Full-Year Production and Cost Guidance Reaffirmed

Chicago, Illinois – November 4, 2019 – Coeur Mining, Inc. (“Coeur” or the “Company”) (NYSE: CDE) today reported third quarter 2019 financial results, including revenue of $199.5 million and cash flow from operating activities of $42.0 million. Including non-cash write downs of $15.0 million taken in the quarter, the Company reported GAAP net loss from continuing operations of $14.3 million, or $0.06 per share. On an adjusted basis1, the Company reported EBITDA of $61.0 million and net loss from continuing operations of $5.3 million, or $0.02 per share.

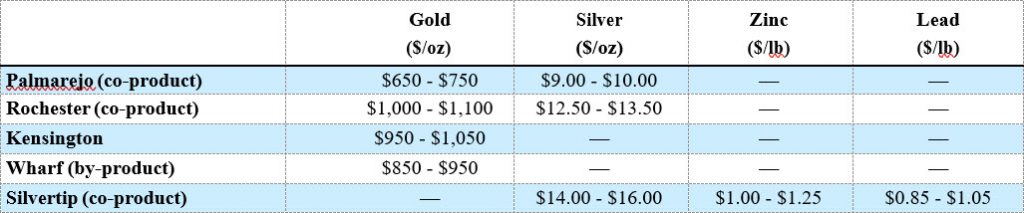

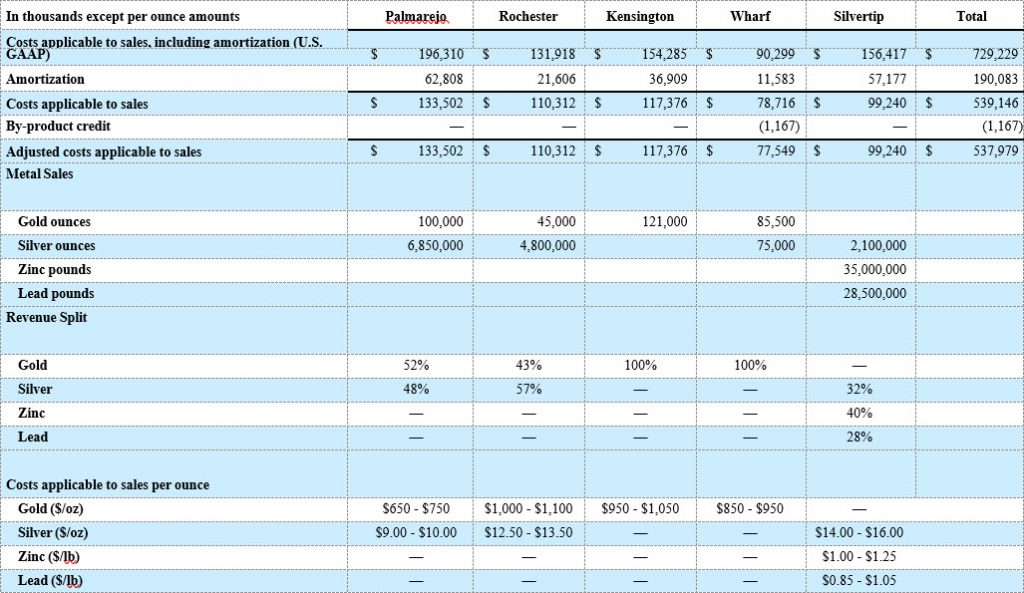

The Company is reaffirming full-year 2019 production guidance of 334,000 – 372,000 ounces of gold, 12.2

– 14.7 million ounces of silver, 25 – 40 million pounds of zinc and 20 – 35 million pounds of lead. In addition, full-year cost guidance is being reaffirmed.

Key Highlights

- Strong increases in quarterly financial results – Revenue, operating cash flow and adjusted EBITDA1 increased 23%, 59% and 99%, respectively, quarter-over-quarter. Strong financial performance was driven by a 15% increase in Companywide gold production and higher precious metals prices during the quarter

- Second consecutive quarter of positive free cash flow1 – The Company generated $11.3 million of free cash flow1 during the third quarter, approximately double the amount in the prior period. The second consecutive quarter of positive free cash flow1 was driven by strong performance at Palmarejo and Wharf

- Successful commissioning of new crushing circuit at Rochester – Rochester began processing ore through its new three-stage crushing circuit, including the high-pressure grinding roll (“HPGR”) unit, during the quarter. Fourth quarter results are expected to improve, reflecting a full quarter with the new crusher circuit in place

- Continued strong performance at Kensington – Kensington produced 34,156 ounces of gold and recorded adjusted costs applicable to sales (“CAS”)1 of $822 per ounce during the quarter. Results reflect the continued benefit of higher-grade ore from Jualin, which is expected to drive production and costs in-line with full-year guidance ranges

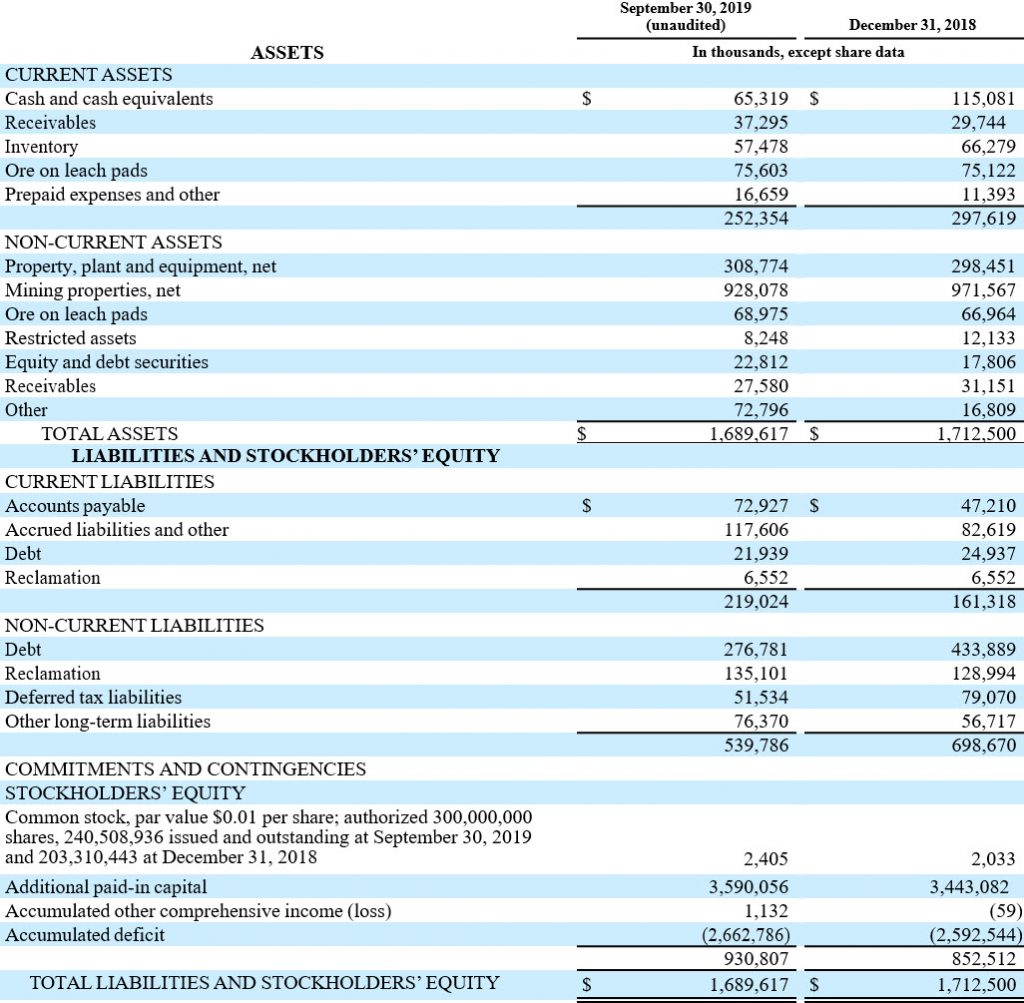

- 19% quarter-over-quarter reduction in total debt2 – Coeur retired over $70.0 million of indebtedness during the quarter, including the remaining balance outstanding under its $250.0 million senior secured revolving credit facility (the “RCF”). The Company has reduced total debt2 by approximately $160.0 million since the beginning of the year

- 72% increase in cash and equivalents – Cash and equivalents as of September 30, 2019 totaled $65.3 million, 72% higher compared to the prior period

“We made significant progress during the third quarter toward achieving our full-year 2019 operational and financial objectives,” said Mitchell J. Krebs, President and Chief Executive Officer. “The combination of strong operational performance and higher prices led to a 23% increase in revenue, a near doubling of adjusted EBITDA1 and positive free cash flow1 for the second consecutive quarter. We also improved our financial flexibility by materially reducing our debt level and bolstering our liquidity while continuing to invest in near-mine exploration and high-return organic growth opportunities.”

