Fully funded 1,500-2,000m maiden drill program to unlock scale potential and underpin production strategy.

HIGHLIGHTS

- Contract signed with drilling contractor, Perforaciones Mineras Estrella S. de R.L. de C.V, for a minimum of 1000m of diamond drilling, equipment and personnel mobilising immediately.

- 1,500–2,000m Phase 1 diamond drill program targeting high-grade antimony mineralisation beneath historical workings along the Lirios Fault Zone (LFZ).

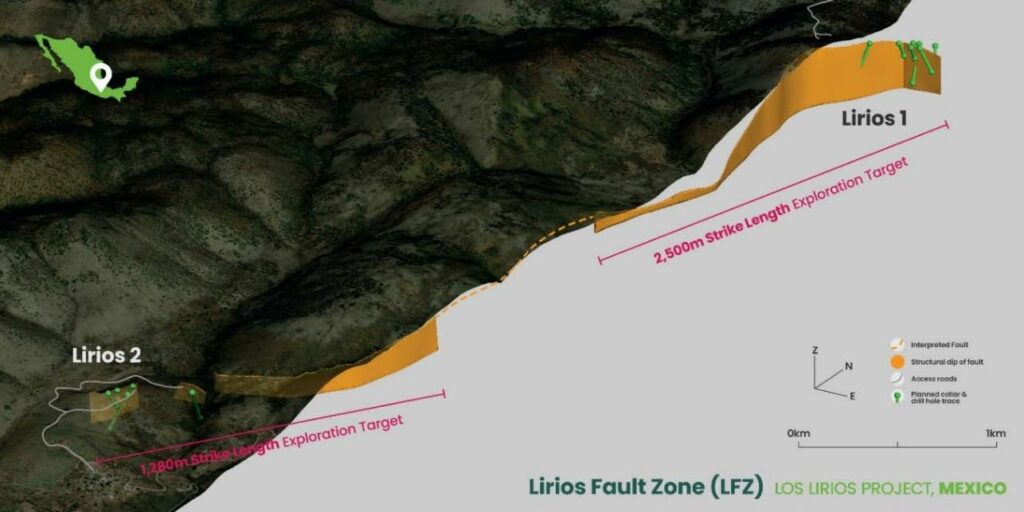

- Drilling will test ~900m of strike within the Lirios Fault Zone (LFZ), a 9km long system.

- Program focused on shallow (70-100m) testing of both structural veins and carbonate replacement (CRD) targets.

- Results expected to drive an expanded program to further define mineralisation at depth and along strike.

- Drilling is the critical first step toward delivering a maiden JORC resource in 3Q 2026 and advancing the asset toward near-term production.

- EVR is fully funded to complete the program, which marks the start of an intensive 2026 exploration campaign.

- Assay results from company’s rock chip program are expected shortly, reporting delayed due to significant increase in demand and to ensure appropriate high-grade assay methodology for samples containing significant stibnite.

EV Resources (ASX: EVR) (“EVR” or “the Company”) is pleased to announce the engagement of a highly experienced drilling contractor and the mobilisation of drilling equipment to its high-grade Los Lirios Antimony Project in Oaxaca State, Mexico. The Company’s wholly owned subsidiary Stibcorp S.A. DE C.V. has executed a contract with Mexican operator Perforaciones Mineras Estrella S. de R.L. de C.V to undertake a 1500-2000m diamond drilling program. Mobilisation is expected to be less than one week.

This fully funded program represents a pivotal transition for the Company as it moves from surface exploration to subsurface definition, with the primary objective of defining a maiden JORC resource in Q3 CY2026.

Managing Director and CEO, Mike Brown, commented:

“This drill program represents the first drilling test of the Los Lirios system and is a critical step in unlocking its broader potential. Although we have been frustrated by delays in reporting sampling we are extremely confident of both the controls and expected tenor of the massive antimony

mineralisation observed at Los Lirios. The issues delaying the assays from rock chips stem from finding the right assaying methodology for samples with significant stibnite present. Although a test of patience, it is a nice challenge to face, and importantly this has allowed us to ensure we have the most appropriate analysis methodology being applied for when drilling samples are sent for assaying. Our geological work to date has provided a strong structural and lithological framework, pointing to the Lirios Fault Zone and associated replacement horizons as compelling targets.

