Highlights

- An extensive program testing the potential of previously unassayed historic core from the Yoquivo Silver-Gold Project has been undertaken, with ~5,000m of sampling completed

- Assay results for 3,516m of the previously unsampled core have now been received, with at least 519m having elevated silver and/or gold (>4g/t AgEq1)

- Testing to date has seen additional high grade intervals (>100g/t AgEq) returned from 13 separate holes, including1:

- YQ-22-012 0.9m at 766g/t AgEq – 426g/t Ag & 4.4g/t Au from 23.05m

- YQ-22-010 3.2m at 187g/t AgEq – 177g/t Ag & 0.1g/t Au from 209.55m

- incl. 1.2m at 305g/t AgEq – 293g/t Ag & 0.2g/t Au from 210.55m

- YQ-22-025 8.75m at 150g/t AgEq – 77g/t Ag & 1.0g/t Au from 131.7m

- incl. 1.1m at 848g/t AgEq – 370g/t Ag & 6.2g/t Au from 135.15m2

- YQ-20-011 2.8m at 172g/t AgEq – 158g/t Ag & 0.2g/t Au from 172.25m

- incl. 0.5m at 390g/t AgEq – 348g/t Ag & 0.5g/t Au from 173.55m

- YQ-22-003 4.45m at 115g/t AgEq – 64g/t Ag & 0.7g/t Au from 119.2m2

- incl. 0.95m at 249g/t AgEq – 100g/t Ag & 1.9g/t Au from 120.25m

- YQ-22-029 1.2m at 307g/t AgEq – 231g/t Ag & 1.0g/t Au from 119.2m

- In combination with the original assays, the new sampling has seen exceptionally broad intersections emerging from the existing drilling in the central portion of the deposit1,3:

- YQ-022-009 144m at 93g/t AgEq – 49g/t Ag & 0.6g/t Au from 199.8m

- incl. 46m at 179g/t AgEq – 78g/t Ag & 1.3g/t Au from 263.45m

- YQ-022-013 66.45m at 83g/t AgEq – 57g/t Ag & 0.3g/t Au from 254.6m

- incl. 19.7m at 174g/t AgEq – 112g/t Ag & 0.8g/t Au from 282.4m

- YQ-020-010 83.3m at 69g/t AgEq – 42g/t Ag & 0.3g/t Au from 126.7m

- incl. 10.2m at 184g/t AgEq – 95g/t Ag & 1.2g/t Au from 126.7m and 13.85m at 140g/t AgEq – 92g/t Ag & 0.6g/t Au from 181.3m

- YQ-25-002 97.63m at 61g/t AgEq – 39g/t Ag & 0.3g/t Au from 96.2m

- incl. 8.84m at 140g/t AgEq – 72g/t Ag & 0.9g/t Au from 111.77m and 13.76m at 115g/t AgEq – 63g/t Ag & 0.7g/t Au from 181.3m

- YQ-25-001 44.78m at 100g/t AgEq – 83g/t Ag & 0.2g/t Au from 176.23m

- incl. 7.76m at 170g/t AgEq – 154g/t Ag & 0.2g/t Au from 207.4m

- YQ-022-009 144m at 93g/t AgEq – 49g/t Ag & 0.6g/t Au from 199.8m

- Advance’s team to investigate the potential for bulk tonnage open pittable resources in addition to high grade underground resources as a part of the upcoming JORC upgrade

- Regional exploration and resource expansion drilling is continuing at Yoquivo, with results currently pending for multiple holes

1 The Yoquivo silver equivalent was derived based on initial flotation and leaching test work conducted by Golden Minerals in 2022. The formula used is AgEq g/t = Ag g/t + (Au g/t * Au price/Ag price), where the assumed $US/oz gold price is $1,840 and the assumed $US/oz silver price is $24. Au and Ag recovery are both assumed at 85% based on this test work. In AVM’s opinion all elements that are included in the metal equivalency calculation have reasonable potential to be recovered and sold (ASX AVM 28 October 2024).

2 See ASX announcement – 5 November 2025 “Advance Confirms High Grade Silver-Gold Mineralisation in Previously Unsampled Core at Yoquivo”

3 Based on a 15g/t AgEq cut-off value and including up to 10m of internal dilution.

Commenting on the results for the historic core sampling at Yoquivo, Advance’s Managing Director

and CEO Dr Adam McKinnon said:

“The extensive, low-cost historic core sampling we’ve undertaken at Yoquivo has been proven to be extremely successful. We have now identified multiple zones of previously unrecognised silver and gold mineralisation in the Pertenencia area – without having to complete any new drilling. Most importantly, the change to universal rather than selective sampling has seen numerous exceptionally large zones of contiguous mineralisation emerge in the central portion of the deposit.”