“At the Silvertip silver-zinc-lead mine in British Columbia, Canada, we continue to make steady progress addressing the operation’s mill availability challenges. We extended the amount of planned downtime during the quarter to prioritize the completion of several key projects, which resulted in lower production levels. However, we mobilized additional third-party resources during the quarter to accelerate our mill stabilization efforts, which are now having the intended impact.”

Mr. Krebs continued, “We anticipate this strong performance to continue in the fourth quarter as we seek to generate a third consecutive quarter of increasing, positive free cash flow.”

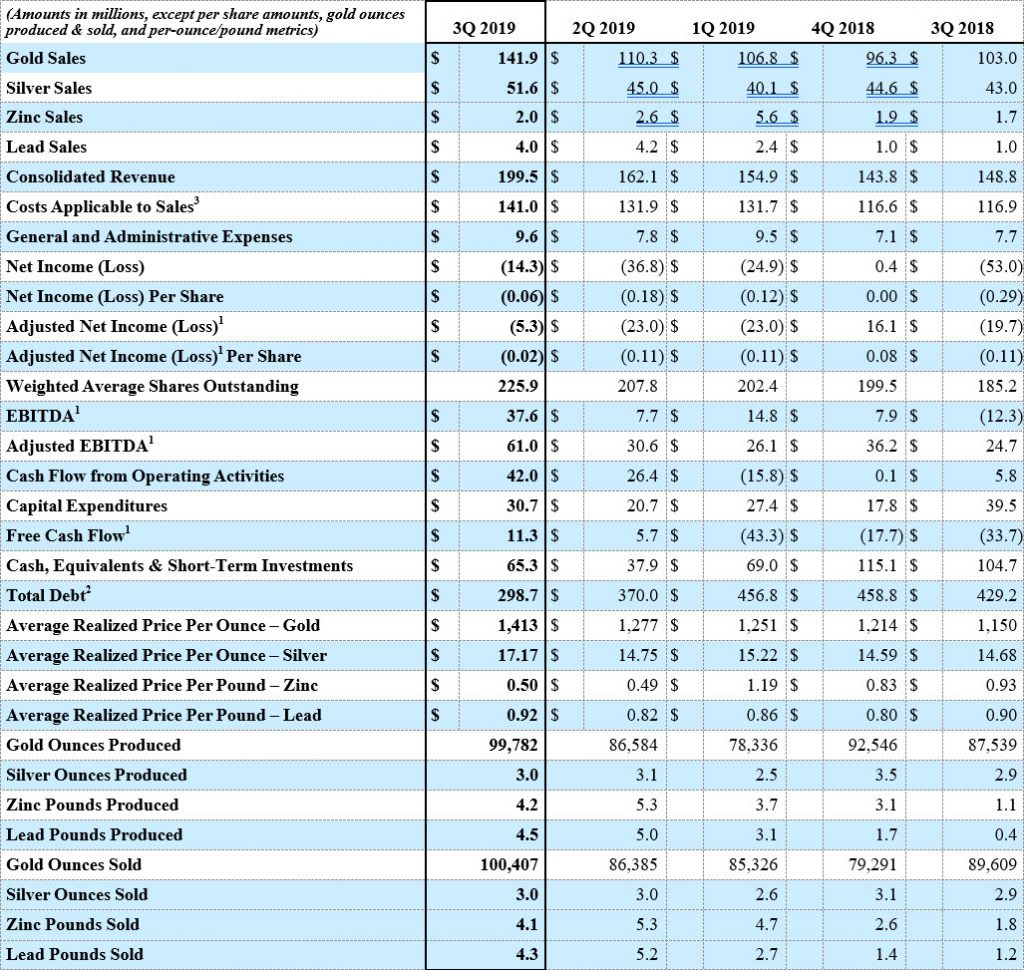

Financial and Operating Highlights (Unaudited)

Financial Results

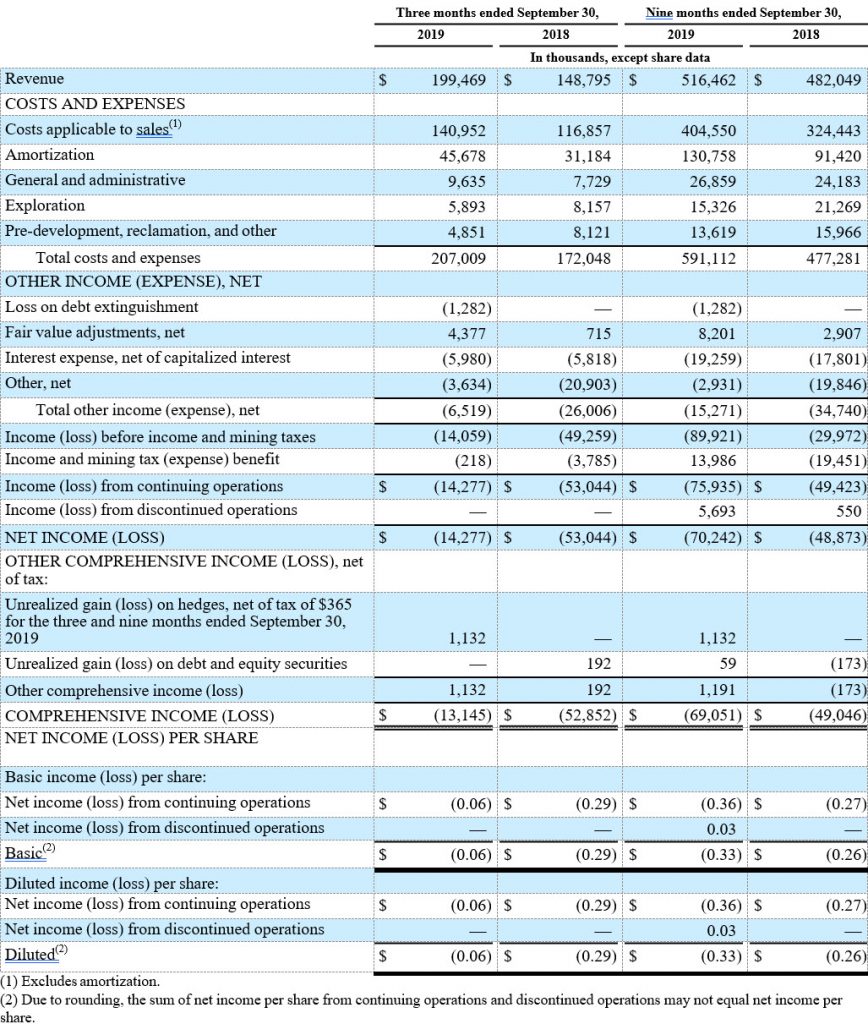

Third quarter revenue increased 23% to $199.5 million compared to $162.1 million in the second quarter of 2019. The Company sold 100,407 ounces of gold representing an increase of 16% compared to the prior period, while silver sales remained relatively consistent at 3.0 million ounces. Zinc and lead sales totaled 4.1 million and 4.3 million pounds during the third quarter, 23% and 17% lower, respectively, quarter-over- quarter.

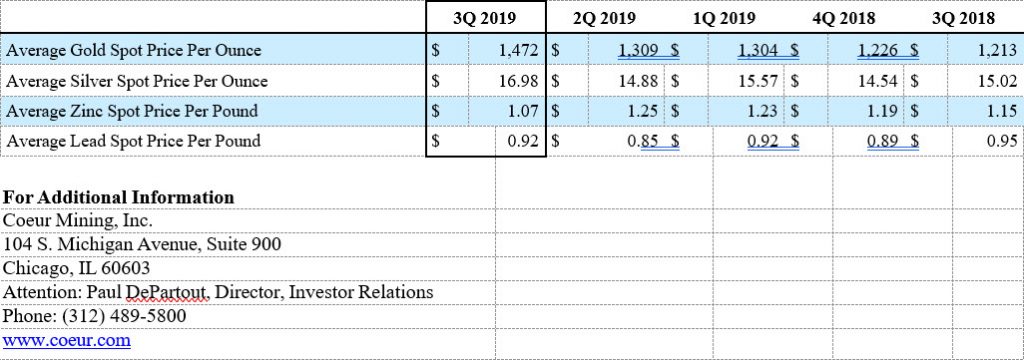

Average realized gold and silver prices increased 11% and 16%, respectively, quarter-over-quarter to $1,413 and $17.17 per ounce. The average realized gold price during the quarter reflects the sale of 10,785 ounces of gold at a price of $800 per ounce pursuant to Palmarejo’s gold stream agreement. Average realized zinc price remained relatively consistent quarter-over-quarter at $0.50 per pound, while average realized lead price increased 12% to $0.92 per pound. The average realized zinc and lead prices are presented net of treatment and refining charges and reflect the impact of provisional price adjustments.

