MITHRIL SILVER AND GOLD RETURNS UP TO 5.36 G/T GOLD, 706 G/T SILVER FROM

1.6 KM VEIN CORRIDOR AT TARGET 5, COPALQUIN PROPERTY, MEXICO

High-Grade ChannelSampling Highlights Compelling New Drill Target

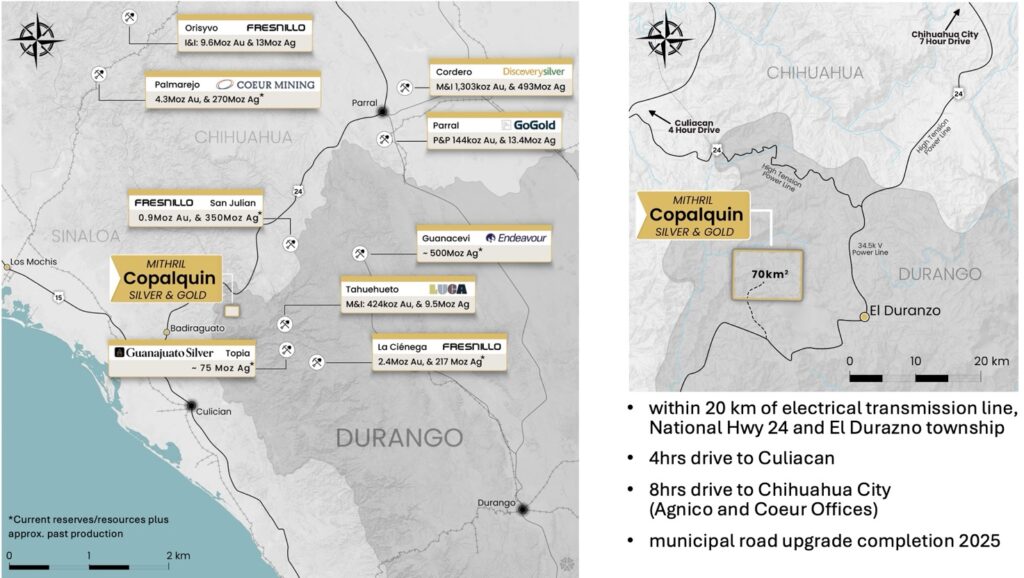

Melbourne, Australia and Vancouver, Canada – Mithril Silver and Gold Limited (“Mithril” or the “Company”) (TSXV: MSG) (ASX: MTH) is pleased to provide high-grade channel sample results for a newly developing drill target (Target 5) at Mithril’s district scale Copalquin property, Durango State, Mexico.