With access preparation completed and permitting progressing as expected, we are on track for drilling to commence prior to the end of January. Importantly, this program is fully funded and represents the start of a much larger campaign planned for 2026, where we aim to deliver a maiden JORC resource in the third quarter of the year. The parallel advancement of drilling at Los Lirios and advancing construction plans at Tecomatlán sets the foundation for a transformative 2026 for EVR.”

DRILL PROGRAM OVERVIEW

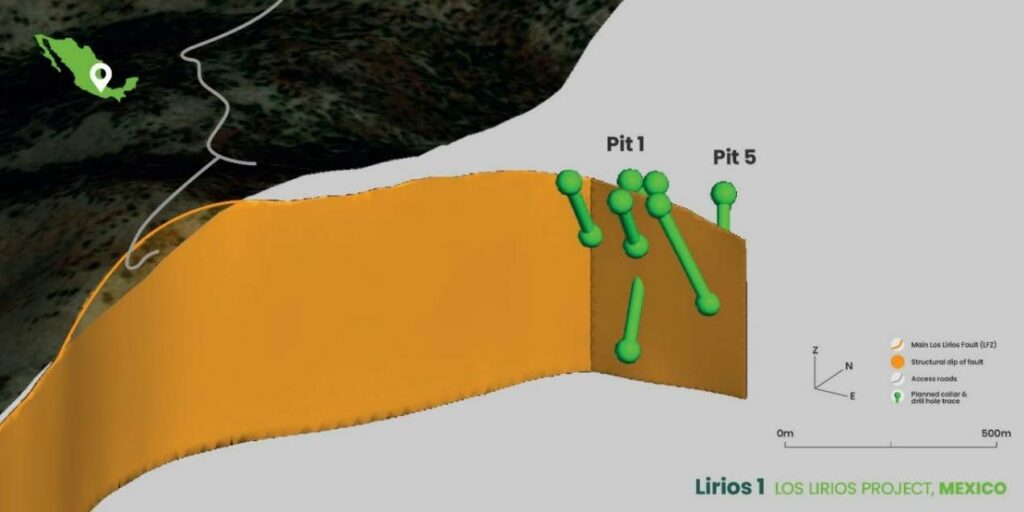

Preparatory works for the maiden drill program are completed, with access improvements and drill pad construction completed across the initial target corridor. Mobilisation is expected to take approximately one week, with the 1,500–2,000m HQ diamond drilling program scheduled to begin shortly thereafter.

The drilling has been designed to maximise structural information and sample quality, targeting the immediate extensions below and along strike from Lirios 1 and Lirios 2 historical artisanal pits. Previous sampling in this area identified high-grade antimony mineralisation at surface. The Phase 1 program will focus on relatively shallow depths of 70-100m below surface, allowing for rapid progress assuming there are no ground issues.

While the total mapped strike length of the Lirios Fault Zone (LFZ) is approximately 4km of the total 9km of interpretated strike length, this initial phase will focus on testing the most prospective 900m of strike length beneath historical workings. Success in this phase will drive an expanded program to test the remaining strike extent following generative targeting work to be completed.

GEOLOGICAL MODEL AND TARGETS

Detailed field mapping and structural measurements have allowed EVR to refine its geological model, identifying two distinct mineralisation styles that will be tested in this program. The principal target is the LFZ, which is seen as the principal fluid conduit and host structure for antimony mineralisation at Los Lirios. Mineralisation associated with the LFZ occurs as quartz-stibnite infill, veining, and strong silicification, which parallels the anticline axis of a weakly folded limestone sequences. Crackle brecciation and silicification along the fold axis indicates folding pre-dated faulting, providing a mechanical weakness for the LFZ and access for ascending hydrothermal fluids.

Pit mapping demonstrates additional mineralisation associated with NW-SE striking cross-faults. These are interpreted as en-echelon structures related to the broader strike-slip stress regime that formed the LFZ.

A second high-value target style consists of sub-horizontal carbonate-replacement bodies (CRD) within limestone units located directly beneath a ductile gypsum layer. The gypsum appears to have acted as a barrier, forcing hydrothermal fluids to spread laterally. This process has produced 2–5 metre-thick stratabound (manto) replacement zones observed in multiple pits.

