Advance Metals Limited (ASX:AVM)(“Advance” or “the Company”) is pleased to provide its Quarterly Activities Report for the period ending 30 September 2025.

Guadalupe y Calvo Gold-Silver Project Acquisition, Chihuahua, Mexico

- During the quarter Advance announced it had secured the right to earn-in to a 100% interest in the high grade Guadalupe y Calvo (GyC) Project from Endeavour Silver Corp1

- The transformational acquisition saw the Company become a major participant in the region with an endowment of more than 100Moz silver-equivalent (AgEq)1 in Foreign Estimates* across three its projects

- The Project includes nearly 86,000 metres of resource definition and exploration drilling, with significant upside potential identified in multiple areas by Advance’s technical team

- Based on this drilling, an Indicated and Inferred Foreign Estimate* for GyC1 was published in 2021, comprising 9.50Mt at 2.7g/t gold-equivalent (AuEq), containing 816Koz AuEq (60.6 Moz AgEq)2

- The Foreign Estimate* includes a high grade Indicated and Inferred underground component of 3.05Mt at 5.0g/t AuEq for 494Koz AuEq1,2

- The Company is currently in the process of obtaining the necessary government and community approvals to commence an extensive exploration program at the site

Yoquivo Silver-Gold Project, Chihuahua, Mexico

- During the quarter the Company completed its maiden diamond drilling campaign at the high grade Yoquivo Silver-Gold Project, with eight holes for a total of 3,111.4m drilled

- Results for the final four holes of the program were returned, with YQ-25-007 in the lower northern portion of Pertenencia extending high grade mineralisation ~70m down dip3,4:

- YQ-25-007

- 7.6m at 116g/t AgEq – 69g/t Ag & 0.6g/t Au from 298.79m,

- incl. 0.54m at 361g/t AgEq – 252g/t Ag & 1.4g/t Au from 305.85m

- 4.87m at 544g/t AgEq – 411g/t Ag & 1.8g/t Au from 310.76m

- incl. 1.11m at 2,063g/t AgEq – 1,556g/t Ag & 6.6g/t Au from 312.38m

- 7.6m at 116g/t AgEq – 69g/t Ag & 0.6g/t Au from 298.79m,

- Regional sampling by AVM geologists during the quarter new high grade vein structures in a previously unmapped portion of the project with rock chip grades to 1,594g/t AgEq4,5

- YQ-25-007

- Advance’s technical team also identified significant potential from previously unassayed core, commencing a large resampling program in the period6,7

*The Foreign Estimates of mineralisation mentioned in this announcement are not compliant with the Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves (2012 JORC Code) and is a “Foreign Estimate”. A Competent Person (under ASX Listing Rules) has not yet done sufficient work to classify the Foreign Estimate as Mineral Resources or Ore Reserves in accordance with the 2012 JORC Code. It is uncertain that following evaluation and/or further exploration work the Foreign Estimate will be able to be reported as Mineral Resources or Ore Reserves in accordance with the JORC Code 2012.

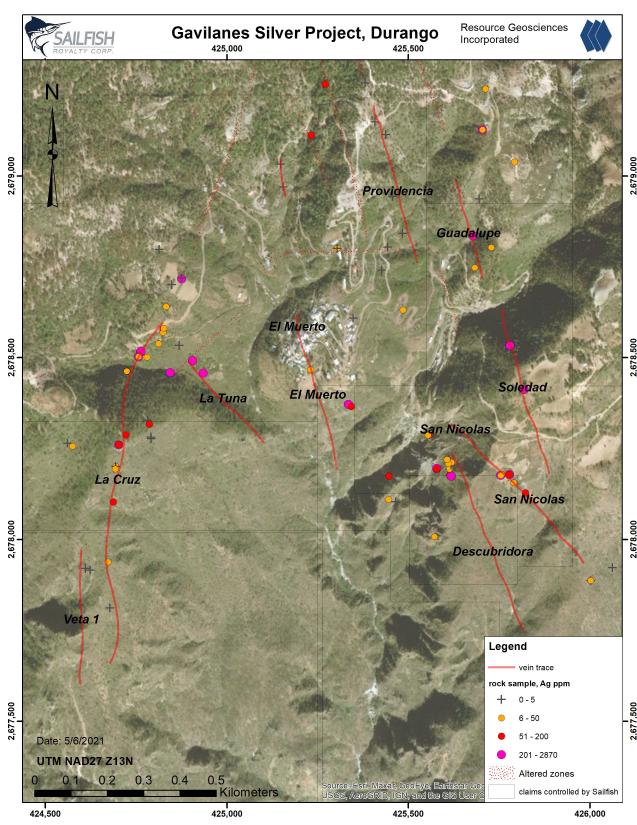

Gavilanes Silver Project, Durango, Mexico

- In early 2025 Advance entered into an agreement with Sailfish Royalty Corp. (TSX-V: FISH, OTCQX: SROYF) to acquire a 100% interest in the Gavilanes Silver Project in Durango, Mexico8

- The deposit is located in the San Dimas mining district, ~23 km northeast of the San Dimas Mine owned and operated by First Majestic Silver Corp

- Gavilanes has an existing Foreign Estimate* of 2.83Mt at 245.6g/t AgEq for 22.4Moz AgEq8,9

- Following an extended completion period, the Gavilanes transaction was settled during the quarter with the Company’s technical team currently planning an initial exploration program for new project

Myrtleford and Beaufort Gold Projects, Victoria, Australia

- During the quarter the Company continued exploration at the Myrtleford Project in the Northeast Goldfields of Victoria, Australia

- Results were returned for a further five holes completed at the project during the quarter, with a standout intersection from hole AMD00910:

- AMD009

- 9.4 metres at 18.6g/t Au from 196.2m

- incl. 1.2 metres at 62.2g/t Au from 200.6m

- 9.4 metres at 18.6g/t Au from 196.2m

- AMD009

- A program of screen fire gold re-analysis also saw the two highest grade intervals from previous AVM drilling upgrading strongly10 to:

- AMD001

- 8.2 metres at 28.8g/t Au from 186m (up 29% from 22.4g/t Au),}

- incl. 3.4 metres at 68.2g/t Au from 186m (up 29% from 52.7g/t Au)