Highlights

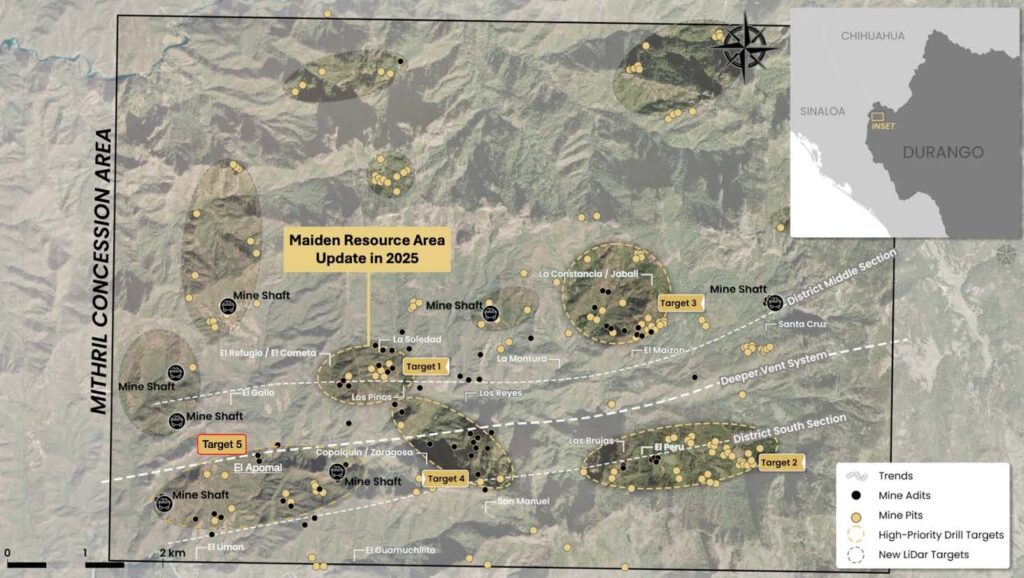

- Mithril’s ongoing mapping and sampling program continues to uncover high-grade gold-silver drill targets across the expansive 70 km² Copalquin District in Mexico.

- Recent work at Target 5 has outlined multiple northwest-trending parallel veins up to 500 metres in length within a 1.6 km wide corridor, located just 1.5 km southwest of the existing Target 1 resource area.

- Notably, sampling at this lower elevation (650–900 m) has returned grades exceeding 1% copper, lead, and zinc. Mineralisation has now been found for over 1,000 metres of vertical relief between Target 2 and Target 5. The styles of mineralisation and associated host rocks support the model of a district wide epithermal system potentially centred along a 5km east- west trend of rhyolite flow domes.

- First-pass drilling at Targets 5 and 3 is scheduled for next quarter, following the completion of Target 1 resource update drilling and the district-scale geological model refinement.

Highlight channel sample results from surface and underground workings within Target 5:

0.7 m @ 4.64 g/t gold, 732 g/t silver (226229; Mina Apomal)

0.8 m @ 2.84 g/t gold, 777 g/t silver (527107; Mina Apomal)

0.5 m @ 5.36 g/t gold, 706 g/t silver (527143; Apomal Norte)

0.8 m @ 2.58 g/t gold, 716 g/t silver (798719; Dulces Nombres)

Samples with high base metal values:

1.0 m @ 1.48 g/t gold, 236 g/t silver, 0.17% copper, 1.73 % lead, 0.06% zinc (798776; Veta Azul)

1.0 m @ 0.04 g/t gold, 8 g/t silver, 0.03% copper, 0.09 % lead 1.28 % zinc (79770; Veta Azul)

1.0 m @ 0.07 g/t gold, 41 g/t silver, 1.59 % copper, 19 ppm lead, 61 ppm zinc (226223; Apomal)

0.85 m @ 0.06 g/t gold, 145 g/t silver, 0.1% copper, 1.14 % lead, 0.05% zinc (527169; Duraznito)

“The high-grade channel sampling results at Target 5 are another strong endorsement of the Copalquin District’s potential to host multiple, high-grade gold-silver deposits,” said John Skeet, MD and CEO of Mithril Silver and Gold. “The wide vein corridor at Target 5, high grades, and presence of significant base metals at lower elevations underscore the robust vertical extent of this epithermal system. Importantly, these results confirm that our district-scale exploration strategy is delivering, with Target 5 now emerging as a compelling new drill target. We look forward to commencing the first-ever drilling at this area in the upcoming quarter, alongside continued work to update the resource at Target 1 and further define the broader mineralised system across the Copalquin District.”

COPALQUIN GOLD-SILVER DISTRICT, DURANGO STATE, MEXICO

With 100 historic underground gold-silver mines and workings plus 198 surface workings/pits

throughout 70km2 of mining concession area, Copalquin is an entire mining district with high-grade

exploration results and a maiden JORC resource. To date there are several target areas in the district

with one already hosting a high-grade gold-silver JORC mineral resource estimate (MRE) at the Target

1 area (El Refugio-La Soledad)1 and a NI 43-101 Technical Report filed on SEDAR+, supported by a

conceptional underground mining study completed on the maiden resource in early 2022 (see ASX

announcement 01 March 2022 and metallurgical test work (see ASX Announcement 25 February 2022).

