(All amounts expressed in U.S. dollars unless otherwise noted)

TORONTO, Feb. 23, 2022 /CNW/ – Agnico Eagle Mines Limited (NYSE: AEM) (TSX: AEM) (“Agnico Eagle” or the “Company”) today announced senior management changes and reported fourth quarter and full year 2021 financial and operating results, as well as future operating guidance.

Ammar Al-Joundi has been appointed President and Chief Executive Officer, effective immediately. Mr. Al-Joundi is a proven executive with a long history of mining industry experience who previously served as President of Agnico Eagle. With this appointment, Mr. Al-Joundi joins the Company’s board of directors (the “Board”). Anthony Makuch advised the Board that he has decided to step down as Chief Executive Officer and as a director of Agnico Eagle.

Mr. Al-Joundi has over 20 years of experience in mining, capital markets and banking, with specialization in finance and business strategy. He joined Agnico Eagle as President in 2015, after serving as Chief Financial Officer at Agnico Eagle (from September 2010 to June 2012) and as Chief Financial Officer and Senior Executive Vice President at Barrick Gold Corporation (from July 2012 to February 2015). Prior to joining Agnico Eagle in 2010, he spent 11 years at Barrick in various senior financial roles including Senior Vice-President of Finance, Senior Vice-President of Business Strategy and Capital Allocation, and Executive Director and CFO of Barrick South America.

“Ammar has the right mix of skill, experience and knowledge to execute the new Agnico Eagle’s strategic plan to become the world’s leading and highest quality senior gold producer,” said Executive Chair Sean Boyd. “We are confident that Ammar is the right leader to complete the integration of Agnico Eagle and Kirkland Lake Gold and, working closely with our combined Board members and executive team and our outstanding employees, he will help drive the Company’s successes as we continue to work to create long-term value for the Company’s shareholders and other key stakeholders,” added Mr. Boyd.

The Agnico Eagle Board expresses its thanks to Mr. Makuch for steering Kirkland Lake Gold Ltd. (“Kirkland Lake Gold”) through this transformative transaction and for his contributions to Kirkland Lake Gold during his tenure.

Tony Makuch said: “We built Kirkland Lake Gold by acquiring, developing and operating high-quality assets in good jurisdictions with significant exploration upside. Just as important, we build a business based on honesty, integrity, respect for all people and support for communities. We have culminated all this with the merger of equals with Agnico Eagle and I am very proud to have been involved in creating the third largest global gold producer in the world. I am leaving Agnico with a strong and dedicated leadership team and I believe they will continue to be successful. I would like to thank the tremendous team of people at Kirkland Lake Gold for their years of hard work and support in building a truly special company.”

Jeff Parr, Vice-Chair of Agnico Eagle and former Chair of Kirkland Lake Gold, said, “We want to thank Tony for his tremendous contribution to the success of Kirkland Lake Gold, building the company into a 1.4 million ounce per year producer with the industry’s lowest unit costs and significant growth potential. Tony’s track record for enhancing the value of assets through investment in exploration, development and the optimization of performance is unsurpassed and we know he will continue to have great success in whatever venture he chooses next.”

Agnico Eagle 2021 highlights:

- Record annual gold production – Payable gold production1 in the full year 2021 was 2,030,176 ounces (excluding 56,229 ounces of payable gold production at Hope Bay, and including 24,057 ounces and 1,956 ounces of pre-commercial gold production at the Tiriganiaq open pit at Meliadine and the Amaruq underground project, respectively) at production costs per ounce of $835, total cash costs per ounce2 of $761 and all-in sustaining costs (“AISC”) per ounce3 of $1,038. Production costs per ounce, total cash costs per ounce and AISC per ounce exclude the Hope Bay mine and the pre-commercial production ounces from Amaruq and Tiriganiaq

- Strong Quarterly production in spite of COVID-19 impacts – Payable gold production in the fourth quarter of 2021 was 501,227 ounces (excluding 705 ounces of payable gold production at Hope Bay, and including 1,608 ounces of pre-commercial gold production at the Amaruq underground project) at production costs per ounce of $892, total cash costs per ounce of $812 and AISC per ounce of $1,126. Production costs per ounce, total cash costs per ounce and AISC per ounce exclude the pre-commercial production ounces from Amaruq. Production and costs in the fourth quarter of 2021 were negatively affected by a reduction in operating activities in Nunavut largely due to a COVID-19 outbreak in mid-December 2021

- Several operational milestones achieved in the fourth quarter of 2021 and full year 2021 – In December 2021, new monthly records for gold production were set at Kittila and Canadian Malartic. In 2021, new annual records for gold production were set at Meliadine, Kittila and Canadian Malartic, while the LaRonde Complex had its best year ever in terms of tonnage milled. Several production milestones were also reached in the fourth quarter of 2021, with the LaRonde Complex pouring its seven millionth ounce of gold, Goldex reached one million ounces of gold produced (since the 2013 restart) and Canadian Malartic reached six million ounces of gold produced (100% basis)

- COVID-19 still a concern, but risks appear manageable at this time – The Company has increased its efforts to monitor and manage risks associated with the Omicron variant of COVID-19. At this time, case counts appear to be dropping and the Company expects that it will be able to maintain budgeted production levels. The Company expects that its efforts to help protect the northern communities from this COVID-19 variant will have a slightly negative effect on production in the first quarter of 2022 as the Nunavut-based workforce (“Nunavummiut”) were sent back to their communities in December 2021. Plans are being reviewed to re-integrate the local workforce as soon as possible

“The fourth quarter of 2021 was Agnico Eagle’s fifth consecutive quarter of over 500,000 ounces of gold production, which is particularly impressive given the impacts of COVID-19 during the latter part of the quarter. On a full year basis, in 2021 the Company achieved records in gold production, operating cashflow and mineral reserves, all while delivering the best safety performance in the Company’s 64-year history”, said Ammar Al-Joundi, Agnico Eagle’s President and Chief Executive Officer. “Looking forward, all of our mines, both those contributed by Agnico Eagle and Kirkland Lake Gold, are well positioned for another strong year in 2022, and well into the future. Furthermore, the Company is investing more than ever before at our mines and in exploration to build an even stronger business, in what we believe are the best places in the world to mine for gold”, added Mr. Al-Joundi.

1 Payable production of a mineral means the quantity of a mineral produced during a period contained in products that have been or will be sold by the Company whether such products are shipped during the period or held as inventory at the end of the period.

2 Production costs per ounce and total cash costs per ounce are non-GAAP ratios that are not standardized financial measures under the financial reporting framework used to prepare the Company’s financial statements and, unless otherwise specified, is reported on a by-product basis in this news release. For the detailed calculation of production costs per ounce and the reconciliation to production costs and for total cash costs on a co-product basis, see “Reconciliation of Non-GAAP Financial Performance Measures” below. See also “Note Regarding Certain Measures of Performance”.

3 AISC per ounce is a non-GAAP ratio that is not a standardized financial measure under the financial reporting framework used to prepare the Company’s financial statements and, unless otherwise specified, is reported on a by-product basis in this news release. For a reconciliation to production costs and for all-in sustaining costs on a co-product basis, see “Reconciliation of Non-GAAP Financial Performance Measures” below. See also “Note Regarding Certain Measures of Performance”.

The New Agnico Eagle – A best-in-class gold mining company with the largest gold production from Canada and well positioned internationally with profitable and prospective assets in Australia, Finland and Mexico.

