Highlights

Quarterly Activities Report – December 2020

- Successful completion of a Share Purchase Plan, which raised $1 million

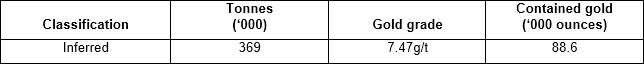

- Santa Teresa Gold Project initial JORC compliant Inferred Mineral Resource estimate of 88.6koz at 7.47g/t gold – Knowledge gained to be used to assist in planning for Comet’s upcoming drilling program

- Appointment of Interminco Services as Project Manager for Santa Teresa

- Initial Field Program completed at the Murchison Mine at the Barraba Copper Project – Extensive surface mineralisation identified

Post Quarter End

- High Grade Copper and Zinc assays received from Initial Field Program at the Murchison Mine at the Barraba Copper Project

Comet Resources Limited (Comet or the Company) (ASX:CRL), is pleased provide the Quarterly Activities Report and Appendix 5B for the quarter ending 31 December 2020 (the Quarter). During the Quarter work focussed on establishment of the field office for Santa Teresa, as well as engagement of local geological consultants, to enable the project to move towards its initial drilling program in 2021. At the Barraba Copper Project work focussed on the Initial Field Program at the Murchison Mine and the collection of soil, mine dump and rock chip samples for assaying, results of which were announced in January 2021.

Matthew O’Kane, Managing Director of Comet Resources, commented “Comet focussed its efforts in Q4 on setting up a team and the resources required in Mexico to advance the Santa Teresa Gold Project, while at the Barraba Copper Project we commenced the first field exploration program at the Murchison Mine while we wait for the permitting of the drilling program planned for the Gulf Creek Mine to be finalised. We are continuing this work in early 2021 and look forward to commencing the initial drilling programs once the required permits are in place.”

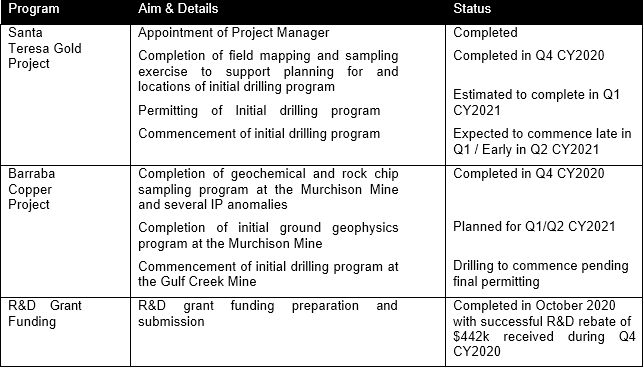

Work Program and Outlook

Santa Teresa Gold Project

The acquisition of the Santa Teresa Gold Project, completed during the Quarter, is enhanced by funding from Raptor Capital International of $US6M (up to US$20M) via a gold stream and royalty facility. The use of proceeds is to fund development activities at Santa Teresa and the facility will be secured only against the Santa Teresa Gold Project itself and any further tenements acquired in the region.

As announced on 13 October 2020, the JORC Inferred Mineral Resource estimate for the Santa Teresa Gold Project (shown in Table 1 below) was calculated based on the application of top cap grades on a lode by lode basis as assessed by the Competent Person, and a gold cut-off grade of 2.5g/t. Please refer to the ASX release dated 13 October 2020 for full details.

The Company appointed Interminco Services Ltd (Interminco) as Project Manager for Santa Teresa. Interminco has a track record spanning over 20 years in Latin America. The Company’s experience and that of its executives includes roles with Rio Tinto and Xstrata, delivering a number of projects from successful exploration through to mine production in Chile, Mexico and the USA. The team is also experienced in commercial strategy, advising on projects for leading global mining companies, as well as Juniors at various stages of development.

Interminco have a team based in Ensenada, approximately 100Km from site. Their initial focus at the project will be planning for the upcoming drilling program and associated permitting, managing the drilling program itself as well as sampling, assaying and database management. To allow planning for the initial drilling program to progress a site based exercise of creating a GIS database of all prior drill collar locations as well as historical shafts, trenches and surface outcroppings on the mineralised veins will be undertaken.

Barraba Copper Project

During the Quarter the Company provided an update on its Barraba Copper Project, located in the New England region of New South Wales, approximately 550km north of Sydney. Comet’s Consulting Geologist, Mr Mart Rampe, completed the Initial Field Program in November 2020, during which a soil sampling program was undertaken, as well as taking samples of mine dump material and rock chips from outcrops.