There is considerable strike and depth potential to increase the resource at El Refugio and at other

target areas across the district, plus the underlying geologic system that is responsible for the

widespread gold-silver mineralisation.

With the district-wide gold and silver occurrences and rapid exploration success, it is clear the

Copalquin District is developing into another significant gold-silver district like the many other districts

in this prolific Sierra Madre Gold-Silver Trend of Mexico.

Copalquin District Exploration Progress Update

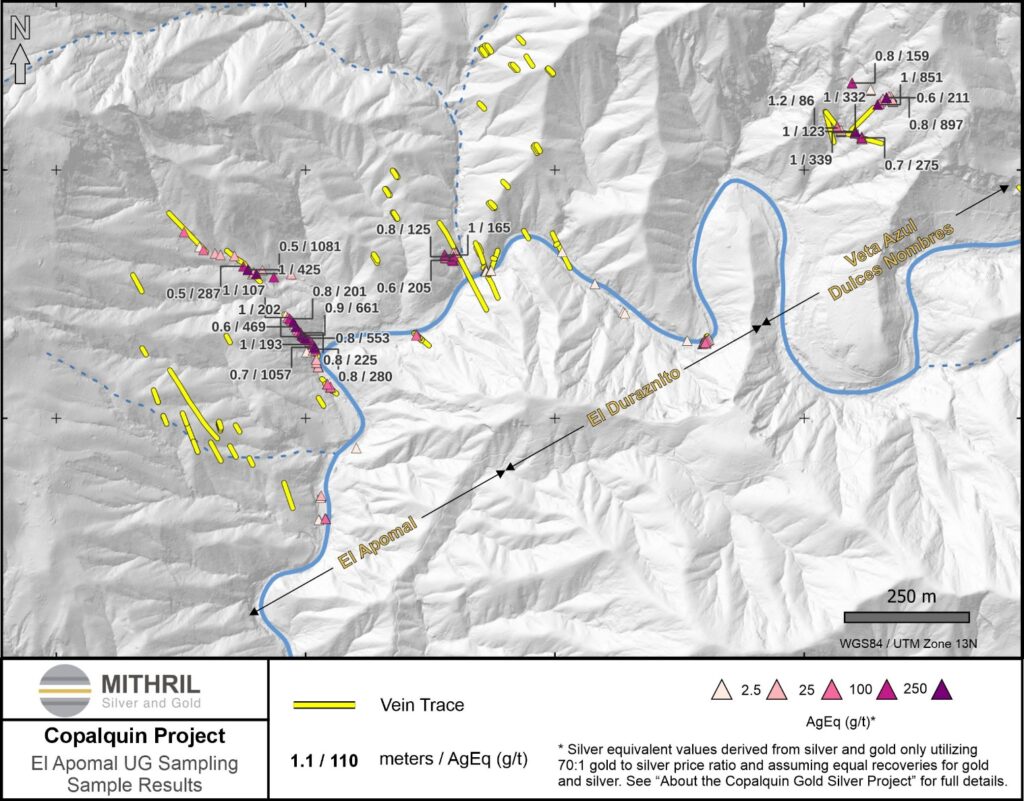

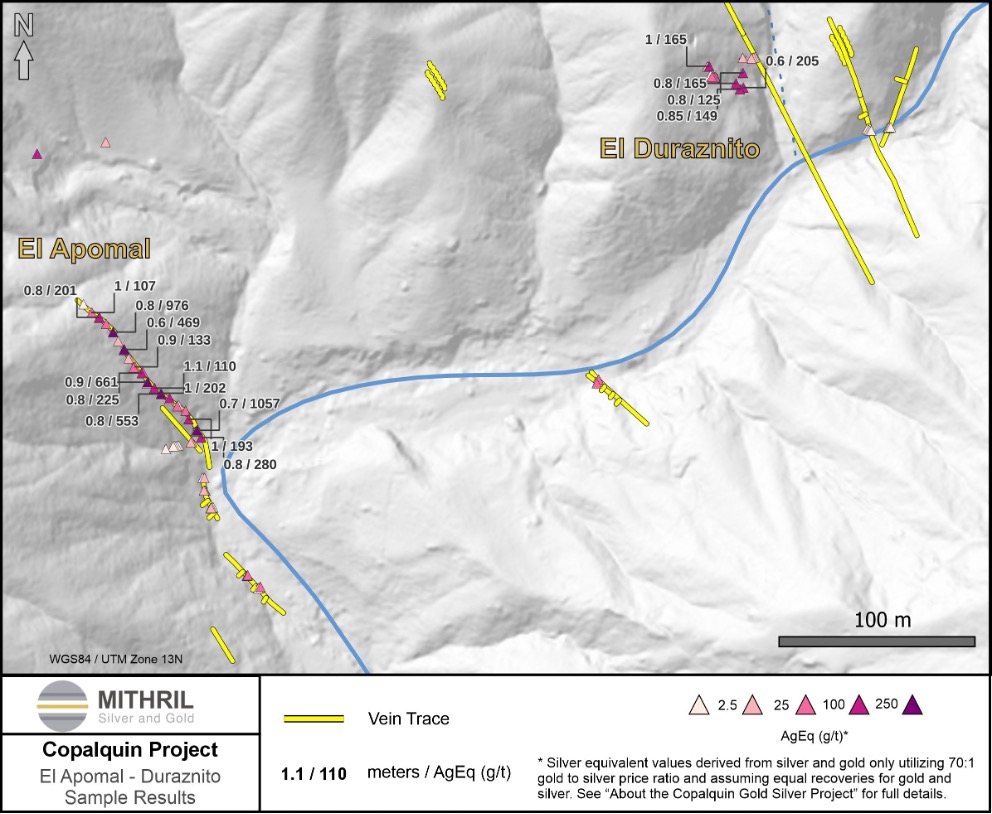

Surficial and underground channel sampling at the Target 5 Area (El Apomal, El Duraznito, Veta Azul, Dulces Nombres) has returned excellent results, with several channel samples intersecting very high- grade silver and high-grade gold within a broad, outcropping vein system, which extends 1.6 km west of the Dulces Nombres to El Apomal Mine (Figure 4).

Full sample results are given in Table 2

