Mithril Silver and Gold Limited (ASX:MTH, TSXV:MSG) (Mithril or the Company) presents its quarterly report for the period ended 31 December 2024.

Highlights

Drilling continued at the Target 1 area of the Copalquin gold-silver district in Mexico, expanding the maiden resource footprint ahead of a resource update in 2025. Highlight drill results include1

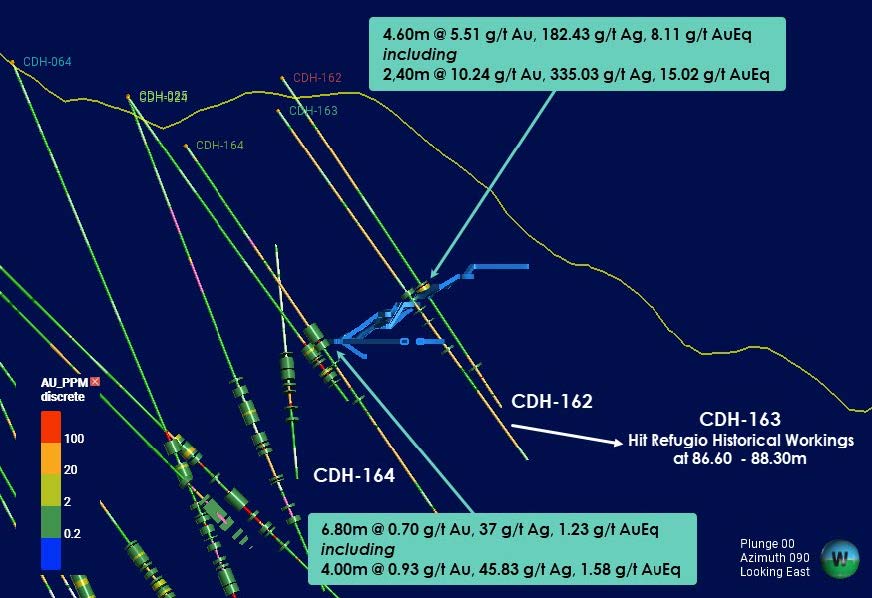

- 4.60 m @ 5.51 g/t gold, 182.4 g/t silver, from 99m (CDH-162), including

- 2.40m @ 10.24 g/t gold, 335 g/t silver, from 100.40m, including

- 0.60m @ 28.0 g/t gold, 997 g/t silver, from 100.40m

CDH-162 was part of the first drilling into an area shallower than the maiden resource model, at the historic El Refugio mine workings on the western side of the Target 1 resource area.

