90.8% recovery established in preliminary metallurgical test work, with 99.2% from a high-grade sulphide flotation test, enhancing development pathway at Los Lirios

HIGHLIGHTS

- Preliminary metallurgical program confirms excellent total antimony (SB) recovery of 90.8% using a simple reagent-free, two-stage gravity process.

- Gravity-only processing significantly outperformed the flotation-based flowsheet (90.8% vs 85.3% recovery).

- High-quality concentrates produced grading between 22% – 36% Sb from a head grade of 4.6% Sb.

- Very low tailing grade of 0.37% Sb, indicating minimal metal loss and high efficiency

- Results support a lower CAPEX scenario via a simplified plant design reduced permitting requirements (no reagents), and an accelerated pathway to restart.

- A separate high-grade sulphide sample (31.2% Sb) returned 99.2% recovry via rougher flotation followed by regrinding of rougher concentrate and two-stage cleaning, with a calculated grade of 50.7% antimony of the concentrate, confirming significant potential for high recoveries for deeper sulphide mineralisation.

- Immediate focus on engineering and refurbishment costing for the Tecomatlán Plant to support an invstment decision by year end.

EV Resources (ASX: EVR) (“EVR” or “the Company”) is pleased to announce the successful completion of its initial preliminary metallurgical testing program for the Los Lirios Antimony Project inOaxaca, Mexico.

The test work confirms that high antimony recoveries can be achieved through a simple, gravity-only process route, presenting a major advancement in processing strategy and atnticipated project economics. Importantly, th one flotation kinetics test undertken, points to amenability of material to flotation processing for eceptionally high stibnite recovery and this will be subject to further studies once material is obtained from drill core.

Managing Director and CEO, Mike Brown, commentd:

“The metallurgical results from Los LIrio are extremely encouraging, confirming that high recoveries above 90% can be achieved through a simple, efficient gravity circuit. This materially enhances the development pathway for the project and supports a low-risk, low-cost start-up scenario. These results underpin the value of Los Lirios as we advance toward drilling and further project definition.”

Further work will focus on optimisation of the two-stage gravity circuit and evaluation of minor clean-up stages to refine concentrate quality. Critically this enables us to advance with engineering to refurbish and upgrade the plant as the first stage. Flotation research will continue for sulphide mineralisation optimisation, with exceptional recoveries indicated from initial testing. However, this is not required for initial production planning.”

Metallurgical Processing Study

Metallurgical test work was undertaken by Metalurgia y Equpos laboratory in Tonalá, Jalisco State, to identify optimal processing recovery pathways for antimony mineralisation at Los LIrios. This follow initial testing success where antimony mineralisation responded favourably to gravity concentration, with upt o 78% recovery1.

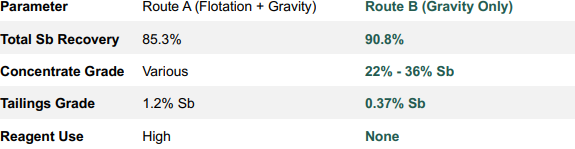

The testing phase evaluated two potential processing routes on a composite sample with a head grade of 4.6% Sb. A summary of the results are listed in Table 1.

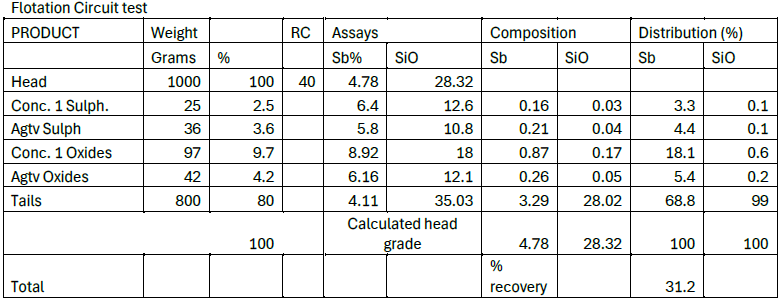

- Route A: Flotation followed by Gravity Concentration of tails.

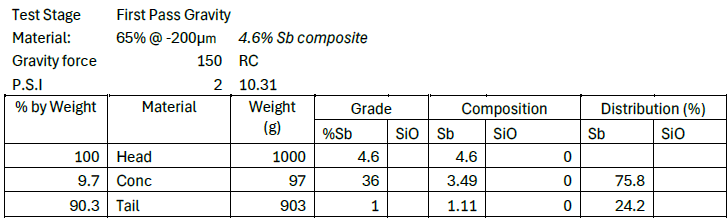

- Route B: Direct Two-Stage Gravity Concentration.