Significant gold and silver target 5 channel sampling highlights include: Dulces Nombres Mine area:

1.0 m@ 0.141 g/t Au, 841 g/t Ag (798709; underground)

0.8 m @ 2.58 g/t Au, 716 g/t Ag (798719; underground)

El Apomal Mine area:

- m @ 4.64 g/t Au, 732 g/t Ag (226229; underground)

- m @ 3.14 g/t Au, 333 g/t Ag (226241; underground)

- m @ 5.2 g/t Au, 297 g/t Ag (226244; underground)

0.6 m @ 1.25 g/t Au, 381 g/t Ag (527103; underground)

0.8 m @ 2.84 g/t Au, 777 g/t Ag (527107; underground)

1.0 m @ 2.47 g/t Au, 252 g/t Ag (527141; surface)

0.5 m @ 5.36 g/t Au, 706 g/t Ag (527143; surface)

Significant base metal target 5 channel sampling highlights include:

1.0 m @ 1.48 g/t gold, 236 g/t silver, 0.17% copper, 1.73 % lead, 0.06% zinc (798776; Veta Azul)

1.0 m @ 0.04 g/t gold, 8 g/t silver, 0.03% copper, 0.09 % lead 1.28 % zinc (79770; Veta Azul)

1.0 m @ 0.07 g/t gold, 41 g/t silver, 1.59 % copper, 19 ppm lead, 61 ppm zinc (226223; Apomal)

0.85 m @ 0.06 g/t gold, 145 g/t silver, 0.1% copper, 1.14 % lead, 0.05% zinc (527169; Duraznito)