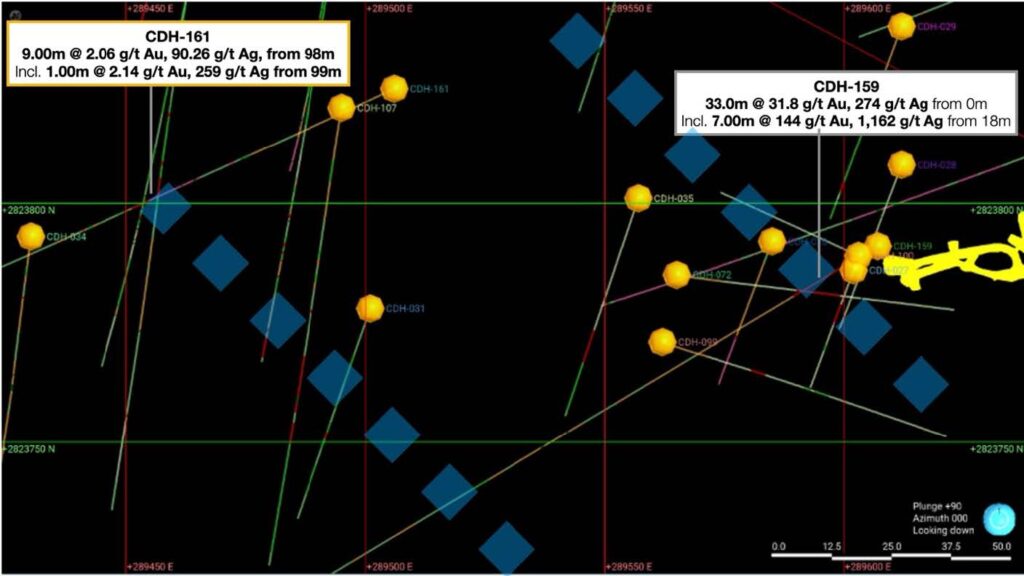

- 9.00m @ 2.06 g/t gold, 90.26 g/t silver, from 98m (CDH-161)

- Including 1.00m @ 2.14 g/t gold, 259 g/t silver from 99m plus

- 1.60m @ 5.09 g/t gold, 299 g/t silver from 125.60m including

- 0.50m @ 12.15 g/t gold, 758 g/t silver from 126.7m

CDH-161 was drilled at El Cometa on the eastern side of the Target 1 resource area, again adding to the expanded resource footprint.

- The second stage of the 9,000m drill program commenced on the eastern side of the Target 1 resource area at El Cometa where recent drill hole CDH-159 intercepted 33m from surface at 31.8 g/t gold and 274 g/t silver2 with almost 4,000 metres of core drilling during the quarter

- The Target 1 area maiden resource3 update drilling is on schedule for end of Q1 2025

- The municipal access road upgrade progressed throughout the quarter and on schedule for completion late March 2025 by which time drilling is scheduled to commence with the addition of a second drill at the first of two further advanced target areas in the district

- The road upgrade and current site preparations will facilitate the significantly expanded and fully funded exploration activities throughout 2025, including 35,000 metres of additional drilling

CDH-159 reported in September 2024 (33.00m @31.8 g/t gold, 274 g/t silver from surface1) became a global top 20 gold-silver intercept reported in 2024 (app.mininghub.com)

Corporate

- Completion of A$12.5M placement (before costs)4 plus proceeds from exercise of Options (A$4.417M) funding an additional 35,000 metres of drilling at Copalquin during 2025.

- Cash balance on 31 December 2024, A$15.74M plus A$1.00M on 6 month term deposit