- Merger with Kirkland Lake Gold Ltd. (the “Merger”) – On February 8, 2022, the Merger with Kirkland Lake Gold Ltd. (“Kirkland Lake Gold”) was completed,

- New three-year operational guidance – Payable gold production for 2022 is forecast to be approximately 3.2 to 3.4 million ounces with total cash costs per ounce expected to be between $725 and $775 and AISC per ounce expected to be between $1,000 and $1,050. Gold production for 2023 and 2024 is expected to be in a similar range to 2022 at approximately 3.2 to 3.4 million ounces of gold with relatively stable total cash costs per ounce and AISC per ounce compared to 2022. As the expected Merger synergies are realized, both cost metrics are expected to then decline in 2023 and 2024. Estimated capital expenditures for 2022 total approximately $1.4 billion, which includes approximately $703 million of sustaining capital4 at the Company’s operating mines and $710 million on growth projects5. Not included in the 2022 estimated capital expenditures is approximately $131 million relating to capitalized exploration

- Strong Combined Mineral Reserve Base Totaling 44.6 Million Ounces of Gold – At December 31, 2021, Agnico Eagle’s proven and probable mineral reserves were a record 25.7 million ounces of gold (337 million tonnes grading 2.37 grams per tonne (“g/t”) gold); measured and indicated mineral resources were 17.2 million ounces (353 million tonnes grading 1.52 g/t gold); and inferred mineral resources were 23.7 million ounces (272 million tonnes grading 2.72 g/t gold). At December 31, 2021, Kirkland Lake Gold’s proven and probable mineral reserves were 18.9 million ounces of gold (584 million tonnes grading 1.01 g/t gold); measured and indicated mineral resources were 22.4 million ounces (647 million tonnes grading 1.08 g/t gold); and inferred mineral resources were 6.9 million ounces (94.0 million tonnes grading 2.28 g/t gold)

- Large exploration program planned for 2022 with a focus on minesite and pipeline opportunities – The exploration budget in 2022 is approximately $324 million ($193 million of expensed exploration and $131 million of capitalized exploration), with a primary focus on the expansion of mineral reserves and mineral resources at operating mines (Detour, Macassa, Fosterville and Meliadine) and pipeline projects (the Odyssey and Hope Bay projects)

- Future Value Drivers

- Synergies and optimization opportunities expected to drive over $2B in value creation over the next 10 years – In 2022, the Company expects to realize Merger-related corporate and operational synergies of approximately $40 million to $60 million, of which $12 million have already been realized at the time of this news release. In subsequent years, the Company expects to ramp up these synergies to approximately $165 million per year. A further $590 million over 10 years are expected to be realized through strategic optimizations which include the development of the Amalgamated Kirkland (“AK”) deposit at the Kirkland Lake camp with initial gold production potentially as early as 2024

- Detour Lake Mine – Successful exploration programs in 2020 and 2021 led to a significant increase in open-pit mineral resources in 2021. These new mineral resources and ongoing business improvement initiatives will be incorporated into a new technical report expected to be filed in the second quarter of 2022. This report is expected to show growth in mineral reserves and provide additional opportunities to enhance the future production profile of the mine

- Macassa Mine – Sinking of the #4 Shaft was completed in January 2022, over a year earlier than initially planned. Completion of other #4 Shaft development activities are expected in late 2022. The #4 Shaft is expected to provide numerous benefits, including increased hoisting capacity, improved unit costs, better ventilation, and enhanced capabilities to pursue exploration potential across the Kirkland Lake camp. Gold production at Macassa is forecast to increase from 170,000 to 190,000 ounces in 2022 with a target to approximately 330,000 to 350,000 ounces in 2024. Production levels could potentially increase once the full benefit of the #4 Shaft is realized

- Fosterville Mine – Based on current exploration results, the Company’s long-term goal for Fosterville is to establish the mine as a long-life asset through success in replacing mineral reserves. The Company believes there is potential to discover additional high-grade zones that could potentially support higher production levels and improvements in unit costs

- Odyssey Project – Underground development and surface construction activities remain on schedule and on budget as of the date hereof. In 2022, approximately 136,835 metres of surface and underground drilling is planned to infill and expand mineral reserves. From 2023 to 2028, gold production is forecast to be approximately 932,000 ounces at total cash costs of approximately $800 per ounce (all numbers on a 100% basis). Average annual payable production is expected to be approximately 545,400 ounces of gold from 2029 to 2039, with total cash costs per ounce of approximately $630

- Kittila Expansion Project – The mill expansion was completed ahead of schedule in late 2020 and shaft sinking is expected to be completed in the second half of 2022, with commissioning of the production hoist expected in late 2022 or early 2023. Completion of the shaft is expected to result in lower operating costs and provide additional drilling access to increase mineral reserves and mineral resources at depth. Estimated total expansion project costs remain within the previously disclosed range of €190 to €200 million

- Optimization and consolidation of mining assets and infrastructure in the Kirkland Lake gold camp – There are several development assets in the Kirkland Lake area with significant mineral reserves and mineral resources. Studies are underway to evaluate the potential to advance some of these assets into production (AK, Upper Beaver, Upper Canada) either as standalone projects or by leveraging existing infrastructure at Macassa or the Holt processing complex

- Strong balance sheet allows for asset development and robust returns to shareholders, including a new share buyback program – With over $2.2 billion in liquidity, the Company is well positioned to fund its existing capital requirements and increase returns to shareholders. With this strong financial position, the Company announced today that, subject to the approval of the Toronto Stock Exchange (the “TSX), it intends to launch a normal course issuer bid to repurchase for cancellation up to 9 million of its common shares, for up to an aggregate amount of $500 million, representing approximately 2% of its 454.8 million common shares issued and outstanding as at February 23, 2022.

- Quarterly dividend increased by 14% – A quarterly dividend of $0.40 per share has been declared (previous quarterly dividend was $0.35)

4 Sustaining capital is a non-GAAP measure that is not a standardized financial measure under the financial reporting framework used to prepare the Company’s financial statements. See “Note Regarding Certain Measures of Performance”.

5 Growth projects or development capital is a non-GAAP measure that is not a standardized financial measure under the financial reporting framework used to prepare the Company’s financial statements. See “Note Regarding Certain Measures of Performance”.

Fourth Quarter 2021 Results Conference Call and Webcast Tomorrow

Agnico Eagle’s senior management will host a conference call on Thursday, February 24, 2022 at 11:00 AM (E.S.T.) to discuss the Company’s fourth quarter and full year financial and operating results, as well as operating plans following completion of the Merger.

Via Webcast:

A live audio webcast of the conference call will be available on the Company’s website www.agnicoeagle.com.

Via Telephone:

For those preferring to listen by telephone, please dial 1-416-764-8659 or toll-free 1-888-664-6392. To ensure your participation, please call approximately five minutes prior to the scheduled start of the call.

Replay Archive:

Please dial 1-416-764-8677 or toll-free 1-888-390-0541, access code 093746#. The conference call replay will expire on Friday, March 25, 2022.

The webcast and presentation slides will be archived for 180 days on the Company’s website.

Fourth Quarter 2021 Financial and Production Results

In the fourth quarter of 2021, net income was $101.1 million ($0.41 per share). This result includes non-cash mark-to-market gains on warrants of $12.8 million ($0.05 per share), non-cash foreign currency translation losses of $12.8 million ($0.05 per share), derivative gains on financial instruments of $7.1 million ($0.03 per share), transaction costs relating to the Merger with Kirkland Lake Gold of $7.0 million ($0.03 per share), foreign currency translation losses on deferred tax liabilities and non-recurring tax adjustments of $6.5 million ($0.03 per share) and various other adjustment losses of $3.8 million ($0.02 per share). Excluding these items would result in adjusted net income6 of $111.3 million or $0.46 per share for the fourth quarter of 2021. For the fourth quarter of 2020, the Company reported net income of $205.2 million or net income of $0.85 per share.

Included in the fourth quarter of 2021 net income, and not adjusted above, is a non-cash stock option expense of $3.6 million ($0.01 per share) and workforce costs of employees affected by the COVID-19 pandemic (primarily Nunavut-based) of $2.2 million ($0.01 per share).

For the full year 2021, the Company reported net income of $543.0 million, or net income of $2.23 per share. This compares with the full year 2020, when net income was $511.6 million, or net income of $2.12 per share.

The decrease in net income in the fourth quarter of 2021 compared to the prior-year period is primarily due to lower operating margins7 (lower average realized metal prices and higher production costs, partially offset by higher sales volumes), lower unrealized gains for non-cash items related to mark-to-market adjustments on financial instruments, higher amortization of property, plant and mine development resulting from higher production volumes at the Meadowbank Complex and the Meliadine and Kittila mines and higher exploration expenses, partially offset by lower environmental remediation costs.