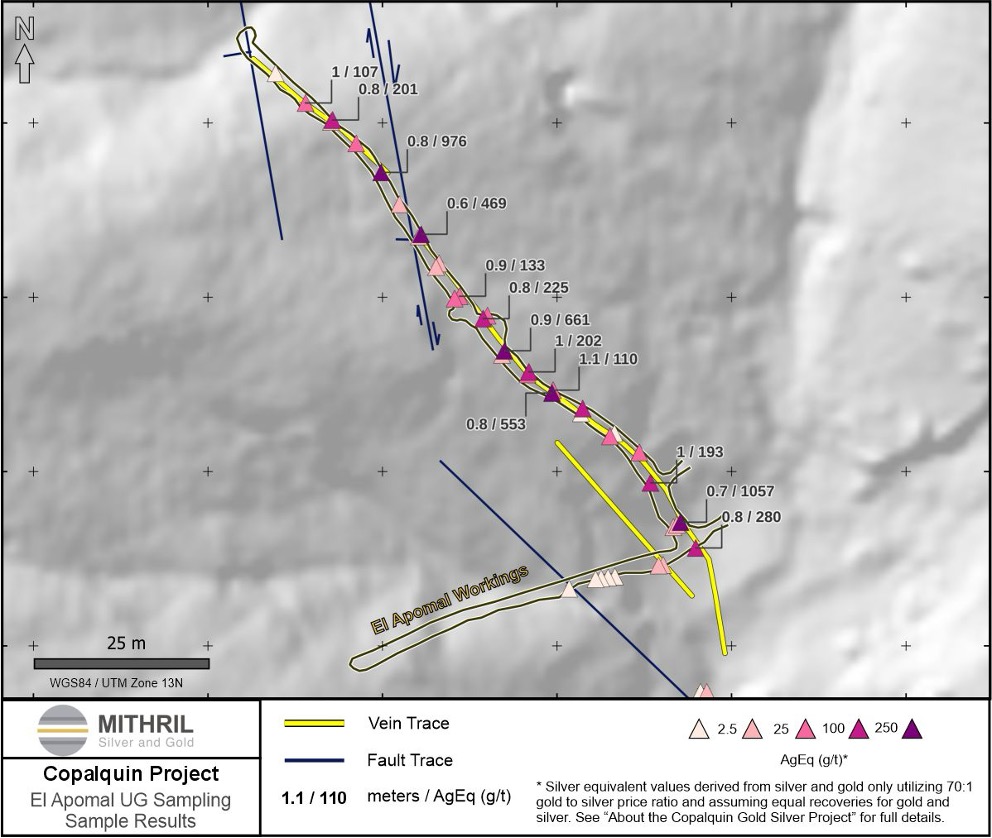

High-Potential Discovery at Target 5 – El Apomal: Target 5 development started with the dewatering, mapping and sampling of the historic El Apomal Mine (Figure 3). The mine, a 130-metre underground adit, is dominated by a mineralized quartz vein, up to 1.5 m wide (The Apomal vein). The southeast trending Apomal vein can be traced over 500 metres and remains open to the northwest and southeast. Several parallel vein sets have been mapped and sampled up to 300 m to the southwest of the Apomal Mine (Figure 3; Assays pending).

Anomalous silver values (up to 196 g/t Ag; Table 3) have been reported at the El Duraznito Mine which is located more than 300 m to the northeast of the Apomal mine (Figure 4, 5; Table 2).

The Veta Azul and Dulces Nombres Mines are located over 900 m northeast of the El Duraznito Mine and have returned high-grade silver values (up to 841 g/t Ag; Figure 4; Table 2). The veins in these mines appear to have a similar orientation to the veins observed underground and on surface in the El Apomal Mine area.

Moderate-grade Au and Ag mineralized quartz veins were intersected in two holes (CDH152 -5.66m @

2.58 g/t gold, 230 g/t silver from 18.5m including 1.98m @ 4.59 g/t gold, 520 g/t silver from 18.5m and CDH-154 – 2.90m @ 1.86 g/t gold, 240 g/t silver from 75.1m) drilled at the historic Copalquin Mine which is located approximately 2.5 km east of El Apomal Mine. The veins at Copalquin are interpreted to be part of the wide vein system observed at Target 5.