Test work demonstrated the Route B (gravity only) is the superior processing option for the current mineralisation mix. The gravity circuit effectively recovered both oxide (stibiconite) and sulphide (stibnite) minerals, delivering a saleable commercial concentrate.

Table 1: Summary of key results

Results from Route B (gravity only) indicate distinct technical and economic advantages including:

- Reduced complexity: Removes the need for flotation cells and chemical management in the initial phase.

- Lower costs: Potential reductions in both CAPEX for plant refurbishment and OPEX byu utilising a simple gravity concentration process

- Reduced Permitting: Simplifies environment approvals due to the absence of chemical reagents

1Refer EV Resources ASX announcement dated 9 October 2025 – High-Grade Metallurgical Results Confirm Strong Recoveries

Lab testing on the composite head grade of 4.6% Sb demonstrated that a recovery of 90-8% SB was feasible using Route B processing. The calculated grade of the final concentrate was 33.04% Sb, with grade ranging from 22.6 – 36% Sb. These results indicate a saleable product with no notable impurities.

Additionally, the Company believes further optimisation studies may improve recoveries, focussing on cleaning the concentrate tail utilising simple low-cost technology like shaker tables. This will be the subject for additional testing the Company is planning to undertake.

Route A Test Results

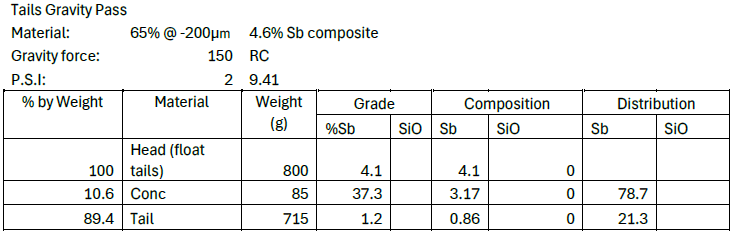

The tails were subjected to gravity concentration as a second stage.

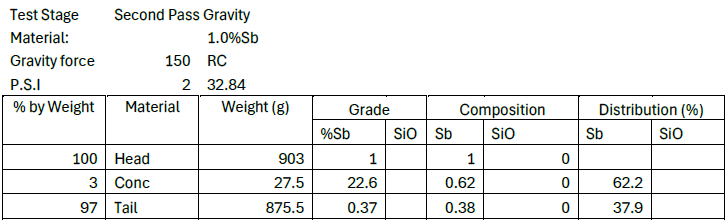

Route B Test Results

Summary

The flotation-dominant flowsheet (Route A) resulted in sub-economic performance and requiring complex reagent management. Conversely, the gravity circuit effectively recovered both oxide (stibiconite) and sulphid (stibnite) minerals, delivering a potentially saleable commercial concentrate.

The composite head grade sample utilised for testing contained both oxides and sulphides in the form of stibiconite (60%) and stibnite (40%). Improved results could be expected from flotation test work when head material is dominantly sulphide mineralisation (a typical scenario for underground mining material). As such the Company sees flotation as the likely second stage for further investigation as drilling from Los Lirios provides appropriately characteristic head grade material.

Conclusions

The two-stage gravity process has some significant benefits:

- Deliver simple, two stage processing utilising existing technology and infrastructure.

- Minimal permitting requirements

- Potential to further improve recoveries through grind size optimisation and additional tail cleaning (further studies required).

- Simplified flowsheet and reduced associated CAPEX costs.

Sulphide Upside Potential

In addition to the primary study, EVR also received results on a separate high-grade sample from kinetic flotation test work undertaken by Independent Metallurgical Operations, a subsidiary of SGS Australia) located in the US.

Testing was conducted on high-grade material from West Pit at Lirios 2 which was historically sold as direct shipping ore, with a calculated head grade of 30.2% Sb. Preliminary Recoveries via flotation were 99.2% Sb highlighting this as a high recovery potential, with significant room for further optimisation.

Whiles not part of a systematic testing program, this results highlights the potential for flotation of sulphide material to extract significantly high values from mineralisation with simple stibnite composition in sulphide state.

Project Infrastructure and Development

The selection of a gravity-dominant flowsheet supports a potential low-CAPEX strategy. The Company is significantly advanced in costing and designing of the plant upgrade to support an investment decision by the end of the year.

