Summary

- AuRico and Alamos recently announced the companies were going to combine in a merger of equals.

- There is a substantial difference in valuation for the two companies flagship assets, as Young-Davidson is by far the better mine.

- The rest of the assets that each company will contribute is about even in terms of valuation.

- Some are skeptical but this merger makes a lot of sense, I'm even more bullish on the combined company.

On April 13, 2015, AuRico Gold (NYSE:AUQ) and Alamos Gold (NYSE:AGI)announced the two companies were going to combine in a merger of equals, creating a new $1.5 billion gold producer. Alamos and AuRico shareholders will each own approximately 50% of the new company, which will retain the Alamos Gold name.

We have some grumblings out of Alamos' shareholders, as not everybody likes the deal. A few analysts are skeptical as well. TD Securities analyst Steven Green said:

The transaction doesn't make sense for Alamos shareholders.

Since Alamos has $358 million in cash and no debt, he noted the deal "effectively rescues" AuRico from its balance sheet issues and provides Alamos no premium in exchange.

Green pointed to the transaction's enterprise value of $392 million for Alamos, versus AuRico's EV of slightly more than $1 billion. As a result, he believes the merger undervalues Alamos and will be significantly dilutive to his net asset value estimate.

I would strongly disagree with this assessment, AuRico is bringing much more to the table, and Alamos is getting a great deal as well.

Comparing The Flagship Assets

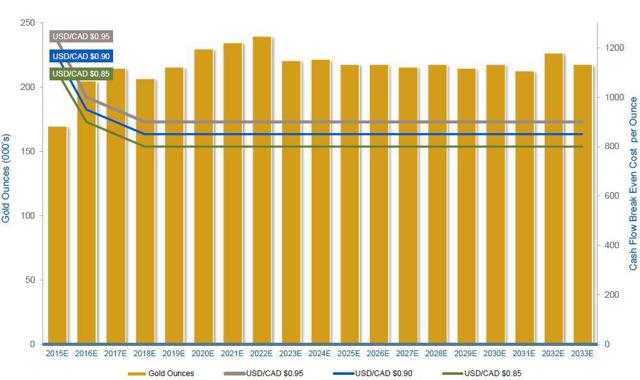

AuRico owns the Young-Davidson mine, which is located in Canada. It's AuRico's best asset by far and in fact will be the flagship mine of the newly combined company. With 3.8 million ounces of gold in underground reserves, Young-Davidson will be in production for 20+ years. It's still in the ramp up phase and won't reach steady state production until 2016. Once it does, it will be producing 225,000 ounces of gold per year and will have a fairly low $800-$881 AISC (depending on USD/CAD exchange rates).

(Source: Aurico Gold)

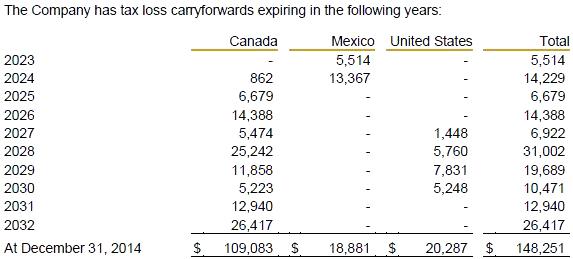

AuRico also has a significant amount of Canadian tax loss pools. In the current gold environment, Young-Davidson won't pay taxes until 2023 if you take into account these carry-forward tax loss pools and the payback for construction. According to AuRico's 2014 Annual Report, those carry-forward losses were $109 million as of December 31, 2014. The company also has some tax loss carry-forwards in Mexico as well.

(Source: Aurico Gold)

Assuming a 20 year production profile for Young-Davidson, with 175,000 ounces for 2015 at an AISC of $1,000, 225,000 ounces of production per year from then on at an AISC of $850, a tax rate of 30% kicking in after 2022 given the tax pools, and a $1,200 gold price, we get the following NPV:

NPV (5%) = $837,906,383.90

| Period | Cash Flow | Present Value |

| 0 | 35,000,000.00 | 35,000,000.00 |

| 1 | 78,750,000.00 | 75,000,000.00 |

| 2 | 78,750,000.00 | 71,428,571.43 |

| 3 | 78,750,000.00 | 68,027,210.88 |

| 4 | 78,750,000.00 | 64,787,819.89 |

| 5 | 78,750,000.00 | 61,702,685.61 |

| 6 | 78,750,000.00 | 58,764,462.49 |

| 7 | 78,750,000.00 | 55,966,154.75 |

| 8 | 55,125,000.00 | 37,310,769.83 |

| 9 | 55,125,000.00 | 35,534,066.51 |

| 10 | 55,125,000.00 | 33,841,968.10 |

| 11 | 55,125,000.00 | 32,230,445.81 |

| 12 | 55,125,000.00 | 30,695,662.68 |

| 13 | 55,125,000.00 | 29,233,964.45 |

| 14 | 55,125,000.00 | 27,841,870.91 |

| 15 | 55,125,000.00 | 26,516,067.53 |

| 16 | 55,125,000.00 | 25,253,397.65 |

| 17 | 55,125,000.00 | 24,050,854.90 |

| 18 | 55,125,000.00 | 22,905,576.10 |

| 19 | 55,125,000.00 | 21,814,834.38 |

| Total: | 837,906,383.90 |

As for Alamos Gold, its flagship operation is the Mulatos mine in Mexico, which has been a huge winner for the company. It was purchased in February 2003 for $10 million, built in 2004-2005 for $74 million, and has so far generated $350 million in free cash flow. It is the reason why Alamos has such a strong balance sheet. The problem is, Mulatos isn't the same mine that it used to be.

Mulatos started off as a heap leach operation, but a few years ago Alamos built a mill to process some of the higher grade ore. Grades of the stacked ore for the heap leach as well as milled grades have been in serious decline. Stacked ore grade has decreased every year since 2009, and is now half of what it used to be. The grade of the milled ore has also decreased, but it will finally see a bump up this year. It won't be enough to make a huge difference in cash costs though, as most production is still from the heap leach.

| Grade of Stacked Ore | Grade of Milled Ore | |

| 2009 | 1.81 g/t | – |

| 2010 | 1.60 g/t | – |

| 2011 | 1.31 g/t | – |

| 2012 | 1.19 g/t | 12.49 g/t |

| 2013 | 1.07 g/t | 6.84 g/t |

| 2014 | 0.98 g/t | 6.52 g/t |

As a result of declining grades, All-in sustaining costs have soared since 2012. Alamos' stock, which used to trade at a very high premium, has come down substantially as it's no longer a low cost producer.

| All-in Sustaining Costs | |

| 2012 | $695 |

| 2013 | $772 |

| 2014 | $1,022 |

| 2015E | $1,100 |

Mulatos has a seven year mine life remaining, and Alamos expects cash costs to decline in the future as it's bringing some higher grade satellite deposits online in the next 1-2 years. There were 1.73 million ounces of reserves left at the end of 2014, and the combined gold recovery for the heap leach and mill is about 75%. Which means there are 1.3 million ounces that will be produced if the entire reserve base is mined out, or 185,714 ounces per year for the next 7 years.

Mulatos won't get back to those low cash costs again, especially since the majority of reserves is only at 0.94 g/t. But these higher grade satellite deposits, as well as the higher grade underground ore near the main pit, should allow All-in sustaining costs to trend lower. If Mulatos can average an AISC of $900 for its remaining life of mine, which is a generous assumption, and you use a 38% tax rate (and include the $15.5 income tax receivable), at $1,200 gold here is the NPV:

NPV (5%)= $233,855,083.93

| Period | Cash Flow | Present Value |

| 0 | 50,042,804.00 | 50,042,804.00 |

| 1 | 36,214,230.00 | 34,489,742.86 |

| 2 | 36,214,230.00 | 32,847,374.15 |

| 3 | 36,214,230.00 | 31,283,213.48 |

| 4 | 36,214,230.00 | 29,793,536.64 |

| 5 | 36,214,230.00 | 28,374,796.80 |

| 6 | 36,214,230.00 | 27,023,616.00 |

| Total: | 233,855,083.93 |

So as you can see, there is a substantial difference in valuation for the two companies flagship assets. Young-Davidson is by far the better mine, 10 years ago it might have been a closer race. But Young-Davidson is a brand new, state of the art project with 20+ years of production ahead of it.

Some might point out that Mulatos still has 3.9 million ounces of resources, and those have value to them. But Young-Davidson also has about 1.9 million ounces of resources as well, which I'm not giving a value to. Also, the vast majority of those ounces that Alamos has left only have a grade of around 1 g/t. That's still well below the grade that was being mined a few years ago, and is only slightly higher than what they are producing today. I also want to mention the resource ounces at Young-Davidson actually have a higher grade than the ounces in reserves.

There is exploration upside to both projects, and maybe a high grade discovery is found at Mulatos. That's very possible given the grade history at the project. But as of now we can only assign a value based on facts, not speculation.

The Rest Of The Bunch

As for the rest of the assets that each company is bringing to the table, I would say it's about even.