The Barraba Copper Project has never been systematically tested by modern exploration techniques. There are a number of known historical mineral deposits on the license, being the Gulf Creek Mine, the Murchison Mine and the Four Mile lode. The initial drilling program will focus on the drill-testing of areas below and along strike of the historically mined lodes at the Gulf Creek Mine. The drilling will be complemented with downhole geophysical surveys with the aim of providing additional information about potential parallel and blind lodes. Prior to drilling commencing at the Gulf Creek Mine, which is drill ready pending permitting, exploration works have been focused on the historic Murchison Mine.

On 13 January 2021, the Company announced the assay results from mineralised samples taken during the field program undertaken in November 2020 at the Murchison Mine. The Field Program included grid based geochemical soil sampling and rock chip sampling. Evidence of copper mineralisation was widespread around the Murchison Copper Mine. Historical mine workings that were previously unknown to the Company around the Gulf Creek North area and proximate to a number of chargeability anomalies identified by a prior induced polarisation (IP) survey were also assessed.

Historical data indicates that the historic Murchison Copper Mine is a volcanogenic massive sulphide (VMS) style deposit, the same as that found at the Gulf Creek Copper Mine. These deposits often occur in clusters due to the nature of the hydrothermal processes that form them. This is the case at the Barraba Copper Project with three historic VMS deposits identified within the Project area. The Murchison Copper Mine (Figure 2) produced ore in the early 1900’s. Historical production records state copper was produced at an average grade of 3%, with historical assays up to 5.1%.

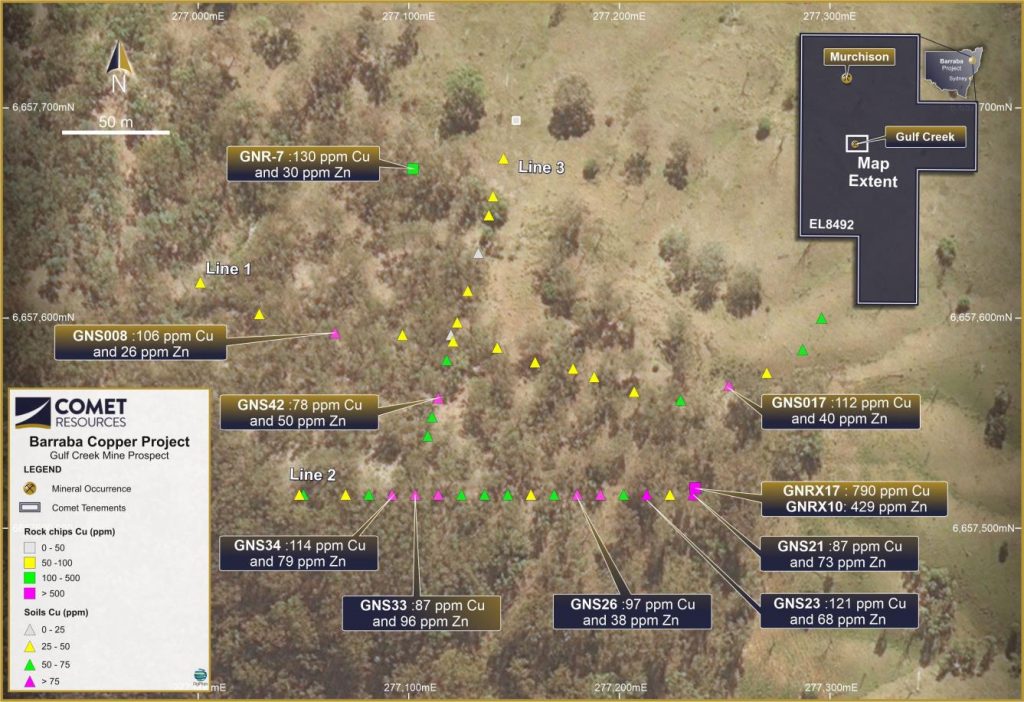

The initial Field Program at the Murchison Mine focused on delineating the tenor of the visible mineralisation as well as its extent. Accordingly, a number of mine dump and outcrop samples were taken for laboratory analysis. In addition, a number of grid-based soil samples were taken across the perceived strike of the mineralisation. The program entailed the analysis of rocks and soils by SGS laboratories (SGS) in conjunction with in-situ field analysis utilizing a Niton personal XRF analyser (p-XRF). All soil sampling was based on a grid array, with samples taken every 5 metres on the two central lines and then every 10 metres on the outer two lines. All four survey lines were orientated approximately South-North. A plan of the sampling locations and results is illustrated in Figure 3.

The results of the soil sampling for the main elements of interests are summarised as follows:

- In general terms, strongly elevated values for copper, zinc and iron were recorded over Soil Sample Line 1, which was placed directly over the Murchison workings. A comparison of the p-XRF results for in-situ analysis v’s the -80# sieved sample analysis by SGS indicates similar trends and orders of magnitude for the main elements of interest.

- Strongly elevated values for copper, zinc and iron were recorded for Soil Line 2.