- 8.2 metres at 28.8g/t Au from 186m (up 29% from 22.4g/t Au),}

- AMD003

- 7.5 metres at 55.0g/t Au from 178.1m (up 15% from 47.9g/t Au)

- incl. 1.3 metres at 305.8g/t Au from 179.6m (up 13% from 271.6g/t Au)

- 7.5 metres at 55.0g/t Au from 178.1m (up 15% from 47.9g/t Au)

- AMD001

- Subsequent to the end of the quarter the Company announced it had intersected visible gold mineralisation in AMD014A11, 140m below any previous intersections at Happy Valley

Corporate

- Subsequent to the end of the quarter the Company announced it had received firm commitments to raise $13 million (before costs) through a two-tranche placement to global institutional and sophisticated investors12

- Significant Board and management changes were also implemented following the end of the quarter:

- Veteran resources professional Mr David O’Connor was appointed as Non Executive Chairman, with Mr Craig Stranger moving to a Non Executive Director role13

- Mr Joshua Jordon and Mr Fadi Diab Diab stepped-down from their respective Non Executive Director Roles13,14

- A Mexican Advisory Board was established with experienced mining professionals Mr Douglas Coleman and Mr Trevor Woolfe to act as inaugural members14

Guadalupe y Calvo Project Acquisition

After the end of the quarter the Company announced the acquisition of the Guadalupe y Calvo Project from Endeavour Silver Corp1. The GyC Project lies in the prolific Sierra Madre Occidental Volcanic Belt, one of the world’s premier precious metal mining regions. The Project area has a long and prolific mining history, including historic production of over 2.0Moz of gold and 31.0Moz of silver1. The acquisition of GyC significantly strengthened Advance’s precious metals portfolio, adding a high-potential gold-silver asset to the Company. The project complements Advance’s existing holdings at Yoquivo and Gavilanes, bringing combined endowment in Foreign Estimates in Mexico to over 100Moz AgEq (Figure 1).

Located in the municipality of the same name in southern Chihuahua State, GyC is located approximately 300km southwest of the state capital and 245km south-southeast from Advance’s high grade Yoquivo Project. The Project is also located approximately the same distance (~240km) north-northwest of the Company’s Gavilanes Project in Durango (Figure 1). The Project includes ten granted concessions covering an area of approximately 27.5 square kilometres is accessible year-round via paved and gravel roads.

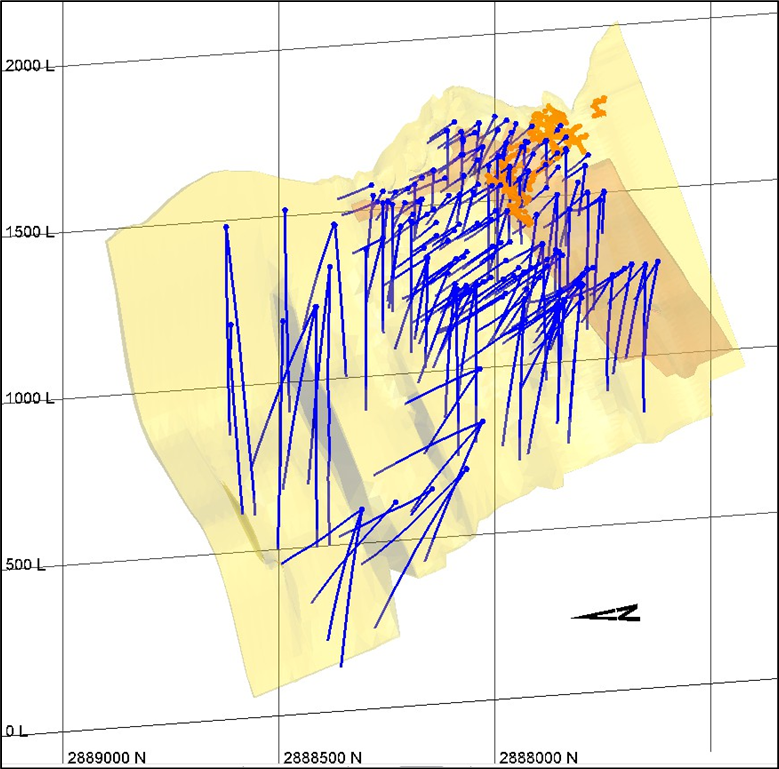

GyC was discovered in 1835 and the area has seen over 180 years of mining and prospecting activity (Figure 2). The Rosario Mine was historically worked by British and North American companies including the Rosario Mining Co. and Western Mexican Mines, producing over 2Moz Au and 31Moz Ag prior to World War II1. Modern exploration began in the early 2000s with significant programs by Glamis Gold, Gammon Gold, and Endeavour Silver, culminating in nearly 86,000 metres of core drilling across multiple campaigns (Figure 3). Recent programs have defined a 600 x 550 metre mineralised panel on the Rosario structure, with mineralisation open along strike and down dip. Advance has identified significant upside potential associated with the project and will look to target high grade extensions with new drilling in the near term, subject to requisite approvals.

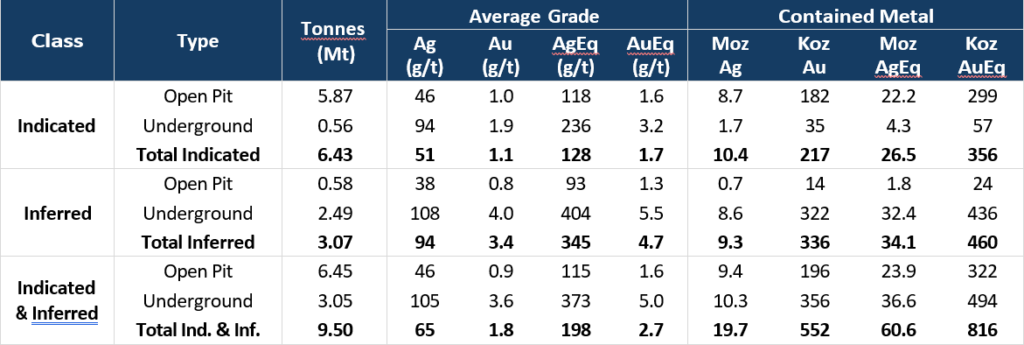

A maiden Foreign Resource Estimate was completed by Ridgestone Mining Inc. on the Rosario and Nankin Veins in 2021 in accordance with the Canadian National Instrument 43-101 (NI 43-101) employing 217 surface drill holes. A cut off grade of 0.27g/t AuEq1,2 was use for the open pit Estimates, while a cut off grade of 1.33g/t AuEq1,2 was employed for the underground Estimates (Table 1).