“We will begin the process of incorporating the historic core sampling data and our most recent drilling at Yoquivo into an upgraded JORC resource later this month, once the remaining assays are received. This will give us not only an opportunity to explore an expanded high grade underground resource scenario but also the potential of a high tonnage open pittable resource scenario, similar to Agnico Eagle’s nearby Pinos Altos Mine some 26km to the northwest.”

Advance Metals Limited (ASX:AVM)(“Advance” or the “Company”) is pleased to provide an update on exploration activities at its high-grade, 100%-owned Yoquivo Silver-Gold Project in southwestern Chihuahua, Mexico. The Company today reports further strong results from its ongoing historic core sampling program in the Pertenencia area.

Previous explorers were highly selective in their approach to sampling of core from the project, with less than 50% of the drilling completed actually assayed4. Advance’s team in Mexico identified that this material presented an exceptional low-cost option to add value to the project and have now sampled around 5,000m of this previously unassayed core. The initial sampling has focussed on an area hosting the existing Foreign Estimate at Yoquivo5,6, which comprises 17.23Moz of contained silver-equivalent at a grade of 570g/t AgEq1.

Assay results have been received for 3,516m of this new sampling, with 519m (17%) having elevated silver and/or gold values of at least 4g/t AgEq1. This testing has also seen additional high grade intervals of greater than 100g/t AgEq returned from 13 separate holes, with new intervals including:

- YQ-022-012 0.9m at 766g/t AgEq – 426g/t Ag & 4.4g/t Au from 23.05m

- YQ-022-010 3.2m at 187g/t AgEq – 177g/t Ag & 0.1g/t Au from 209.55m

- incl. 1.2m at 305g/t AgEq – 293g/t Ag & 0.2g/t Au from 210.55m

- YQ-022-025 8.75m at 150g/t AgEq – 77g/t Ag & 1.0g/t Au from 131.7m

- incl. 1.1m at 848g/t AgEq – 370g/t Ag & 6.2g/t Au from 135.15m2

- YQ-020-011 2.8m at 172g/t AgEq – 158g/t Ag & 0.2g/t Au from 172.25m

- incl. 0.5m at 390g/t AgEq – 348g/t Ag & 0.5g/t Au from 173.55m

- YQ-022-003 4.45m at 115g/t AgEq – 64g/t Ag & 0.7g/t Au from 119.2m2

- incl. 0.95m at 249g/t AgEq – 100g/t Ag & 1.9g/t Au from 120.25m

- YQ-022-029 1.2m at 307g/t AgEq – 231g/t Ag & 1.0g/t Au from 119.2m

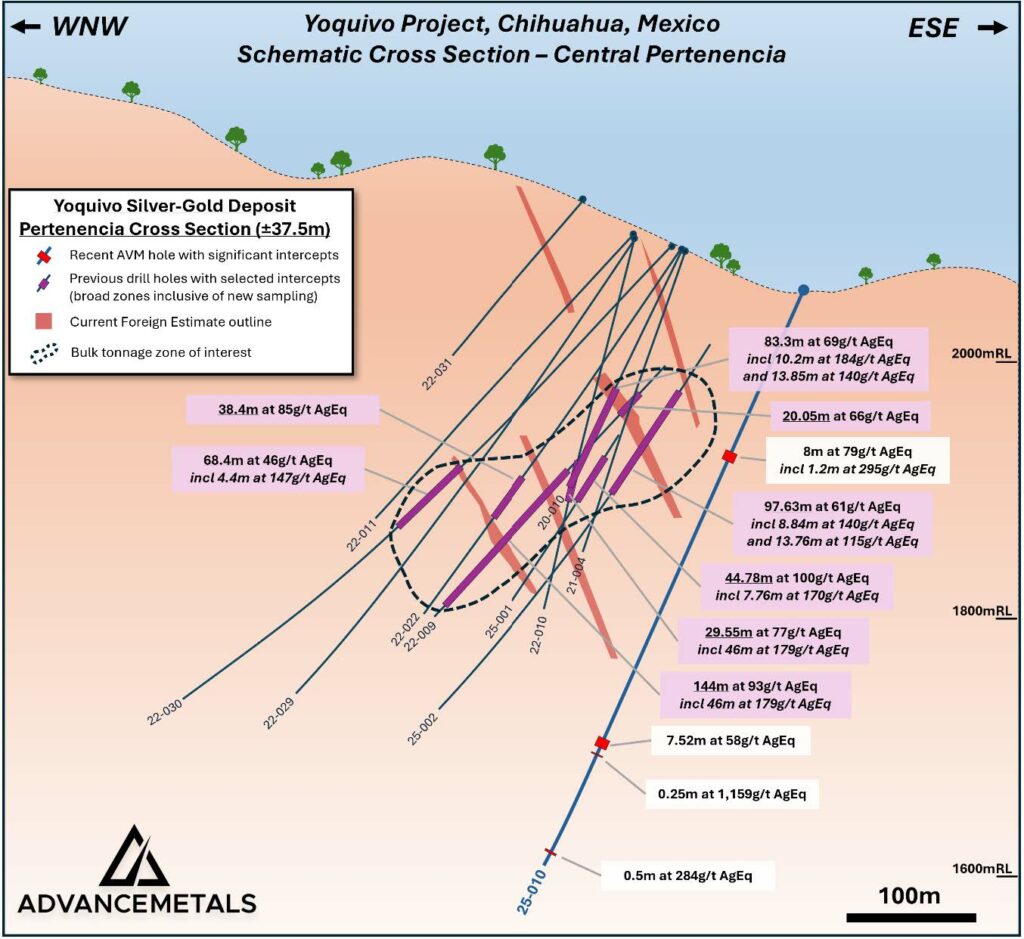

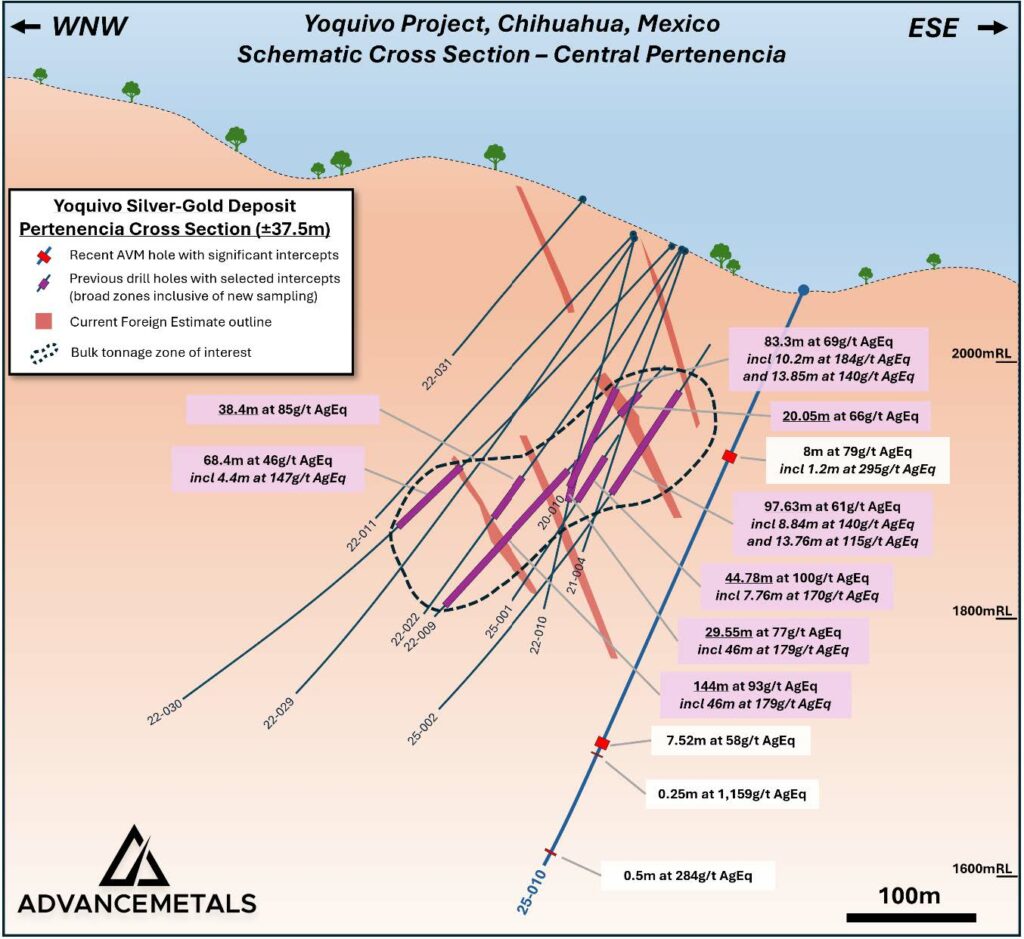

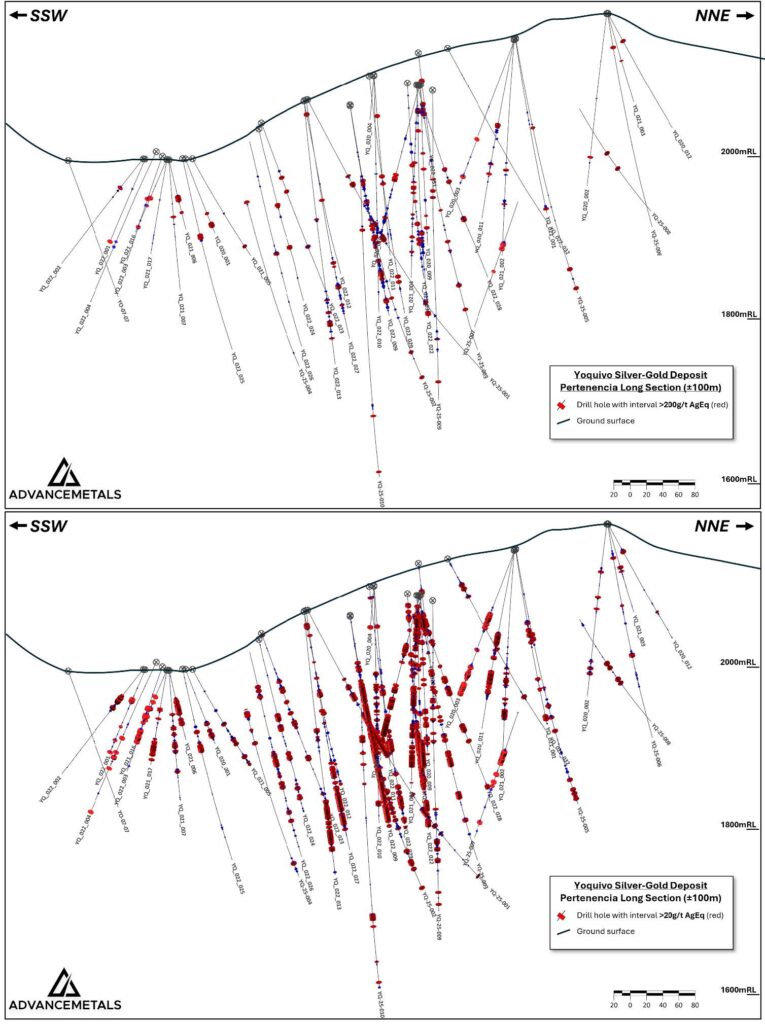

A full list of significant intersections from the resampling program to date is shown in Table 1, with drill hole locations shown in Figures 2 – 4.

4 ASX announcement – 27 August 2025 “Advance to unlock untested silver-gold potential from previous drilling at Yoquivo”

5 ASX announcement – 28 October 2024 “Advance Metals to acquire Yoquivo High Grade Silver Project in Mexico”

6 The Foreign Estimates of mineralisation mentioned in this announcement are not compliant with the Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves (2012 JORC Code) and is a “Foreign Estimate”. A Competent Person (under ASX Listing Rules) has not yet done sufficient work to classify the Foreign Estimate as Mineral Resources or Ore Reserves in accordance with the 2012 JORC Code. It is uncertain that following evaluation and/or further exploration work the Foreign Estimate will be able to be reported as Mineral Resources or Ore Reserves in accordance with the JORC Code 2012.