The increase in net income for the full year 2021, compared to the prior-year period, is primarily due to higher operating margins (higher sales volumes due to record gold production and higher average realized metal prices), lower environmental remediation costs and lower foreign currency translation loss. These factors were partially offset by higher unrealized losses for non-cash items related to mark-to-market adjustments on financial instruments, higher amortization of property, plant and mine development from higher production volumes and the contribution of the Hope Bay mine, higher exploration expenses, higher general and administrative costs, which includes a health care donation of $8 million during the year, and higher income and mining taxes driven by higher operating margins.

In the fourth quarter of 2021, cash provided by operating activities was $261.7 million ($336.2 million before changes in non-cash components of working capital), compared to the fourth quarter of 2020 when cash provided by operating activities was $403.5 million ($386.8 million before changes in non-cash components of working capital).

For the full year 2021, cash provided by operating activities was a record $1,316.0 million ($1,597.2 million before changes in non-cash components of working capital), compared to the full year 2020 when cash provided by operating activities was $1,192.1 million ($1,211.1 million before changes in non-cash components of working capital).

The decrease in cash provided by operating activities (before changes in non-cash components of working capital) in the fourth quarter of 2021, compared to the prior-year period, is primarily due to a decrease in mine operating margins that resulted from lower average realized metal prices and higher production costs, partially offset by higher sales volumes.

The increase in cash provided by operating activities in the full year 2021, compared to the prior-year period, is primarily due to an increase in operating margins that resulted from higher sales volumes and higher average realized metals prices, partially offset by higher cash taxes related to the higher mine operating margins and payments for taxes related to the 2020 tax year in the first quarter of 2021.

In the fourth quarter of 2021, the Company’s payable gold production was 501,227 ounces (excluding 705 ounces of payable gold production at Hope Bay, and including 1,608 ounces of pre-commercial gold production at the Amaruq underground project). This compares to quarterly payable gold production of 501,445 ounces in the prior-year period (which included pre-commercial gold production of 10,995 ounces from the IVR pit at the Meadowbank Complex and 4,509 ounces from the Tiriganiaq open pit at Meliadine). Including the Hope Bay mine, the Company’s quarterly gold production was 501,932 ounces in the fourth quarter of 2021.

Gold production in the fourth quarter of 2021, when compared to the prior-year period, was essentially the same. However, production in the fourth quarter of 2021 was negatively affected by a reduction in operating activities in Nunavut largely due to a COVID-19 outbreak in mid-December 2021.

For the full year 2021, the Company’s payable gold production was a record 2,030,176 ounces (excluding 56,229 ounces of payable gold production at Hope Bay, and including 24,057 ounces and 1,956 ounces of pre-commercial gold production at the Tiriganiaq open pit at Meliadine and Amaruq underground project, respectively). This compares to payable gold production of 1,736,568 ounces in the prior-year period (which included pre-commercial gold production of 18,930 ounces from the Barnat deposit at Canadian Malartic, 10,995 ounces from the IVR pit at the Meadowbank Complex and 6,491 ounces from the Tiriganiaq open pit at Meliadine). Including the Hope Bay mine, the Company’s payable gold production was a record 2,086,405 ounces for the full year 2021.

The higher gold production for the full year 2021, when compared to the prior-year period, was primarily due to strong performance at the Company’s mines, including higher gold grades and tonnage at the Canadian Malartic, Meliadine and Pinos Altos mines and the Meadowbank Complex, and higher tonnage at the LaRonde Complex and the Goldex and Kittila mines. This was partially offset by lower production at the La India mine related mostly to water conservation efforts and at Creston Mascota, where only residual leaching occurred. Gold production for the full year 2020 was negatively affected by COVID-19 related reductions in mining activities which affected seven of the Company’s then eight operations. A detailed description of the production at each mine is set out below.

Production costs per ounce in the fourth quarter of 2021 were $892 (excluding the Hope Bay mine), compared to $771 in the prior-year period (prior to the acquisition of the Hope Bay mine). Total cash costs per ounce in the fourth quarter of 2021 were $812 (excluding the Hope Bay mine), compared to $701 in the prior-year period. Including the Hope Bay mine, production costs per ounce were $929 and total cash costs per ounce were $814 in the fourth quarter of 2021.

Production costs per ounce for the full year 2021 were $835 (excluding the Hope Bay mine), compared to $838 in the prior-year period (prior to the acquisition of the Hope Bay mine). Total cash costs per ounce for the full year 2021 were $761 (excluding the Hope Bay mine), compared to $775 in the prior-year period. Including the Hope Bay mine, production costs per ounce were $853 and total cash costs per ounce were $770 in the full year 2021.

In the fourth quarter of 2021, production costs per ounce and total cash costs per ounce increased when compared to the prior-year period primarily due to higher minesite costs per tonne at various operations including at the LaRonde and Meadowbank Complexes and at the Pinos Altos and La India mines, and the strengthening of the Canadian dollar against the U.S. dollar. A detailed description of the minesite costs per tonne at each mine is set out below.

For the full year 2021, production costs per ounce and total cash costs per ounce (excluding the Hope Bay mine) decreased when compared to the prior-year periods primarily due to higher gold production, partially offset by higher minesite costs per tonne at the LaRonde Complex and the Pinos Altos mine and the strengthening of the Canadian dollar against the U.S. dollar.

AISC per ounce in the fourth quarter of 2021 were $1,126 (excluding the Hope Bay mine), compared to $985 in the prior-year period. Including the Hope Bay mine, AISC per ounce were $1,136 in the fourth quarter of 2021. AISC per ounce for the full year 2021 were $1,038 (excluding the Hope Bay mine), compared to $1,051 in the prior-year period. Including the Hope Bay mine, AISC per ounce were $1,059 in the full year 2021.

AISC per ounce (excluding the Hope Bay mine) in the fourth quarter of 2021 increased when compared to the prior-year period primarily due to higher total cash costs per ounce and higher sustaining capital expenditures. AISC per ounce (excluding the Hope Bay mine) for the full year 2021 decreased when compared to the prior-year period primarily due to lower total cash costs per ounce, partially offset by higher sustaining capital expenditures at the LaRonde Complex, and the Canadian Malartic and the Goldex mines.

The 2021 guidance, excluding Hope Bay, was forecast to be 2.005 to 2.090 million ounces (midpoint of 2.048 million ounces) of gold at total cash costs per ounce of $700 to $750 and AISC per ounce of $950 to $1,000 per ounce. Production costs, total cash costs per ounce and AISC per ounce exclude the pre-commercial production ounces from Amaruq and Tiriganiaq.

6 Adjusted net income and adjusted net income per share are non-GAAP measures that are not standardized financial measures under the financial reporting framework used to prepare the Company’s financial statements. For a reconciliation to net income and net income per share see “Reconciliation of Non-GAAP Financial Performance Measures” below. See also “Note Regarding Certain Measures of Performance”.

7 Operating margin is a non-GAAP measure. For a reconciliation to net income see “Reconciliation of Non-GAAP Financial Performance Measures” below. See also “Note Regarding Certain Measures of Performance”.

Strong financial position allows for asset development and robust returns to shareholders

Cash and cash equivalents and short-term investments decreased to $191.1 million at December 31, 2021, from the September 30, 2021 balance of $243.6 million, primarily due to the increase of payments to suppliers (related to completion of the sealift season in Nunavut). As of December 31, 2021, the outstanding balance on the Company’s unsecured revolving bank credit facility was nil, and available liquidity under this facility was approximately $1.2 billion, not including the uncommitted $600 million accordion feature. On December 22, 2021, the Company amended its $1.2 billion unsecured revolving bank credit facility to improve pricing (reflecting the Company’s strengthened credit profile), increase the uncommitted accordion feature from $300 million to $600 million and extend the maturity date from June 22, 2023 to December 22, 2026.

Following completion of the Merger on February 8, 2022, the Company’s cash position increased to approximately $973 million. On February 9, 2022, Fitch Ratings announced that it changed the rating outlook on the Company’s investment grade credit rating to “positive” from “stable” and confirmed the rating at BBB, further re-affirming the Company’s strong balance sheet.