Table 1. Foreign Estimate1,2 completed in 2021 for the Rosario and Nankin Veins at the Guadalupe y Calvo

Project, including combined Indicated and Inferred totals.

*Cautionary Statement – The Foreign Estimate of mineralisation included in this announcement are not compliant with the Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves (2012 JORC Code) and is a “Foreign Estimate”. A Competent Person (under ASX Listing Rules) has not yet done sufficient work to classify the Foreign Estimate as Mineral Resources or Ore Reserves in accordance with the 2012 JORC Code. It is uncertain that following evaluation and/or further exploration work the Foreign Estimate will be able to be reported as Mineral Resources or Ore Reserves in accordance with the JORC Code 2012.

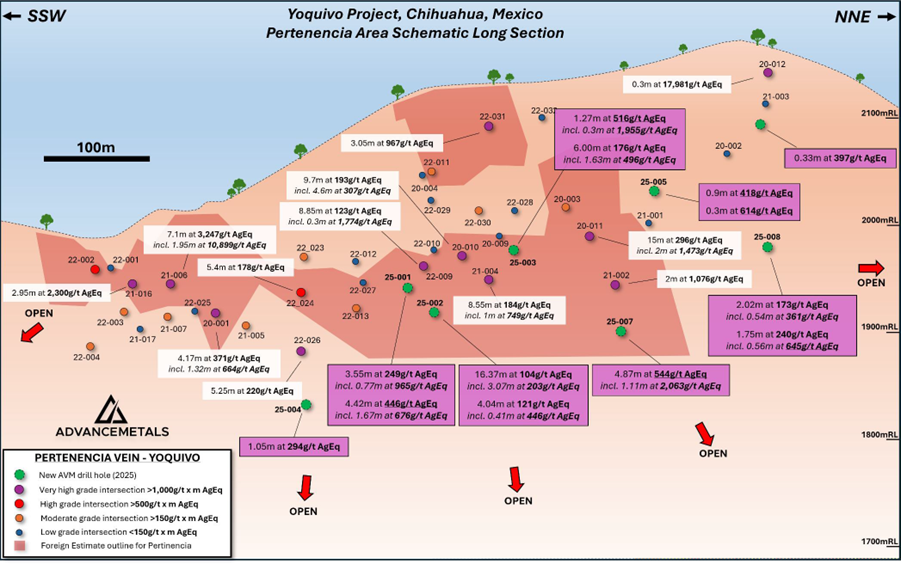

Yoquivo Silver-Gold Project

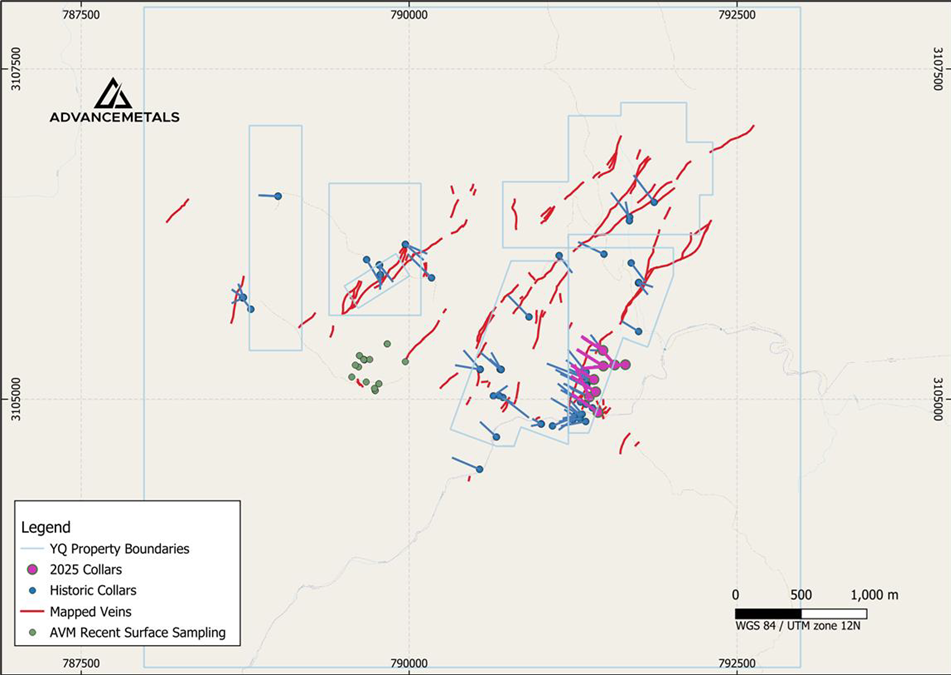

Advance acquired a 100% interest in the project from Golden Minerals Company (NYSE: AUMN & TSX: AUMN) in October 2024. The project is located 210km west–southwest of Chihuahua City, in Ocampo Municipality, Chihuahua State and sits within the Sierra Madre Volcanic Belt, a district that hosts multiple other large precious metal mines including Pinos Altos, Ocampo, El Cocheño and Orisyvo. After acquiring the project in 2017, Golden Minerals completed more than 70 drill holes for over 16,500m of drilling at the Project and reported a Foreign Estimate of 937kt at 570g/t AgEq (2.1g/t Au & 410g/t Ag) for 17.2Moz AgEq6. Advance has identified the potential for significant upside at the Project, noting that a majority of the mapped silver and gold-bearing veins remain poorly drilled (see Figure 4).