Exploration Activity Discussion

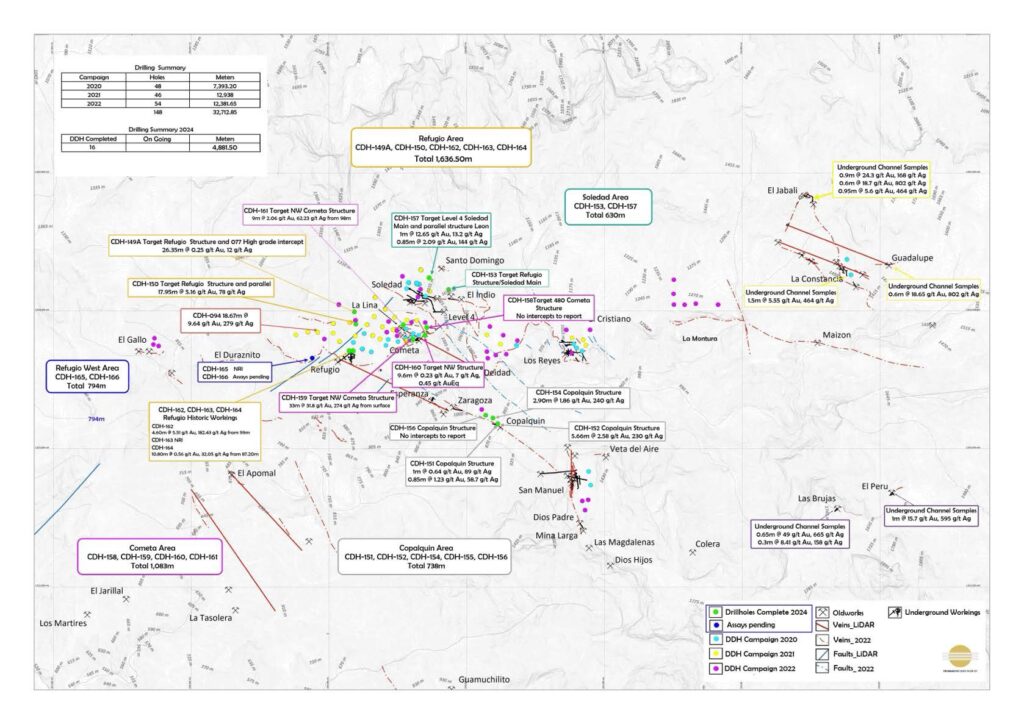

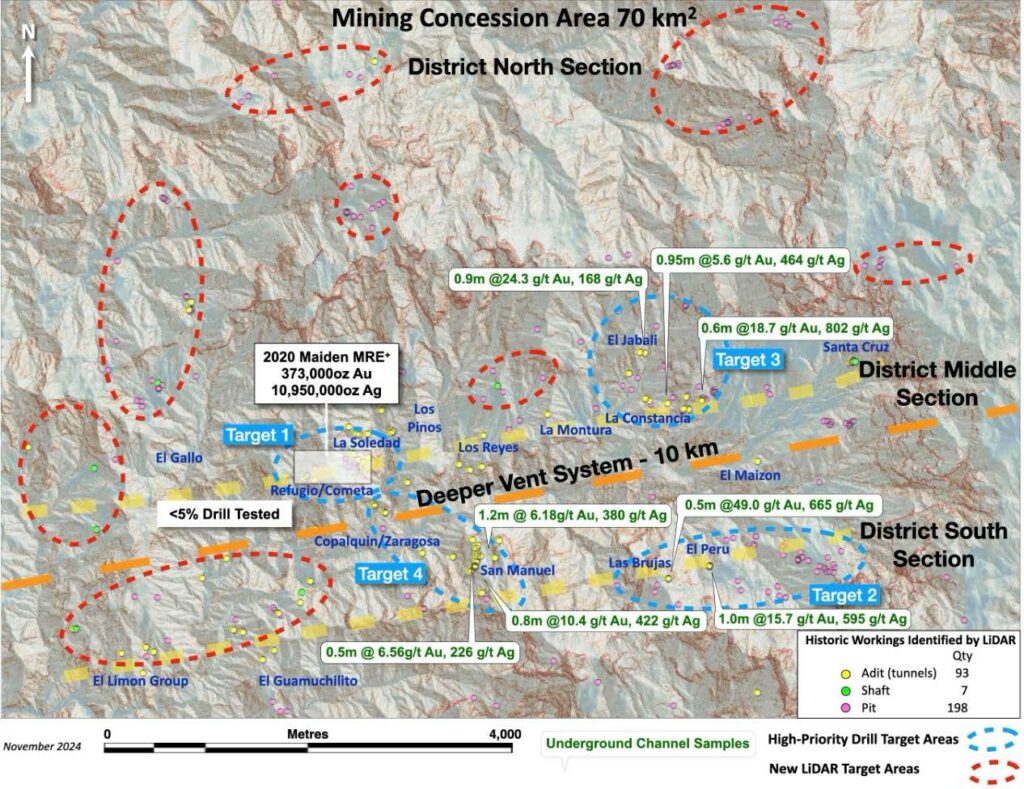

By the end of the December 2024 quarter, a total of 7,138 metres were drilled since commencing in June 2024, testing Soledad, Cometa and Refugio to better define dimensions along strike and depth of the mineral evidence that already has shown exceptional silver and gold potential and multi-event quartz deposition. Additionally, the first holes drilled during the previous quarter at the historic Copalquin mine, 300m lower elevation and 900m SE of the Target 1 area. These holes provided evidence of an epithermal, multi-phase banded quartz vein, interpreted to be part of the conduit system responsible for the widespread gold-silver mineralization throughout the district and supporting our model of a large and long lived epithermal gold-silver system.