Gold and silver sales accounted for 71% and 26% of third quarter revenue, respectively, while zinc and lead together accounted for the remaining 3%. The Company’s U.S. operations accounted for approximately 59% of third quarter revenue, up from approximately 56% in the second quarter primarily due to increased sales from Wharf, which totaled $36.7 million.

Costs applicable to sales increased 7% quarter-over-quarter to $141.0 million, reflecting higher costs associated with increased production at Wharf during the quarter. Third quarter general and administrative expenses were $9.6 million compared to $7.8 million in the prior period, largely due to higher employee- related expenses and legal fees.

Quarterly exploration expense was $5.9 million, or 4% higher quarter-over-quarter, reflecting Coeur’s continued commitment to its success-based exploration program and the commencing of new drilling campaigns during the quarter. Exploration activities in the third quarter were primarily focused on expansion drilling at Palmarejo, Kensington, Silvertip, and the Sterling and Crown exploration properties in southern Nevada. See page 13 for further details.

During the third quarter, the Company recorded an income tax expense of $0.2 million, largely attributable to higher taxable earnings during the quarter. Cash income and mining taxes paid during the quarter totaled

$0.7 million, partially offset by $0.3 million of value-added tax refunds.

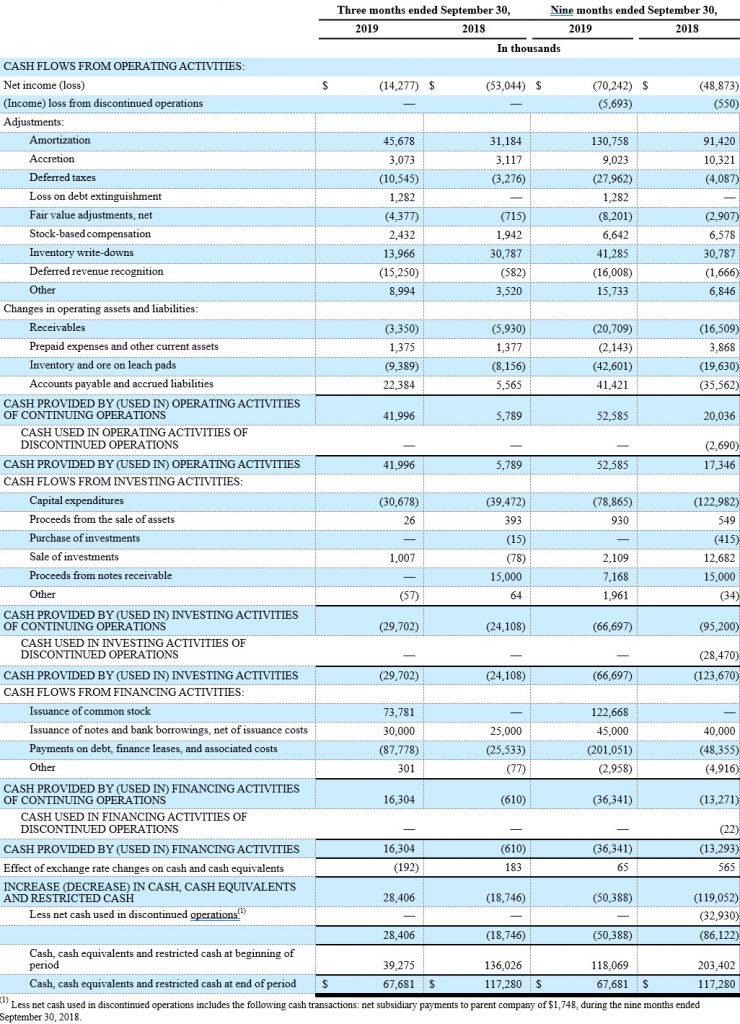

Operating cash flow of $42.0 million in the third quarter reflects improved profitability across the Company’s portfolio, with the exception of Silvertip. Third quarter operating cash flow also reflects a $14.7 million working capital outflow associated with sales made under Kensington’s $25.0 million prepayment agreement. The Company expects the remaining $10.3 million working capital outflow under this arrangement will occur during the fourth quarter.

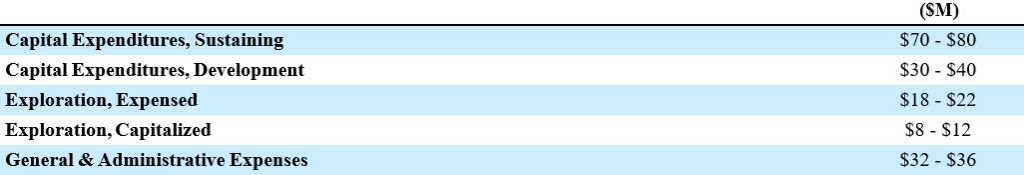

Third quarter capital expenditures totaled $30.7 million, compared to $20.7 million in the second quarter. Higher capital expenditures were driven by increased investment at Rochester and Silvertip during the third quarter. Sustaining and development capital expenditures accounted for approximately 52% and 48%, respectively, of the Company’s total capital expenditures in the third quarter.

Third Quarter Debt Reduction Initiatives

During the third quarter, Coeur completed its previously announced $75.0 million at-the-market common stock offering program, raising net proceeds (after sales commissions) of $73.8 million. The Company also entered into privately negotiated agreements to exchange $20.0 million of aggregate principal amount of its senior unsecured notes for common stock during the quarter.

These transactions helped the Company retire $71.3 million of outstanding indebtedness, including the remaining $53.0 million balance under the RCF. As of September 30, 2019, the Company had $315.3 million of liquidity, including $65.3 million of cash and cash equivalents and $250.0 million of availability under the RCF.

Update on Hedging Strategy

During the third quarter, Coeur implemented a series of zero-cost collar hedges on a portion of its gold production in 2019 and 2020. The structure of the hedging program allows for downside protection against potential decreases in the price of gold, while enabling participation in the potential upside up to a specified ceiling. The strategy was designed to support free cash flow1 generation and help fund key internal growth projects. Additional details are outlined below:

- 21,000 ounces of gold per month for the remainder of 2019 at an average floor of $1,405 per ounce and an average ceiling of $1,798 per ounce; and

- 12,000 ounces of gold per month from January 2020 through August 2020 at an average floor of $1,408 per ounce and an average ceiling of $1,803 per ounce

Operations

Third quarter 2019 highlights for each of the Company’s operations are provided below.

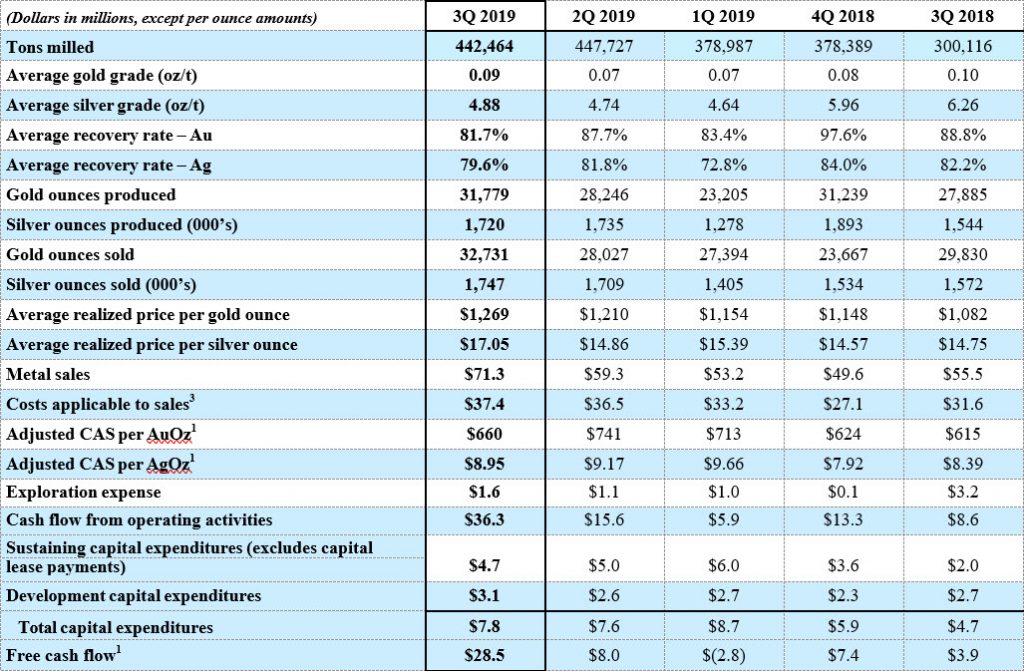

Palmarejo, Mexico

- Third quarter gold production increased 13% to 31,779 ounces, while silver production remained consistent at approximately 1.7 million ounces compared to the prior quarter. Year-over-year, gold and silver production increased by approximately 14% and 11%, respectively