AuRico also owns the El Chanate mine, which is a smaller open pit operation in Mexico that produces about 65,000-70,000 ounces of gold per year. With All-in sustaining costs of around $1,000 per ounce, the mine can produce a decent amount of after-tax cash flow annually ($9-$10 million at current gold prices). But El Chanate only has 8 years of mine-life remaining, and there are limited resources left. So this isn't an asset with a tremendous amount of value at the moment.

Assuming 70,000 ounces per year for the next 8 years at an AISC of $1,000, a tax rate of 35%, the tax loss pools, and a $1,200 gold price, the NPV is:

NPV (5%) = $86,159,151.45

| Period | Cash Flow | Present Value |

| 0 | 14,000,000.00 | 14,000,000.00 |

| 1 | 14,000,000.00 | 13,333,333.33 |

| 2 | 14,000,000.00 | 12,698,412.70 |

| 3 | 14,000,000.00 | 12,093,726.38 |

| 4 | 9,100,000.00 | 7,486,592.52 |

| 5 | 9,100,000.00 | 7,130,088.11 |

| 6 | 9,100,000.00 | 6,790,560.11 |

| 7 | 9,100,000.00 | 6,467,200.10 |

| 8 | 9,100,000.00 | 6,159,238.19 |

| Total: | 86,159,151.45 |

One of the assets that AuRico Gold is bringing to the table that I think a lot of investors are overlooking is Lynn Lake. AuRico has the option to acquire a 60% interest in the project by funding up to C$20M over 3 years and delivering a feasibility study. While it's still early stage, it's a very high grade open pit deposit that is located in Canada. It offers very attractive project economics as well with a low initial cap-ex and a long 12 year mine life.

Lynn Lake | |||

Mine Type | Open Pit | ||

Au Grade (g/t) | 2.2 | ||

Au M&I (Moz) | 1.50 | ||

Avg. LOM Annual Mill Prod. (koz) | 145 | ||

Avg. LOM Cash Costs (C$oz) | $530 | ||

Initial Capex (C$M) | $185 | ||

Projected Mine Life (years) | 12 | ||

Lynn Lake has an NPV (5%) of about C$325, that is using a gold price of $1,200 and a CDN:US exchange rate of 0.90. AuRico's 60% interest (assuming the buy in) has an NPV (5%) of US$175 million.

AuRico also owns the Kemess project, which is a copper-gold project that is being spun off into a separate company called AuRico Metals. The newly formed Alamos Gold will own a 4.9% equity interest in AuRico Metals. The remaining shares of the spinoff will be distributed 50% each to former Alamos and AuRico shareholders.

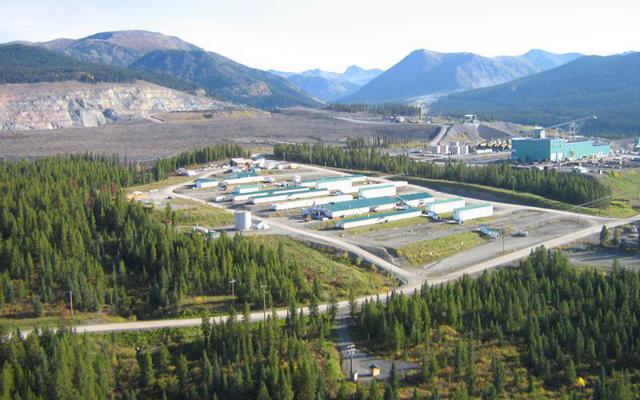

There is $1 billion of surface infrastructure at Kemess, which you can see below, as Kemess South was a once producing mine. Kemess North was discovered several years ago, and an even higher grade deposit called Kemess East was just discovered last year.

(Source: Aurico Gold)

AuRico was looking to possibly develop Kemess North and use all of this existing infrastructure. But with Kemess East looking much more promising, the focus has been shifted. Either way you have two large gold-copper deposits that can utilize this existing infrastructure, including the mill. AuRico says that's about $750 million in additional cap-ex they would of had to spend on the Kemess North project.

| Other Assets From AuRico | |

| El Chanate | $86.1 million |

| Lynn Lake | $175 million |

| Kemess | $275 million |

| Total | $536.1 million |

Alamos doesn't have any other producing mines but it does have several projects:

- Kirazli (Turkey)

- A?? Da??/Çamyurt (Turkey)

- Esperanza (Mexico)

- Quartz Mountain (US)

The problem is these projects aren't really company makers, there is nothing particularly exciting about them at the moment. Kirazli and A?? Da?? only have a 5 and 7 year mine life respectively. Çamyurt is 3 km away from A?? Da?? and has a higher grade, but it doesn't have much in resources either and it's unclear if these two can be developed together.

