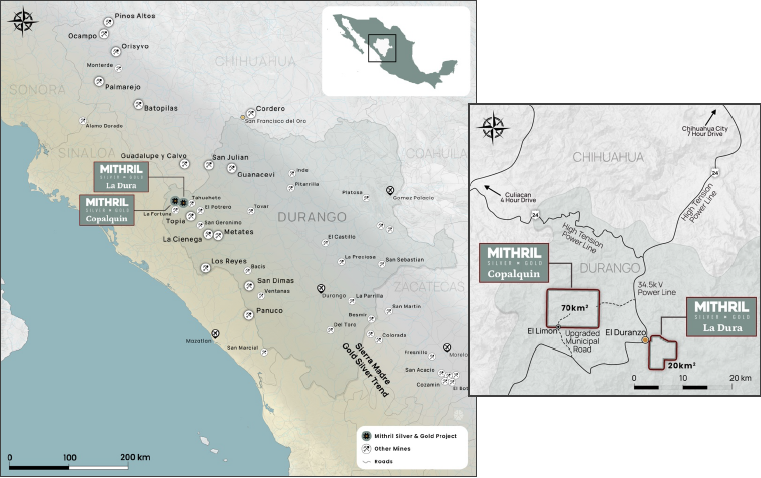

Melbourne, Australia and Vancouver, Canada – January 30, 2026 – Mithril Silver and Gold Limited (“Mithril” or the “Company”) (TSXV: MSG) (ASX: MTH) (OTCQB: MTIRF) is pleased to provide its December 2025 quarterly activities and cash flow report for its Copalquin and La Dura properties in Durango State, Mexico.

EXPLORATION HIGHLIGHTS

District-Scale Discovery Progressing – Copalquin Gold–Silver Project, Mexico

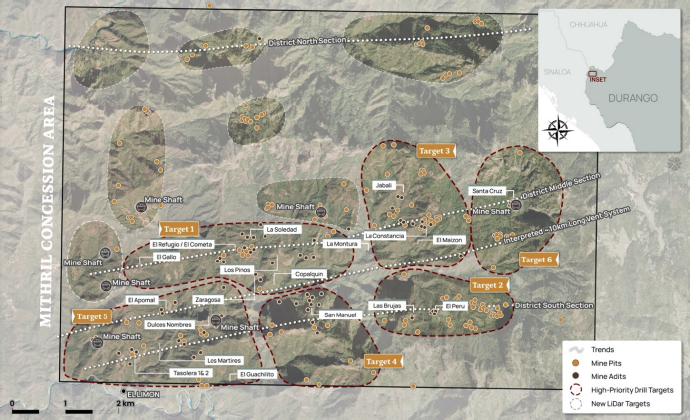

Copalquin confirmed as a large, vertically extensive epithermal gold–silver system, with mineralisation defined over 9 km strike length and 1,200 m vertical extent, with multiple targets, a dominant east–west structural corridor and multiple northwest-trending structures within the 70 km2 mining concession area.

Target 1 – Refugio–La Soledad (Maiden Resource Growth)

- Ongoing drilling continued to expand and infill the Target 1 resource area and allow development of a geology model that is now robust and predictive. Updating of the maiden resource at Target 1 is planned for Q2, following a 3,000 metre drill programme to infill key areas in the model. Beyond the resource update drilling, Target 1 is still open at depth, west towards El Gallo and the northwest extension of the La Soledad structure.

- Highlight intercepts reported include: 1

- 7.20 m @ 2.78 g/t gold, 148 g/t silver from 260.9 m (MTH-RE25-44), including

- 2.05 m @ 7.41 g/t gold, 419 g/t silver from 266.05 m, plus

- 2.80 m @ 3.97 g/t gold, 208 g/t silver from 272.35 m

- 8.03 m @ 7.19 g/t gold, 260 g/t silver from 257.72 m (MTH-RE25-45), including

- 4.40 m @ 9.87 g/t gold, 507 g/t silver from 260.7 m The above intercepts extend the Target 1 strike over 30%

Target 5 – Apomal–Candelaria Silver-Rich System (New Target Area – first drilling)

- Maiden drilling confirmed a silver-dominant epithermal system developed at lower elevation within the Copalquin district. Multiple, parallel NW trending veins hosted in the granodiorite intrusive in the southwest area of the district.