- Higher gold production during the quarter was primarily driven by the improvement in average grade, partially offset by lower recoveries. Consistent quarter-over-quarter silver production reflected higher grade offset by slightly lower recoveries and mill throughput. Lower recoveries during the quarter reflect additional in-circuit inventory and adjustments on final settlements of doré sales

- Third quarter adjusted CAS1 for gold and silver on a co-product basis decreased 11% and 2%, respectively, to $660 and $8.95 per ounce. Strong cost performance during the quarter reflects higher average grades and prudent expense management

- Free cash flow1 of $28.5 million during the third quarter was largely driven by higher operating cash flow from increased metal sales and lower unit costs. Capital expenditures during the quarter were focused on mine development and infrastructure projects

- Production began at La Nación, located within the Independencia mine complex, in the beginning of the third quarter. La Nación is anticipated to continue ramping up through the end of 2019 as infrastructure projects are completed, adding approximately 400 tons per day of additional mill feed

- Commissioning of a new thickener was completed on-budget and on-schedule in the third quarter. The project is expected to increase metallurgical recoveries for both gold and silver by approximately 2% and has an estimated one-year payback

- Full-year 2019 production guidance remains unchanged at 95,000 – 105,000 ounces of gold and 6.5 – 7.2 million ounces of silver

- Guidance for CAS and capital expenditures also remains unchanged. CAS are expected to be $650 – $750 per gold ounce and $9.00 – $10.00 per silver ounce. Capital expenditures are expected to be approximately

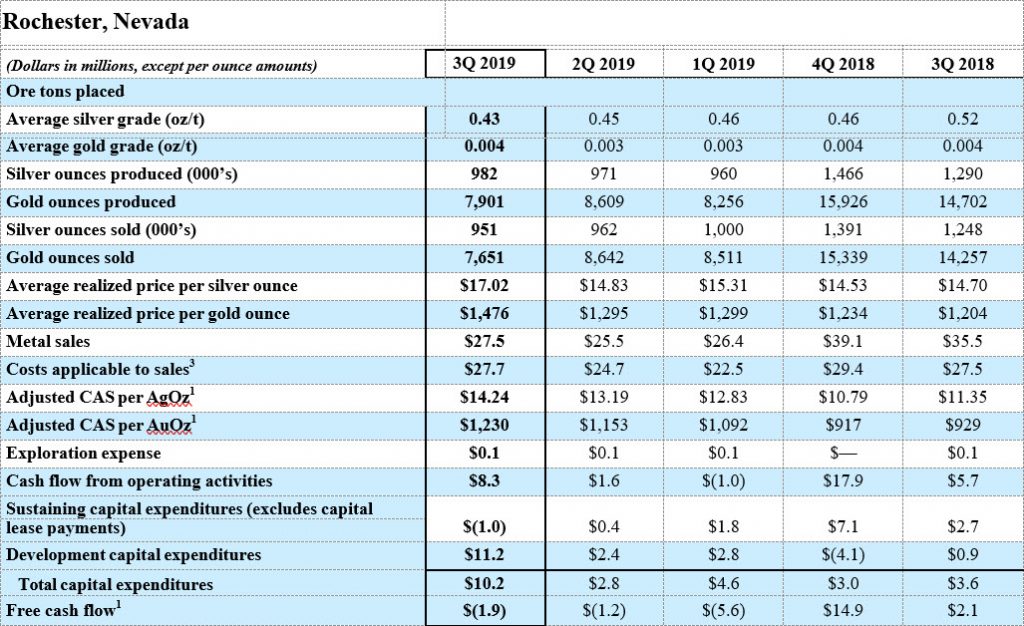

- Tons placed in the third quarter decreased 10% quarter-over-quarter and 38% year-over-year to approximately 2.5 million tons. Fewer tons placed reflects the commissioning of the new three-stage crushing circuit during the quarter

- Silver production remained consistent quarter-over-quarter at approximately 1.0 million ounces, while gold production decreased 8% to 7,901 ounces. Year-over-year, silver and gold production decreased 24% and 46%, respectively

- Silver production was impacted by slightly lower average grade, while gold production decreased largely due to fewer tons placed. Side slope leaching on the Stage III and Stage IV leach pads as well as the stacking of run-of-mine material early in the quarter were used to supplement production

- Third quarter adjusted CAS1 for silver and gold on a co-product basis increased 8% and 7%, respectively, quarter-over-quarter to $14.24 and $1,230 per ounce. Higher costs during the quarter were primarily related to lower production and the stacking of run-of-mine material during the commissioning of the new crushing circuit. Third quarter adjusted CAS1 excludes $4.8 million, primarily related to a one-time charge associated with the operation’s power costs

- Free cash flow1 of $(1.9) million was driven by higher capital expenditures, which more than offset improved operating cash flow during the quarter. Capital expenditures were focused on the new crushing circuit, further development of the Stage IV leach pad and initial work on Plan of Operations Amendment 11

- Initial recovery results from bottle roll and column tests on HPGR-crushed ore during the quarter were encouraging and in-line with original expectations. The Company plans to continue monitoring and benchmarking results against third-party test work to further validate recovery rates associated with the HPGR unit

- Production in the fourth quarter is anticipated to benefit from the stacking of additional tons, reflecting a full quarter integrating the new crushing circuit. The Company began stacking HPGR-crushed material close to the liner of the Stage IV leach pad in September

- The Company is maintaining full-year 2019 production guidance of 4.2 – 5.0 million ounces of silver and 40,000 – 50,000 ounces of gold. CAS in 2019 are also unchanged and expected to be $12.50 – $13.50 per silver ounce and $1,000 – $1,100 per gold ounce

- The Company’s guidance for capital expenditures is also unchanged and expected to be approximately $17 – $20 million

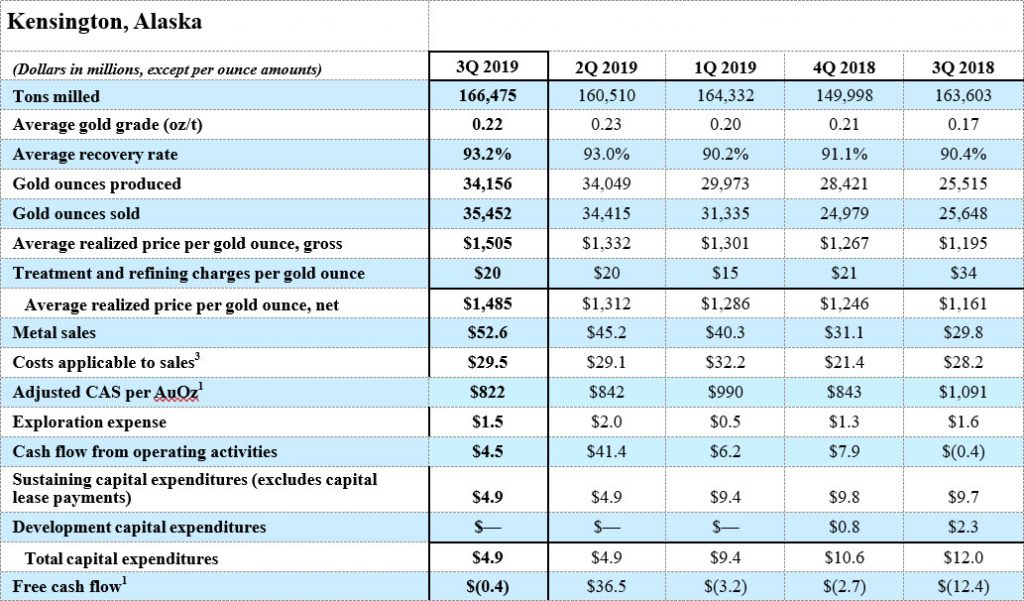

- Commercial production at Jualin was declared on December 1, 2018. The figures shown in the table above exclude pre-commercial production