According to the 2012 Prefeasibility study on Kirazli and A?? Da??, their NPV is as follows:

| After-tax NPV (5%) at $1,239 gold price | |

| Kirazli | $154.1 million |

| A?? Da?? | $121.5 million |

Esperanza only has a 6 year mine life, its NPV is:

| After-tax NPV (5%) at $1,150 gold price | |

| Esperanza | $122 million |

I'm not assigning any value to Quartz Mountain, as Alamos only paid $3.5 million for it less than two years ago and it only has low grade inferred resources. Çamyurt doesn't have a study done on it yet, but it should be close in value to the two other Turkish assets.

| Other Assets From Alamos | |

| Kirazli | $154.1 million |

| Çamyurt | $100 million |

| A?? Da?? | $121.5 million |

| Esperanza | $122 million |

| Total | $497.6 million |

Investors Should Buy the Newly Formed Alamos Gold

I know some are skeptical but this merger makes a lot of sense. Before the news was announced, I was bullish on both companies as they were very undervalued for the assets that they owned. I'm even more bullish on the combined company.

AuRico has some quality assets, but they had $89 million in cash and $333 million of debt. That's not a tremendous amount of debt, and it's not like AuRico was in desperate need for cash, especially with Young-Davidson ramping up production. But they also didn't have much flexibility in terms of either buying or building more projects. AuRico couldn't issue shares given how low their market cap was, it would be just too much dilution.

Alamos on the other hand had $358 million in cash and no debt. But Mulatos is getting low on reserves, and the other projects that they own are not really company makers. Alamos said in the conference call discussing the merger that they have been looking to put their cash to work and acquire a quality, long-life asset in Canada. The problem is they are hard to come by and the ones that are available aren't cheap.

Ken Stowe, who sits on the Board of Alamos, used to be the CEO of Northgate. Northgate owned the Young-Davidson mine before AuRico bought the company out in 2011. So Alamos has a high regard for Young-Davidson, as they know the project very well thanks to Stowe. They clearly wanted to own it.

In the end, both companies fill a need with this merger. AuRico gets a major cash infusion along with some decent assets that will generate future cash flow. And Alamos gets a brand new, state-of-the-art, long-life mine in Canada. Given Young-Davidson's reserve base, production profile, mine-life, expansion potential, low cost structure, and the fact that it is located in a very safe mining jurisdiction, even the major gold producers would want this mine in their portfolio.

All those that think Alamos got a bad deal aren't looking at the big picture. The company only paid $750 million for all of AuRico, and Young-Davidson alone has a $1.5 billion value on AuRico's balance sheet. Alamos wasn't the only company here that has undervalued assets.

Alamos isn't a desperate company, there was no reason to do this deal unless they thought they were getting a lot in return. This might be considered a cash grab by AuRico, but both companies got what they wanted. The end result is a company with:

- A production profile of 450,000 ounces of gold per year.

- A fairly good balance sheet with $427 million in cash and $333 million in debt.

- Several low risk, open pit projects that are all inexpensive to build.

- Exploration upside at Mulatos which could greatly extend the mine life.

- $10 million in annual costs savings from this merger, including increased purchasing power in Mexico ($2 million), G&A synergies ($5 million), and tax savings ($3 million) going forward. The tax savings is because Alamos hasn't had Canadian source income to deduct its head office costs against, that will change going forward from the revenue from Young-Davidson.

- A spin-off of Kemess, which will finally unlock its true value. Kemess lives in the shadow, this spin-off will bring into the light.

Conclusion

Alamos and AuRico announced a merger of equals, but some feel this isn't a good deal for Alamos. However, AuRico is bringing much more to the table as Young-Davidson is by far the best asset of the new company. Mulatos is struggling with lower grade and higher costs. Costs should start to come down but the mine life is very short and Alamos hasn't found enough high grade ore to return the mine to its former glory.

The rest of the assets that each company brings to the table is about equal. Alamos has many smaller scale projects but no other assets in production.

This merger makes a lot of sense, and despite what investors are reading, this is actually a good deal for both companies. They each had a need/want, AuRico wanted cash and Alamos wanted a high quality long-life asset in Canada.

The combined company will produce 450,000 ounces per year, has a healthy balance sheet, and has many low risk, open pit projects that aren't too expensive to build. The spin-off of Kemess will also finally unlock its true value, which wasn't being recognized.

Original Article: http://seekingalpha.com/article/3133726-aurico-gold-and-alamos-gold-both-getting-a-good-deal