- CDH-161 intersected 9.00m @ 2.06 g/t gold, 90.26 g/t silver, from 98m, including

- 1.00m @ 2.14 g/t gold, 259 g/t silver from 99m plus

- 1.60m @ 5.09 g/t gold, 299 g/t silver from 125.60m including

- 0.50m @ 12.15 g/t gold, 758 g/t silver from 126.7m

In order to establish the vertical and horizontal continuity of Cometa Zone (Refugio E-W Structure and crosscutting of NW structures) drill testing at depth and along strike of both CDH-159 (33.00m @31.8 g/t gold, 274 g/t silver from surface) and CDH-161 progressed.

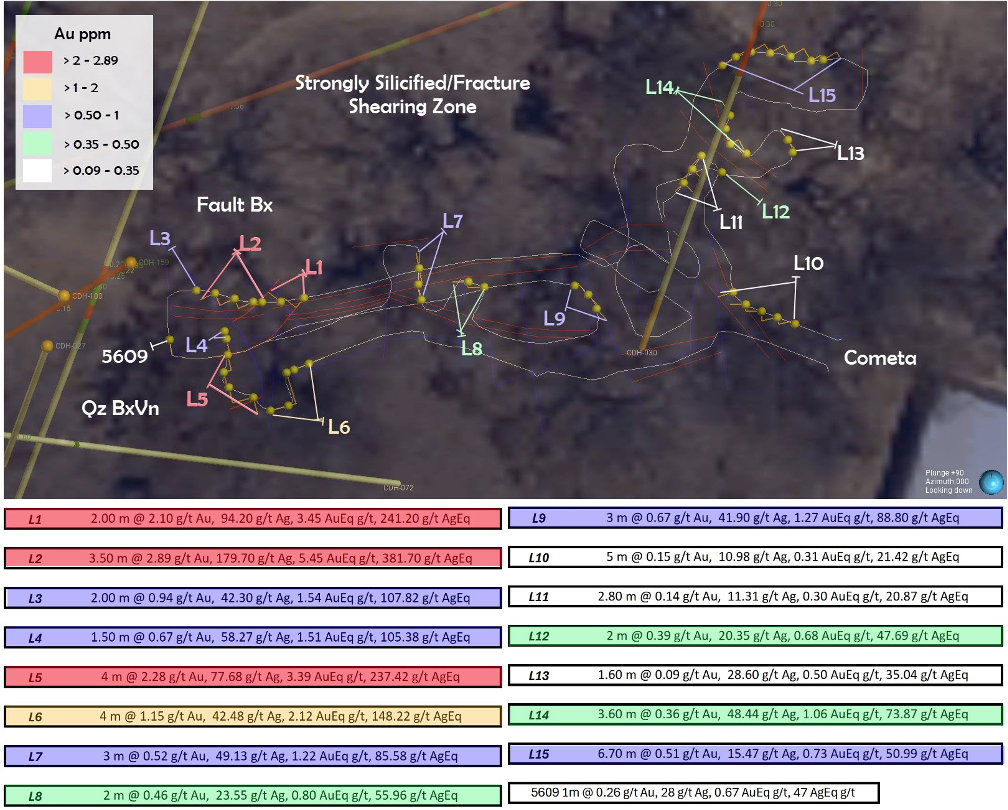

After completion of detailed mapping and sampling in the underground workings at El Cometa, we can now say that Fault/Breccias and Fault/Veins along drift are occurring both as high and low angle structures. There is a dominant 220-250 degrees oriented, 50-70 degrees angle SE structure offset by a NW structure that has been developed with channel sample assays pending.