- Third and second quarter operating cash flow and free cash flow1 in the table reflect the impact of a $25.0 million prepayment received in the second quarter, which resulted in $14.7 million of working capital outflows in the third quarter. Excluding the effect of the prepayment, third and second quarter operating cash flow was $19.2 million and $16.4 million, respectively, while free cash flow1 was $14.3 million and $11.5 million, respectively

- Continued strong gold production during the third quarter totaled 34,156 ounces, consistent with the prior period. Year-over-year gold production increased 34%

- Adjusted CAS1 decreased modestly quarter-over-quarter, totaling $822 per ounce and remained below the low end of the full-year guidance range of $950 – $1,050 per ounce

- Jualin accounted for approximately 15% of Kensington’s third quarter production, compared to approximately 17% in the prior quarter. Jualin is now anticipated to account for approximately 15% of Kensington’s total production in 2019, largely due to an expected increase in production from the Kensington Main deposit

- Capital expenditures of $4.9 million during the quarter were largely focused on ongoing underground development

- Full-year 2019 production guidance is unchanged at 117,000 – 130,000 ounces of gold

- Full-year CAS and capital expenditures guidance are also being maintained. CAS are expected to be $950 – $1,050 per ounce; capital expenditures are expected to be $20 – $25 million

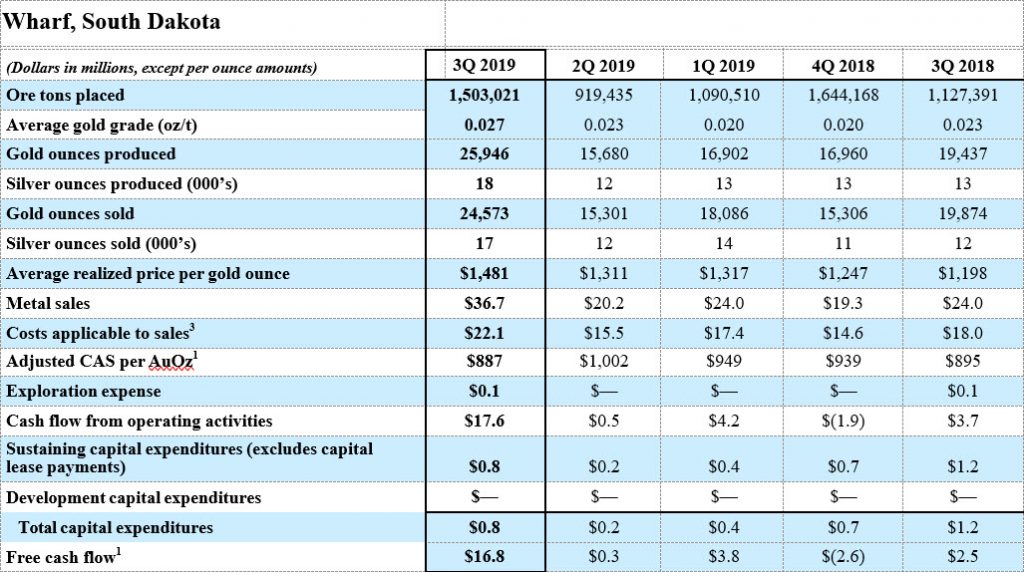

- Gold production in the third quarter increased 65% quarter-over-quarter and 33% year-over-year to 25,946 ounces

- Higher production during the quarter was largely driven by the placement of additional tons and improved grade. Tons placed increased 63% quarter-over-quarter to 1.5 million, while average gold grade increased 17% to 0.027 ounces per ton

- Operational results reflect better crusher performance and improved weather conditions. Strong crusher performance and the placement of higher-grade ore are expected to drive solid production results in the fourth quarter

- Adjusted CAS1 on a by-product basis decreased 11% quarter-over-quarter to $887 per ounce, primarily as a result of increased production during the third quarter

- Free cash flow1 of $16.8 million was driven by higher production, an improvement in the average realized price of gold and lower unit costs during the quarter

- The Company is maintaining full-year 2019 production guidance of 82,000 – 87,000 ounces of gold

- Coeur is also maintaining its full-year 2019 guidance for CAS and capital expenditures. CAS are expected to be $850 – $950 per ounce and capital expenditures are expected to be approximately $3 – $5 million

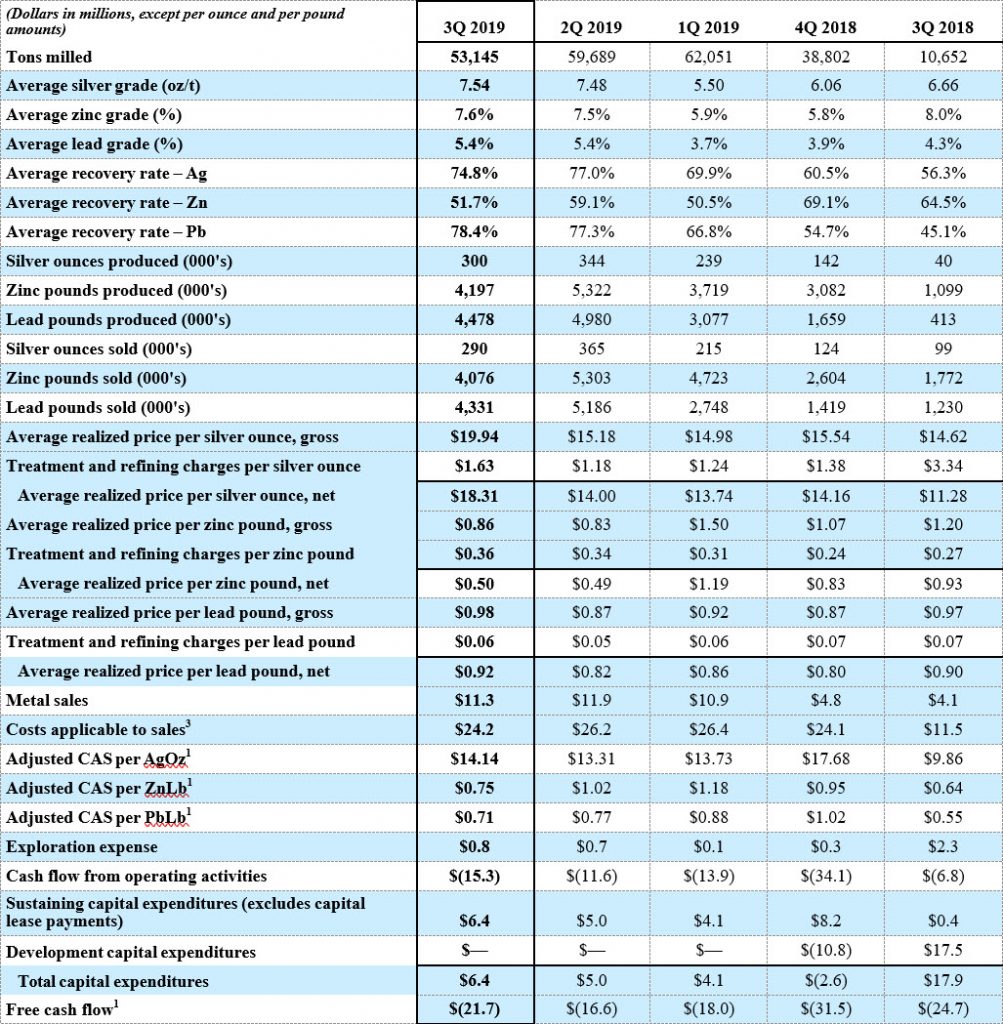

- Silvertip achieved commercial production on September 1, 2018. The figures shown in the table above exclude pre-commercial production. Adjusted CAS1 figures shown in the table above exclude the impact of non-cash write downs of metal inventory

- Third quarter silver production decreased 13% to 0.3 million ounces quarter-over-quarter, while zinc and lead production decreased 21% and 10%, respectively, to 4.2 million pounds of zinc and 4.5 million pounds of lead. Lower production was largely driven by planned and unplanned downtime, which impacted mill availability during the quarter