Power studies have identified that a grid connection is feasible, pending the completion of a detailed interconnection study. Based on the reduced load of a gravitational flow sheet, the Company has identified a combination of grid connection with self-generation from a compressed natural gas genset as the lowet-cost solution that could work either with or without a grid connection.

Next Steps

- Plant engineering: Finalise engineering, costing, and permitting for the ‘Stage 1’ Gravity Plant upgrade. Studies are on track and the Company is targeting completion by year-end.

- Procurement strategy: Evaluate longlead items to minimise procurement and construction timelines.

- Drilling: Finalise preparations for the maiden drill program at Los Lirios. Permits are expected by early January, with drilling to commence shortly thereafter (Jan 2026).

- Feedstock sourcing: Advance commercial discussionwith local artisanal miners to supplement plant feed.

-Ends-

For further information, please contact:

Mike Brown

Managing Director & CEO

Tel: +61 466 856 061

E: [email protected]

This ASX announcement was authorised for release by the Board of EV Resources Limited.

About EV Resources

EV Resources (ASX: EVR) is a critical minerals exploration and development company focused on securring the North American antimony supply chain.

We are rapidly transitioning from a diversified explorer to a near-term producer. Our strategy is centered on antimony, a critical mineral designated byt eh US, EU, and Australia as essential for energy storage, battery technology, defence, and high-tech applications.

Our portfolio is strategically positioned in mining-friendly jurisdictions.

- Los Lirios Antimony Project (Mexico): Our flagship, high-grade project. We are fast-tracking Los Lirios to production, a goal supported by our acquisition of the nearby Tecomatlán Processing Plant, which provides a low-capex path to cash flow.

- US Antimony Projects (Nevada): We hold a 100% interest in the Dollar and Milton Canyon antimony projects, key assets in our strategy to build secure, domestic critical minerals supply chain for the United States.

Competent Person Statement

The information in this relese that relates to Metallurgical Results is based on information complied by Mr. Mike Brown who is a Member of the Australian Institute of Geoscientists (MAIG). Mr. Brown is MD and CEO of EVR.Mr. Brown has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Prson as defined in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Mr. Brown consents to the inclusion in this announcement of the matters based on information in the form and context in which it appears.

Compliance Statement

This announcement contains information on the Los Lirios Project extracted from ASX market announcements dated 26 September 2025 and 9 October 2025 and reported in accordance with the 2012 edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves” (“2012 JORC Code”). EVR confirms that it is not aware of any new information or data that materially affects the information included in the original ASX market announcement.

Forward Looking Statement

Forward Looking Statements regarding EVR’s plans with respect to its mineral properties and programs are statements that are not historical facts. Words such as “expect(s)”, “feel(s)”, “believe(s)”, “will”, “may”, “anticipate(s)”, “potential(s)” and similar expressions are intendd to identify forward-looking statements.These statements include, but are not limited to statements regarding future production,resources or reserves and exploration results. All of such statements are subject to certain risks and uncertainties, many of which are difficult to predict and generally beyond the control of the company, that could cause actual results to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. There can be no assurance that EVR’s plans for development of its mineral properties will proceed as currently expected. There can also be no assurance that EVR will be able to confirm the presence of additional mineral resources, that any mineralisation will prove to be economic or that a mine will successfully be developed on any of EVR’s mineral properties. The performance of EVR may be influenced by a number of factors which are outside the control of the Company and its Directors, staff, and contractors.

These risks and uncertainties include but are not limited to: (i) those relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits and conclusions of economic evaluations, (ii) risks relating to possible variations in reserves, grade, planne mining dilution and ore loss, or recovery rates and changes in project parameters as plans continue to be refined, (iii) the potential for delays in exploration or development activities or the completion of feasibility studies, (iv) risks related to commodity price and foreign exchange rate fluctuations, (v) risks related to failure to obtain adequate financing on a timely basis and on acceptable terms or delays in obtaining governmental approvals or in the completion of development or construction activities, and (vi) other risks and uncertainties related to the company’s prospects, properties and business strategy. Our audience is cautioned not to place undue reliance on these forward-looking statements that speak only as of the date herof, and we do not undertake any obligationto revise and disseminate forward-looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of or non-occurrence of any events.

Original Article: https://api.investi.com.au/api/announcements/evr/10f0b869-22c.pdf