Target 5 veins mapped to date, are primarily hosted in granodiorite and are situated at a lower elevation in the system at 650 – 900 m compared with the mineralised zones at Target 1 (900 – 1,150 m) and Target 2 (1,500 – 1,700 m). Mineralised parallel vein sets have now been mapped and sampled for over 1,000 metres of vertical relief between Target 2 and Target 5 across a width of approximately 5 km, a further indication of the Copalquin District to potentially host a large, multi-target mineralized system.

The styles of mineralisation and associated host rocks found at various elevations conform to the model of a district wide low sulphidation epithermal system potentially centred along a 5km east- west trend of rhyolite flow domes.

Continued mapping and sampling is underway to the south and southeast of the El Apomal Mine where several outcropping veins have been identified. An exploration road is advancing to the Target 5 area to provide access for drill pads.

Further targets for mapping and sampling include the areas to the immediate south of Target 5 towards the historic mines Tasolera 1 and 2 (~1 km from Apomal) and to the southeast towards the historic mine Guamuchilito (~1.7 km from Apomal).

Outcropping Vein Sets to the Southwest and Northeast. Gold and silver grades are shown as silver equivalent (AgEq) with silver being

the most economically dominant metal at Target 5.

being the most economically dominant metal at Target 5.

ABOUT THE COPALQUIN GOLD SILVER PROJECT

The Copalquin mining district is located in Durango State, Mexico and covers an entire mining district

of 70km2 containing several dozen historic gold and silver mines and workings, ten of which had notable

production. The district is within the Sierra Madre Gold Silver Trend which extends north-south along

the western side of Mexico and hosts many world-class gold and silver deposits.

Multiple mineralisation events, young intrusives thought to be system-driving heat sources,

widespread alteration together with extensive surface vein exposures and dozens of historic mine

workings, identify the Copalquin mining district as a major epithermal centre for Gold and Silver.

Within 15 months of drilling in the Copalquin District, Mithril delivered a maiden JORC mineral resource

estimate demonstrating the high-grade gold and silver resource potential for the district. This maiden

resource is detailed below (see ASX release 17 November 2021)^ and a NI 43-101 Technical Report filed

on SEDAR+

- Indicated 691 kt @ 5.43 g/t gold, 114 g/t silver for 121,000 oz gold plus 2,538,000 oz silver

- Inferred 1,725 kt @ 4.55 g/t gold, 152 g/t silver for 252,000 oz gold plus 8,414,000 oz silver (using a cut-off grade of 2.0 g/t AuEq*)

- 28.6% of the resource tonnage is classified as indicated

* In determining the gold equivalent (AuEq.) grade for reporting, a gold:silver price ratio of 70:1 was determined, using the formula: AuEq grade = Au grade + ((Ag grade/70) x (Ag recovery/Au recovery)). The metal prices used to determine the 70:1 ratio are the cumulative average prices for 2021: gold USD1,798.34 and silver: USD25.32 (actual is 71:1) from kitco.com. At this early stage, the metallurgical recoveries were assumed to be equal. Subsequent preliminary metallurgical test work produced recoveries of 91% for silver and 96% for gold (ASX Announcement 25 February 2022) and these will be used when the resource is updated in the future. In the Company’s opinion there is reasonable potential for both gold and silver to be extracted and sold.

^ The information in this report that relates to Mineral Resources or Ore Reserves is based on information provided in the following ASX announcement: 17 Nov 2021 – MAIDEN JORC RESOURCE 529,000 OUNCES @ 6.81G/T (AuEq*), which includes the full JORC MRE report, also available on the Mithril Resources Limited Website.