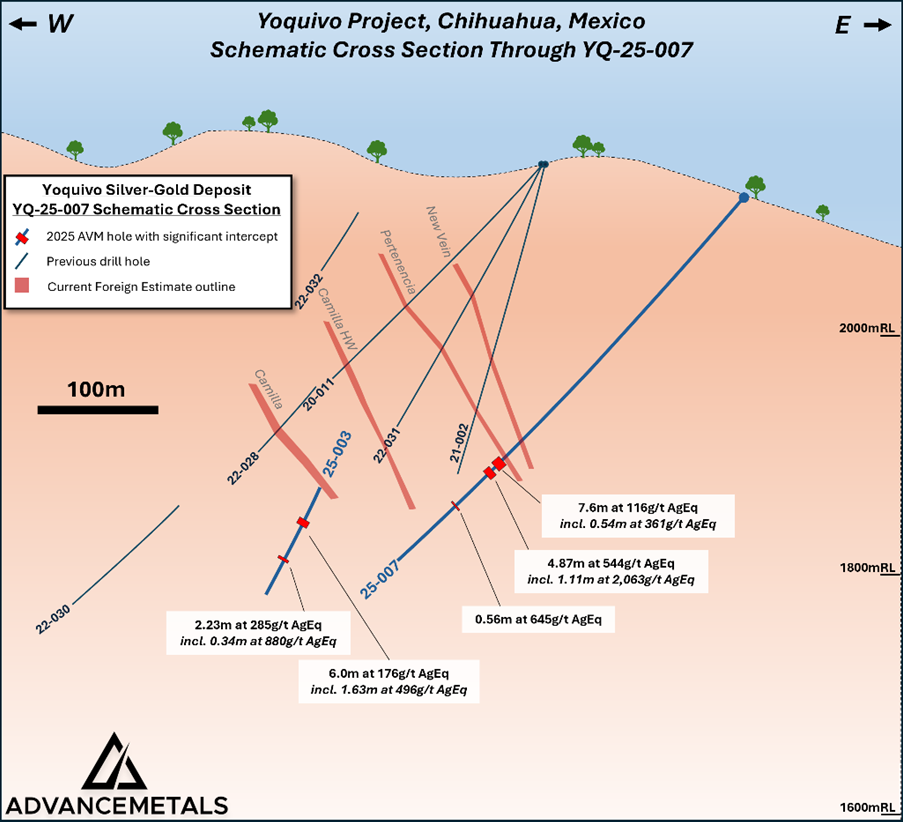

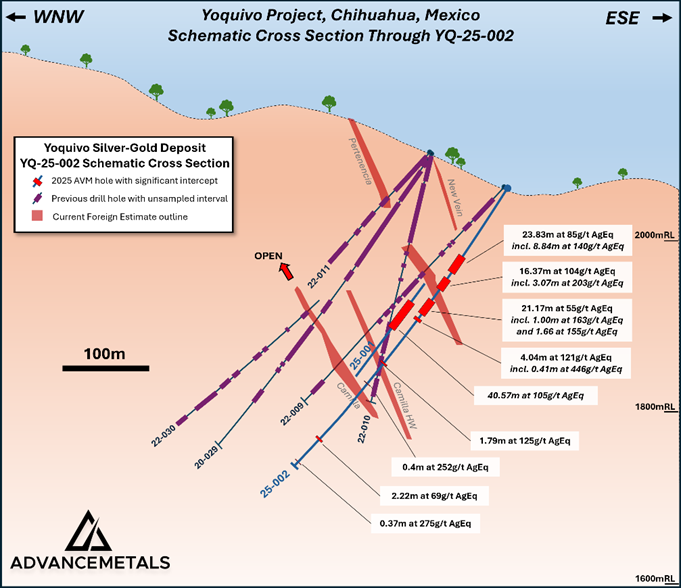

During the quarter the Company completed its maiden diamond drilling campaign at Yoquivo, with eight holes for a total of 3,111.4m drilled. Results have now been received for the final four diamond holes (YQ- 25-005 to 008) completed as a part of the maiden program at Yoquivo. Hole YQ-25-007 was drilled in the lower northern portion of the existing Foreign Estimate6 for the Pertenencia Vein (Figures 5 & 6), intersecting very strong mineralisation approximately 60-70 metres below previous intersections in this portion of the Resource2:

- YQ-25-007

- 7.6m at 116g/t AgEq – 69g/t Ag & 0.6g/t Au from 298.79m,

- incl. 0.54m at 361g/t AgEq – 252g/t Ag & 1.4g/t Au from 305.85m

- 4.87m at 544g/t AgEq – 411g/t Ag & 1.8g/t Au from 310.76m

- incl. 1.11m at 2,063g/t AgEq – 1,556g/t Ag & 6.6g/t Au from 312.38m

- 7.6m at 116g/t AgEq – 69g/t Ag & 0.6g/t Au from 298.79m,

The lower high grade intersection in YQ-25-007 is amongst the best mineralisation drilled to date in the central and lower portions of the Pertenencia Vein (Figure 3). This zone comprises discrete silver-bearing sulphide veins, with peak grades of 2,584g/t AgEq -1,935g/t Ag & 8.5g/t Au (Figure 1). The position of this intersection at the base of the existing Foreign Estimate2 leaves the zone open at depth and highlights the potential for significant future Resource extensions.

Assay results were also returned for a further three scoping holes (YQ-25-005, 006 & 008) completed to the north of the existing Foreign Estimate2 (Figure 3). All three holes intersecting encouraging mineralisation in narrow high grade structures, including1:

- YQ-25-005

- 0.9m at 418g/t AgEq – 332g/t Ag & 1.1g/t Au from 355.8m

- 0.3m at 649g/t AgEq – 519g/t Ag & 1.7g/t Au from 387.0m

- YQ-25-006

- 0.33m at 397g/t AgEq – 270g/t Ag & 1.7g/t Au from 50.7m

- YQ-25-008

- 2.02m at 173g/t AgEq – 117g/t Ag & 0.7g/t Au from 195.0m,

- incl. 0.55m at 493g/t AgEq – 319g/t Ag & 2.3g/t Au from 196.47m

- 1.75m at 240g/t AgEq – 178g/t Ag & 0.8g/t Au from 225.0m

- incl. 0.56m at 645g/t AgEq – 463g/t Ag & 2.4g/t Au from 225.0m

- 2.02m at 173g/t AgEq – 117g/t Ag & 0.7g/t Au from 195.0m,

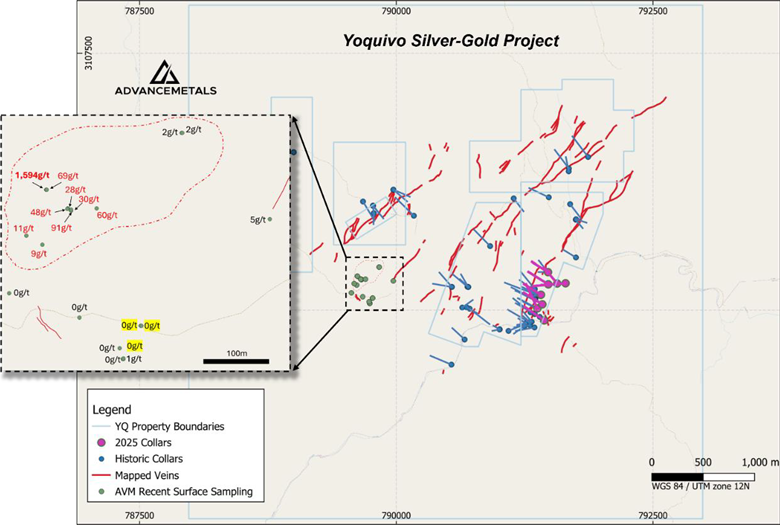

During the quarter AVM geologists also noted potentially encouraging veining, alteration and minor workings in a previously unmapped area to the southeast of the Dolar Vein system at Yoquivo. Following-up these observations, mapping and rock chip sampling were completed in the area with a total of 21 samples taken (Figure 7). While outcrop in this area is somewhat obscured by shallow cover, varying styles of veining could be identified in exposures at surface, with the main area comprising stockwork zones of up to four metres width.

The highest grade rock chip sample was taken from a dipping quartz vein located immediately above a small historic adit (Figure 8), grading an impressive 20.4g/t Au & 30g/t Ag5. In other areas, new mineralised quartz veins were identified that were not associated with workings. The best silver-gold in rock chips are spread across multiple contiguous samples in an area of approximately one hectare.

Assays of the vein (upper right corner) returned 30g/t Ag & 20.4g/t Au (1,594g/t AgEq)4,5.

During the quarter, a full assessment of the previously-drilled diamond holes in the immediate Pertenencia area identified 6,351 metres of unsampled core, representing more than 50% of the total drilling in the area (see Figure 9 for example). The Company has all previous core holes stored in a nearby facility in Durango and has commenced sampling of the highest-potential unassayed core. The initial sampling program will includes approximately 3,500 metres, targeting holes closest to known mineralisation.

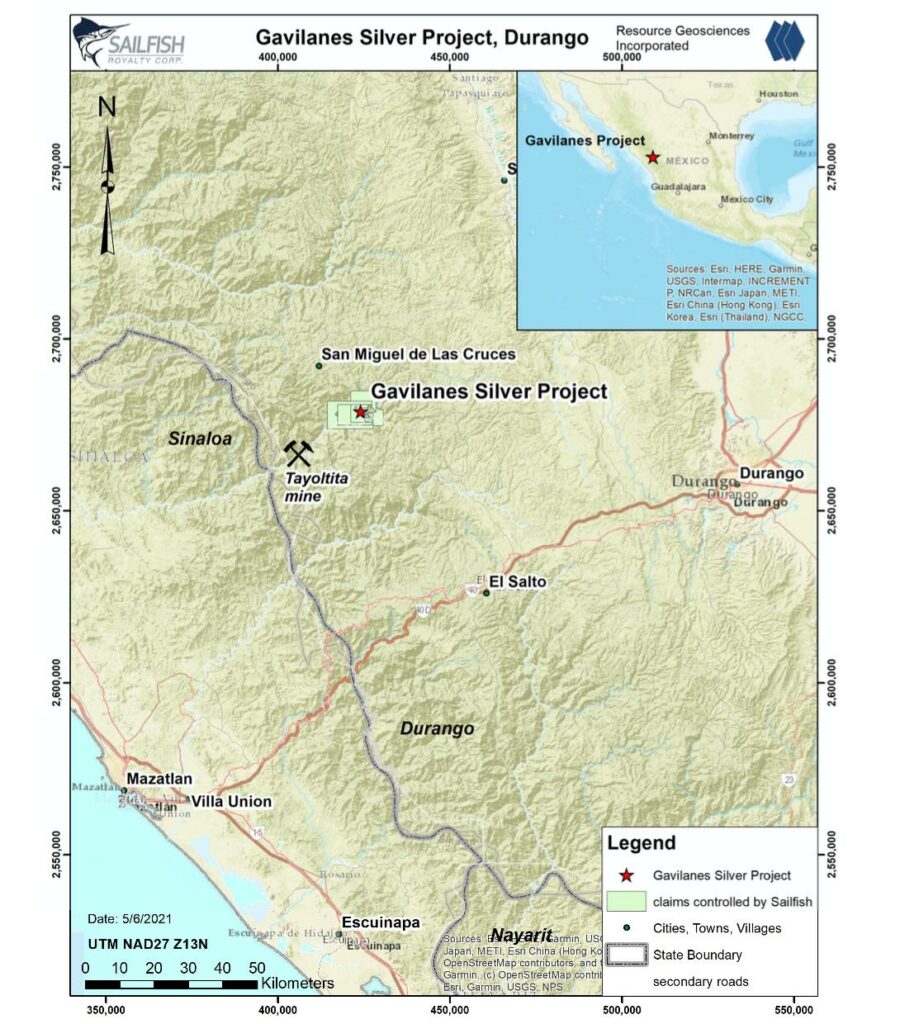

Gavilanes Silver Project Acquisition

Early in 2025 Advance announced a binding sale agreement with Sailfish Royalty Corp to acquire a 100% interest in the high grade Gavilanes Silver Project in Durango, Mexico8. Following an extended completion period, the Gavilanes transaction was settled during the quarter with the Company’s technical team currently planning an initial exploration program for project (subject to requisite approvals).

The Gavilanes Project is located in the prolific Sierra Madre Occidental District (Figure 10). The project spans a 135km2 land package with low to intermediate sulfidation epithermal polymetallic veins, offering substantial growth and development potential. Current exploration has tested just 0.17km of the main zone, while an additional 0.28km2 of known veins remain undrilled8.

Drilling to date has confirmed the presence of extensive veins and breccia zones, with veins extending over 2km but drill coverage limited to less than 900m along strike. Additional zones, including Central and Western Zones, show promise but require detailed mapping and sampling.