Approximately 36% of the Company’s remaining 2022 estimated Canadian dollar exposure is hedged at an average floor price above 1.25 C$/US$. Approximately 26% of the Company’s remaining 2022 estimated Mexican peso exposure is hedged at an average floor price above 20.15 MXP/US$. Approximately 25% of the Company’s remaining 2022 estimated Euro exposure is hedged at an average floor price of approximately 1.18 US$/EUR. The Company’s remaining 2022 Australian dollar exposure is currently unhedged. The Company’s full year 2022 cost guidance is based on assumed exchange rates of 1.25 C$/US$, 20.00 MXP/US$, 1.20 US$/EUR and 1.32 A$/US$.

Including the diesel purchased for the Company’s Nunavut operations on the 2021 sealift (consumed to mid-year 2022), approximately 40% of the Company’s diesel exposure for 2022 is hedged at an average price below the 2022 cost guidance assumption of C$0.90 per litre. These hedges have partially mitigated the effect of inflationary pressures to date and are expected to provide protection against inflation for the 2022 sealift diesel costs.

The Company will continue to monitor market conditions and anticipates continuing to opportunistically add to its operating currency and diesel hedges to strategically support its key input costs. Current hedging considerations are not factored into 2022 guidance.

Returns to Shareholders

With over $2.2 billion in liquidity, the Company is well positioned to fund its existing capital requirements and increase returns to shareholders. With this strong financial position, the Company announced today that, subject to the approval of the TSX, it intends to launch a normal course issuer bid to repurchase for cancellation up to 9 million of its common shares, for up to an aggregate amount of $500 million, representing approximately 2% of its 454.8 million common shares issued and outstanding as at February 23, 2022.

The Company will file a notice of intention with the TSX in this regard. The Company may commence purchases under the bid, continuing for up to one year, after the TSX has accepted the notice of intention. Repurchases will be made through the facilities of the TSX and the NYSE as well as through other designated exchanges and alternative trading systems in Canada in accordance with applicable regulatory requirements. The price paid for such repurchased shares will be the market price of such shares at the time of acquisition or such other price as may be permitted by the TSX and United States securities laws. All repurchased shares will be cancelled. The timing and amount of any purchases under the program are subject to regulatory approvals and to management discretion based on factors such as market conditions and other factors.

Dividend Record and Payment Dates for the First Quarter of 2022

Agnico Eagle’s Board of Directors has declared a quarterly cash dividend of $0.40 per common share, payable on March 15, 2022 to shareholders of record as of March 7, 2022. The quarterly dividend has increased 14% from the previous quarterly dividend of $0.35. Agnico Eagle has declared a cash dividend every year since 1983.

Expected Dividend Record and Payment Dates for the 2022 Fiscal Year

| Record Date | Payment Date |

| March 7, 2022* | March 15, 2022* |

| June 1, 2022 | June 15, 2022 |

| September 1, 2022 | September 15, 2022 |

| December 1, 2022 | December 15, 2022 |

*Declared

Dividend Reinvestment Plan

Please see the following link for information on the Company’s dividend reinvestment plan: Dividend Reinvestment Plan

Capital Expenditures

Total capital expenditures (including sustaining capital) in the fourth quarter of 2021 were $235.6 million (excluding Hope Bay). Including Hope Bay, the total capital expenditures in fourth quarter of 2021 were $245.4 million.

The following table sets out capital expenditures (including sustaining capital) in the fourth quarter of 2021 and the full year 2021.

Demonstrating strong ESG performance

In December 2021, as a result of an increase in COVID-19 cases at its Nunavut operations, the Company took precautionary steps to further protect the continued health of its Nunavut workforce and local residents in the communities in which it operates. In collaboration with the Nunavut public health authorities, the Company sent home the Nunavummiut from the Meliadine, Meadowbank and Hope Bay operations as well as its Nunavut exploration projects. Furthermore, as a result of the resurgence of COVID-19 cases, personnel levels at site were reduced in December 2021. As a result, there was a reduction of activities at the Company’s Nunavut operations for the remainder of December 2021. Activities at the Meliadine mine were affected until mid-January 2022 and activities at the Meadowbank Complex were affected until early February 2022. Both operations are back to operating at normal levels. The Company is actively working with the Nunavut public health authorities on a reintegration plan with the objective to return the Nunavummiut to the Company’s Nunavut operations later in the first quarter of 2022. An operational update on each of the Company’s Nunavut operations is set out below.

In the fourth quarter of 2021, there were 232 confirmed COVID-19 cases at the Company’s operations. The increased spread and transmissibility of the Omicron variant of COVID-19 significantly increased the confirmed COVID-19 cases in the last weeks of 2021 and the beginning of 2022. Rigorous protocols and hygiene measures remain in place in order to keep the Company’s employees and communities safe while the mines continue to operate during the pandemic. This is a rapidly evolving situation and the Company is monitoring activities at its operations and reassesses its response on an ongoing basis.

Agnico Eagle’s ESG practices and contributions to the local communities continued to be recognized by several organizations in 2021. The following awards were received by the Company’s operations:

- Agnico Eagle recognized on the Corporate Knights list of 2021 Global 100 Sustainable Corporations

- Supervisors at the LaRonde and Goldex mines received health & safety awards from the Quebec Mining Association for maintaining safe working environments as demonstrated by their teams passing milestones of up to 200,000 hours worked without a lost time accident

- The Kittila mine received the “Collaboration partner of the year” award from Visit Levi tourism association

- Agnico Eagle Mexico recognized with the 2021 “Human Rights Committed Company Award” by the Chihuahua State Human Rights Commission

Agnico Eagle and Kirkland Lake Gold Merger of Equals

On February 8, 2022, the Merger with Kirkland Lake Gold was completed. The combined company will continue as Agnico Eagle Mines Limited and will remain listed on the TSX and NYSE under the ticker “AEM”. In aggregate, Agnico Eagle issued approximately 209,274,263 common shares to former Kirkland Lake Gold shareholders as consideration for their shares. Set out below is the key senior management team, not previously announced.

David Smith, Chief Financial Officer: David will continue to lead the finance, Investor Relations and IT teams. David is a Professional Engineer, with experience as a mining analyst and has held a variety of mining engineering positions in Canada and abroad. He joined Agnico Eagle in 2005 and most recently served as Senior Vice President, Finance & Chief Financial Officer since 2012.

Jean Robitaille, Chief Transformation & Innovation Officer: Jean will continue to provide leadership in the areas of Business Strategy, Business Development, Capital Allocation, Business Improvement & Innovation, Project Evaluations and Technical Services & Studies. He has been with Agnico Eagle for over 30 years, working in senior executive roles in Technical Services, Project Development and Operations. Since 2020, he served as Senior Vice President, Corporate Development, Business Strategy & Technical Services.

Natasha Vaz, Chief Operating Officer – Ontario, Australia & Mexico: Natasha will lead the operations and construction teams for Ontario, Australia and Mexico. Natasha is a Professional Engineer with over 15 years of operational and technical experience in the mining industry. Natasha is the current chair of the Board of Directors of the Ontario Mining Association. Most recently she served as Chief Operating Officer of Kirkland Lake Gold.

Dominique Girard, Chief Operating Officer – Nunavut, Quebec & Europe: Dominique will continue to lead the operations and construction teams for Nunavut, Quebec and Europe as well as the Canadian Procurement team. Dominique is a mineral processing engineer whose career with Agnico Eagle began in 2000 and includes serving as VP Technical Services, VP Nunavut, General Manager at Meadowbank mine and Mill Superintendent at the Kittilä mine. Most recently he served as Senior Vice President, Operations – Canada & Europe since 2020.

Eric Kallio, EVP, Exploration Strategy & Growth: Eric is a geologist with over 30 years of experience working in exploration, mine planning, scoping and feasibility studies in Canada and abroad and will lend this experience to promoting the growth of Agnico Eagle. Eric has been instrumental in the discovery or advancement of several successful projects, including the Dome Mine Open Pit in Timmins ON, the Detour Gold Open Pit near Cochrane ON, the Island Gold project near Wawa, ON and discoveries by Lake Shore Gold in the Timmins gold camp. Most recently he served as Senior Vice President, Exploration for Kirkland Lake Gold.