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original market announcement and that all material assumptions and technical parameters underpinning the estimates in the relevant market announcement continue to apply and have not materially changed. The company confirms that the form and context in which the Competent Person’s findings are presented have not been materially modified from the original market announcement.

# For Target 5 area where silver equivalent (AgEq) has been used in the maps, AgEq is determined using the formula: AgEq grade = Ag grade + ((Au grade x 70) x (Au recovery/Ag recovery)). The metal prices used to determine the 70:1 ratio are the cumulative average prices for 2021: gold USD1,798.34 and silver: USD25.32 (actual is 71:1) from kitco.com. At this early stage, the metallurgical recoveries for Au and Ag are assumed to be equal in the absence of metallurgical test work for Target 5 material. In the Company’s opinion there is reasonable potential for both gold and silver to be extracted and sold.

Mining study and metallurgical test work supports the development of the El Refugio-La Soledad resource with conventional underground mining methods indicated as being appropriate and with high gold-silver recovery to produce metal on-site with conventional processing.

Mithril is currently exploring in the Copalquin District to expand the resource footprint, demonstrating its multi-million-ounce gold and silver potential. Mithril has an exclusive option to purchase 100% interest in the Copalquin mining concessions by paying US$10M on or any time before 7 August 2028.

-ENDS-

Released with the authority of the Board. For further information contact:

John Skeet

Managing Director and CEO

[email protected]

+61 435 766 809

NIKLI COMMUNICATIONS

Corporate Communications

[email protected]

[email protected]

Competent Persons Statement – JORC

The information in this announcement that relates to metallurgical test results, mineral processing and project development and study work has been compiled by Mr John Skeet who is Mithril’s CEO and Managing Director. Mr Skeet is a Fellow of the Australasian Institute of Mining and Metallurgy. This is a Recognised Professional Organisation (RPO) under the Joint Ore Reserves Committee (JORC) Code.

Mr Skeet has sufficient experience of relevance to the styles of mineralisation and the types of deposits under consideration, and to the activities undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the Joint Ore Reserves Committee (JORC) Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Mr Skeet consents to the inclusion in this report of the matters based on information in the form and context in which it appears. The Australian Securities Exchange has not reviewed and does not accept responsibility for the accuracy or adequacy of this release.

The information in this announcement that relates to sampling techniques and data, exploration results and geological interpretation for Mithril’s Mexican project, has been compiled by Mr Patrick Loury who is Mithril’s Project Consultant. Mr Loury is a member of the American Institute of Professional Geologists and a Certified Professional Geologist (CPG). This is a Recognised Professional Organisation (RPO) under the Joint Ore Reserves Committee (JORC) Code.

Mr Loury has sufficient experience of relevance to the styles of mineralisation and the types of deposits under consideration, and to the activities undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the Joint Ore Reserves Committee (JORC) Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Mr Loury consents to the inclusion in this report of the matters based on information in the form and context in which it appears.

The information in this announcement that relates to Mineral Resources is reported by Mr Rodney Webster, Principal Geologist at AMC Consultants Pty Ltd (AMC), who is a Member of the Australasian Institute of Mining and Metallurgy. The report was peer reviewed by Andrew Proudman, Principal Consultant at AMC. Mr Webster is acting as the Competent Person, as defined in the 2012 Edition of the Joint Ore Reserves Committee (JORC) Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, for the reporting of the Mineral Resource estimate. A site visit was carried out by Jose Olmedo a geological consultant with AMC, in September 2021 to observe the drilling, logging, sampling and assay database. Mr Webster consents to the inclusion in this report of the matters based on information in the form and context in which it appears

The Australian Securities Exchange has not reviewed and does not accept responsibility for the accuracy or adequacy of this release.

Qualified Persons – NI 43-101

Scientific and technical information in this Report has been reviewed and approved by Mr John Skeet (FAUSIMM, CP) Mithril’s Managing Director and Chief Executive Officer. Mr John Skeet is a qualified person within the meaning of NI 43-101.

Original Article: https://mithrilsilvergold.com/announcements/6986210