The new sampling has seen an increasing number of drill holes in the Pertenencia with near complete sampling from the top to the bottom of the hole. In combination with the original assays, the new sampling has highlighted exceptionally broad intersections of contiguous, moderate-grade mineralisation emerging from the existing drilling in the central portion of the deposit, including1:

- YQ-022-009 144m at 93g/t AgEq – 49g/t Ag & 0.6g/t Au from 199.8m

- incl. 46m at 179g/t AgEq – 78g/t Ag & 1.3g/t Au from 263.45m

- YQ-022-013 66.45m at 83g/t AgEq – 57g/t Ag & 0.3g/t Au from 254.6m

- incl. 19.7m at 174g/t AgEq – 112g/t Ag & 0.8g/t Au from 282.4m

- YQ-020-010 83.3m at 69g/t AgEq – 42g/t Ag & 0.3g/t Au from 126.7m

- incl. 10.2m at 184g/t AgEq – 95g/t Ag & 1.2g/t Au from 126.7m and

- 13.85m at 140g/t AgEq – 92g/t Ag & 0.6g/t Au from 181.3m

- YQ-25-002 97.63m at 61g/t AgEq – 39g/t Ag & 0.3g/t Au from 96.2m

- incl. 8.84m at 140g/t AgEq – 72g/t Ag & 0.9g/t Au from 111.77m and

- 13.76m at 115g/t AgEq – 63g/t Ag & 0.7g/t Au from 181.3m

- YQ-25-001 44.78m at 100g/t AgEq – 83g/t Ag & 0.2g/t Au from 176.23m

- incl. 7.76m at 170g/t AgEq – 154g/t Ag & 0.2g/t Au from 207.4m

As highlighted by the combined new and existing assay results shown in Figure 2, the difference in scale and continuity is significant at lower cutoff grades. The current Foreign Estimate6 for Yoquivo was calculated in 2023 at a AgEq1 cutoff grade of 200g/t, based on a narrow vein, underground-style resource5. An assumed price of US$24 for silver and $US1,840 for gold was also used for the Foreign Estimate1,5,6.

With silver and gold prices currently strongly higher than the previous assumptions, the Company’s technical team now believes that the Pertenencia area could have potential as a higher tonnage/bulk mining deposit. To this end, the upcoming JORC resource upgrade will examine a range of cutoff grade scenarios.

Diamond drilling is presently ongoing at Yoquivo, with assays for multiple holes at Pertenencia and in the broader region currently pending. Assay results have also recently been returned for hole YQ-25-010, highlighting several silver gold intersections down hole (Figure 1 & Table 4):

- YQ-25-010 8m at 79g/t AgEq – 79g/t Ag & 0.2g/t Au from 160.75m

- incl. 1.2m at 295g/t AgEq – 227g/t Ag & 0.9g/t Au from 166.35m

- 7.52m at 58g/t AgEq – 40g/t Ag & 0.2g/t Au from 400.48m

- 0.25m at 1,159g/t AgEq – 717g/t Ag & 5.8g/t Au from 416.75m

- 0.5m at 284g/t AgEq – 277g/t Ag & 0.1g/t Au from 492.75m

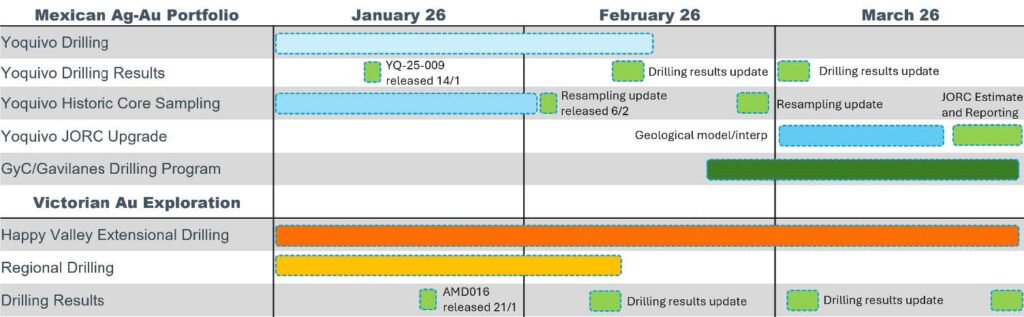

Exploration Outlook for Advance Metals

For further information:

Dr Adam McKinnon

Managing Director and CEO

Advance Metals Limited

+61 (0) 411 028 958

[email protected]

www.advancemetals.com.au

Jane Morgan

Investor & Media Relations Manager

Advance Metals Limited

+61 (0) 405 555 618

[email protected]

This announcement has been authorised for release by the Board of Advance Metals Limited.

Original Article: https://app.sharelinktechnologies.com/announcement-preview/asx/1211ceef4f15241078d94283a2e2aafd