- CDH-162 intersected 4.60 m @ 5.51 g/t gold, 182.43 g/t silver, from 99m, including

- 2.40m @ 10.24 gold g/t gold, 335.03 g/t silver, from 100.40m, plus including

- 0.60m @ 28 gold g/t gold, 997 g/t silver, from 100.40m

- CDH-164 intersected 6.80 m @ 0.70 g/t Au, 36.98 g/t silver, from 87.20m

CDH-162, CDH-163 and CDH-164 were drilled in Refugio historic workings shallower than the maiden resource. A wide quartz breccia zone was intercept along a hydrothermal breccia in all holes. CDH-162 hit Refugio Structure 4.60m @ 5.51 g/t Au, 182.43 g/t Ag, from 99m. CDH-163 hit the El Refugio historic workings from 86.60m to 88.30m returning with anomalous intercepts of 2.70m @ 0.28 g/t Au, 19.28 g/t Ag from 88.30m, CDH-164 also hit a breccia zone intercepting 6.80m @ 0.70 g/t Au, 36.98 g/t Ag from 87.20m, including 4m @ 0.93 g/t Au, 45.83 g/t Ag, from 88.00 m

CDH-165 and CDH-166 both holes were drilled on the western margin to provide geological information to support the development of the geological model. No reportable intercepts from these exploration holes.

Page 3

Figure 1 Cross-section at the historic El Refugio mine workings where the first drilling has been recently completed (CDH-162 to 164).

separate and parallel structures 100m apart. Further drilling is planned to establish the continuity the mineralisation in this area.

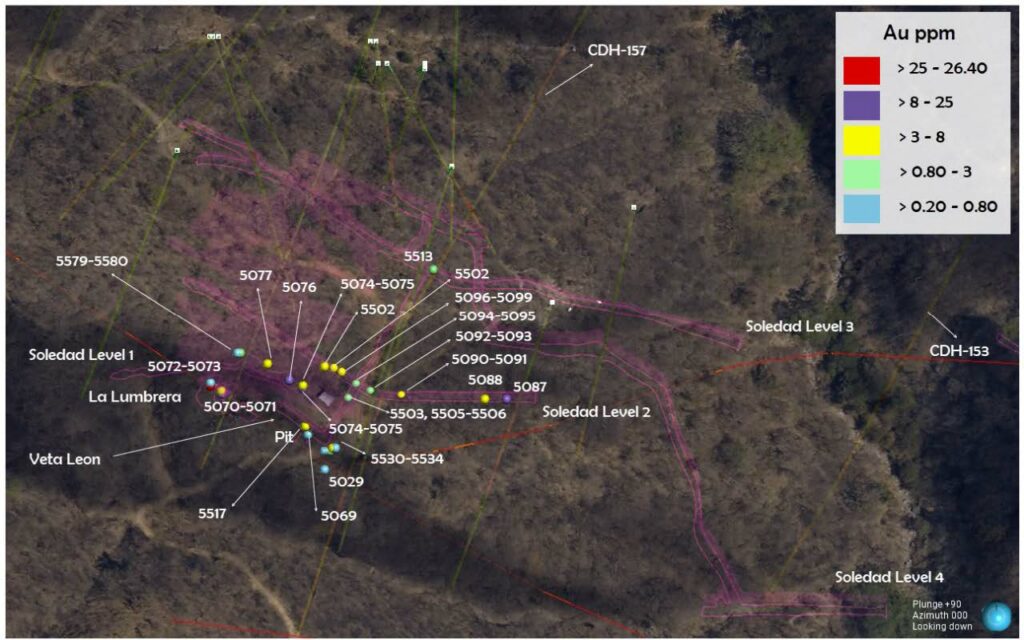

Channel Sampling results at Target 1 Area reported during the quarter (Lumbrera, La Soledad, El Cometa underground workings)5

Lumbrera Vein

- 1.75m @ 9.19 g/t gold, 653 g/t silver (5070-5071) L1

- 1.50m @ 13.6 g/t gold, 545 g/t silver (5072-5073) L2

Lumbrera Pit:

- 1.00m @ 0.70 g/t gold, 61.0 g/t silver (5069)

Soledad Level 1:

- 2.00 m @ 8.99 g/t gold, 736 g/t silver (5074-5075) L3

- 0.90m @ 9.57 g/t gold, 361 g/t silver (5076)

- 0.80m @ 6.87 g/t gold, 267 g/t silver (5077)