- Elevated values for zinc and copper were recorded on Soil sample Lines 3 and 4. The lower results appear to reflect the greater distance of the sampling from the old workings.

Full results are available in the Company’s press release from January 13, 2021.

A number of outcrops (see Figure 3 for sample locations) were analysed with the p-XRF and included a number of samples from the mine dump. In addition, rock chip samples from the same general locations were also forward to SGS Laboratories with the view to verifying the p-XRF data. These data clearly highlighted strong copper and zinc mineralization, whether by p-XRF or laboratory testing. Notable observations include:

- Copper values up to 4.6% and zinc values up to 4.0%

- High cobalt values up to 0.7%

These results are strongly supportive of further exploration being required, including geophysical surveys. Planning for this work is now underway with the objective of outlining drilling targets as soon as possible.

Gulf Creek North Prospect

A reconnaissance program was also undertaken over ground to the north of the Gulf Creek Mine within freehold land where exploration access has been granted. The focus of the program was to determine whether historically identified IP anomalies, some of which coincided with an orange/red oxidised soil profile, represented a mineralising event.

During the investigation of the area, the presence of several pits and an 18 metre deep shaft were noted, evidencing past workings. Mullock from these workings exhibited strong iron oxide alteration.

In-situ soil analysis by a Niton p-XRF was carried out along three soil lines, the locations of which are illustrated in Figure 4. Sample spacings were at either 10 or 20 metres. In addition, a number of rock faces were analysed by the Niton p-XRF, whilst a representative selection of rock chip samples were collected and forwarded to SGS for laboratory analysis. The location of the rock chip samples are also illustrated in Figure 4.

A number of elements from the soil sampling were assessed and plotted. Only Soil Sample Line No 1 exhibited any significant trends. Please see appendices four to six for full results.

Of the elements that were analysed, only copper and zinc values show a modest increase towards the east, perhaps indicating a slight influence from historic workings located in that general area. However, in-situ values for all other elements are quite low.

A number of outcrops (see Figure 4 for sample locations) were spot-analysed with the p-XRF and a number of rock chips were also forwarded to SGS laboratories for additional analysis.

The p-XRF sampling indicated moderately elevated values for copper (up to 0.08%) and zinc (up to 0.04%), with two samples also demonstrating high cobalt values (up to 0.35%). No significant values were recorded by laboratory analysis.

Overall, the soil and rock sampling results from the Gulf Creek North Prospect area indicate the presence of some subdued copper and zinc mineralisation, but of a relatively low tenor. Further soil sampling is however justified to better define the relationship between the elevated soil values, the previously defined IP anomalies and the historical workings.

Corporate Activities

Prior to the end of the September quarter, Comet announced the completion of the first tranche of its placement of 100,000,000 fully paid ordinary shares (Shares)(Placement) at a price of $0.02 per share to raise $2,000,000 before costs. The Company issued 98,500,000 Shares under the Placement to raise $1,970,000 pursuant to its placement capacity under ASX Listing Rules 7.1 (59,100,000 Shares) and 7.1A (39,400,000 Shares). The remaining 1,500,000 fully paid ordinary shares from the placement were issued on 16 October 2020.

On 5 October 2020, the Company announced that it had received applications from existing shareholders for $2.3 million at an offer price of $0.02 per share under its Share Purchase Plan (SPP), which closed on Thursday 1 October 2020. Due to the strong demand from shareholders for the SPP offer, with oversubscriptions of $1.8 million being received, the Company decided to accept over subscriptions of $500,000 meaning the SPP raised a total of $1,000,000 before costs of the offer.

Pursuant to Section 6 of the Appendix 5B, the Company paid $81k in director fees, superannuation and wages to the board of Comet Resources Limited.

Expenditure incurred from operating, investing and financing activities during the September and December Quarter relates to legal and technical due diligence in regard to project acquisitions, exploration costs and for general working capital purposes (the Sep & Dec Q Expenditure). A further breakdown is included below.

Sep & Dec Q Expenditure Summary

- Metallurgical Test Work

- Field expenses and preparation of work programs

- Technical consulting fees

- Tenement access, administration and management

- Corporate and administrative expenses

- Project Acquisition related expenses

This announcement has been authorised by the Board of Comet Resources Limited.

For further information please contact:

MATTHEW O’KANE

Managing Director

(08) 6489 1600

[email protected]

cometres.com.au

Suite 9, 330 Churchill Avenue Subiaco WA 6008

PO Box 866 Subiaco WA 6904

Original Article: https://mcusercontent.com/2fca36b6963d9ac563567f99e/files/e97671d2-2801-47eb-87f5-4f224846bf1e/Quarterly_Activities_Report_and_Appendix_5B_Dec_2020_1_.pdf