Guy Gosselin, EVP, Exploration: Guy will continue to lead the global exploration teams, including Australia, Canada, Europe, Mexico, South America and USA. Guy is a Professional Engineer with over 25 years of experience and has been instrumental in leading the Agnico Eagle exploration team through the acquisition, growth and advancement of projects, particularly in Nunavut with the discovery of Amaruq and in the Abitibi. He joined Agnico Eagle in 2000 and most recently served as Senior Vice President, Exploration since 2019.

Carol Plummer, EVP, Operational Excellence: Carol will provide leadership and foster collaboration in the areas of Health, Safety and Security, Environmental Management & Critical Infrastructure and Operational Sustainability (Budget/LOM) in order to help drive efficiencies and ensure operational and cultural alignment throughout the Company’s regional and functional teams. Carol is a Professional Engineer who joined Agnico Eagle in 2004 and has held several key positions, including Senior Vice-President Sustainability, Vice-President Corporate Development, Vice-President Project Development USA & Latin America and General Manager at the Lapa, Kittilä and LaRonde mines. Since 2021 she served as Senior Vice President Sustainability, People & Culture.

Chris Vollmershausen, EVP Legal, General Counsel & Corporate Secretary: Chris will continue to lead the legal team at Agnico Eagle and provide strategic legal advice to the Company and the board of directors. Chris is a corporate securities lawyer and has held a number of executive roles at Agnico Eagle including Vice President, Legal. He joined Agnico Eagle in 2014 and most recently served as Senior Vice President, Legal, General Counsel & Corporate Secretary since 2020.

New Agnico Eagle Three-Year Guidance

The new Agnico Eagle is announcing its inaugural detailed production and cost guidance for 2022 and mine by mine production forecasts for 2022 through 2024. Gold production for 2022 is forecast to be approximately 3.2 to 3.4 million ounces. The 2022 gold production forecast includes the full year of production at the Detour, Macassa and Fosterville mines.

The 2022 production guidance incorporates the impact of the Omicron variant of COVID-19 across the Company’s operations year-to-date. The Company continues to have rigorous protocols at all the operating regions and supports a global vaccination program. However, operational activities could still be affected given the uncertainty surrounding the evolution of the virus and the measures taken by the Company, governments and others to contain the spread and impact of the virus.

Gold production for 2023 and 2024 is expected to be in a similar range to 2022 at approximately 3.2 to 3.4 million ounces of gold. The production forecast for 2024 does not include potential production upside from pipeline projects such as the AK deposit, the Odyssey internal zones and the Akasaba project at the Goldex mine. Collectively, if approved and developed, these projects could potentially add up to 100,000 ounces of gold to the 2024 forecast.

Total cash costs per ounce in 2022 are expected to be between $725 and $775 using an assumed C$/US$ foreign exchange rate of 1.25. Although the Company expects some variability in operating costs from 2022 to 2024, average total cash costs per ounce are expected to remain relatively stable over that period (assuming a C$/US$ foreign exchange rate of 1.25). The Company remains focused on reducing costs through productivity improvements and innovation initiatives at all of its operations.

AISC per ounce in 2022 are expected to be between $1,000 and $1,050. Although the Company expects some variability in operating costs from 2022 to 2024, the average AISC per ounce are expected to remain stable over that period (assuming a C$/US$ foreign exchange rate of 1.25).

Forecast total cash costs per ounce and AISC per ounce for 2022 to 2024 do not include any potential synergies resulting from the Merger. As the expected Merger synergies, set out below, are realized both cost metrics are expected to decline over the same period.

Following the completion of the Merger, the Company now has six cornerstone production assets (the LaRonde and Meadowbank Complexes and the Detour, Fosterville, Meliadine and Canadian Malartic mines) each with annual production rates in 2022 expected to be in excess of 300,000 ounces of gold.

Solid Three-Year Guidance with Stable Costs

Mine by mine production and cost guidance for 2022, and mine by mine gold production forecasts for 2023 and 2024 are set out below. Opportunities to further optimize and improve gold production and unit cost forecasts from 2022 through 2024 are being evaluated.

| Estimated Payable Gold Production (2022-2024) | ||||||||||

| 2022* | 2023 | 2024 | ||||||||

| Forecast | Forecast | Forecast | ||||||||

| Range | Range | Range | ||||||||

| LaRonde Complex | 370,000 | 390,000 | 375,000 | 390,000 | 375,000 | 390,000 | ||||

| Canadian Malartic (50%) | 315,000 | 325,000 | 325,000 | 335,000 | 335,000 | 345,000 | ||||

| Goldex mine | 130,000 | 140,000 | 130,000 | 140,000 | 120,000 | 130,000 | ||||

| Detour Lake mine | 700,000 | 730,000 | 700,000 | 730,000 | 700,000 | 730,000 | ||||

| Macassa mine | 170,000 | 190,000 | 200,000 | 220,000 | 330,000 | 350,000 | ||||

| Meliadine mine | 360,000 | 380,000 | 370,000 | 390,000 | 370,000 | 390,000 | ||||

| Meadowbank Complex | 335,000 | 360,000 | 340,000 | 370,000 | 410,000 | 450,000 | ||||

| Fosterville mine | 390,000 | 410,000 | 360,000 | 390,000 | 230,000 | 265,000 | ||||

| Kittila mine | 235,000 | 250,000 | 245,000 | 255,000 | 235,000 | 245,000 | ||||

| Pinos Altos mine | 125,000 | 130,000 | 125,000 | 130,000 | 125,000 | 130,000 | ||||

| La India mine | 80,000 | 85,000 | 65,000 | 75,000 | 20,000 | 25,000 | ||||

| Total Gold Production | 3,210,000 | 3,390,000 | 3,235,000 | 3,425,000 | 3,250,000 | 3,450,000 | ||||

| * Forecast includes the full year of production at the Detour, Macassa and Fosterville mines. |

| Total cash costs per ounce on a by-product basis of gold produced ($ per ounce): | |||

| 2022* | |||

| Forecast(mid-point) | |||

| LaRonde Complex | $ | 641 | |

| Canadian Malartic mine (50%) | 791 | ||

| Goldex mine | 776 | ||

| Detour Lake mine | 645 | ||

| Macassa mine | 718 | ||

| Meliadine mine | 852 | ||

| Meadowbank Complex | 1,186 | ||

| Fosterville mine | 385 | ||

| Kittila mine | 833 | ||

| Pinos Altos mine | 900 | ||

| La India mine | 1,003 | ||

| Total | $ | 749 |

*Forecast total cash costs per ounce do not include any potential synergies resulting from the Merger and is based on the mid-point of 2022 production guidance

Currency and commodity price assumptions used for 2022 cost estimates and sensitivities are set out in the table below:

| Currency and commodity price assumptions used for 2022 cost estimates and sensitivities | |||||||

| 2022 commodity and currency price assumptions | Approximate impact on total cash costs per ounce basis | ||||||

| C$/US$ | 1.25 | 5% change in C$/US$ | $25 | ||||

| US$/EUR | 1.20 | 5% change in US$/EUR | $3 | ||||

| MXP/US$ | 20.00 | 5% change in MXP/US$ | $1 | ||||

| A$/US$ | 1.32 | 5% change in A$/US$ | $2 | ||||

| Diesel (C$/ltr) | $ | 0.90 | 10% change in diesel price | $6 | |||

| Silver ($/oz) | $ | 22.00 | $1 / oz change in silver price | <$1 | |||

| Copper ($/lb) | $ | 4.00 | 10% change in copper price | <$1 | |||

| Zinc ($/lb) | $ | 1.40 | 10% change in zinc price | <$1 |

Depreciation Guidance

Agnico Eagle expects 2022 depreciation and amortization expense to be between $1.37 and $1.47 billion.

For financial reporting purposes, the Merger is determined to be a business combination with Agnico Eagle identified as the acquirer. As a result, the purchase consideration is allocated to the identifiable assets and liabilities of Kirkland Lake Gold based on their fair values as of February 8, 2022 (the “Purchase Price Allocation”). The estimated 2022 depreciation and amortization expense has considered a preliminary fair value allocation to the Kirkland Lake Gold assets, however, the estimate is subject to change based on the finalization of the Purchase Price Allocation, which will take place within the twelve months following the acquisition date.