- 1.50m @ 1.72 g/t gold, 22.2 g/t silver (5079-5080) L4

Soledad Level 2:

- 0.94 m @ 8.81 g/t gold, 51.0 g/t silver (5087)

- 0.80 m @ 5.36 g/t gold, 143 g/t silver (5088)

- 1.80m @ 4.58 g/t gold, 193.3 g/t silver (5090-5091) L5

- 1.50m @ 2.46 g/t gold, 141.5 g/t silver (5092-5093) L6

- 1.50m @ 0.84 g/t gold, 99.2 g/ t silver (5094-5095) L7

- 3.40m @ 1.56 g/t gold, 100.8 g/t silver (5096-5099) L8

- 2.00 m @ 4.23 g/t gold, 481 g/t silver (5500-5501) L9

- 0.70m @ 3.42 g/t gold, 251 g/t silver (5502)

- 2.80m @ 1.62 g/t gold, 106.1 g/t silver (5503,5505-5506) L10

Soledad Level 3:

- 1.90m @ 0.38 g/t gold, 16.9 g/t silver (5509-5510) L11

- 1.80m @ 0.83 g/t gold, 42.5 g/t silver (5511-5512) L12

- 2.70m @ 1.21 g/t gold, 56.0 g/t silver (5513, 5515-5516) L13

Leon Vein

- 0.70m @ 6.00 g/t gold, 75.6 g/t silver (5517)

El Cometa underground workings:

The mapping and sampling within the El Cometa underground workings, with recent dewatering of the lower level of workings (from accumulated rainfall), provides vein and structure data to develop the geologic model for this important and complex, shallower mineralisation on the eastern side of the Target 1 resource area where significant high-grade drill intercepts have been reported.

1 area current drilling location, channel sampling area and the high priority drill target areas of Las Brujas-El Peru and La Constancia-El Jabali.

Several new areas highlighted across the district for follow-up work.

CORPORATE

Cash – At end of the December 2024 quarter, the Company had total cash of A$15.74M, plus A$1.0M held in term deposit.

Placement – On 28 October 2024, the Company announced it had received binding commitments for the Placement of 25,000,000 new fully paid ordinary shares in the Company at an issue price of $0.50 to raise approximately $12.5M (before costs)6. The Placement was well supported by Australian, North American and European investors. Participants in Placement received one free attaching option for every two shares subscribed for under the Placement. The options will be unlisted, have an exercise price of $0.75 and an exercise period of 2 years from date of issue. Directors of the Company committed to subscribe for $200,000 in the Placement.

Exploration expenditure

Exploration expenditure for the quarter was $1.756M (Mexico: $1.753M, Australia $0.003M).

Related party Payments

In line with its obligations under ASX Listing Rule 5.3.5, Mithril Silver and Gold Limited notes that the only payments to related parties of the Company, as advised in the Appendix 5B for the period ended 31 December 2024, pertain to payments to directors and consultants for fees, salary and superannuation

ENVIRONMENTAL, SOCIAL AND GOVERNANCE

The Company philosophy operating in the Copalquin district is to support communities via children’s education and providing employment opportunities. This includes supporting community schools in the district, employing twenty people from within the district under the federal employment laws, supporting routine medical visits and developing infrastructure in the district for long term benefit. This includes the municipal access road, connecting to the township of El Durazno 12 km east of the Copalquin District, with support for the municipal upgrade works scheduled for commencement in October 2024.

ABOUT THE COPALQUIN GOLD SILVER PROJECT

The Copalquin mining district is located in Durango State, Mexico and covers an entire mining district of 70km2 containing several dozen historic gold and silver mines and workings, ten of which had notable production. The district is within the Sierra Madre Gold Silver Trend which extends north-south along the western side of Mexico and hosts many world-class gold and silver deposits.

Multiple mineralisation events, young intrusives thought to be system-driving heat sources, widespread alteration together with extensive surface vein exposures and dozens of historic mine workings, identify the Copalquin mining district as a major epithermal centre for Gold and Silver.