- Highlight results include: 2

- 2.75 m @ 660 g/t AgEq (2.28 g/t gold, 500 g/t silver) from 93.6 m (AP25-003), including

- 1.00 m @ 1,714 g/t AgEq (5.80 g/t gold, 1,308 g/t silver) from 94.7 m

- 3.35 m @ 366 g/t AgEq (1.71 g/t gold, 246 g/t silver) from 90.15 m (AP25-005), including

- 1.05 m @ 1,146 g/t AgEq (5.35 g/t gold, 771 g/t silver) from 92.45 m

- 1.25 m @ 728 g/t AgEq (4.55 g/t gold, 409 g/t silver) from 119.2 m (AP25-006), plus

- 0.90 m @ 616 g/t AgEq (2.41 g/t gold, 447 g/t silver) from 138.1 m, plus

- 0.80 m @ 427 g/t AgEq (1.51 g/t gold, 321 g/t silver) from 149.5 m

- Surface and channel sampling up to 3,300 g/t Ag and 2.0 g/t Au over 1.4 m3 and 4,520 g/t Ag and 38.3 g/t Au over 0.60 m4 from historic workings.

- Drilling to date has tested only a small proportion of mapped veins, highlighting substantial upside potential at this large target area

Target 3 – El Jabali-Guadelupe (Maiden Drill Programme in January 2026)

- Mapping and sampling continued to define a coherent target on the eastern side of the Copalquin system adjacent to one of the multiple rhyolite domes that feature across the 10 km long district trend

- Channel sampling highlights included 0.65 m @ 16.0 g/t Au, 1,275 g/t Ag (El Jabali area)4.

- Subsequent to the end the quarter, the maiden drill programme has commenced at Target 3 in January 2026.5

District Geological Model Strengthened

Integrated mapping, sampling, spectral analysis and petrography have confirmed:

- a dominant east–west corridor hosting high-grade gold-silver mineralisation;

- northwest-trending and cross-cutting ‘feeder’ structures

- vertically zoned silver and gold mineralisation ranging from silver rich to gold rich across the district for 9 km.

- multiple mineralised centres analogous to Mexican epithermal districts throughout the Sierra Madre Gold-Silver trend.

- Subsequent to the end of the quarter, an aerial magnetic survey commenced over the Copalquin mining concession area. This is expected to confirm and reveal the key structures, including shear zones, faults and other geologic features, responsible for the widespread silver and gold mineralisation across the Copalquin District

Acquisition of the La Dura Mining Concessions, Adjacent to Mithril’s Copalquin Property6

La Dura consists of 5 contiguous mining concessions with a total area of 2,052 hectares and located in Durango State, Mexico, 5 km from the town of El Durazno and 20 km from Mithril’s flagship Copalquin property.

The property hosts a significant Au-Ag sheeted to stockwork vein system associated with NW striking faults in Tertiary rhyolite. Mineralization occurs on surface along 650 metres of strike and has been mined in the San Manuel shoot at the La Dura historic mine, to about 140 metres depth. Veins are characterised by low sulphide mineralisation with minimal to no alteration of the host rhyolite tuff. Historically, the veins have been exploited and explored solely on the progress of the underground workings and assaying. The project warrants property scale mapping, wide spaced soil sampling and channel sampling to develop targets for drill testing. A LiDAR survey has been completed (awaiting interpretation) and an aerial magnetic survey is scheduled to be flown upon completion of the survey underway at Copalquin, both as precursors to a field programme.