Eight mineralised structures have been identified in surface outcrop, and three, the Guadalupe- Soledad, Descubridora, and San Nicolas zones, have been drill tested by prior project owner Santacruz Silver Mining Ltd (Figure 9). The La Cruz structure was tested by only three shallow drillholes. The other four known mineralised structures or veins are untested by drilling. True widths range from less than 1m to greater than 10m.

Gavilanes has an existing Foreign Estimate8 of 2.83Mt at 245.6g/t AgEq for 22.4Moz AgEq9. Advance has identified significant upside potential given the limited nature of existing drilling. The Company is currently considering options for an initial drilling program at the site following the expected completion of the acquisition in the coming months.

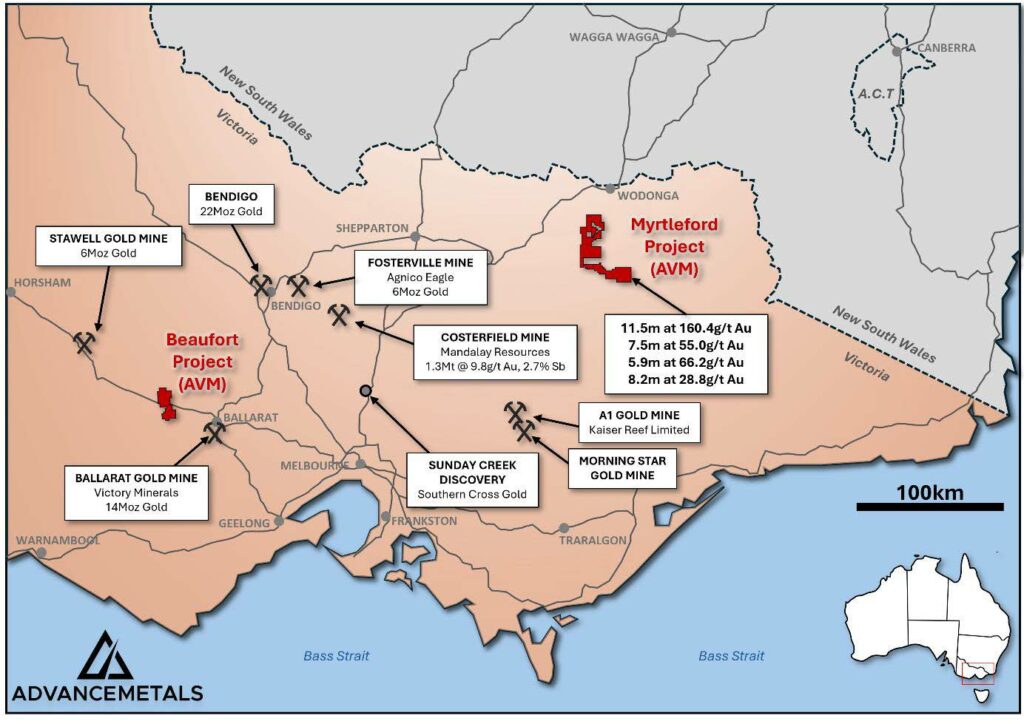

Myrtleford Project

Early in 2025 Advance entered into a binding joint venture agreement with Serra Energy Metals Corp. to acquire up to an 80% interest in the high grade Myrtleford and Beaufort Gold Projects, located in the Victorian Goldfields, Australia8. The Projects boast an extensive land position in the heart of Australia’s renowned Victorian Goldfields (Figure 12), a region that has produced over 80 million ounces of gold. Across the tenements, hundreds of mineralised workings remain unexplored with modern techniques, presenting exceptional opportunities for new significant discoveries.

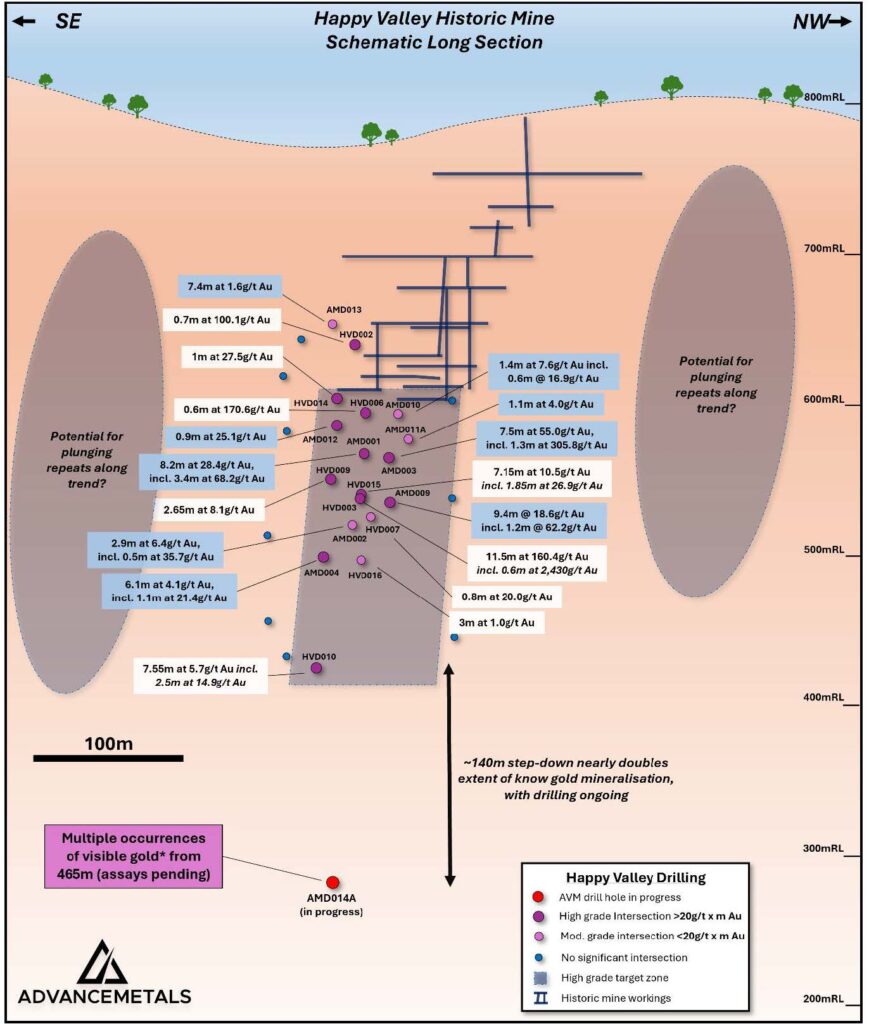

During the quarter, exploration was focussed on the Happy Valley deposit in the southeastern portion of the Myrtleford Project. Results were received for holes new holes AMD009 to AMD013 (Figure 13), with the intersection in AMD009 a standout10:

- AMD009

- 9.4 metres at 18.6g/t Au from 196.2m

- incl. 1.2 metres at 62.2g/t Au from 200.6m

- 9.4 metres at 18.6g/t Au from 196.2m

A program of screen fire gold re-analysis also saw the two highest grade intervals from previous AVM drilling upgrading strongly10 to:

- AMD001

- 8.2 metres at 28.8g/t Au from 186m (up 29% from 22.4g/t Au2),

- incl. 3.4 metres at 68.2g/t Au from 186m (up 29% from 52.7g/t Au2)

- 8.2 metres at 28.8g/t Au from 186m (up 29% from 22.4g/t Au2),

- AMD003

- 7.5 metres at 55.0g/t Au from 178.1m (up 15% from 47.9g/t Au3)

- incl. 1.3 metres at 305.8g/t Au from 179.6m (up 13% from 271.6g/t Au3)

- 7.5 metres at 55.0g/t Au from 178.1m (up 15% from 47.9g/t Au3)

Subsequent to the end of the quarter the Company announced it had intersected visible gold in AMD014A from 465m down hole (Figure 14), associated with sulphide-bearing quartz veins 140m below any previous intersection11. Assays are currently pending for this hole but it suggests strong depth continuity, with the high grade gold system now potentially extending over 500m vertically (see Figure 13), with mineralisation open in all directions.

*In relation to the disclosure of visible mineralisation, the Company cautions that visual estimates of mineral abundance should never be considered a proxy or substitute for laboratory analysis. Laboratory assay results are required to determine actual widths and grade of the visible mineralisation reported in preliminary geological logging. The Company will update the market when laboratory analytical results become available for these holes, expected to be in late November/Early December 202511.

Corporate

In early October the Company announced a two-tiered placement of $13 million to institutional and sophisticated investors12. The placement was completed at price of $0.10 per share and was very strongly supported by both local and offshore precious metals-focused funds, including cornerstone investments by Jupiter Asset Management and Tribeca Investment Partners who received a combined allocation of $6.5 million, with other key institutional investors including Lowell Resources Fund, APAC Resources and Next Investors.

Following the placement the Company announced the appointment of highly accomplished mining executive David O’Connor as Non Executive Chairman, with previous Chairman Craig Stranger staying on the Board as a Non Executive Director13. David has more than 40 years of international experience spanning exploration, development and M&A and is currently Chief Geologist at AbraSilver Resource Corp. At the same time, Joshua Gordon and Fadi Diab have stepped down from the Board to pursue other business opportunities.

The Company also established a Mexican Advisory Board subsequent to the end of the quarter14, with the appointment of inaugural members Douglas Coleman and Trevor Woolfe, who both have a long association with the resources industry in Mexico.

Tenements

A list of tenements held by AVM and its subsidiaries as of 30 September 2025 is given below.

| Tenement Reference | Nature of interest | |

| Mining tenements held at the end of the quarter | Elko Coal Licenses in British Columbia, Canada. Licenses 418648, 418649 and 418650. | |

| Yoquivo Silver Project, Chihuahua, Mexico Concession Title No. 214876, 223499, 2200851, 217475, 216491, 217476, 218071 | 100% ownership | |

| Gavilanes Project, Durango, Mexico Concession Title No. 240541, 240542, 233280, 172309, 178392, 187678, 221108, 221107, 231437, 231438, 227254 | ||

| Exploration Licences in Victoria, Australia ELs 006454, 006724, 007670, 007927, 007928 | Earning-in to 80% holding | |

| Guadalupe y Calvo Project, Chihuahua, Mexico Concession Title No. 159362, 164161, 211461, 219036, 222724, 223165, 224250, 224430, 240131, 240132 | Earning-in to 100% holding | |

| Mining tenements acquired during the quarter | Gavilanes Project, Durango, Mexico Concession Title No. 240541, 240542, 233280, 172309, 178392, 187678, 221108, 221107, 231437, 231438, 227254 | 100% ownership |

| Guadalupe y Calvo Project Project, Chihuahua, Mexico Concession Title No. 159362, 164161, 211461, 219036, 222724, 223165, 224250, 224430, 240131, 240132 | Earning-in to 100% holding | |

| Mining tenements relinquished during the quarter | Andersons Creek – Federal Lode Claims, Idaho, USA, Claims AC01-AC24 | |

| Garnet Creek – Federal Lode Claims, Idaho, USA, Claims GC01-GC147 | Nil | |

| Augustus Polymetallic – Federal Lode Claims, Arizona, USA Claims – AUG001 – AUG072 | ||

| Beneficial percentage interests held in farm-in or farm-out agreements at the end of the quarter | Nil | Nil |

| Beneficial percentage interests in farm-in or farm-out agreements acquired or disposed during the quarter | Nil | Nil |

ASX Additional Information

- ASX Listing Rule 5.3.1: Exploration and Evaluation Expenditure during the Quarter was $1,828,000. Full details of exploration activity during the Quarter are set out in this report.

- ASX Listing Rule 5.3.2: There were no substantive mining production and development activities during the Quarter.

- ASX Listing Rule 5.3.5: Payments to related parties of the Company and their associates during the Quarter was $56,000. The Company advises that this relates to non-executive directors’ fees and executive directors’ salaries only.

Notes and references

1AVM ASX release ‘AVM to hit 100Moz AgEq with Guadalupe y Calvo acquisition’ on 22 July 2025.

2The GyC gold equivalent was derived based on preliminary leaching test work conducted by previous owners of the project. The formula used is AuEq g/t = Au g/t + (Ag g/t*Ag price/Au price), where the assumed $US/oz gold price is $1,700 and the assumed silver price is $23. Au and Ag recovery are both assumed at 95% based on this test work. The AgEq value is derived assuming identical price and recovery assumptions, with a gold to silver ratio of 73.91:1. In Advance’s opinion all elements included in the metal equivalency calculations have reasonable potential to be recovered and sold.