- Third quarter adjusted CAS1 on a co-product basis were $14.14 per silver ounce, $0.75 per payable zinc pound and $0.71 per payable lead pound, compared to $13.31, $1.02 and $0.77, respectively, in the prior quarter

- Free cash flow1 of $(21.7) million was driven by lower operating cash flow and higher capital expenditures quarter-over-quarter

- Planned downtime was extended to take advantage of favorable weather conditions to address key projects to improve mill availability. Additional third-party maintenance resources were mobilized during the quarter to accelerate mill stabilization efforts

- The Company also deployed a coordinated human resources strategy to further enhance the operation’s leadership team, improve recruitment and retention efforts, and bolster training of mill operators. These efforts, combined with the accelerated mill maintenance plan, have resulted in significant improvements in mill availability late in the third quarter and quarter-to-date

- The Company believes that the permit amendment application to operate at a year-round mining and milling rate of 1,100 tons (1,000 metric tonnes) per day is in the final stages of the approval process and expected to be received in the fourth quarter

- Full-year 2019 production guidance is unchanged at 1.5 – 2.5 million ounces of silver, 25 – 40 million pounds of zinc and 20 – 35 million pounds of lead

- Full-year 2019 guidance ranges for CAS and capital expenditures are also unchanged. CAS are expected to be $14.00 – $16.00 per ounce of silver, $1.00 – $1.25 per pound of zinc and $0.85 – $1.05 per pound of lead; capital expenditures are expected to total $20 – $25 million

Exploration

During the third quarter, the Company drilled 110,361 feet (33,638 meters) at a total cost of $7.5 million ($5.9 million expensed and $1.6 million capitalized), compared to 151,153 feet (46,072 meters) at a total cost of $6.8 million ($5.7 million expensed and $1.1 million capitalized) in the second quarter. Total feet drilled during the third quarter was approximately 27% lower compared to the prior period, largely due to reduced infill drilling at Palmarejo and Kensington. The 2019 drill programs at Rochester and Wharf began during the quarter.

At Silvertip, two surface core drill rigs continued expansion drilling at the Discovery East and North zones. Results from the ongoing expansion drilling efforts remain encouraging. Infill drilling at Discovery East commenced in September with one drill rig active during the month. Three core rigs are scheduled to continue infill drilling the area through the end of November. Ground geophysical surveys and soil sampling were completed over the Tiger Terrace target area and show coincident anomalies over an approximately two-mile trend, located three miles south of the Silvertip mine. First pass drilling is currently planned for 2020.

At Kensington, surface and underground core drill rigs focused on expansion drilling at the Elmira, Eureka, Comet and Seward veins. The Comet and Seward veins are strategically located above the Kensington access tunnel, allowing for the potential to leverage existing infrastructure if the veins are developed. Results from expansion drilling were encouraging and represent a first pass exploration effort. No infill drilling was completed at Kensington during the quarter.

At the Sterling and Crown exploration properties, located in southern Nevada, two reverse circulation rigs were active during the third quarter. One rig was focused on expansion drilling at the Daisy South and West, and SNA resource zones, which are contained in the Crown Block. Results from the drilling in these zones were encouraging. Exploration drilling and surface mapping in the Crown Block are expected to continue during the fourth quarter, with one rig maintaining focus on the SNA resource zone. Infill drilling at Sterling commenced in August with encouraging results near the historic 8 Adit and 144 zones at the southern portion of the historic Sterling mining area. Expansion drilling at both Crown and Sterling is expected to continue during the fourth quarter.

At Palmarejo, up to seven surface and underground core rigs were active during the third quarter. Infill drilling focused on La Nación and veins southeast of the Guadalupe mine, with encouraging results particularly at La Nación. Expansion drilling focused on extending mineralization northwest from the Guadalupe mine and north of the Independencia mine as well as expanding mineralized material at Independencia East. Infill and expansion drilling are expected to continue through the fourth quarter.

Infill and expansion drilling at the Richmond Hill project, located approximately four miles north-northeast of Wharf, commenced at the end of September and is expected to continue into the fourth quarter. A single reverse circulation rig is currently on site.

At Rochester, an infill diamond drilling program commenced during the quarter, employing directional drilling techniques to drill underneath the Stage I leach pad. The program is expected to be completed early in the fourth quarter.

Expansion drilling is expected to commence in the fourth quarter at the Lincoln Hill project, located approximately four miles west of Rochester.

At the La Preciosa project, located in Durango, Mexico, a new resource model is being developed based on an improved geological interpretation for the site. This work and further evaluation of the project is expected to continue during 2020.

2019 Costs Applicable to Sales Guidance

2019 Capital, Exploration and G&A Guidance

Note: The Company’s guidance figures assume $1,275/oz gold, $15.50/oz silver, $1.15/lb zinc and $0.95/lb lead as well as CAD of 1.30 and MXN of 20.00.

Financial Results and Conference Call

Coeur will host a conference call to discuss its third quarter financial results on November 5, 2019 at 11:00 a.m. Eastern Time.

Dial-In Numbers:

(855) 560-2581 (U.S.)

(855) 669-9657 (Canada)

(412) 542-4166 (International)

Conference ID: Coeur Mining

Hosting the call will be Mitchell J. Krebs, President and Chief Executive Officer of Coeur, who will be joined by Thomas S. Whelan, Senior Vice President and Chief Financial Officer, Terry F. D. Smith, Senior Vice President of Operations, Hans J. Rasmussen, Senior Vice President of Exploration, and other members of management. A replay of the call will be available through November 19, 2019.

Replay numbers:

(877) 344-7529 (U.S.)

(855) 669-9658 (Canada)

(412) 317-0088 (International)

Conference ID: 101 35 184

About Coeur

Coeur Mining, Inc. is a U.S.-based, well-diversified, growing precious metals producer with five wholly-owned operations: the Palmarejo gold-silver complex in Mexico, the Rochester silver-gold mine in Nevada, the Kensington gold mine in Alaska, the Wharf gold mine in South Dakota, and the Silvertip silver-zinc-lead mine in British Columbia. In addition, the Company has interests in several precious metals exploration projects throughout North America.

Cautionary Statements

This news release contains forward-looking statements within the meaning of securities legislation in the United States and Canada, including statements regarding anticipated production, costs, capital expenditures, recovery rates, exploration expenditures, expenses, free cash flow, expectations regarding Silvertip, including but not limited to timing of receipt of permits, grades, exploration and development efforts, the impact of the new crushing circuit at Rochester, the prepayment transaction at Kensington, our gold price hedging strategy, and operations at Palmarejo, Rochester, Wharf, Kensington and Silvertip. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause Coeur’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, the risk that Silvertip will not obtain necessary permits on the expected timeline or at all, the risk that the anticipated benefits of the new crushing circuit at Rochester will not be achieved, the risk that anticipated production, cost and expense levels are not attained, the risks and hazards inherent in the mining business (including risks inherent in developing large-scale mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), changes in the market prices of gold, silver, zinc and lead and a sustained lower price environment, the uncertainties inherent in Coeur’s production, exploratory and developmental activities, including risks relating to permitting and regulatory delays (including the impact of government shutdowns), ground conditions, grade variability, any future labor disputes or work stoppages, the uncertainties inherent in the estimation of mineral reserves, changes that could result from Coeur’s future acquisition of new mining properties or businesses, the loss of any third-party smelter to which Coeur markets its production, the effects of environmental and other governmental regulations, the risks inherent in the ownership or operation of or investment in mining properties or businesses in foreign countries, Coeur’s ability to raise additional financing necessary to conduct its business, make payments or refinance its debt, as well as other uncertainties and risk factors set out in filings made from time to time with the United States Securities and Exchange Commission, and the Canadian securities regulators, including, without limitation, Coeur’s most recent reports on Form 10-K and Form 10-Q. Actual results, developments and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements. Coeur disclaims any intent or obligation to update publicly such forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, Coeur undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Coeur, its financial or operating results or its securities.

Christopher Pascoe, Coeur’s Director, Technical Services and a qualified

person under Canadian National

Instrument 43-101, approved

the scientific and technical

information concerning Coeur’s

mineral projects in this

news release. For a

description of the key assumptions, parameters and methods

used to estimate

mineral reserves and resources, as well as data

verification procedures and a general discussion of the extent

to which the estimates may be affected by any known

environmental, permitting, legal,

title, taxation, socio-political, marketing

or other relevant

factors, Canadian investors should refer to the Technical

Reports for each of Coeur’s properties as filed on SEDAR at www.sedar.com.