General & Administrative Cost Guidance

Agnico Eagle expects 2022 general and administrative expenses to be between $165 and $175 million, excluding share-based compensation. In 2022, share based compensation expense is expected to be between $50 and $60 million (including non-cash stock option expense of between $10 and $15 million).

The 2022 forecast for general and administrative expenses exclude corporate synergies set out in the “Optimization and Synergies Expected to Generate Significant Value” section of this news release.

Other Cost Guidance

In 2022, Agnico Eagle expects additional expenses of approximately $31 million related to site maintenance costs at Hope Bay and other expenses of approximately $13 million related to sustainable development activities in the Abitibi region of Quebec and COVID-19 costs.

Tax Guidance

For 2022, the Company expects its effective tax rates to be:

Canada – 40% to 45%

Mexico – 35% to 40%

Australia – 30%

Finland – 20%

The Company’s overall effective tax rate is expected to be approximately 40% for the full year 2022.

Updated Three Year Operational Guidance Plan

Since the prior three-year gold production guidance issued on February 11, 2021 (“Previous Guidance”) for 2022 and 2023, there have been several operating developments resulting in changes to the overall three-year production profile at several mines. Descriptions of these operating developments, based on the mid-point of gold production guidance, are set out below.

ABITIBI REGION, QUEBEC

| LaRonde Complex Forecast | 2021 | 2022 | 2023 | 2024 | |

| Previous Guidance (oz) | 375,000 | 382,500 | 405,000 | n.a. | |

| Current Guidance (oz) | 379,734 (actual) | 380,000 | 382,500 | 382,500 | |

| LaRonde Complex Forecast 2022 | Ore Milled (‘000 tonnes) | Gold (g/t) | Gold Mill Recovery (%) | Silver (g/t) | Silver Mill Recovery (%) |

| 2,981 | 4.17 | 95.1% | 10.26 | 75.5% | |

| Production and Minesite Costs per Tonne (C$)8 | Zinc (%) | Zinc Mill Recovery (%) | Copper (%) | Copper Mill Recovery (%) | |

| C$120.68 | 0.40% | 71.1% | 0.13% | 77.3% |

| __________ |

| 8 Minesite costs per tonne is a non-GAAP measure that does not have a standardized meaning under the financial reporting framework used to prepare the Company’s financial statements. For a reconciliation to production costs see “Reconciliation of Non-GAAP Performance Measures” below. See also “Note Regarding Certain Measures of Performance”. |

At the LaRonde Complex, the gold production guidance is in line with Previous Guidance for 2022 and lower in 2023. The expected reduction in gold production in 2023 is primarily due to an adjustment to the mining rate and mining sequence at the LaRonde mine. The optimized mining plan is expected to help secure the excavation of the high grade stopes in the East and West mines. The lower grade stopes located in the junction area between the East and West mines are now expected to be mined in the later part of the mine life.

At the LaRonde Zone 5 (“LZ5”) mine, the successful implementation of automated mining techniques has resulted in a consistent improvement in productivity in 2021 and the forecast production rate for 2022 is expected to be 3,200 tonnes per day (“tpd”).

| Canadian Malartic Forecast | 2021 | 2022 | 2023 | 2024 |

| Previous Guidance (oz) | 350,000 | 330,000 | 350,000 | n.a. |

| Current Guidance (oz) | 357,392 (actual) | 320,000 | 330,000 | 340,000 |

| Canadian Malartic Forecast 2022 | Ore Milled (‘000 tonnes) | Gold (g/t) | Gold Mill Recovery (%) | Production and Minesite Costs per Tonne (C$) |

| 9,487 | 1.17 | 89.7% | C$34.09 |

At Canadian Malartic (in which Agnico Eagle has 50% ownership), the lower production guidance in 2022 and 2023 as compared to Previous Guidance is primarily due to a reduction in the mill throughput to 51,500 tpd (100% basis). This reduction is being carried out to optimize the processing plan to improve the production profile during the transition to the underground Odyssey project. This optimization is also expected to result in enhanced financial metrics and cash flow. The mill throughput is forecast to return to full capacity of approximately 60,000 tpd (on a 100% basis) in the second half of 2024 as the underground mining operations ramp up.

In 2022, approximately one-third of the production is expected to be sourced from the Canadian Malartic pit and two-thirds from the Barnat pit.

The Odyssey project is forecast to gradually start production in the first half of 2023, contributing approximately 23,000 ounces of gold in 2023 and 38,000 ounces of gold in 2024 (50% basis).

| Goldex Forecast | 2021 | 2022 | 2023 | 2024 |

| Previous Guidance (oz) | 133,000 | 140,000 | 142,500 | n.a. |

| Current Guidance (oz) | 134,053 (actual) | 135,000 | 135,000 | 125,000 |

| Goldex Forecast 2022 | Ore Milled (‘000 tonnes) | Gold (g/t) | Gold Mill Recovery (%) | Production and Minesite Costs per Tonne (C$) |

| 2,815 | 1.66 | 89.9% | C$46.52 |

At Goldex, the production guidance is slightly lower than Previous Guidance for 2022 and 2023. The production guidance in 2022 and 2023 reflects a more conservative mining rate in the South zone of 800 tpd, consistent mining rates from the Deep 1 area and the anticipated increase in the Rail-Veyor capacity to 7,500 tpd.

ABITIBI REGION, ONTARIO

| Detour Lake forecast | 2021 | 2022 | 2023 | 2024 |

| Previous Guidance (oz)* | 700,000 | 700,000 | 700,000 | n.a. |

| Current Guidance (oz) | 712,824 (actual) | 715,000 | 715,000 | 715,000 |

| Detour Lake Forecast 2022 | Ore Milled (‘000 tonnes) | Gold (g/t) | Gold Mill Recovery (%) | Production and Minesite Costs per Tonne (C$) |

| 25,772 | 0.94 | 91.8% | C$22.37 |

| *For the Detour Lake mine, Previous Guidance refers to the prior three-year gold production guidance issued by Kirkland Lake Gold on December 10, 2020. |

At Detour, the production guidance is higher in 2022 and 2023, when compared to Previous Guidance, reflecting the continuous optimization of the operation.

| Macassa Forecast | 2021 | 2022 | 2023 | 2024 |

| Previous Guidance (oz)* | 237,500 | 310,000 | 412,500 | n.a. |

| Current Guidance (oz) | 210,192 (actual) | 180,000 | 210,000 | 340,000 |

| Macassa Forecast 2022 | Ore Milled (‘000 tonnes) | Gold (g/t) | Gold Mill Recovery (%) | Production and Minesite Costs per Tonne (C$) |

| 233 | 24.4 | 98.4% | C$692.80 |

| *For the Macassa mine, Previous Guidance refers to the prior three-year gold production guidance issued by Kirkland Lake Gold on December 10, 2020. |

The lower production guidance for the Macassa mine in 2022 and 2023, when compared to Previous Guidance, reflects a slower ramp up of mining activities than anticipated. This slower ramp up is partly due to a re-evaluation of the development and mining sequence, compounded by the ongoing impact of reduced equipment availability caused by increased maintenance requirements, poor battery performance and delays in new battery delivery.

NUNAVUT

| Meliadine Forecast | 2021* | 2022 | 2023 | 2024 |

| Previous Guidance (oz) | 370,000 | 390,000 | 385,000 | n.a. |

| Current Guidance (oz) | 391,687 (actual) | 370,000 | 380,000 | 380,000 |

| Meliadine Forecast 2022 | Ore Milled (‘000 tonnes) | Gold (g/t) | Gold Mill Recovery (%) | Production and Minesite Costs per Tonne (C$) |

| 1,709 | 6.98 | 96.5% | C$231.11 |

| * Includes 2021 pre-commercial gold production of 24,057 ounces from the Tiriganiaq open pit |

At Meliadine, the production guidance is lower than the Previous Guidance in 2022 and in 2023. The lower production guidance in 2022 incorporates the impact of COVID-19 related reductions in mining activities in January 2022. In 2023, the production guidance reflects minor adjustments to the mining sequence.

| Meadowbank Complex Forecast | 2021* | 2022 | 2023 | 2024 |

| Previous Guidance (oz) | 370,000 | 400,000 | 415,000 | n.a. |

| Current Guidance (oz) | 324,808 (actual) | 347,500 | 355,000 | 430,000 |

| Meadowbank Complex Forecast 2022 | Ore Milled (‘000 tonnes) | Gold (g/t) | Gold Mill Recovery (%) | Production and Minesite Costs per Tonne (C$) |

| 3,702 | 3.14 | 93.0% | C$139.72 |

| * Includes 2021 pre-commercial gold production of 1,956 ounces from the Amaruq underground project |

At the Meadowbank Complex, the production guidance is lower than Previous Guidance for 2022 and 2023. The lower production guidance in 2022 incorporates the COVID-19 related suspension of mining and milling activities that commenced in December 2021 and gradual ramp-up into February 2022. In addition, the Company has revised the open pit mining sequence and mining rate in 2022 and 2023 to 35 million tonnes per year, in line with current performance. As a result, the ore processed and gold grades in 2022 and 2023 are slightly lower than previously anticipated. The Company now forecasts gold production above 400,000 ounces per year starting in 2024.