Drill orientations have been selected to optimise intersections with both the principal LFZ trend and the cross-cutting structures. Specifically, at Lirios 1, a dextral strike-slip fault trending approximately 340° to the north of the historic pits has rotated structures toward a NE-SW

The Los Lirios maiden drill program represents a major step in EVR’s strategy to fast-track antimony development. The high-grade nature and low impurities potentially provide the Company with a high-quality product that could then be accelerated through development stages. The current program is expected to define priority zones for follow-up drilling, directly underpinning the Company’s objective to deliver a maiden JORC resource in 3Q 2026 and advance the path to future production.

NEXT STEPS

Following the commencement of drilling in late January, the Company anticipates a steady flow of news over the coming months. Immediate milestones include:

- Receipt of channel sampling assay results from Los Lirios

- Receipt of rock chip reconnaissance sampling assay results from Dollar and Milton Projects, Nevada

- Finalisation of preliminary engineering and budget for Tecomatlán Plant and commencement of Phase 1 refurbishment

- Receipt of initial drilling results (over next 6-10 weeks)

- Commencing test orientational geophysical surveys over historical pits to determine most responsive geophysical survey system.

– ENDS –

For further information, please contact:

Mike Brown

Managing Director & CEO

Tel: +61 466 856 061

E: [email protected]

This ASX announcement was authorised for release by the Board of EV Resources Limited.

We are rapidly transitioning from a diversified explorer to a near-term producer. Our strategy is centred on antimony, a critical mineral designated by the US, EU, and Australia as essential for energy storage, battery technology, defence, and high-tech applications.

Our asset portfolio is strategically positioned in mining-friendly jurisdictions:

- Los Lirios Antimony Project (Mexico): Our flagship, high-grade project. We are fast-tracking Los Lirios to production, a goal supported by our acquisition of the nearby Tecomatlán Processing Plant, which provides a low-capex path to cash flow.

- US Antimony Projects (Nevada): We hold a 100% interest in the Dollar and Milton Canyon antimony projects, key assets in our strategy to build a secure, domestic critical minerals supply chain for the United States.

Compliance Statement

The information in this release that relates to Exploration Results is based on information compiled by Mr Michael Brown who is a Member of the Australian Institute of Geoscientists. Mr Brown is the Managing Director and CEO of EVR. Mr Brown has sufficient experience which is relevant to the style of mineralisation

Forward Looking Statement

Forward Looking Statements regarding EVR´s plans with respect to its mineral properties and programs are statements that are not historical facts. Words such as “expect(s)”, “feel(s)”, “believe(s)”, “will”, “may”, “anticipate(s)”, “potential(s)”and similar expressions are intended to identify forward-looking statements. These statements include, but are not limited to statements regarding future production, resources or reserves and exploration results. All of such statements are subject to certain risks and uncertainties, many of which are difficult to predict and generally beyond the control of the company, that could cause actual results to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. There can be no assurance that EVR’s plans for development of its mineral properties will proceed as currently expected. There can also be no assurance that EVR will be able to confirm the presence of additional mineral resources, that any mineralisation will prove to be economic or that a mine will successfully be developed on any of EVR’s mineral properties. The performance of EVR may be influenced by a number of factors which are outside the control of the Company and its Directors, staff, and contractors.

These risks and uncertainties include, but are not limited to: (i) those relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits and conclusions of economic evaluations, (ii) risks relating to possible variations in reserves, grade, planned mining dilution and ore loss, or recovery rates and changes in project parameters as plans continue to be refined, (iii) the potential for delays in exploration or development activities or the completion of feasibility studies, (iv) risks related to commodity price and foreign exchange rate fluctuations, (v) risks related to failure to obtain adequate financing on a timely basis and on acceptable terms or delays in obtaining governmental approvals or in the completion of development or construction activities, and (vi) other risks and uncertainties related to the company’s prospects, properties and business strategy. Our audience is cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof, and we do not undertake any obligation to revise and disseminate forward-looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of or non-occurrence of any events.

Original Article: https://api.investi.com.au/api/announcements/evr/7a58172a-04e.pdf