The veins at the various workings appear to be hosted by upper series volcanic rocks and may have significant depth potential should they extend into the lower series andesitic rocks at some greater depth.

Corporate

- The Annual General Meeting was held on 5th November 2025 with all resolutions passed

- Cash balance of A$14.1M at end of the December 2025 quarter and Mithril remains debt free

- Mexican value added tax refunds have slowed towards the end of 2025. A refund of MXN3.8M (~A$0.32M) was received in January 2026. Approximately MXN10M (~A$0.8M) of refunds for 2025 are in process and it is anticipated these will complete over the coming months.

Commenting on the December 2025 quarter, Managing Director and CEO John Skeet said:

“The December quarter marked another period of significant exploration progress at Copalquin. Drilling at Target 1 continued to expand the scale of the mineralised system ahead of the upcoming resource update, while Target 5 has emerged as a compelling silver-rich growth opportunity within the south-west of the district.

At the same time, we advanced Target 3 to be drill ready (commenced January 2026) and strengthened our district-scale geological model through systematic mapping, sampling and geophysical work. These results continue to reinforce our view that Copalquin represents a large, vertically extensive epithermal gold–silver system with multiple high-grade centres and substantial resource growth potential. Firming of the key structural targets for drill testing in the coming months will follow completion of the aerial magnetic survey (commenced in January 2026).

The addition of the nearby La Dura mining concessions to the portfolio takes advantage of our established presence in the area to progress another compelling gold-silver property, utilising our Copalquin experience and with minimal financial commitment.

With a strong treasury and multiple drill programmes underway, Mithril is well positioned to achieve its exploration milestones in 2026.”

Copalquin District and La Dura Property – 2026

CORPORATE AND FINANCIAL SUMMARY

- The Annual General Meeting was held on 5th November 2025 with all resolutions passed

- Cash balance of A$14.1M at end of the December 2025 quarter and Mithril remains debt free

- Mexican value added tax refunds have slowed towards the end of 2025. A refund of MXN3.8M (~A$0.32M) was received in January 2026. Approximately MXN10M (~A$0.8M) of refunds for 2025 are in process and it is anticipated these will complete over the coming months.

Exploration Expenditure

Exploration expenditure for the quarter was A$3.88M focussed entirely on the Copalquin District in Mexico.

Related party Payments

In line with its obligations under ASX Listing Rule 5.3.5, Mithril Silver and Gold Limited notes that the only payments to related parties of the Company, as advised in the Appendix 5B for the period ended 31 December 2025, pertain to payments to directors and consultants for fees, salary and superannuation

PLANNED EXPLORATION ACTIVITIES – MARCH 2026 QUARTER

During the March 2026 quarter, Mithril plans to:

- Complete resource expansion and infill drilling at Target 1;

- Progress the Target 1 Mineral Resource Estimate update;

- Advance drilling programs at Target 5;

- Commence maiden drilling at Target 3;

- Complete interpretation of the aerial magnetic survey;

- Advance drill plans for Targets 4 and 6

- Develop drill plan for key Copalquin District structural targets

- Continue district-scale mapping, sampling and technical studies.

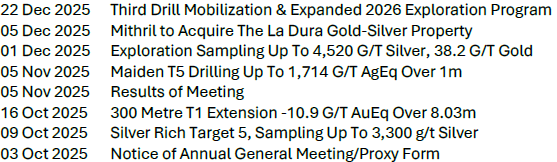

Material ASX Announcements released during the December 2025 quarter:

ABOUT THE COPALQUIN AND LA DURA GOLD SILVER PROPERTIES

Mithril is undertaking an aggressive exploration program in 2026, with 25,000 metres of drilling planned during the first half of the year across the Copalquin District. Upcoming work will focus on expanding known mineralized zones, testing new high-priority targets, integrating district-wide geophysical data, and continuing to advance the Company’s district-scale exploration thesis. The district features over 100 historic underground workings including several notable producing multi-level mines and 200 surface workings. Mapping and sampling across the lower half of the 70 km2 mining concession area demonstrates and a large epithermal silver-gold system with multiple target areas for potential resource growth plus the conduit system responsible for the widespread silver and gold mineralisation.

