costs which are allocated to the operations based on their share of silver equivalent ounces produced. The higher corporate general and administrative costs in Q3 2025 were caused by the $2.7 million revaluation of the Deferred Share Units (“DSUs”) due to the higher share price that increases the liability value of cash-settled DSUs held by the Company’s independent directors.

In Q3 2025, the Company’s mine operating earnings were $15.6 million (Q3 2024 – $12.5 million) from revenue of $142.8 million (Q3 2024 – $53.4 million) and cost of sales of $127.2 million (Q3 2024 – $41.0 million). The improvement in mine operating earnings is due to higher operating earnings at Bolañitos and Guanaceví driven by higher realized metal prices, as well as the additional contribution of $3.9 million in operating earnings from Kolpa. These earnings are offset by Terronera’s operating loss of $3.6 million during the commissioning period. The increase in cost of sales compared to the prior period was driven by an additional $35.1 million from Kolpa, and $35.1 million from Terronera.

In Q3 2025, the Company had operating earnings of $1.8 million (Q3 2024 – earnings of $3.8 million) after exploration, evaluation and development costs of $7.3 million (Q3 2024 – $4.7 million), and general and administrative expenses of $6.5 million (Q3 2024 – $4.0 million). Exploration expenses increased as work began post-acquisition at Kolpa in Q2 2025, which was not incurred in the comparative period. As noted above, the increase in general and administrative expenses is primarily due to a $2.7 million revaluation of DSUs, which was $2.1 million higher than Q3 2024.

The loss before taxes for Q3 2025 was $37.5 million (Q3 2024 – loss of $13.3 million) after a loss on derivative contracts of $39.0 million (Q3 2024 – $19.4 million), partially offset by a foreign exchange gain of $0.6 million (Q3 2024 – loss of $3.1 million), investment and other income of $0.2 million (Q3 2024 – income of $5.9 million), and finance costs of $1.0 million (Q3 2024 – $0.5 million). The outstanding derivative contracts for gold, silver, and the Mexican peso were revalued at the end of the period and the higher precious metal prices drove a larger derivative liability fair value, thereby generating a $39.0 million derivative loss for the period.

The Company realized a net loss for the period of $42.0 million (Q3 2024 – net loss of $17.3 million) after an income tax expense of $4.5 million (Q3 2024 – $4.0 million). The deferred tax recovery was $6.2 million (Q3 2024 – $0.5 million), derived from changes in temporary timing differences between accounting and tax recognition.

Adjusted net loss was $2.1 million compared to adjusted net earnings of $1.6 million in Q3 2024, largely due to the largely due to the $5.7 million comparative difference in investment and other category partially offset by the higher mine profitability.

This news release should be read in conjunction with the Company’s condensed consolidated interim financial statements for the period ended September 30, 2025, and associated Management’s Discussion and Analysis (“MD&A”) which are available on the Company’s website, www.edrsilver.com, on SEDAR+ at www.sedarplus.com and on EDGAR at www.sec.gov.

Conference Call

Management will host a conference call to discuss the Company’s Q3 2025 financial results today at 10:00am Pacific (PST)/ 1:00pm Eastern (EST).

| Date: | Friday, November 7, 2025 |

| Time: | 10:00am Pacific (PST) / 1:00pm Eastern (EST) |

| Telephone: | Canada & US +1-833-752-3348 International +1-647-846-2804 |

| Replay: | Canada/US Toll Free +1-855-669-9658 International +1-412-317-0088 Access code is 8825809 |

To access the replay using an international dial-in number, please click here.

The replay will also be available on the Company’s website at www.edrsilver.com.

About Endeavour Silver – Endeavour is a mid-tier silver producer with four operating mines in Mexico and Peru and a robust pipeline of exploration projects across Mexico, Chile, and the United States. With a proven track record of discovery, development, and responsible mining, Endeavour is driving organic growth and creating lasting value on its path to becoming a leading senior silver producer.

Contact Information

Allison Pettit, Vice President, Investor Relations

Tel: (877) 685 – 9775

Email: [email protected]

Website: www.edrsilver.com