Non-U.S. GAAP Measures

We supplement the reporting of our financial information determined under United States generally accepted accounting principles (U.S. GAAP) with certain non-U.S. GAAP financial measures, including EBITDA, adjusted EBITDA, adjusted EBITDA margin, free cash flow, adjusted net income (loss) and adjusted costs applicable to sales per ounce (gold and silver) or pound (zinc or lead). We believe that these adjusted measures provide meaningful information to assist management, investors and analysts in understanding our financial results and assessing our prospects for future performance. We believe these adjusted financial measures are important indicators of our recurring operations because they exclude items that may not be indicative of, or are unrelated to our core operating results, and provide a better baseline for analyzing trends in our underlying businesses. We believe EBITDA, adjusted EBITDA, adjusted EBITDA margin, free cash flow, adjusted net income (loss) and adjusted costs applicable to sales per ounce (gold and silver) and pound (zinc and lead) are important measures in assessing the Company’s overall financial performance. For additional explanation regarding our use of non-U.S. GAAP financial measures, please refer to our Form 10-K for the year ended December 31, 2018 and our Form 10-Q for the quarter ended September 30,2019.

Notes

- EBITDA, adjusted EBITDA, adjusted EBITDA margin, free cash flow, adjusted net income (loss) and adjusted costs applicable to sales per ounce (gold and silver) or pound (lead and zinc) are non-GAAP measures. Please see tables in the Appendix for the reconciliation to U.S. GAAP. Free cash flow is defined as cash flow from operating activities less capital expenditures and gold production royalty payments. Please see table in Appendix for the calculation of consolidated free cash flow.

- Includes capital leases. Net of debt issuance costs and premium received.

- Excludes amortization.