3AVM ASX release ‘Drilling extends high grade silver-gold mineralisation at depth at Yoquivo’ on 15 August 2025.

4The Yoquivo silver equivalent was derived based on initial flotation and leaching test work conducted by Golden Minerals in 2022. The formula used is AgEqg/t = Agg/t + (Aug/t * Au_price/Ag_price), where the assumed $US/oz gold price is $1,860 and the assumed $US/oz silver price is $24. Au and Ag recovery are both assumed at 85% based on this test work. In AVM’s opinion all elements that are included in the metal equivalency calculation have reasonable potential to be recovered and sold.

5AVM ASX release ‘New area hosting high grade silver-gold mineralisation discovered at the Yoquivo Project’ on 24 September 2025.

6AVM ASX release ‘Advance to acquire Yoquivo high grade silver project in Mexico’ on 24 October 2024.

7AVM ASX release ‘Advance to unlock untested silver-gold potential from previous drilling at Yoquivo’ on 27 August 2025.

8AVM ASX release ‘Advance Metals to Acquire High Grade Gold Project in Victoria and High Grade Silver Project in Mexico’ on 6 January 2025.

9The Gavilanes silver equivalent was derived based on assumed metallurgical recoveries of similar deposits by the author of the NI43-101 technical document Derick Unger. The formula used is AgEqg/t = Ag/t + (Aug/t*70.175) + (Cuppm*0.00658) + (Pbppm*0.00188) + (Znppm*0.00188) , whereassumed recoveries for Ag, Au, Cu, Pb and Zn are 96%, 80%, 50%, 50% & 50% respectively, and prices in USD are $19.00/oz, $1,600/oz, $3.50/pound, $1.00/pound and $1.00/pound respectively. In AVM’s opinion all elements that are included in the metal equivalency calculation have reasonable potential to be recovered and sold.

10AVM ASX release ‘New assay data upgrades high grade gold zone at the Happy Valley Prospect’ on 26 September 2025.

11AVM ASX release ‘Visible gold intersected in deep drilling at Happy Valley’ on 29 October 2025.

12AVM ASX release ‘Advance successfully completes placement of $13 million’ on 3 October 2025.

13AVM ASX release ‘Advance appoints accomplished mining executive David O’Connor as Non-Executive Chairman’ on 22 October 2025.

14AVM ASX release ‘Advance bolsters silver discovery and growth capabilities with establishment of Mexican Advisory Board’ on 20 October 2025.

For further information:

Dr Adam McKinnon

Managing Director and CEO

Advance Metals Limited

+61 (0) 411 028 958

[email protected]

www.advancemetals.com.au

Jane Morgan

Investor & Media Relations Manager

Advance Metals Limited

+ 61 (0) 405 555 618

[email protected]

This announcement has been authorised for release by the Board of Advance Metals Limited.

Competent Person’s Statement

The information in this report concerning data and exploration results has been compiled by Dr. Adam McKinnon, a Competent Person who is a Member of the Australian Institute of Mining and Metallurgy (AusIMM). Dr. McKinnon is the Managing Director of Advance Metals Limited and possesses the relevant expertise in the style of mineralisation, type of deposit under evaluation, and the associated activities, qualifying him as a Competent Person under the guidelines of the 2012 Edition of the ‘Australasian Code for the Reporting of Exploration Results, Mineral Resources and Ore Reserves.’ Dr. McKinnon has approved the inclusion of this information in the report in the form and context in which it appears.

With regard to references to the Yoquivo foreign estimates and in particular the ASX announcement dated 28 October 2024, “Advance Metals to acquire Yoquivo High Grade Silver Project in Mexico”, the Competent Person for the information and data contained in that Announcement was Mr Steve Lynn and JORC Table 1 disclosures are contained therein.

With regard to references to the Gavilanes Foreign Estimates and in particular the ASX announcement dated 6 January 2025, “Advance Metals to acquire high grade gold projects in Victoria and high grade silver project in Mexico”, the Competent Person for the information and data contained in that Announcement was Mr Joel Sidoruk.

With regard to references to the Guadalupe y Calvo Foreign Estimate and in particular the ASX announcement dated 22 July 2025, “AVM to hit 100Moz AgEq with Guadalupe y Calvo acquisition”, the Competent Person for the information and data contained in that Announcement was Mr Joel Sidoruk.

The Company is not aware of any new information or data that materially affects the information and data included in the above Announcements. In addition, all material assumptions and technical parameters underpinning the estimates in the Announcement have not changed. The Company confirms that the form and context in which the Competent Persons’ findings are presented have not been materially modified from the original market announcements.

Cautionary Statement on Foreign Estimates

The Foreign Estimates of mineralisation mentioned in this presentation are not compliant with the Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves (2012 JORC Code) and is a “Foreign Estimate”. A Competent Person (under ASX Listing Rules) has not yet done sufficient work to classify the Foreign Estimate as Mineral Resources or Ore Reserves in accordance with the 2012 JORC Code. It is uncertain that following evaluation and/or further exploration work the Foreign Estimate will be able to be reported as Mineral Resources or Ore Reserves in accordance with the JORC Code 2012.

Forward‐Looking Statements

Certain statements in this announcement relate to the future, including forward-looking statements relating to the Company and its business (including its projects). Forward‐looking statements include, but are not limited to, statements concerning Advance Metals Limited planned exploration program(s) and other statements that are not historical facts. When used in this document, words such as “could,” “plan,” “estimate,” “expect,” “intend,” “may”, “potential,” “should,” and similar expressions are forward looking statements.

These forward-looking statements involve known and unknown risks, uncertainties, assumptions, and other important factors that could cause the actual results, performance or achievements of the Company to be materially different from future results, performance or achievements expressed or implied by such statements. Actual events or results may differ materially from the events or results expressed or implied in any forward-looking statement and deviations are both normal and to be expected. Neither the Company, its officers nor any other person gives any representation, assurance or guarantee that the events or other matters expressed or implied in any forward-looking statements will actually occur. You are cautioned not to place undue reliance on those state

Original Article: https://app.sharelinktechnologies.com/announcement-preview/asx/ead292001bfe461db2066c14414e3f59