Amaruq underground is forecast to contribute approximately 30,000 ounces of gold in 2022 and 100,000 ounces of gold in 2023 and in 2024.

Every year, the caribou migration is factored into the Company’s production plan. This migration can affect the ability to move materials on the road between Amaruq and Meadowbank and between Meadowbank and Baker Lake. Wildlife management is an important priority and the Company is working with Nunavut stakeholders to optimize solutions to safeguard wildlife and minimize production disruptions.

AUSTRALIA

| Fosterville Forecast | 2021 | 2022 | 2023 | 2024 |

| Previous Guidance (oz)* | 412,500 | 362,500 | 362,500 | n.a. |

| Current Guidance (oz) | 509,601 (actual) | 400,000 | 375,000 | 247,500 |

| Fosterville Forecast 2022 | Ore Milled (‘000 tonnes) | Gold (g/t) | Gold Mill Recovery (%) | Production and Minesite Costs per Tonne (A$) |

| 768 | 16.66 | 97.3% | A$264.86 |

| *For the Fosterville mine, Previous Guidance refers to the prior three-year gold production guidance issued by Kirkland Lake Gold on December 10, 2020. |

The improved production forecast for the Fosterville mine in 2022 and 2023 reflects higher confidence in the mine plan and successful mineral reserve replacement in 2021.

FINLAND

| Kittila Forecast | 2021 | 2022 | 2023 | 2024 |

| Previous Guidance (oz) | 250,000 | 257,500 | 265,000 | n.a. |

| Current Guidance (oz) | 239,240 (actual) | 242,500 | 250,000 | 240,000 |

| Kittila Forecast 2022 | Ore Milled (‘000 tonnes) | Gold (g/t) | Gold Mill Recovery (%) | Production and Minesite Costs per Tonne (EUR) |

| 1,984 | 4.35 | 87.4% | € 84.85 |

At Kittila, the lower production guidance for 2022 and 2023 compared to Previous Guidance is primarily due to revisions to the grade profile related to changes to the mining sequence which resulted from the delayed shaft commissioning. Commissioning of the production hoist is now expected in late 2022 or early 2023.

MEXICO

| Pinos Altos Forecast | 2021 | 2022 | 2023 | 2024 |

| Previous Guidance (oz) | 122,500 | 125,000 | 120,000 | n.a. |

| Current Guidance (oz) | 126,932 (actual) | 127,500 | 127,500 | 127,500 |

| Pinos Altos Forecast 2022 | Total Ore (‘000 tonnes) | Gold (g/t) | Gold Recovery (%) | |

| 1,918 | 2.21 | 93.6% | ||

| Production and Minesite Costs per Tonne | Silver (g/t) | Silver Mill Recovery (%) | ||

| $75.52 | 48.01 | 46.2% |

At Pinos Altos, the production guidance is higher than the Previous Guidance in 2022 and 2023 largely due to an expected increase in throughput levels from the contribution of the Sinter and Reyna de Plata satellite deposits and higher gold grades at Pinos Altos. The Company will continue the development of the Cubiro satellite deposit and prepare the operation for a production ramp-up in the second half of 2023.

| La India Forecast | 2021 | 2022 | 2023 | 2024 |

| Previous Guidance (oz) | 77,000 | 75,000 | 42,500 | n.a. |

| Current Guidance (oz) | 63,529 (actual) | 82,500 | 70,000 | 22,500 |

| La India Forecast 2022 | Total Ore (‘000 tonnes) | Gold (g/t) | Gold Recovery (%) | |

| 7,348 | 0.52 | 67.2% | ||

| Production and Minesite Costs per Tonne | Silver (g/t) | Silver Recovery (%) | ||

| $11.52 | 2.57 | 14.3% |

At La India, the production guidance in 2022 and 2023 is higher than the Previous Guidance. In 2022, the La India mine is expected to benefit from the delayed recovery of the gold ounces stacked on the heap leach in the second quarter of 2021. This delay was due to the shortage of water, which affected heap leach kinetics. In 2023, the higher gold production results from an optimization of the final pit bottom and an increase in mineral reserves at the El Realito deposit.

Total Capital Expenditure Forecast

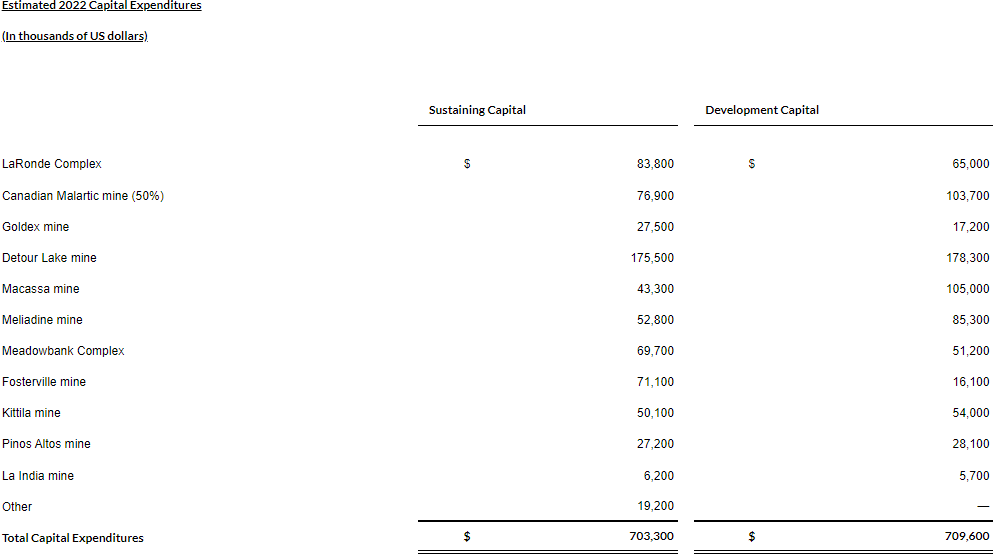

Estimated capital expenditures for 2022 total approximately $1.4 billion, which includes approximately $703.3 million of sustaining capital at the Company’s operating mines and $709.6 million on growth projects, as set out in the table below. Additionally, approximately $11.3 million is expected to be spent on sustaining capitalized exploration and $119.4 million on non-sustaining capitalized exploration. For additional detail on capitalized exploration, refer to the “2022 Exploration Program and Budget” section of this news release.

| Estimated 2022 Capital Expenditures | ||||||

| (In thousands of US dollars) | ||||||

| Sustaining Capital | Development Capital | |||||

| LaRonde Complex | $ | 83,800 | $ | 65,000 | ||

| Canadian Malartic mine (50%) | 76,900 | 103,700 | ||||

| Goldex mine | 27,500 | 17,200 | ||||

| Detour Lake mine | 175,500 | 178,300 | ||||

| Macassa mine | 43,300 | 105,000 | ||||

| Meliadine mine | 52,800 | 85,300 | ||||

| Meadowbank Complex | 69,700 | 51,200 | ||||

| Fosterville mine | 71,100 | 16,100 | ||||

| Kittila mine | 50,100 | 54,000 | ||||

| Pinos Altos mine | 27,200 | 28,100 | ||||

| La India mine | 6,200 | 5,700 | ||||

| Other | 19,200 | — | ||||

| Total Capital Expenditures | $ | 703,300 | $ | 709,600 |

Using the Company’s 2022 budget assumptions, annual sustaining capital expenditures for 2023 and in future years are expected to remain stable at approximately $675 to $725 million. Based on the extensive list of high-quality development growth opportunities, which are discussed below, and depending on prevailing gold prices and the timing of project approvals, the Company expects that total development capital in future years could be approximately $625 to $675 million. Overall, annual capital expenditures are expected to be approximately $1.3 to $1.4 billion through 2024.

