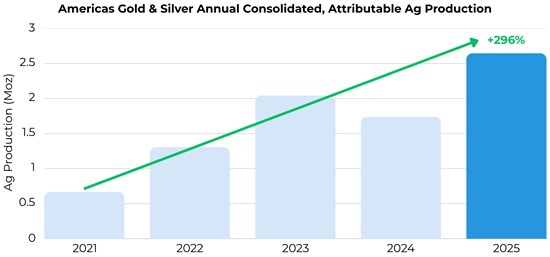

Toronto, Ontario–(Newsfile Corp. – January 21, 2026) – Americas Gold and Silver Corporation (TSX: USA) (NYSE American: USAS) (“Americas” or the “Company”) a growing North American precious metals and antimony producer, is pleased to announce strong consolidated annual silver (“Ag”) production of 2.65 million ounces for 2025, a 52% increase compared to 2024 attributable production of 1.74 million ounces1. Americas’ Cosalá Operations in Mexico achieved a new annual production record of 1.19 million ounces, driven by a record quarter output of 463,000 ounces for the fourth quarter of 2025.

Paul Andre Huet, Chairman and CEO, commented: “We capped off a highly successful and transformative 2025 with a 52% increase in attributable silver production to 2.65 million ounces – achieved in a robust and rising silver price environment that significantly amplifies the revenue and cash flow benefits of our expanded output.

This was highlighted by the record year at Cosalá, where our team delivered the operation’s best-ever annual and quarterly silver output for USA while at the same time ramping up the new EC 120 Mine to reach commercial production. This is an incredible milestone and a testament to the exceptional execution by our entire team at Cosalá, led by General Manager Gabriel Soto. Congratulations to everyone at the operation for achieving these record-breaking numbers while setting the table for a strong future.

At Galena, consistent productivity gains came alongside our focus on major capital projects and the integration of the newly acquired Crescent Mine. I am proud of our team for embracing major transformational operating initiatives including the re-introduction of long hole stoping, the deployment of an expanded underground mining fleet, and major upgrades at the No. 3 and Coeur shafts to support higher waste development and accelerated mining rates going forward. We recently concluded a planned 10-day shutdown in Q4 2025 to fast-track upgrades by installing a new 2250 HP motor and redundant secondary egress motor at the Coeur shaft – de-risking the operation and further supporting our ambitious growth trajectory. At Crescent, we are off to a running start with major infrastructure and equipment upgrades in place within a few short weeks following the close of the acquisition in December.

Our full-year antimony and copper by-product production from the Galena Complex further demonstrates the value potential of our unique position as the largest active U.S. antimony miner. Beginning January 1, 2026, we will start receiving revenue from these valuable by-products under the new offtake agreement negotiated with Ocean Partners and Teck, as announced in June 2025. The future is very exciting with respect to antimony production as we continue test work initiatives and evaluate numerous pathways to unlock the substantial bi-product antimony value at the Galena Complex. Moving forward, Americas’ is poised to become an industry leader in the nations ongoing efforts to re-establish critical metals security in the United States.

Overall, I am extremely pleased with our first year of transformative operational efforts which has laid the foundation for continued growth in 2026 across Idaho and Mexico.”

Figures 1 & 2: Roof bolting and inspection of work by Cosalá staff at EC120, following a record year for the operation.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5082/281064_americasgoldsilver2.jpg

The strong production results for 2025 benefited from higher grades mined at Cosalá from the Upper Zone at the San Rafael mine and strong performance at the EC 120 mine, which achieved commercial production on January 1, 2026. The strong results were achieved despite two planned shutdowns at the Galena Complex (10 days in Q3 2025 and 10 days in Q4 2025) to conduct upgrades at the No. 3 and Coeur shafts, respectively, to increase hoisting capacity to support increased production rates going forward. Both of the planned shutdowns were completed ahead of schedule (10 of 14 planned days in Q3 2025 and 10 of 21 planned days in Q4 2025) reflecting strong execution by the projects teams which contributed to the strong production numbers for 2025.