Average Spot Prices

COEUR MINING, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

COEUR MINING, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

COEUR MINING, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

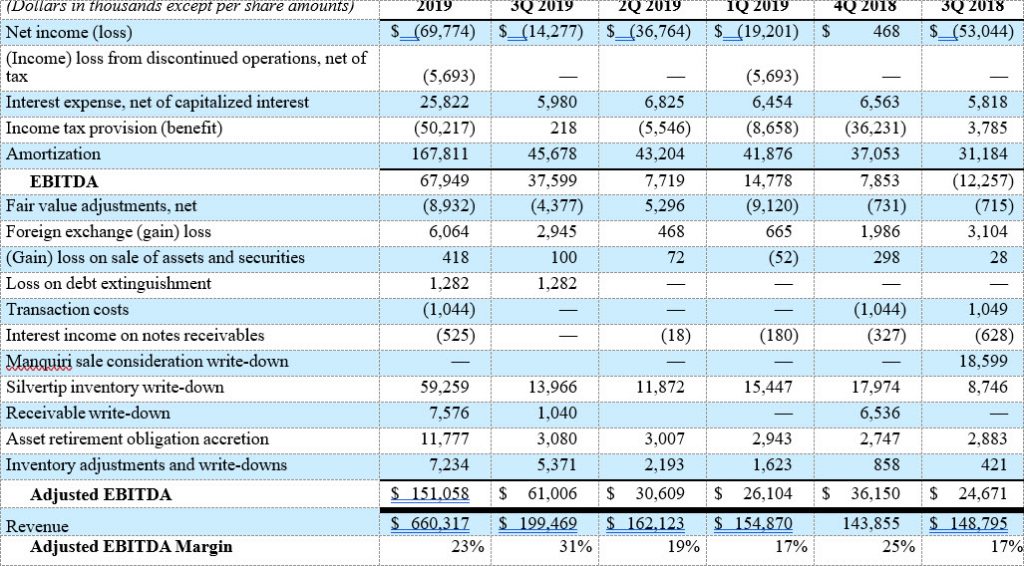

Adjusted EBITDA Reconciliation

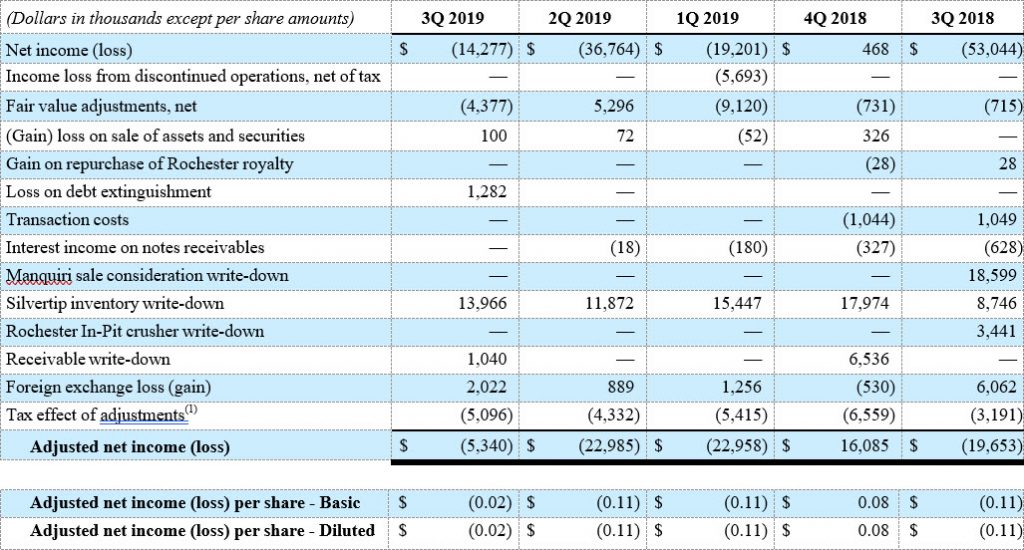

Adjusted Net Income (Loss) Reconciliation

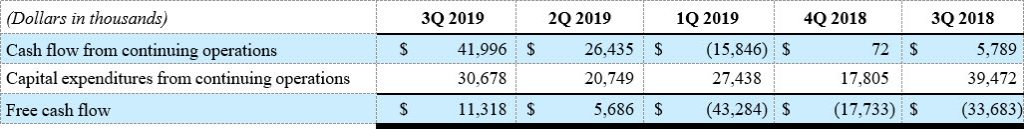

Consolidated Free Cash Flow Reconciliation

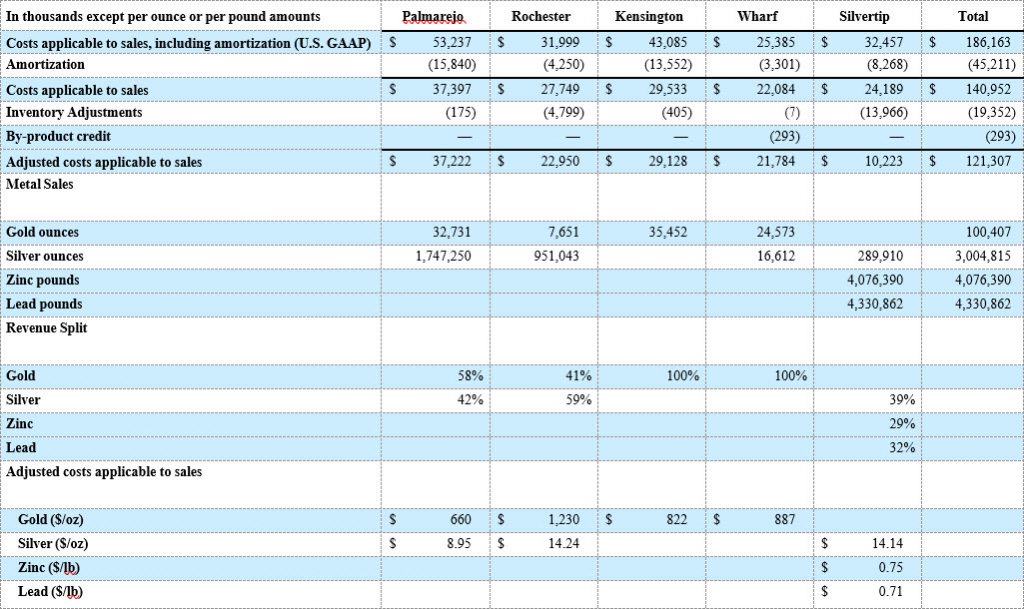

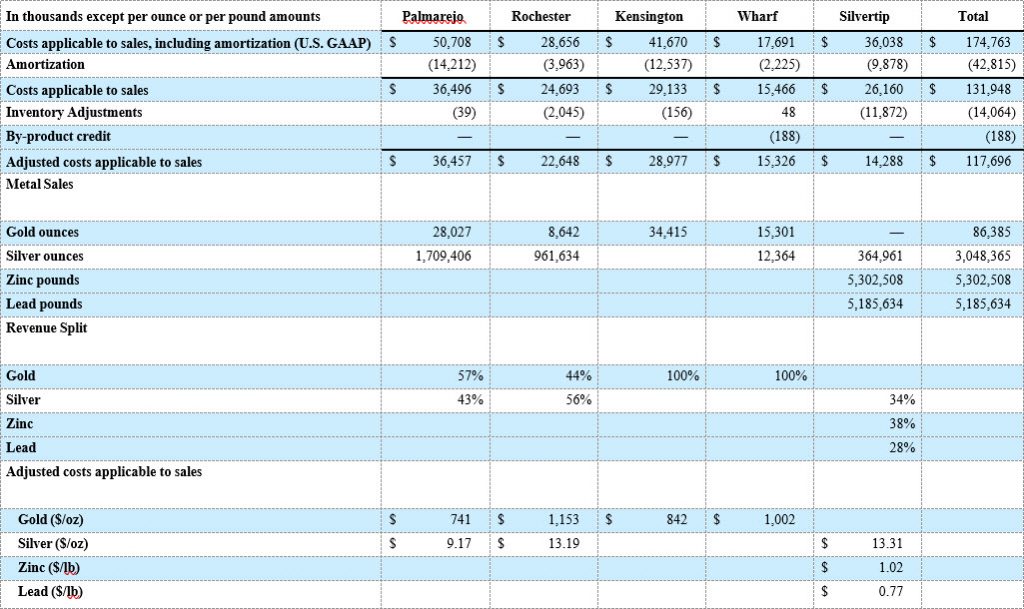

Reconciliation of Costs Applicable to Sales

for Three Months Ended September 30, 2019

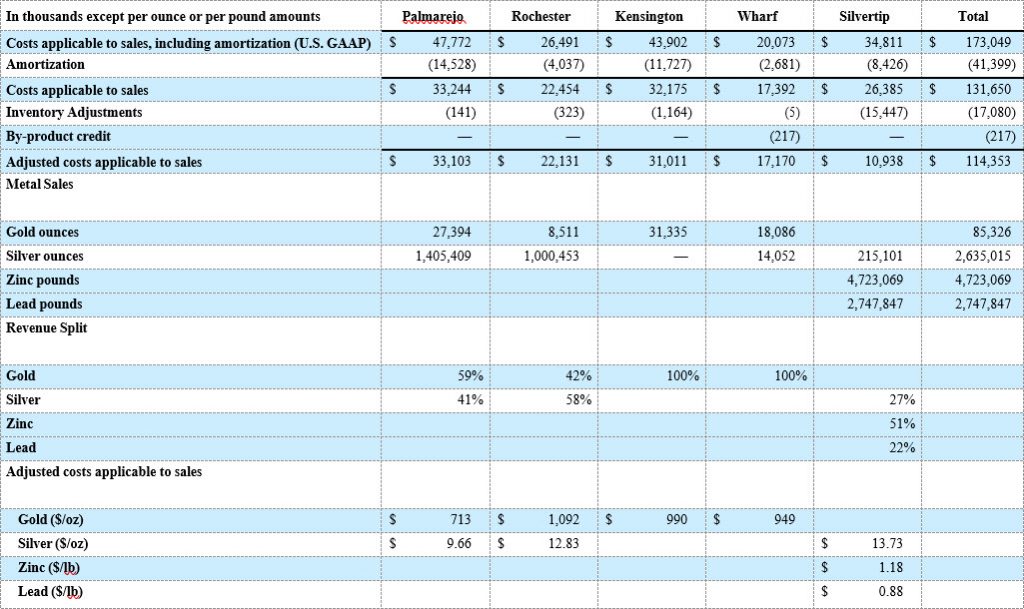

Reconciliation of Costs Applicable to Sales

for Three Months Ended June 30, 2019

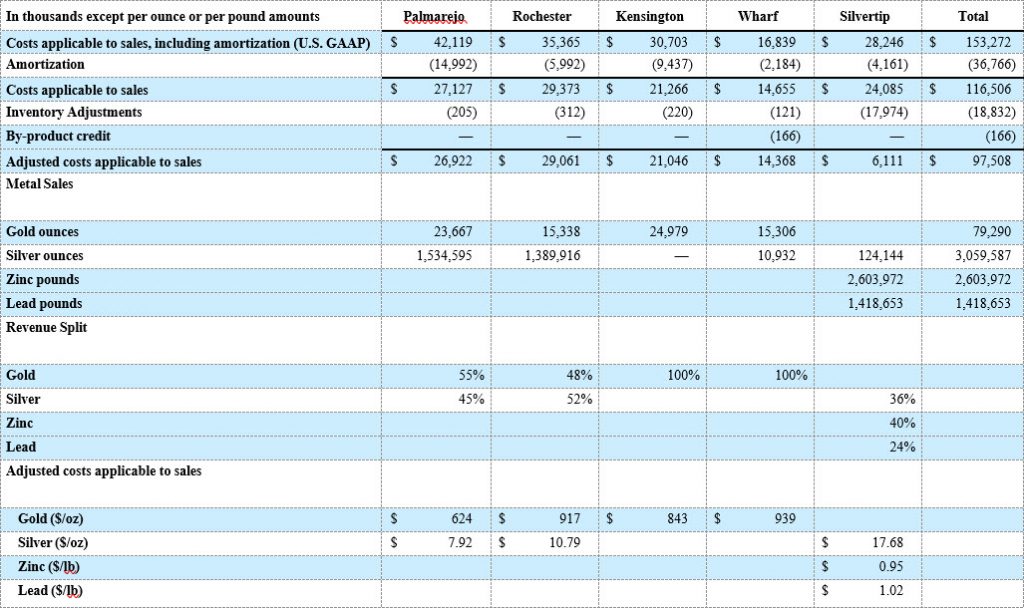

Reconciliationof Costs Applicable to Sales

for Three Months Ended March 31, 2019

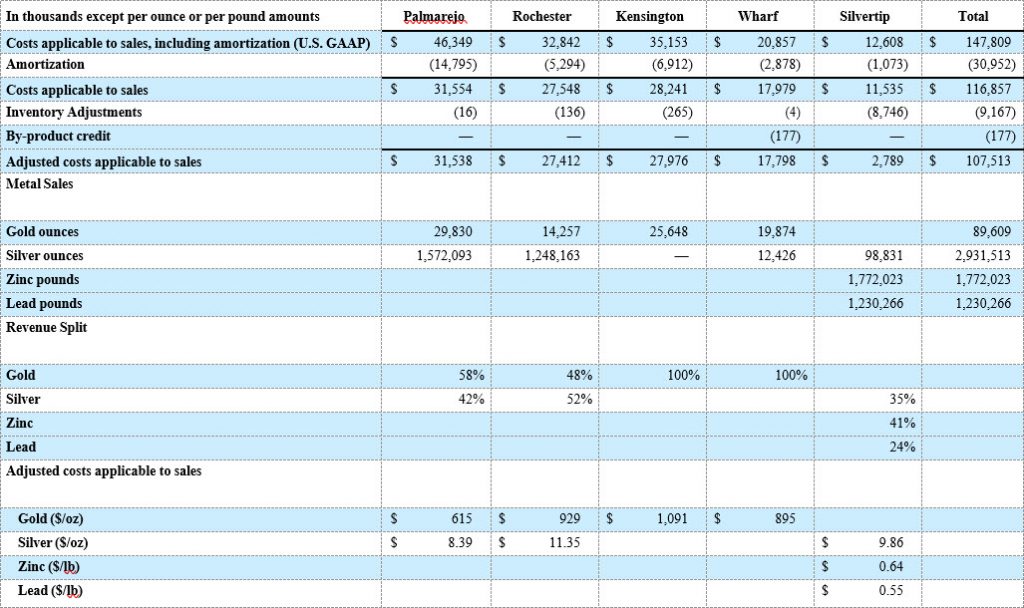

Reconciliationof Costs Applicable to Sales

for Three Months Ended December 31, 2018

Reconciliation of Costs Applicable to Sales

for Three Months Ended September 30, 2018

Reconciliation of Costs Applicable to Sales for 2019 Guidance

Original Article: https://www.coeur.com/_resources/news/nr_20191104.pdf