The nearby 20 km2 La Dura property has recently been added to the portfolio where a LiDAR survey has been flown (interpretation anticipated in February 2026) and will undergo an aerial magnetic survey in February 2026, upon completion of the aerial magnetic survey at Copalquin.

Within 15 months of drilling in the Copalquin District, Mithril delivered a maiden JORC mineral resource estimate at the first of several target areas (Target 1), demonstrating the high-grade gold and silver resource potential for the district. This maiden resource is detailed below (see ASX release 17 November 2021)^ and a NI 43-101 Technical Report filed on SEDAR+

Target 1 Maiden Resource:

- Indicated 691 kt @ 5.43 g/t gold, 114 g/t silver for 121,000 oz gold plus 2,538,000 oz silver

- Inferred 1,725 kt @ 4.55 g/t gold, 152 g/t silver for 252,000 oz gold plus 8,414,000 oz silver (using a cut-off grade of 2.0 g/t AuEq*)

- 28.6% of the resource tonnage is classified as indicated

Table 1 Mineral resource estimate at Target 1 El Refugio – La Soledad using a cut-off grade of 2.0 g/t AuEq*

* In determining the gold equivalent (AuEq.) grade for reporting, a gold:silver price ratio of 70:1 was determined, using the formula: AuEq grade = Au grade + ((Ag grade/70) x (Ag recovery/Au recovery)). The metal prices used to determine the 70:1 ratio are the cumulative average prices for 2021: gold USD1,798.34 and silver: USD25.32 (actual is 71:1) from kitco.com.

For silver equivalent (AgEq.) grade reporting, the same factors as above are used with the formula AgEq grade = Ag grade + ((Au grade x 70) x (Au recovery/Ag recovery))

At this early stage, the metallurgical recoveries were assumed to be equal (93%). Subsequent preliminary metallurgical test work produced recoveries of 91% for silver and 96% for gold (ASX Announcement 25 February 2022) and these will be used when the resource is updated in the future. In the Company’s opinion there is reasonable potential for both gold and silver to be extracted and sold.

^ The information in this report that relates to Mineral Resources or Ore Reserves is based on information provided in the following ASX announcement: 17 Nov 2021 – MAIDEN JORC RESOURCE 529,000 OUNCES @ 6.81G/T (AuEq*), which includes the full JORC MRE report, also available on the Mithril Resources Limited Website.

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original market announcement and that all material assumptions and technical parameters underpinning the estimates in the

relevant market announcement continue to apply and have not materially changed. The company confirms that the form and context in which the Competent Person’s findings are presented have not been materially modified from the original market announcement.

Mining study (conceptual) and metallurgical test work supports the development of the El Refugio-La Soledad resource with conventional underground mining methods indicated as being appropriate and with high gold-silver recovery to produce metal on-site with conventional processing. The average vein width is approximately 4.5 metres.

Mithril is currently exploring in the Copalquin District to expand the resource footprint, demonstrating its multi-million-ounce gold and silver potential. Mithril has an exclusive option to purchase 100% interest in the Copalquin mining concessions by paying US$10M on or any time before 7 August 2028.

-ENDS-

Released with the authority of the Board. For further information contact:

John Skeet

Managing Director and CEO

[email protected]

+61 435 766 809

NIKLI COMMUNICATIONS

Corporate Communications

[email protected]

[email protected]

The Australian Securities Exchange has not reviewed and does not accept responsibility for the accuracy or adequacy of this release.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Original Article: https://api.investi.com.au/api/announcements/mth/1d7701b5-97a.pdf