2022 Exploration Program and Budget – Continuation of Aggressive Exploration Program at Detour Lake and Odyssey Underground Project to Advance Two Significant Future Contributors to Mineral Reserve Growth. Large Program to Extend Life of Mine at LaRonde, Macassa, Meliadine, Amaruq, Fosterville and Kittila while Advancing Priority Pipeline Projects Hope Bay and Santa Gertrudis

As a result of continued exploration success at several projects, the Company has budgeted $324 million for exploration expenditures in 2022, comprised of $193 million for expensed exploration and $131 million for capitalized exploration.

The objective is to build on recent exploration success and identify additional mineral resources and convert mineral resources into mineral reserves. This is part of the strategy to develop the full potential of existing operations and key projects in the Company’s pipeline.

The priorities of the 2022 exploration program are the expansion of the Detour Lake pit, the underground Odyssey project at Canadian Malartic and campaigns at several assets: LaRonde Complex, Meliadine, Macassa, Fosterville, Kittila and Hope Bay.

At the LaRonde Complex, the Company expects to spend approximately $12.0 million for continued development of exploration drifts from the LaRonde 3 infrastructure towards the west below the LZ5 mine workings and for 43,500 metres of drilling into multiples targets including Zone 5, Zone 6, Zone 20N and the recently discovered Zone 20N Zn South with the aim of adding new mineral reserves and mineral resources to extend the mine life of the LaRonde Complex into the 2030s.

At the Goldex mine, the Company expects to spend approximately $5.6 million for 45,300 metres of drilling comprised of 39,300 metres of conversion drilling and 6,000 metres of exploration drilling, focused on the M Zone, West area, South Zone and at depth in the Deep 3 Zone.

At the Canadian Malartic mine, the Company expects to spend approximately $11.9 million (50% basis) for 136,800 metres (100% basis) of exploration and conversion drilling focused on aggressive infill drilling at the East Gouldie deposit to improve confidence in the mineral resource, to continue the conversion of inferred mineral resources to indicated mineral resources and to refine the geological model. With ramp development under way as part of the Odyssey Mine project, the Company will be able to continue underground conversion drilling from the ramp in 2022. In addition, the Company is planning to spend approximately $4.1 million (50% basis) on 21,900 metres (100% basis) of exploration drilling to expand mineralization towards the east in the East Gouldie horizon and the new Titan zone at depth on the Rand property. Some drilling is also planned on the nearby East Amphi property to extend the Nessie and Kraken zones.

At the Detour Lake mine, the Company expects to spend approximately $35.8 million for 194,000 metres of capitalized drilling to expand mineral resources at depth and to the west, and $10.1 million for 40,000 metres for exploration drilling to continue to investigate the Sunday Lake deformation zone to the east and west of the current pit’s mineral resources.

At the Macassa mine, the Company expects to spend approximately $20.3 million for 99,900 metres in capitalized drilling and to develop exploration drifts to replace mineral reserves and mineral resources depletion. Another $18.9 million is budgeted for exploration, including $10.4 million for 89,700 metres of exploration drilling to continue to investigate extensions of key targets at South Mine Complex (East, West, Upper and Lower), Main Break, ’04 Break, Amalgamated Break and near-surface. The remaining $8.6 million of exploration will be spent developing a 1.3 kilometre exploration ramp from the Near-Surface area in order to access, develop and infill with underground drilling the mineralization on the AK property.

For regional exploration in Ontario, the Company expects to spend a total of $19.1 million for 53,900 metres of drilling, including: $2.6 million for 12,200 metres for surface exploration drilling at the AK property for mineral resource conversion; $7.9 million for 15,800 metres of drilling at the Upper Beaver and Upper Canada deposits and other targets in the Kirkland Lake camp; and $8.7 million for the Taylor, Hislop, Holloway West and other properties in the Kirkland Lake and Timmins areas that are joint ventures with Melkior Resources, Mistango River Resources, OreFinders Resources and Wallbridge Mining.

At the Meliadine mine, the Company expects to spend approximately $8.4 million for 27,300 metres of capitalized drilling with a focus on conversion drilling at the Tiriganiaq, Normeg, Wesmeg and Pump deposits, as well as exploration drilling of the Tiriganiaq, Wesmeg, Pump and F-Zone deposits, which are all open at depth.

At the Meadowbank Complex, the Company expects to spend approximately $10.4 million for 42,800 metres of drilling comprised of 20,200 metres of conversion drilling and 22,700 metres of exploration drilling focused on testing open-pit extensions of mineralization and the potential for further underground deposits at the Amaruq satellite operation. The Company expects to spend $9.1 million for 19,000 metres of drilling to investigate for new, near-surface satellite deposits close to the road and infrastructure around the Meadowbank/Amaruq area. Any new open-pittable discoveries have the potential to extend the life of mine at Amaruq in conjunction with the extensions of higher-grade underground mineralization at Amaruq.

At the Hope Bay mine, the Company expects to complete 80,000 metres of drilling in a $32.2 million exploration program that will include $17.9 million to develop new exploration drifts and 29,000 metres of underground exploration drilling at the Doris deposit to explore the extensions of mineralization and to add mineral reserves and mineral resources in the BTD zone to the north and in the BCO, BCN and West Valley zones below the dike. The Company expects to spend $14.3 million for 51,000 metres of surface drilling into exploration targets around the Doris Mine, between the Doris and Madrid deposits, and around the Madrid deposit with the objective of adding mineral reserves and mineral resources to the project.

At the Fosterville mine, the Company expects to spend approximately $34.6 million for 121,400 metres of capitalized drilling and the development of exploration drifts to replace mineral reserve depletion and to add mineral resources in the Cygnet, Lower Phoenix and Robbin’s Hill areas. Another $19.7 million is budgeted for 62,000 metres of underground and surface exploration with the aim of discovering additional high-grade mineralization at Fosterville. An additional $2.9 million is budgeted for 20,000 metres of regional exploration drilling on properties surrounding the Fosterville mine and $4.2 million is budgeted for 9,800 metres of drilling in the Northern Territories mostly to test new targets at Pine Creek, Maud Creek, Mt Paqualin and Union Reefs.

At the Kittila mine, the Company expects to spend approximately $12.4 million for 69,600 metres of drilling focused on the Main zone in the Roura and Rimpi areas as well as the Sisar zone. The drilling includes 46,800 metres of capitalized conversion drilling at the mine as described above and 22,800 metres of expensed exploration drilling. The expensed drilling will be focused on targets beyond the current mineral reserve area, especially from 1,500 to 2,000 metres depth and at shallower depths in the area north of the mine.

At the Pinos Altos mine, the Company expects to spend approximately $3.5 million for 17,400 metres of expensed exploration drilling. The two main objectives are to continue to infill and expand the mineral resource at Cubiro, and to test the depth potential of the Cerro Colorado, Santo Nino and Reyna East zones and other targets on the property. Another $800,000 is budgeted for 5,000 metres of capitalized drilling.

At the La India mine, the Company expects to spend approximately $2.6 million for 13,000 metres of drilling to investigate for the extensions of oxide targets near the Main Zone and to grow and infill the Chipriona polymetallic sulphide deposit.

Project development and exploration costs for Santa Gertrudis in 2022 are estimated at approximately $19.0 million. Regional exploration includes $13.2 million for approximately 35,500 metres of drilling focused on expanding the mineral resources and testing extensions of high-grade structures such as the Amelia deposit and exploring new targets, and $3.5 million for approximately 16,500 metres of drilling will primarily be for infilling open pit deposits. Another $2.3 million are expected to be spent on internal studies and metallurgical work.

Continues…..