Figure 3: Annual consolidated, attributable silver production.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5082/281064_1e407dbe1403da51_004full.jpg

Full-year antimony (“Sb”) and copper (“Cu”) production from the Galena Complex totaled approximately 561,000 pounds and 797,000 pounds, respectively, including 127,000 pounds of antimony and 200,000 pounds of copper in Q4 2025. The Sb:Cu ratio for 2025 averaged approximately 0.7:1, underscoring the predictability and strategic value of Galena’s high-grade silver-copper-antimony tetrahedrite ore.

Americas’ unaudited consolidated cash balance as at December 31, 2025, was approximately US$130 million, an increase of approximately US$90 million compared to September 30, 2025. The increased cash balance was largely driven by the US$132.25 million bought deal private placement financing closed in December 2025, of which US$20 million was used to fund the cash portion of the Crescent Silver Mine acquisition, which also closed in December 2025. America’s is well funded to continue its aggressive growth trajectory in 2026.

About Americas Gold and Silver Corporation

Americas Gold & Silver is a rapidly growing North American mining company producing silver, copper, and antimony from high-grade operations in the U.S. & Mexico. In December 2024, Americas acquired 100% ownership of the Galena Complex (Idaho) in a transaction with Eric Sprott, former 40% Galena owner, in exchange becoming Americas’ largest shareholder at ~14%. This unitized Galena as a cornerstone U.S. silver asset and the nation’s largest antimony mine. In December 2025, Americas acquired the fully permitted, past-producing Crescent Silver Mine (9 mi from Galena), creating significant potential future synergies through shared infrastructure & processing. Americas also owns & operates the Cosalá Ops. in Mexico. Americas is fully funded to aggressively grow production at the Galena Complex, Crescent and in Mexico with an aim to be a leading North American silver producer and a key source of U.S.-produced antimony.

For more information:

Maxim Kouxenko

Manager, Investor Relations

Americas Gold and Silver Corporation

+1 (647) 888-6458

Cautionary Statement on Forward-Looking Information

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information includes, but is not limited to, Americas’ expectations, intentions, plans, assumptions, and beliefs with respect to, among other things, the ability to achieve production results and maintain conditions for operational results and expectations described herein, and the predictability and strategic value of Galena’s high-grade silver-copper-antimony tetrahedrite ore and are subject to the risks and uncertainties outlined below. Often, but not always, forward-looking information can be identified by forward-looking words such as “anticipate,” “believe,” “expect,” “goal,” “plan,” “intend,” “potential,” “estimate,” “may,” “assume,” and “will” or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions, or statements about future events or performance. Forward-looking information is based on the opinions and estimates of Americas as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of Americas to be materially different from those expressed or implied by such forward-looking information. These risks and uncertainties include, but are not limited to: interpretations or reinterpretations of geologic information; unfavorable exploration results; inability to obtain permits required for future exploration, development, or production; general economic conditions and conditions affecting the mining industry; the uncertainty of regulatory requirements and approvals; potential litigation; security conditions in the areas where the Company’s operations are located (including the Cosalá Operations in Sinaloa, Mexico); fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms or at all; risks associated with the mining industry generally, such as economic factors (including future commodity prices, currency fluctuations, and energy prices), ground conditions, failure of plant, equipment, processes, and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in grade or recovery rates, permitting timelines, capital expenditures, reclamation activities, labor relations; and risks related to changing global economic conditions and market volatility. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward-looking information is available in Americas’ filings with the Canadian Securities Administrators on SEDAR+ and with the SEC. Americas does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events, or other such factors which affect this information, except as required by law. Americas does not give any assurance (1) that Americas will achieve its expectations, or (2) concerning the result or timing thereof. All subsequent written and oral forward-looking information concerning Americas are expressly qualified in their entirety by the cautionary statements above.

1 Throughout this news release, consolidated production results and consolidated operating metrics are based on the attributable ownership percentage of each operating segment: 100% Cosalá Operations and 60% Galena Complex up to December 18, 2024, prior to acquisition of Galena Complex’s 40% non-controlling interests, and 100% from both operations thereafter including fiscal 2025.