Within 15 months of drilling in the Copalquin District, Mithril delivered a maiden JORC mineral resource estimate demonstrating the high-grade gold and silver resource potential for the district. This maiden resource is detailed below (see ASX release 17 November 2021)^ and a NI43-101 Technical Report, “Copalquin Property Mineral Resource Estimate”, filed on SEDAR+, July 2024.

- 2,416,000 tonnes @ 4.80 g/t gold, 141 g/t silver for 373,000 oz gold plus 10,953,000 oz silver (Total 529,000 oz AuEq*) using a cut-off grade of 2.0 g/t AuEq*

- 28.6% of the resource tonnage is classified as indicated

| Tonnes (kt) | Tonnes (kt) | Gold (g/t) | Silver (g/t) | Gold Eq.* (g/t) | Gold (koz) | Silver (koz) | Gold Eq.* (koz) | |

| El Refugio | Indicated | 691 | 5.43 | 114.2 | 7.06 | 121 | 2,538 | 157 |

| Inferred | 1,447 | 4.63 | 137.1 | 6.59 | 215 | 6,377 | 307 | |

| La Soledad | Indicated | – | – | – | – | – | – | – |

| Inferred | 278 | 4.12 | 228.2 | 7.38 | 37 | 2,037 | 66 | |

| Total | Indicated | 691 | 5.43 | 114.2 | 7.06 | 121 | 2,538 | 157 |

| Inferred | 1,725 | 4.55 | 151.7 | 6.72 | 252 | 8,414 | 372 | |

| TOTAL | 2,416 | 4.80 | 141 | 6.81 | 373 | 10,953 | 529 |

Table 1 – Mineral resource estimate El Refugio – La Soledad using a cut-off grade of 2.0 g/t AuEq*

* The gold equivalent (AuEq.) values are determined from gold and silver values and assume the following: AuEq. = gold equivalent calculated using and gold:silver price ratio of 70:1. That is, 70 g/t silver = 1 g/t gold. The metal prices used to determine the 70:1 ratio are the cumulative average prices for 2021: gold USD1,798.34 and silver: USD25.32 (actual is 71:1) from kitco.com. Metallurgical recoveries are assumed to be approximately equal for both gold and silver at this early stage. Actual metallurgical recoveries from test work to date are 96% and 91% for gold and silver, respectively. In the Company’s opinion there is reasonable potential for both gold and silver to be extracted and sold. Actual metal prices have not been used in resource estimate, only the price ratio for the AuEq reporting. Formula for AuEq. = Au grade + ((Ag grade/gold:silver price ratio) x (Ag recovery/Au recovery))

^ The information in this report that relates to Mineral Resources or Ore Reserves is based on information provided in the following ASX announcement: 17 Nov 2021 – MAIDEN JORC RESOURCE 529,000 OUNCES @ 6.81G/T (AuEq*), which includes the full JORC MRE report, also available on the Mithril Resources Limited Website.

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original market announcement and that all material assumptions and technical parameters underpinning the estimates in the relevant market announcement continue to apply and have not materially changed. The company confirms that the form and context in which the Competent Person’s findings are presented have not been materially modified from the original market announcement.

Mining study and metallurgical test work supports the development of the El Refugio-La Soledad resource with conventional underground mining methods indicated as being appropriate and with high gold-silver recovery to produce metal on-site with conventional processing.

Mithril is currently exploring in the Copalquin District to expand the resource footprint, demonstrating its multi-million-ounce gold and silver potential.

Mithril has an exclusive option to purchase 100% interest in the Copalquin mining concessions by paying US$10M on or any time before 7 August 2026 (option has been extended by 3 years). Mithril has reached an agreement with the vendor for an extension of the payment date by a further 2 years (bringing the payment date to 7 August 2028).

-ENDS-

Released with the authority of the Board. For further information contact:

John Skeet

Managing Director and CEO

[email protected]

+61 435 766 809

Mark Flynn

Investor Relations

[email protected]

+61 416 068 733

Original Article: https://api.investi.com.au/api/announcements/mth/5aec697c-dcb.pdf